In the past 24 hours, the market has seen many new popular coins and topics, which are likely to be the next wealth creation opportunities.

Authored by: Bitget Research Institute

Abstract

Yesterday, the US announced that the April CPI exceeded expectations, which was generally interpreted as positive news, leading to a widespread surge in the crypto market:

Sectors with strong wealth creation effects include: mainstream coin sector, TON ecosystem, MEME sector;

User hot search tokens & topics: PIXELS, Sonne Finance, GME

Potential airdrop opportunities: Tonstakers, Bemo

Data statistics time: May 16, 2024, 4:00 (UTC+0)

I. Market Environment

Yesterday, the US released the April CPI data, which met expectations and showed a turning point, widely interpreted as positive news. Traders generally bet on two interest rate cuts within 24 years, increasing market activity, and mainstream cryptocurrencies all saw around 10% single-day gains.

Regarding BTC ETF, the total inflow from various sources was $303 million yesterday, showing that the capital market has shown optimism about multiple interest rate cuts by the US Federal Reserve within the year. Similarly, in the recent period, major institutions have disclosed their BTC ETF holdings, with more and more pension funds, top asset management companies, and banks allocating to BTC ETF. These institutions generally allocate gradually, indicating that the purchasing power of BTC ETF will continue to grow in the future.

In the crypto industry, Blast confirmed an airdrop on June 26, and several larger projects have already confirmed token economics, preparing for airdrops or TGE, including LayerZero, Orbiter, Debank, etc.

II. Wealth Creation Sectors

1) Sector Movement: Mainstream Coin Sector (BTC, ETH, SOL)

Main reasons: The core reason for the collective rebound of mainstream coins yesterday was the halt in the CPI data, which was widely interpreted as controlling inflation. Therefore, the market generally judged that the US Federal Reserve is expected to cut interest rates twice within the year. The capital market and risk market generally surged, with Nasdaq, Dow Jones, and S&P 500 all hitting historic highs. The mainstream assets in the crypto industry, BTC, ETH, and SOL, also swept away the gloom of the past two weeks.

Rise situation: BTC rose by 7.6% in the past 24 hours, ETH rose by 5.5%, SOL rose by 13.75%;

Factors affecting the future market:

Further positive release at the macro level: Currently, the trend of mainstream crypto assets such as BTC is basically showing a positive correlation with US dollar liquidity. As the US Federal Reserve gradually releases liquidity to the market, crypto assets will also gradually rise. However, during this process, investors should also pay attention to the US Federal Reserve's management of market expectations and keep up with policy steps;

ETF approval and ecosystem development: For ETH, whether ETFs can be approved in the near future is a key factor in determining whether ETH can break out of a trend. For SOL, whether the ecosystem can continue to thrive and gain more market acceptance is a core factor in determining whether SOL can continue to rise.

2) Sectors to Focus on in the Future: TON Ecosystem

Main reasons: The TON ecosystem has seen rapid growth in TVL recently, and the current ecosystem TVL has reached $508 million. According to the development history of past public chains, corresponding infrastructure projects have already appeared on the TON chain, such as Liquid Staking, Swap, Lending, etc., and a top aggregation effect has gradually formed. Investors can participate in such projects, not only to harvest early high APR, but also to have the opportunity for potential airdrops.

Specific project list:

Tonstakers: This project is the largest liquidity staking service provider in the TON ecosystem. Users can stake TON in this protocol to earn an annualized return of 3.8%, and the project has not yet issued tokens, with expectations for airdrops;

STON.fi: This project is currently the largest DEX in the TON ecosystem, and some LP pools have received support from the TON Foundation. Users can provide liquidity in the DEX to earn returns, and the project has not yet issued tokens, with expectations for airdrops.

EVAA Protocol: This project is currently the largest lending project in the TON ecosystem. Users can deposit tokens into this protocol to enjoy lending rate returns, and the project has not yet issued tokens, with expectations for airdrops.

3) Sectors to Focus on in the Future: MEME Sector

Main reasons: With the return of RoaringKitty, US retail investors have become active again. RoaringKitty's influence on the US retail investor community is evident. After his return, US stocks GME and AMC both saw significant gains, and this sentiment will also spread to the crypto assets. Similarly, WSB has been actively interacting with the crypto circle recently, so there is a high possibility that some MEME assets will be used for speculation in the future.

Specific coin list:

PEPE: PEPE's imagery is most in line with the speculative group of US retail investors, making it easier for the group to resonate. At the same time, PEPE is quite active in trading and its price is prone to sharp rises and falls;

PEOPLE: The main feature of this project is that the project team has almost given up on it, but it still has a high speculative popularity. The recent sharp rise of PEOPLE is mainly due to the long position squeezing short positions.

FLOKI: As a veteran MEME, FLOKI's recent activities have been quite frequent and are worth paying attention to.

III. User Hot Searches

1) Popular Dapps

PIXELS (Dapp): Pixels is a social and casual Web3 game based on the Ronin network, with an open world game environment for exploration, farming, and creation. According to DappRadar's data statistics, Pixels has reached a UAW of 740,000, with a large user base. One of Pixels' major features is its combination of play-to-earn (P2E) functionality and farm NFTs, aiming to provide a comprehensive gaming environment through the PIXEL token, closely integrating currency usage and gameplay, and is widely loved by players.

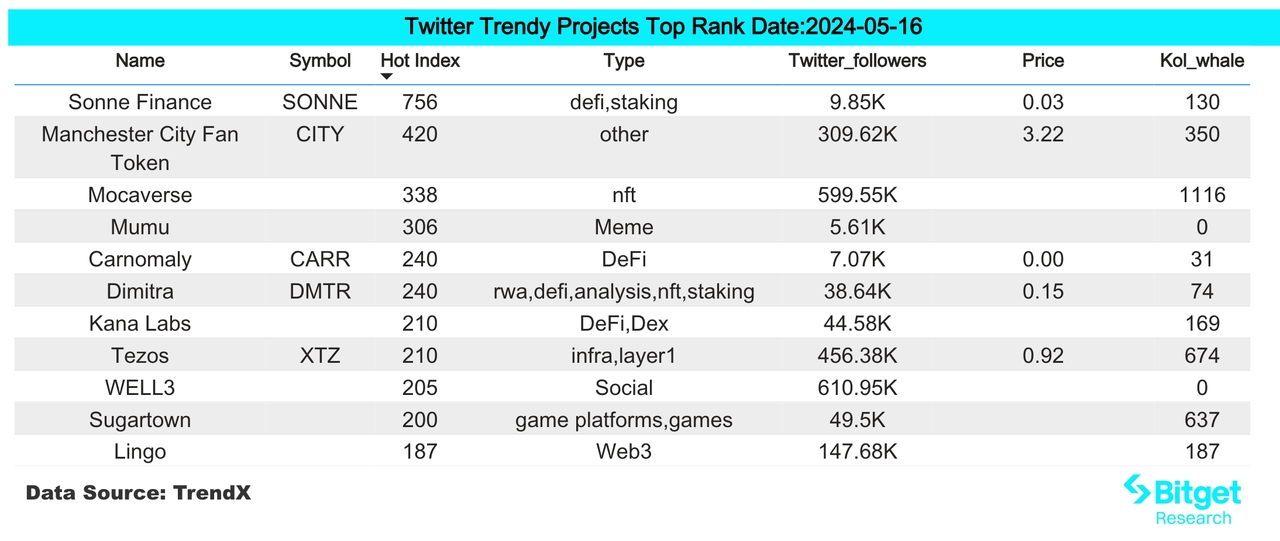

2) Twitter

Sonne Finance (Dapp): The project is a decentralized, non-custodial liquidity management protocol deployed on the Optimism and Base chains. Yesterday, Sonne Finance was hit by a hacker attack, resulting in a loss of $20 million. The hacker attack was carried out through a flash loan attack, borrowing VELO tokens and sending them to the soVELO contract through transfer, then creating a contract to borrow Sonne Finance's tokens, continuously operating until the project's funds were drained. The risk of on-chain DeFi projects is relatively high, and it is necessary to pay attention to the risk of managing interactions with on-chain projects.

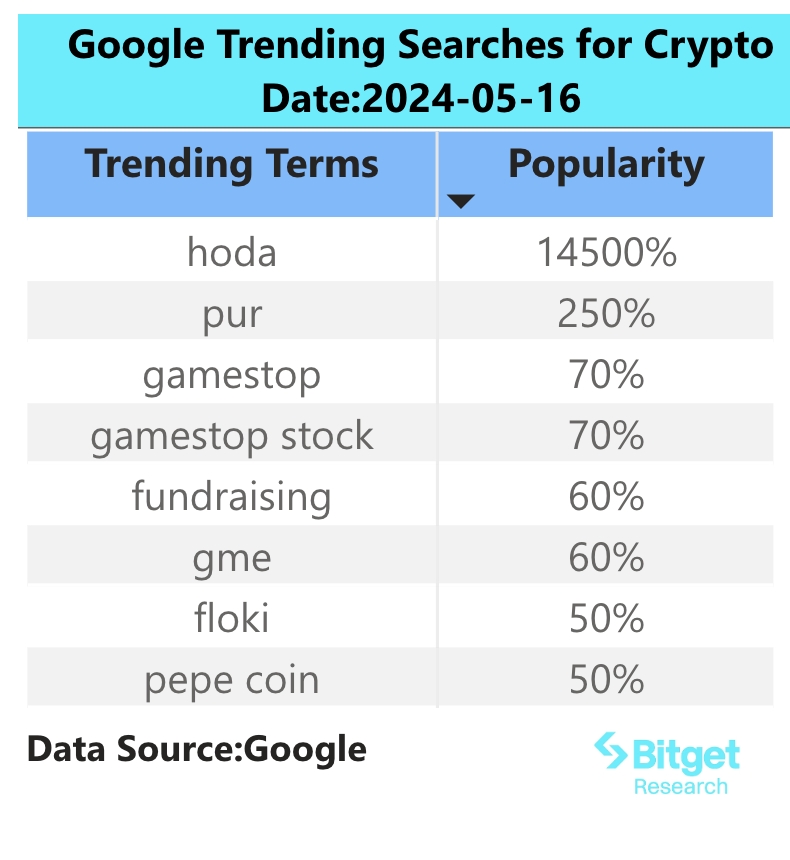

3) Google Search & Region

From a global perspective:

GME (Shares, Token): Well-known Wall Street trader Keith Gill's return has driven a significant rise in the US stock market's GME (Gamestop), with the price quickly rising from $17.46 to $64, triggering 4 circuit breakers for individual stocks. The price began a significant retracement yesterday, with a 20% single-day decline, attracting high market attention. The rise of GME directly drove the market for MEME coins in the crypto market. Bitget has listed GME and can continue to focus on trading opportunities.

From the perspective of various regional hot searches:

(1) The main focus of hot searches in various English-speaking regions yesterday was on GME, AMC, and PEPE:

GME, AMC, PEPE (Token): Recently, tokens with unusual movements on the secondary market and DEX, the market for meme coins has sudden and sporadic characteristics. The market for meme coins is generally dominated by spot trading, and it is necessary to pay attention to entry points, profit-taking, and stop-loss points from a technical analysis perspective. It is recommended that users be cautious of risks when participating in trading and try to engage in intraday trading.

(2) Market overall trends in Africa, Asia, and other regions:

BTC (Token): Yesterday, the US Department of Labor released the April CPI data, showing a month-on-month increase of 3.4%, and the core CPI increased by 3.6% month-on-month, meeting market expectations. Compared to the previous month, the month-on-month CPI data slightly decreased, which was interpreted by the market as the CPI peaking and falling back. The US dollar index and US bond yields plummeted, causing attention from users in Africa, Asia, and other regions.

IV. Potential Airdrop Opportunities

[Tonstakers]

Tonstakers is the largest liquidity staking service provider in the TON ecosystem, where users can stake TON in the protocol to earn an annualized return of 3.8%. The current TVL of the project is $240 million, with a potentially high valuation.

The project has gained attention from the Ton Foundation, and currently has 68,000 stakers in the protocol. The project is collaborating with core developers of Ton, Tonkeeper, OKX, and other institutions, with future token issuance support.

Specific participation methods: 1) Visit the project's official website and click "stake now"; 2) Link to the Ton wallet for staking.

[Bemo]

Bemo is the second-largest liquidity staking service provider in the TON ecosystem, where users can stake TON in the protocol to earn an annualized return of 3.9%. The current TVL of the project is $60 million, and it is an early project in the Ton ecosystem with significant potential.

The project's official website has opened airdrop operational activities, and application stakers of Bemo can receive rewards in xtXP, which can be exchanged for $BMO tokens in the future.

Specific participation methods: 1) Visit the project's official website and click "stake now"; 2) Link to the Ton wallet for staking.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。