Original Title: "The Future of Payments"

Author: Mike Giampapa, General Partner at Galaxy Ventures

Translation: Luffy, Foresight News

Payments were emphasized as a primary use case in the Bitcoin whitepaper of 2008. After years of development, blockchain-based payments have become increasingly viable and popular compared to traditional payment methods. Over the past decade, billions of dollars have been invested in developing underlying blockchain infrastructure, and now we have systems that can achieve "scalable payments."

The cost and performance curve of blockchain aligns with "Moore's Law," and over the past few years, the cost of storing data on the blockchain has decreased by several orders of magnitude. Following the Ethereum Dencun upgrade (EIP-4844), the average cost of transactions on Layer 2 networks such as Arbitrum and Optimism has also dropped to $0.01, and the transaction cost of alternative Layer 1 is close to a few cents.

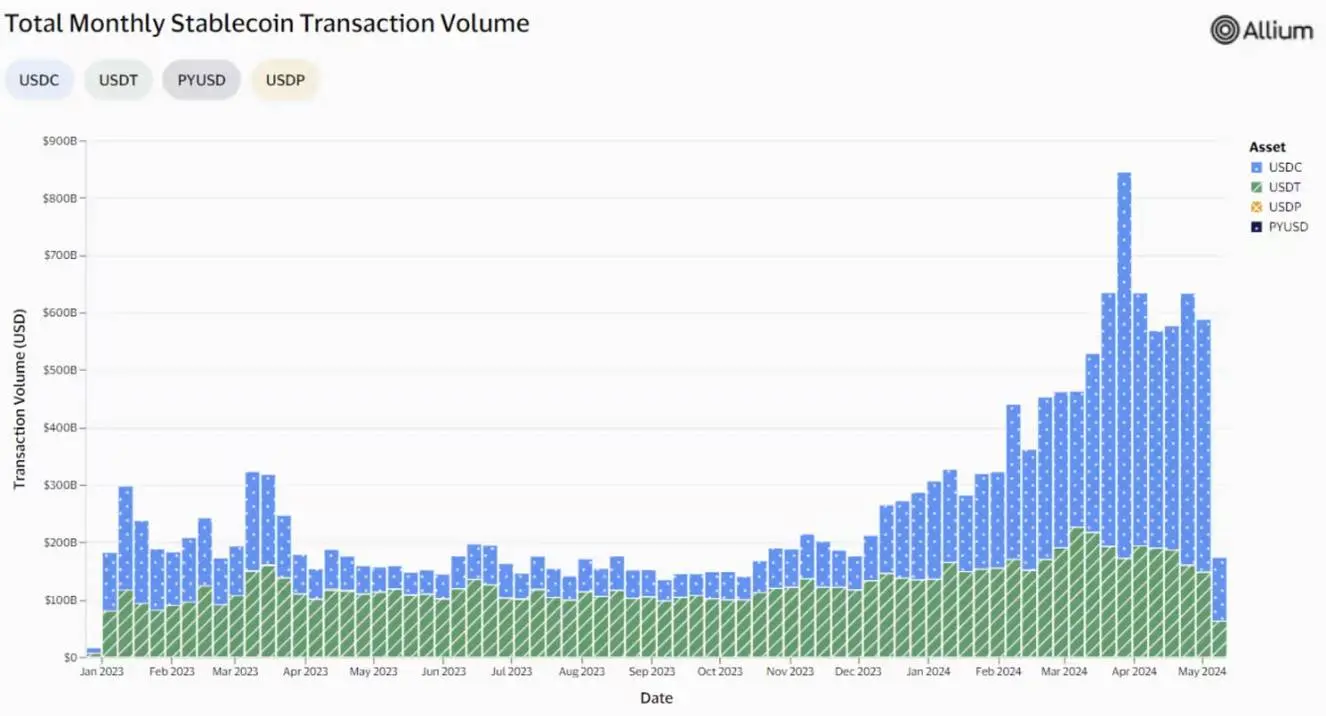

In addition to more efficient and cost-effective infrastructure, the rise of stablecoins has been explosive and sustainable. In the volatile cryptocurrency industry, it is clearly a long-term trend. Visa recently launched a public stablecoin dashboard (Visa Onchain Analytics), allowing us to glimpse this growth trend and demonstrating how stablecoins and underlying blockchain infrastructure are used to facilitate global payments. The stablecoin transaction volume of the entire market has grown by about 3.5 times year-on-year. When the analysis focuses on transaction volume seemingly initiated directly by consumers and businesses (excluding automatic transactions or smart contract operations), Visa estimates that the stablecoin transaction volume in the past 30 days is approximately $265 billion (with an annualized transaction volume of about $32 trillion), roughly twice the payment volume of PayPal in 2023, and approximately equivalent to the GDP of India or the UK.

Source: Visa Onchain Analytics

We have spent a lot of time delving into the fundamental drivers of this growth and firmly believe that blockchain has the potential to become the mainstream payment method of the future.

Background of the Payment Industry

To grasp the fundamental drivers of the growth of cryptocurrency payments, we must first understand some historical background. The payment infrastructure used internationally today (such as ACH and SWIFT) was established in the 1970s, more than 50 years ago. The ability to remit funds globally was a groundbreaking achievement and a milestone in the financial industry.

However, the global payment infrastructure is now essentially outdated and fragmented. It is an expensive and inefficient system that operates within limited banking hours and relies on many intermediaries. A significant problem with the current payment infrastructure is the lack of global standards. Fragmentation hinders seamless international transactions and introduces complexity in establishing consistent protocols.

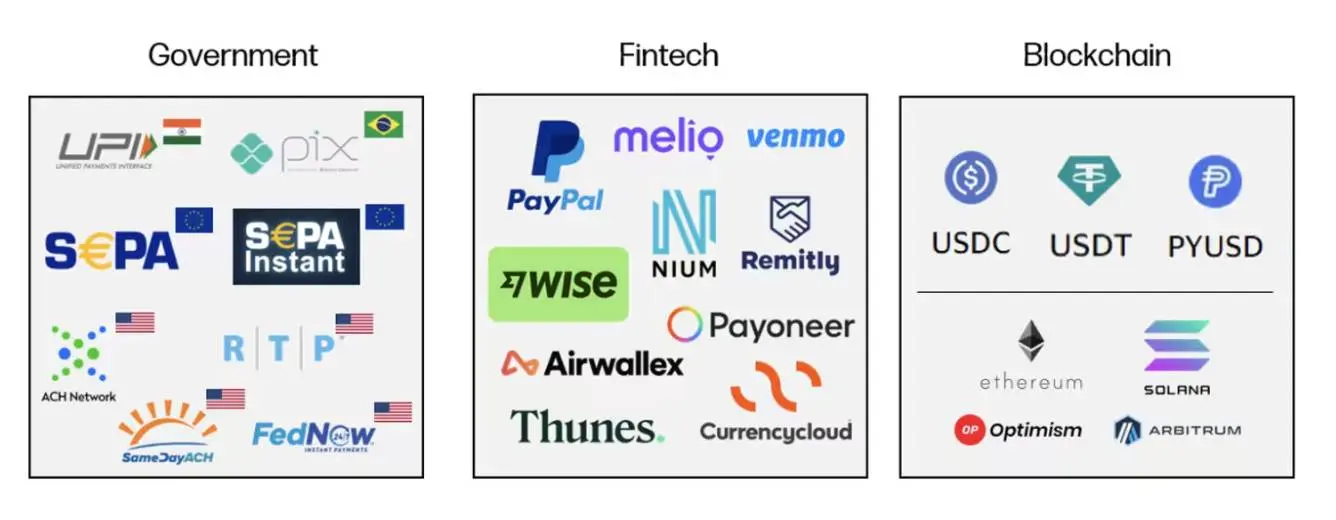

The emergence of real-time settlement systems has been a major advancement in recent years. The success of international real-time payment solutions, such as India's UPI and Brazil's PIX, has been well proven. In the United States, government and consortium-led efforts have introduced real-time settlement systems, such as Same Day ACH, the Clearing House's RTP, and the Federal Reserve's FedNow. The adoption of these new payment methods has been hampered by the fragmentation among numerous competing interests, posing significant challenges.

Fintech companies are attempting to improve user experience on this traditional infrastructure. For example, companies like Wise, Nium, and Thunes enable customers to aggregate liquidity from global accounts, making transactions feel instant to users. However, they have not overcome the limitations of the underlying payment channels and are not capital-efficient solutions.

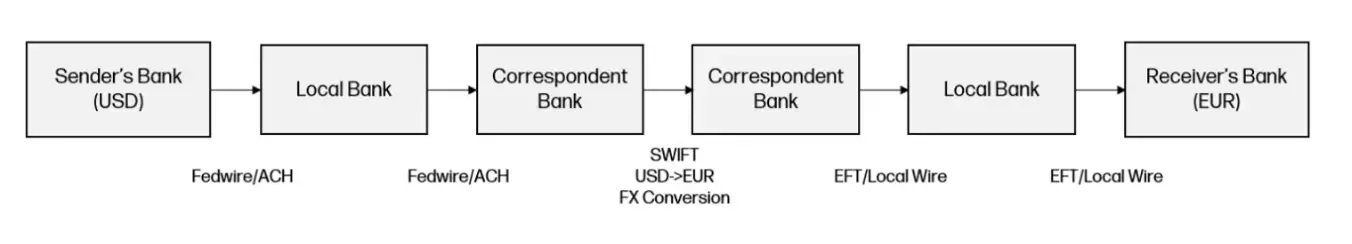

Complexity of Today's Payments

Given the fragmented nature of the existing financial system, payment transactions are becoming increasingly complex. This situation is best illustrated by the structure of cross-border payment transactions, which involve many pain points:

Source: Galaxy

Multiple intermediaries: Cross-border payments typically involve multiple intermediaries, such as local and correspondent banks, clearinghouses, forex brokers, and payment networks. Each intermediary adds complexity to the transaction process, leading to delays and increased costs.

Lack of standardization: Lack of standardized processes leads to inefficiencies. Different countries and financial institutions may have different regulatory requirements, payment systems, and information transmission standards, making simplifying payment processes challenging.

Manual processing: Traditional systems lack automation, real-time processing capabilities, and interoperability with other systems, leading to delays and manual intervention.

Lack of transparency: The opacity of cross-border payment processes can lead to inefficiencies. Limited visibility into transaction status, processing times, and associated fees can make it difficult for businesses to track and reconcile payments, leading to delays and management expenses.

High costs: Cross-border payments often incur high transaction fees, exchange rate markups, and intermediary fees.

Cross-border payments typically take up to 5 business days to settle, with an average cost of 6.25%. Despite these challenges, the market size of B2B cross-border payments remains huge and continues to grow. FXC Intelligence estimates that the total market size of B2B cross-border payments in 2023 was $39 trillion and is expected to grow by 43% to reach $53 trillion by 2030.

Clearly, real-time settlement is urgently needed, but a globally unified payment standard has not yet emerged. Fortunately, there is a solution available to everyone that can transfer value globally instantly and inexpensively—blockchain.

Source: Galaxy (All third-party company product and service names in this presentation are for identification purposes only)

Adoption of Cryptocurrency Payments

Stablecoin payments provide an ideal solution to the challenges currently present in areas such as cross-border payments, and stablecoins are experiencing long-term growth globally. As of May 2024, the total supply of stablecoins is approximately $161 billion. USDT and USDC rank third and sixth in terms of cryptocurrency market capitalization, respectively. Although their combined market capitalization accounts for only about 6% of the cryptocurrency market, their on-chain transaction value accounts for approximately 60% of the entire crypto market.

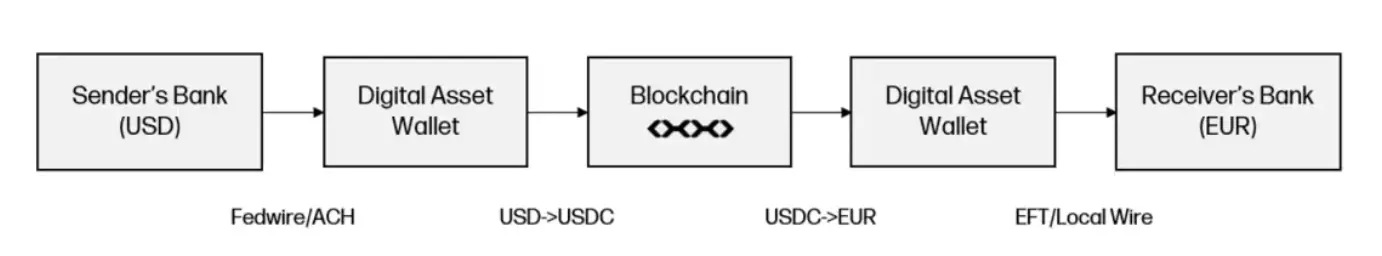

Looking back at our cross-border payment example, the simplified fund flow provided by blockchain offers an elegant solution to the current complexity dilemma:

Source: Galaxy

Near-instant settlement: Compared to most traditional financial payment methods that take several days to settle, blockchain can settle transactions globally almost instantly.

Reduced costs: Cryptocurrency payments are lower in cost compared to existing products due to the elimination of various intermediaries and technical infrastructure.

Greater visibility: Blockchain provides a higher level of visibility in tracking fund flows and reduces management expenses for reconciliation.

Global standard: Blockchain provides a "high-speed railway" that allows anyone connected to the internet to easily access it.

Stablecoins can greatly simplify payment processes and reduce the number of intermediaries. Compared to traditional payment methods, fund flows are almost instantly visible, settlement times are faster, and costs are lower.

Overview of the Cryptocurrency Payment Stack

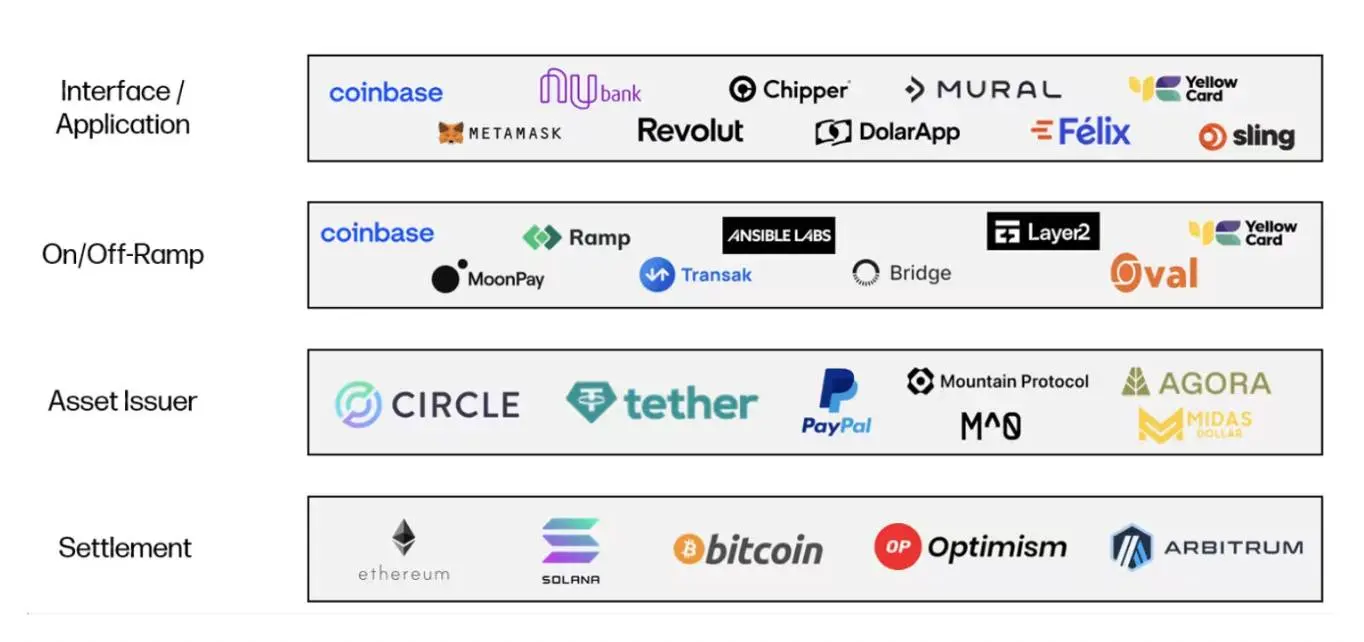

When we examine the cryptocurrency payment market, we find that the stack mainly consists of four levels:

Source: Galaxy (All third-party company product and service names in this presentation are for identification purposes only)

Settlement Layer

The underlying blockchain infrastructure for settling transactions. Layer1 blockchains such as Bitcoin, Ethereum, and Solana, as well as general Layer2 solutions like Optimism and Arbitrum, are competing in the market for block space in terms of speed, cost, scalability, security, and more. We expect payment use cases to become significant consumers of block space over time.

Asset Issuers

Asset issuers are entities responsible for creating, maintaining, and redeeming stablecoins, which are cryptographic assets designed to maintain a stable value relative to a pegged asset or a basket of assets (most commonly the US dollar). Stablecoin issuers typically operate on a balance sheet-driven business model similar to banks, where they take in customer deposits and invest them in higher-yielding assets such as US treasuries, then issue stablecoins as liabilities, profiting from the spread or net interest margin.

On/Off Ramps

On/Off ramps play a crucial role in increasing the availability and adoption of stablecoins as the primary mechanism for financial transactions. Fundamentally, they act as the technical layer connecting stablecoins on the blockchain to fiat currencies and bank accounts. Their business models are often traffic-driven, earning a small commission from the volume of US dollars flowing through their platforms.

Interfaces/Applications

Front-end applications are the customer-facing software in the cryptocurrency payment stack, providing a user interface for cryptocurrency payments and leveraging other parts of the stack to facilitate such transactions. Their business models vary, but often involve a combination of platform fees and traffic-driven fees generated through front-end transaction volume.

Emerging Trends in Cryptocurrency Payments

In the convergence of cryptocurrency and payments, there are many trends that excite us:

Cross-Border Payments as the First Battleground

As mentioned, cross-border transactions are typically the most complex, inefficient, and costly due to the rent extracted by numerous intermediaries in the process. Therefore, we see the highest acceptance in the market for blockchain-based alternative payment solutions. Providers supporting B2B payments (such as payments to suppliers and employees, corporate financial management, etc.) and remittance use cases are being closely watched in the market.

We view cross-border payments as akin to logistics, where the "last mile" (the gateway between fiat and crypto) is particularly challenging. This is where companies like Layer2 Financial provide real value, as they take on the responsibility of integrating with various backend crypto and fiat partners (blockchains, custodians, exchanges/liquidity providers, banks, traditional payment channels, etc.) and provide a seamless and compliant experience for customers. Layer2 also helps facilitate high-speed/low-cost routes for transactions and can complete the entire lifecycle of cross-border payments using cryptocurrencies in as fast as approximately 90 minutes, which is 1-2 orders of magnitude faster than existing solutions.

With the improvement in cost and efficiency, we see adoption of this technology across all regions and end customers (crypto-native businesses and traditional enterprises). Demand is particularly high in regions where fiat currencies are less stable and the use of the US dollar is inconvenient. For these reasons, Africa and Latin America have been hotbeds of entrepreneurial activity. For example, Mural has been hugely successful in facilitating payments between suppliers and developer contractors in the US and Latin America.

Early-Stage Support for Payment-Grade Infrastructure

Most market infrastructure around the crypto ecosystem (such as custody platforms, key management systems, liquidity venues) has been primarily built for retail trading. Over the years, this ecosystem has matured to include more enterprise/institutional-grade software and services, but overall, these infrastructures were not built to support real-time and scalable payments.

We see opportunities for new entrants and existing providers to launch/expand their products to capture this emerging use case. For example, new custody/key management systems like Turnkey have improved transaction signing efficiency by approximately 2 orders of magnitude, reducing signing latency for millions of wallets to 50-100 milliseconds. They also enable companies to design policies around asset operations to enhance automation and process scalability.

Liquidity partners are also retooling their products to provide more frequent (ideally real-time) settlement capabilities for on/off ramps. More automation is being fully realized, providing a better experience for end users.

On-Chain Yield Will Change the Game

The issuance of digital fiat currencies on the blockchain is the first instance of the tokenization trend. As mentioned, we see significant growth in the adoption of stablecoins, but holders of these assets currently cannot earn yield from their holdings (relative to 4-5% on US treasuries).

Currently, Tether/USDT and Circle/USDC dominate the stablecoin market, accounting for over 90% of the approximately $160 billion stablecoin market. Recently, we have seen a range of new entrants offering on-chain yield in different forms. Stablecoin issuers like Agora, Mountain, and Midas are offering yield-bearing assets pegged to the US dollar, providing returns or rewards to holders. We also see companies like BlackRock, Franklin Templeton, Hashnote, and Superstate launching a range of tokenized US treasury products to provide on-chain yield. Finally, we see creative tokenized structured products like Ethena offering a synthetic asset pegged to the US dollar, using ETH-based transactions to provide on-chain yield.

We expect these new assets to be a significant catalyst for on-chain financial expansion. A market for yield-bearing assets is emerging, and we see future users leveraging specific tools based on use cases, risk/return preferences, and their geographical location. This could have a transformative impact on global financial services.

Early Signs of Practicality for Stablecoins

While stablecoins have clear product-market fit in various use cases, the daily lives of non-crypto natives often operate in the fiat world. For example, businesses may be willing to use stablecoins and blockchain for cross-border payments, but most companies today prefer to hold and accept fiat currencies.

One barrier is the ability for businesses to accept stablecoin payments. Stripe recently announced support for its merchant customers to accept stablecoins, a significant shift in the status quo. It can provide more payment options for consumers and make it easier for businesses to accept, hold, and transact in digital assets.

Another barrier is the ability to use stablecoins. Visa has expanded its stablecoin settlement capabilities, supporting closer interoperability between blockchain and the Visa network. For example, we see organic demand for stablecoin-backed card products that allow cardholders to use their stablecoins anywhere Visa cards are accepted.

As stablecoins become more widely accepted and used in traditional payment methods, we increasingly look forward to these digital assets becoming ubiquitous alongside non-digital assets.

Conclusion

Blockchain-based payments are one of the most important and exciting trends we see at the intersection of cryptocurrency and financial services. We believe that blockchain will be used for settling more and more financial transactions, and payments will become a key use case and major consumer of block space in the future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。