Users can deposit any asset based on the Ethereum ERC-20 token standard into Symbiotic.

Written by: Sam Kessler, CoinDesk

Translated by: Felix, PANews

Key Points:

According to sources familiar with the matter, the co-founders of the dominant market liquidity staking protocol Lido, along with the venture capital firm Paradigm, are secretly backing a new company called Symbiotic, which will compete in the rapidly growing "re-staking" field.

The emergence of a well-funded re-staking project may herald a redefinition of the DeFi landscape.

The co-founders of Lido, the largest liquidity staking protocol on Ethereum, are secretly backing a competitor to EigenLayer. EigenLayer, a popular re-staking protocol, has rapidly risen this year to become a strong force in DeFi.

According to several sources, the project is called Symbiotic, and it has received support not only from the venture capital firm Cyber Fund, but also from Konstantin Lomashuk and Vasiliy Shapovalov, co-founders of Lido, as well as from Paradigm, one of Lido's main investors.

Internal Symbiotic documents obtained by CoinDesk show that the project allows users to "re-stake" popular assets that are incompatible with EigenLayer's native assets, using Lido's stETH and others. Symbiotic, developed by the team behind the Stakemind staking service, will be "a permissionless re-staking protocol that provides flexible mechanisms for decentralized networks to coordinate node operators and economic security providers."

These documents are marked as "draft" and "confidential," but several teams building in the nascent re-staking ecosystem have indicated that they are already discussing integration with Symbiotic (including active validation services and liquidity re-staking services based on EigenLayer).

"The new kid in town"

A few years ago, Lido caused a sensation in the DeFi space by developing a protocol that allowed users to stake cryptocurrencies on Ethereum (essentially locking them up) while still being able to obtain the token "stETH" for trading. The project proved to be very popular and has now become the largest DeFi protocol on Ethereum, with $27 billion in deposits. Its dominant position has led some participants to worry about the operational risks posed by Lido's super influence.

However, recently, as users have been transferring assets to EigenLayer, Lido has been struggling to address the issue of declining market share. EigenLayer allows users to re-stake Ethereum's native token ETH to help secure other networks. EigenLayer is one of the most successful projects in the crypto space in recent years, having attracted around $16 billion in deposits since opening to investors last year.

Similar to EigenLayer, Symbiotic will provide a solution called Active Validation Services (AVS) for decentralized applications to jointly ensure each other's security. Users will be able to re-stake assets stored in other crypto protocols to help secure these AVSs (whether they are rollups, interoperability infrastructure, or oracles) in exchange for rewards.

The key difference between Symbiotic and EigenLayer is that users can directly deposit any asset based on the Ethereum ERC-20 token standard into Symbiotic, meaning the protocol will be directly compatible with stETH and thousands of other assets based on the ERC-20 standard. EigenLayer only accepts ETH tokens.

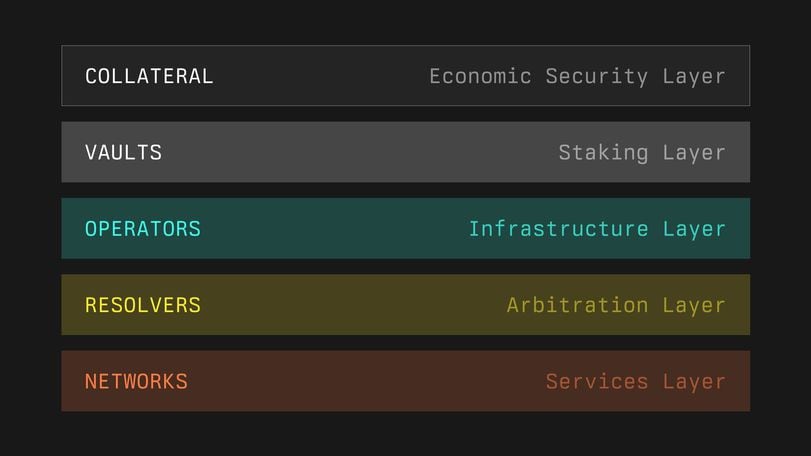

A screenshot of internal Symbiotic documents obtained by CoinDesk describes the "5 interrelated components" of the protocol.

Ironically, according to several sources, when the venture capital giant Paradigm approached Sreeram Kannan, co-founder of EigenLayer, to invest in his project, Sreeram Kannan declined their funding and chose a16z instead. Paradigm told Sreeram Kannan that they would invest in EigenLayer's competitor.

Room for multiple companies in the race

The emergence of a potentially strong competitor to EigenLayer highlights the industry's focus on the re-staking race, with institutions and investors eager to enter the field. Blockworks reported in April that another re-staking startup, Karak, had received funding from Coinbase and others.

"The race is big enough to accommodate more than one big company," said an infrastructure operator planning to integrate with Symbiotic, who requested anonymity due to the project's secret status. "I think Uber and Lyft are the best examples, and it's the same here; the re-staking market will be huge."

The involvement of Cyber Fund led by Lido co-founders and Paradigm may put Symbiotic in a favorable position to challenge EigenLayer. This further proves that those closely related to Lido believe that EigenLayer poses a potential threat to Lido's dominant position.

Although Lido remains the largest DeFi protocol on Ethereum, its strategy around re-staking may determine whether (and how) it can maintain its leading position in the staking field.

Liquidity re-staking companies that have deposited user funds into EigenLayer have eroded the market for Lido's stETH. The two largest liquidity re-staking protocols, Ether.Fi and Renzo, have seen net inflows of $625 million in the past 30 days. Meanwhile, Lido has seen net outflows of $75 million during the same period.

This week, members of the Lido DAO (the governance body that controls the Lido protocol) publicly proposed the "Lido Alliance," which is a framework for thinking about re-staking. The proposal states: "The Lido DAO will identify and recognize projects with similar values and missions that can make a positive contribution to the stETH ecosystem." "Developing stETH into an ecosystem consistent with Ethereum contributes to decentralized networks."

While Lido is not directly associated with Symbiotic, the re-staking company funded by Lido co-founders aligns closely with the framework of the Lido Alliance. EigenLayer only accepts ETH deposits, while Symbiotic does not accept ETH deposits at all. Instead, Symbiotic will allow users to directly deposit any ERC-20 token, such as Lido's stETH.

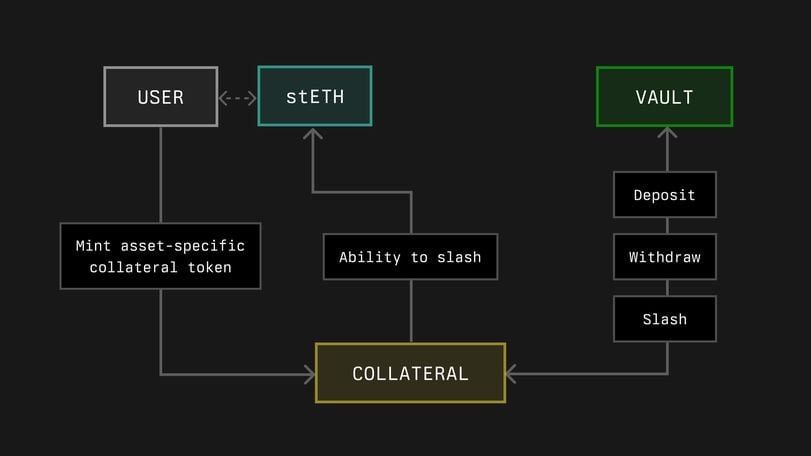

Symbiotic's project documents state: "Collateral in Symbiotic can include ERC-20 tokens, withdrawal credentials for Ethereum validators, or other on-chain assets (such as LP positions), with no restrictions on the blockchain holding the position."

Discussions about the re-staking project

A screenshot of internal Symbiotic documents obtained by CoinDesk is titled "Example of collateral using ERC20 tokens. The creation of collateral will be abstracted when users deposit into the treasury."

Symbiotic's approach to collateral is related to its ambition to become a "permissionless" protocol, which means that applications built on the platform should have a lot of leeway to decide how to expand the platform to serve their use cases.

Mike Silgadze, co-founder of Ether.Fi, expressed excitement about what they are doing in a Telegram chat. "I'm excited about what they're doing. It looks interesting and innovative," he said. "They seem very focused on building something completely permissionless and decentralized."

According to sources, another liquidity re-staking protocol, Renzo, has been discussing integration with Symbiotic after its launch.

Symbiotic has not yet publicly released any information or confirmed plans for when it will launch, but four sources consulted for this article indicated that the platform is expected to be released in some form by the end of this year.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。