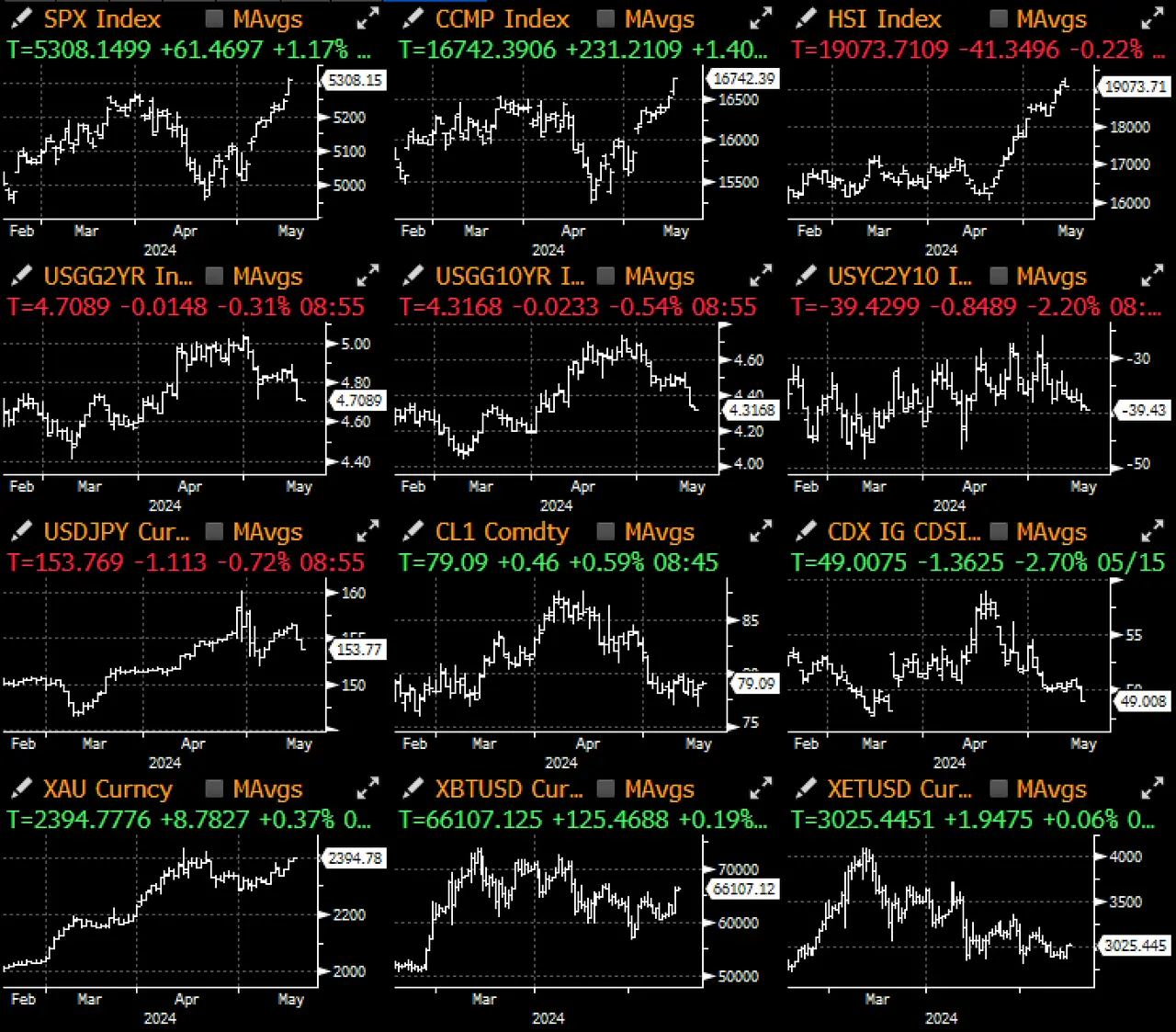

After three consecutive inflation data exceeding expectations, the CPI data released on Wednesday roughly met expectations, which is enough to stimulate another large-scale rebound in the risk market. Taking stock of the market performance:

SPX index hits a new high

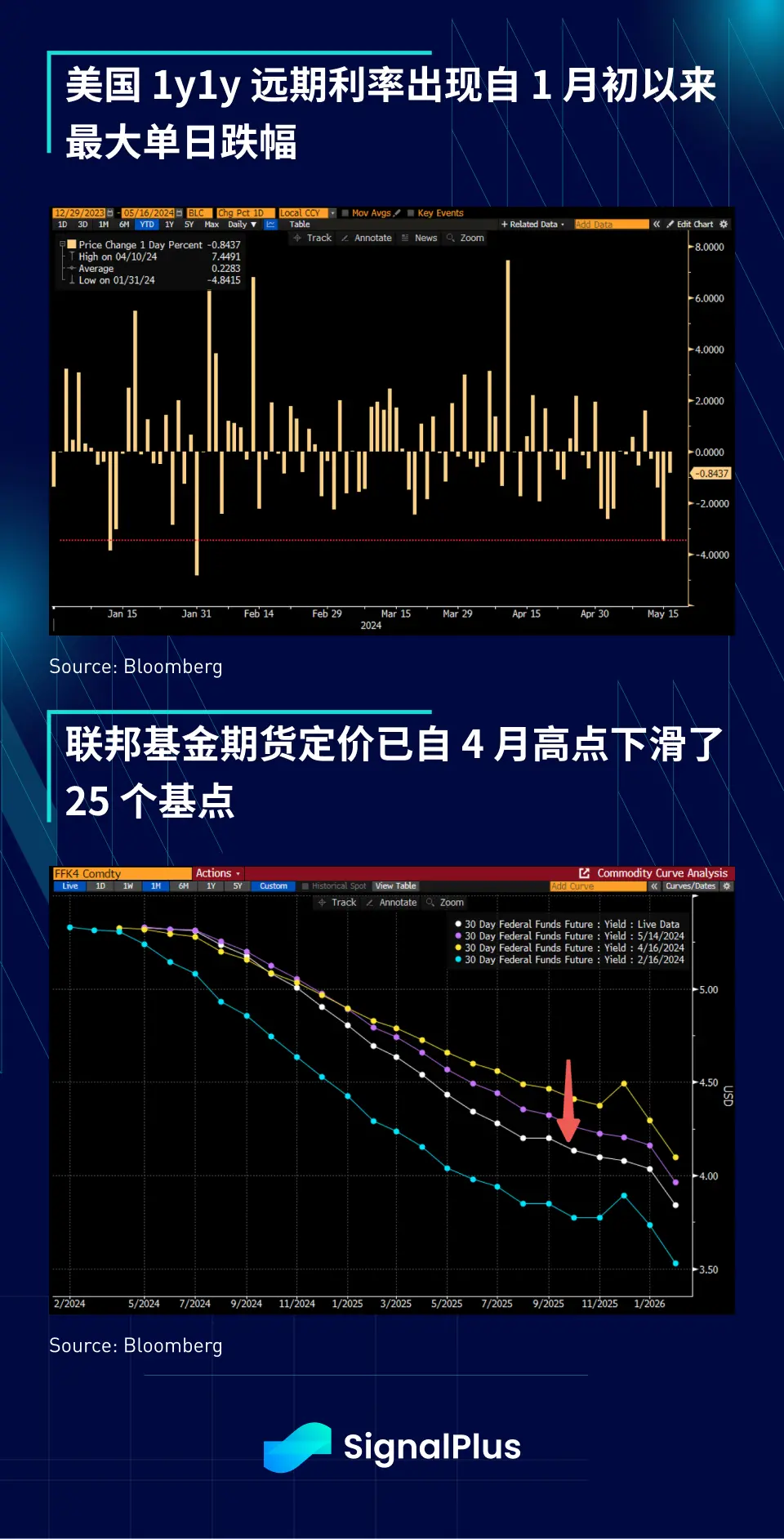

US 1y1y forward interest rates saw the largest single-day decline since early January

2025 federal funds futures pricing dropped 25 basis points from the April high (equivalent to a rate cut)

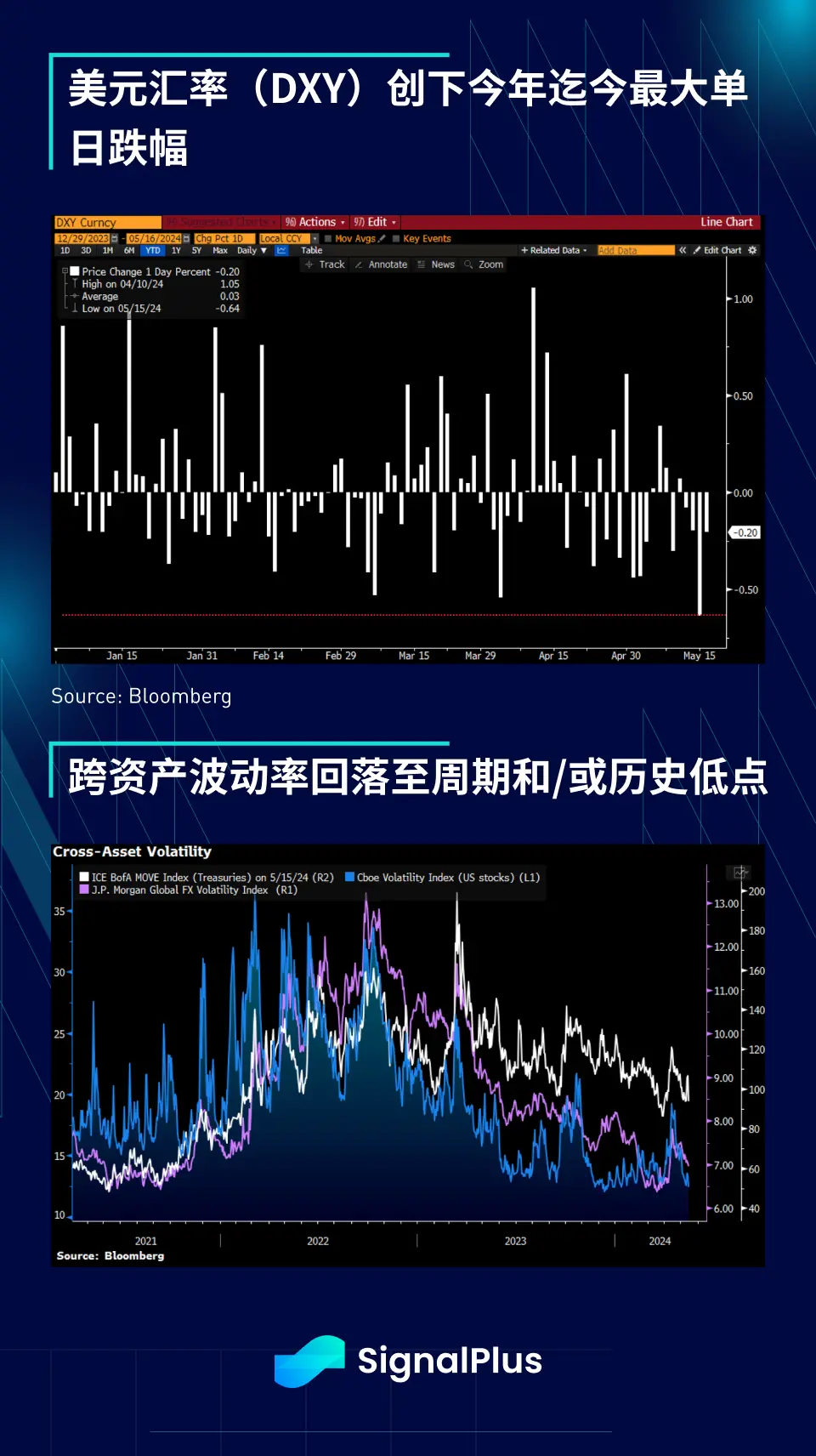

The US dollar index DXY recorded its largest single-day decline so far this year

Cross-asset volatility (forex, stocks, interest rates) fell to mid-term and/or historical lows

Will the Fed cut interest rates soon? The probability of a rate cut in June in the federal funds futures market is only 5%, and in July it is only 30%. Even in September, the likelihood of a rate cut is only around 64%. So, what is everyone excited about?

Will the Fed cut interest rates soon? The probability of a rate cut in June in the federal funds futures market is only 5%, and in July it is only 30%. Even in September, the likelihood of a rate cut is only around 64%. So, what is everyone excited about?

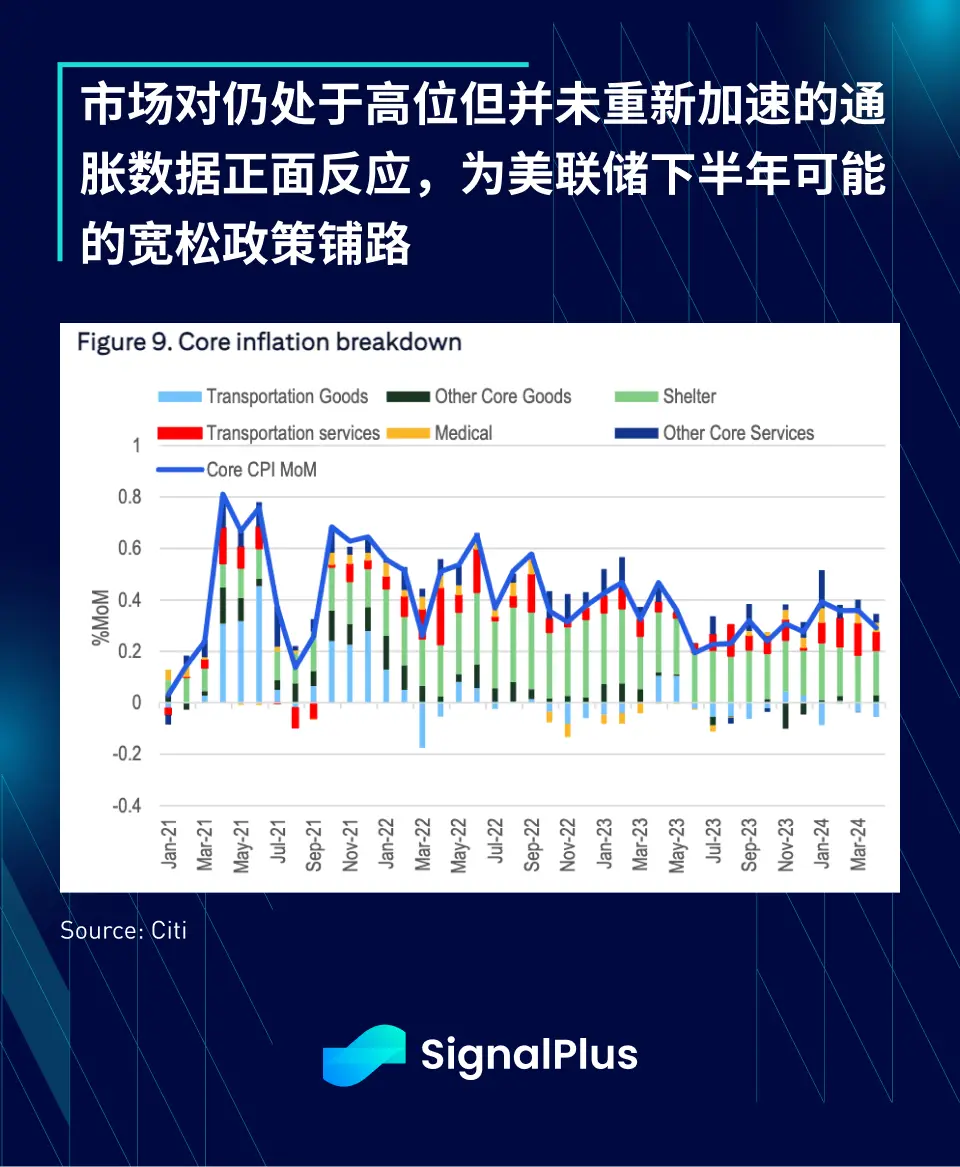

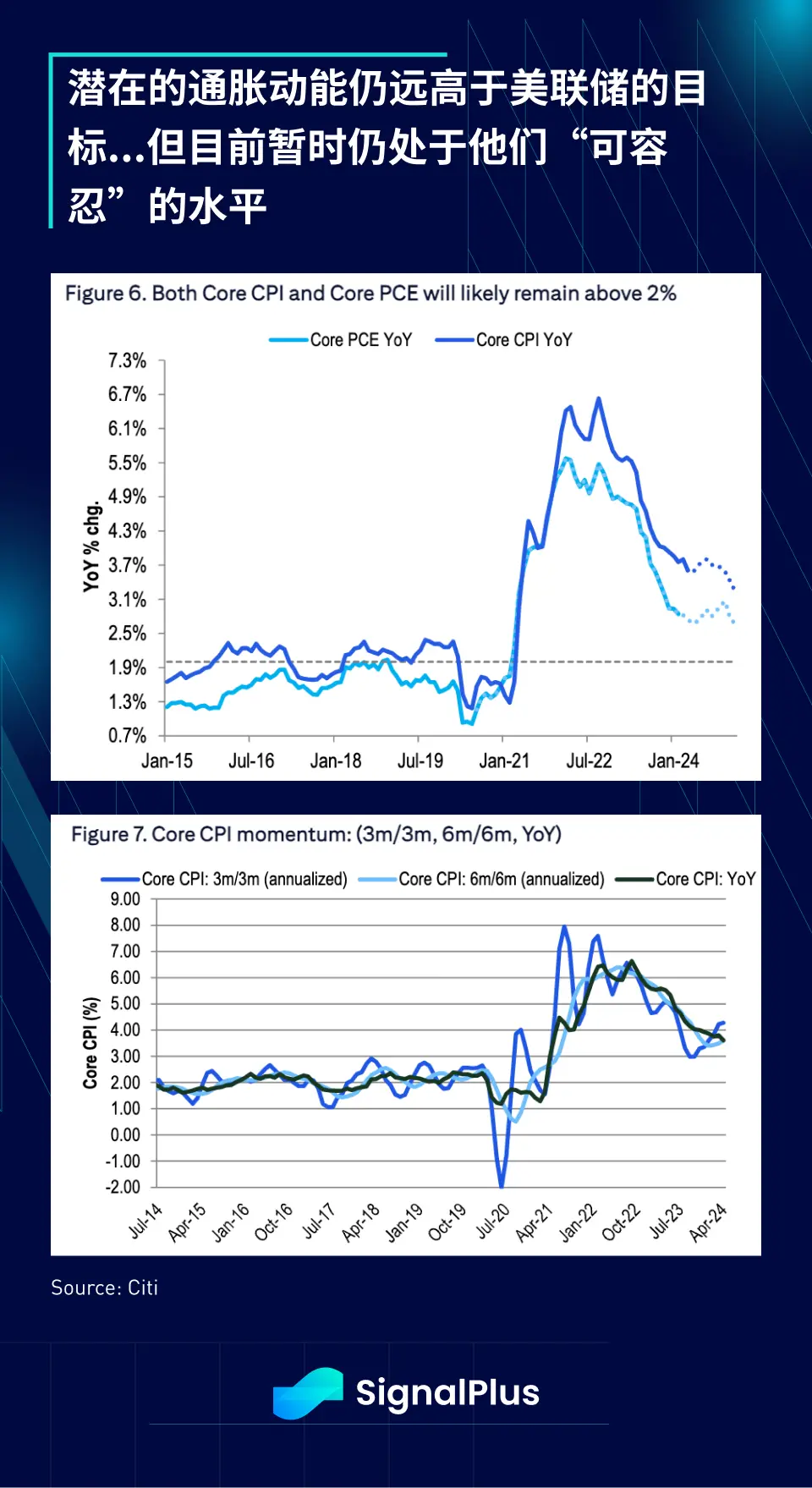

As we mentioned earlier, the Fed has shifted to a completely unbalanced stance. As long as inflation does not accelerate again, even if inflation pressures persist, they can be tolerated, while any signs of weakness in the labor market will be seen as a driver for policy easing. Therefore, although overall inflation and core inflation are still above the Fed's targets of 3.6% and 3.4% respectively, the market's concern is that prices will accelerate again, which did not happen last month. This aligns with the theme of the Fed returning to "watching for the right time to ease," as "slowing labor market" and "high but tolerable inflation" are being confirmed one by one.

Returning to the CPI data itself, core CPI rose by 0.29% month-on-month in April, slightly below market expectations after exceeding expectations for three consecutive months. The softness mainly came from the decline in commodity prices and the controlled growth of housing prices and owner's equivalent rent. Core service inflation, excluding housing, rose by 0.42% month-on-month, roughly meeting expectations.

After the CPI/PPI release, Wall Street expects core PCE to increase by around 0.24% month-on-month in April, moving towards the 2% annualized level and the Fed's comfort zone, and traders remain confident that inflation will continue to fall in the second half of the year.

On the other hand, retail sales data for April was significantly weak, with generally soft spending across different categories. Retail sales were flat month-on-month, below the widely expected increase of 0.4% - 0.5% month-on-month, and core retail sales fell by 0.3% month-on-month, with the previous value also being revised down. General merchandise and non-store sales even saw the largest decline since the first quarter of 2023.

The weaker-than-expected retail sales data continued a series of recent soft consumer data, including rising credit card and auto loan delinquency rates, depletion of accumulated excess savings, and deteriorating labor market conditions. While it is still too early to assert that the economy is significantly slowing down, it seems that we are approaching a turning point in economic growth. Are high interest rates finally beginning to erode the US economy?

As always, the market is happy to ignore any risks of economic slowdown, focusing only on the Fed's loose policy for the time being. A reminder, although the market is very forward-looking and adept at incorporating all available information into pricing, please note that the market is not that forward-looking. Enjoy the current party briefly!

In the cryptocurrency sector, the price of BTC continues to be influenced by overall stock sentiment, breaking through this month's high and rising to around $67,000, the peak in April. ETF inflows have also been very strong, with an additional $300 million flowing in after the CPI release yesterday, and even GBTC saw net inflows. However, the performance of various tokens still varies greatly, with ETH and some of the top 20 tokens still struggling to recover from declines, and the market's gains becoming increasingly concentrated in a small number of tokens (BTC, SOL, TON, DOGE), rather than the overall market's rise.

This situation is expected to continue, with the focus remaining on the main beneficiaries of TradFi fund inflows, BTC (13F filings show that the BTC ETF exposure of some large hedge funds continues to increase), and the FOMO phenomenon for native tokens or degenerate tokens will be relatively less in this cycle. Good luck to everyone!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。