When influencers claim to be experts, the subsequent return on investment tends to be more negative.

Written by: TechFlow of Deep Tide

For "leeks" (a term for inexperienced investors), paying attention to various KOL (Key Opinion Leader) bloggers' investment recommendations is an important source of wealth secrets.

So, are KOL investment recommendations a consistently winning strategy or just a series of coincidences?

Different bloggers have completely different answers to this question. A single 100x correct investment recommendation, or a single recommendation that leads to zero returns, can both be highly subjective survivorship biases.

From the perspective of the entire industry, how do the investment recommendations made by KOLs perform in the end?

In February, several researchers from Harvard Business School, Indiana University Kelley School of Business, and Texas A&M University jointly published a paper titled "Cryptocurrency Influencers".

The article studied the performance of cryptocurrency-related assets mentioned in approximately 36,000 tweets published by 180 of the most famous cryptocurrency social media influencers (KOLs) over a two-year period ending in December 2022, covering over 1,600 tokens.

Key Findings:

After classifying the tweets using machine learning and tracking the subsequent price performance of the mentioned tokens through various statistical descriptions and tests, the key findings are as follows:

The initial tweets by cryptocurrency influencers are associated with positive returns. However, these tweets are followed by significant long-term negative returns, indicating that they generate minimal long-term investment value.

The impact of these tweets is most pronounced when they involve small tokens, have a large number of Twitter followers, and are made by individuals who claim to be experts.

Using machine learning methods to classify the tweets, the study found that the above results are even stronger when the tweets have a more positive sentiment or are related to "buy" recommendations.

Data Illustration

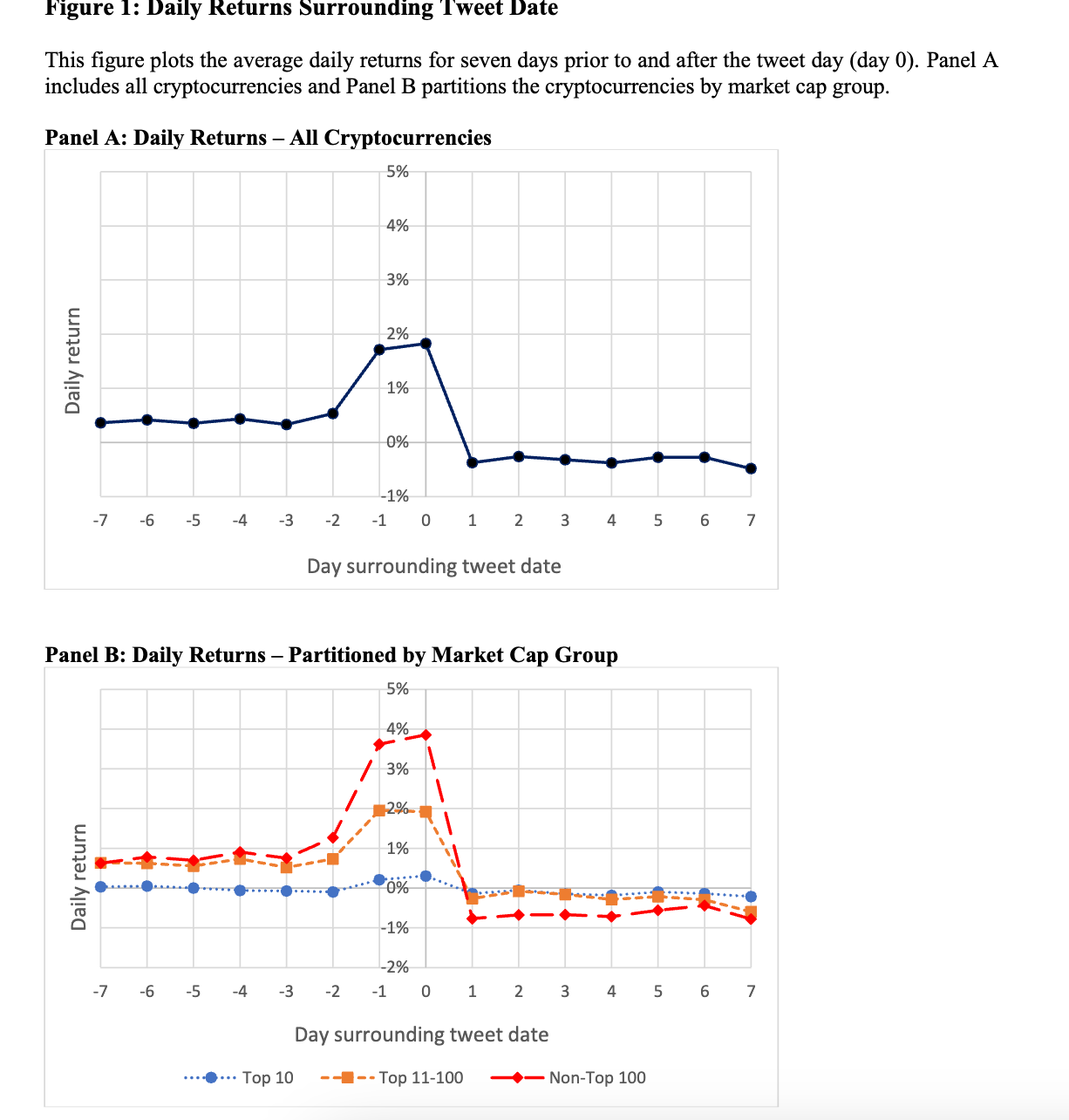

Cryptocurrency influencers' tweets show positive short-term return effects:

The average daily (two-day) return rate after tweeting about a token is 1.83% (1.57%).

For cryptocurrency projects outside the top 100 by market capitalization, the return rate one day after the tweet is 3.86%.

The earliest significant decline in returns occurs five days after the tweet is published. The average return rate from the second day to the fifth day is -1.02%, indicating that over half of the initial gains are erased within five trading days.

From a longer-term perspective, the average cumulative returns at the end of 10 and 30 days after the tweet are -2.24% and -6.53%, respectively. Further analysis of these negative subsequent returns shows that they are even more negative for low-market-cap cryptocurrencies (where information and liquidity issues are most severe).

A rough estimate suggests that investing $1,000 in a non-top 100 cryptocurrency mentioned in a tweet and holding the investment for thirty days would result in a loss of $79 (7.9%), with an annualized loss of 62.8%.

So-called experts: When influencers claim to be experts, the subsequent return on investment tends to be more negative; and when these experts have more followers, the return on investment is even worse.

Overall, the research results indicate that the long-term investment advice provided by cryptocurrency influencers is unprofitable on average. Profits can only be made by immediately exiting positions after the tweet, but this strategy may not always be feasible due to market illiquidity. Additionally, this immediate selling behavior contradicts the "never sell" culture in the cryptocurrency community.

Reflection

The collective evidence in the paper suggests that investors should be cautious in following cryptocurrency KOLs' investment recommendations, as most of the gains disappear shortly after the tweet is published.

However, the authors of the article also acknowledge that the evidence is not conclusive. Cryptocurrency KOLs may simply be chasing trends or promoting tokens that will gain them the most popularity and followers, thereby benefiting them economically.

Furthermore, a more benign alternative explanation is that cryptocurrency influencers genuinely believe that cryptocurrency assets will ultimately experience high levels of growth. Influential individuals may also only focus on short-term buying recommendations and assume that investors know to sell immediately.

Nevertheless, the results of the paper still provide valuable information, as they offer clear evidence that investment recommendations are unlikely to be useful if one holds the tokens for more than a few months or even years.

The paper also suggests that regulatory agencies and business media may prompt more scrutiny of such activities to determine whether these activities conflict with more relevant interests.

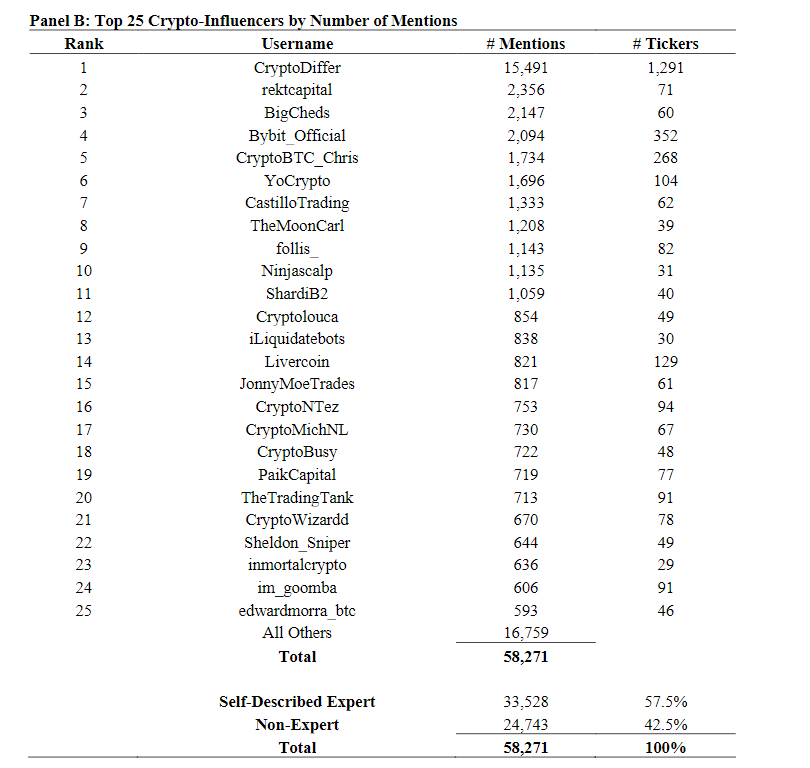

Appendix: Top 25 Twitter accounts mentioned in the paper (the table is based on rankings from two years ago due to the research timeline)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。