BTC 4-hour chart:

Yesterday's CPI index met expectations, triggering market expectations for a Fed rate cut, leading to a 7% increase in Bitcoin. Due to better-than-expected inflation data, the market expects the Fed to lower interest rates in the near future, and Bitcoin is currently in an upward trend.

Currently, with the appearance of a large bullish candle, if the price is supported and consolidates within the current range, the view is that further upward movement will be maintained.

The first resistance within the day is at $66,170, and the second resistance is at $66,800. If the price breaks through the first resistance, it is considered that $67,000 is a possible retracement range, and the second resistance is also the resistance level of the new high point.

Because a short-term adjustment may occur near the first and second resistance levels, a box trading strategy can be adopted. If the price is supported after consolidation, the bullish view can be maintained.

The first support is at $65,650, and the second support is at $64,830. In the short term, it is expected that the first support area is where a rebound can be anticipated. If it falls below this support, further adjustment is considered, with the maximum adjustment seen at $64,500.

The short-term box support is between $65,600 and $66,170. It is expected that the price will undergo a small consolidation after the rise in today's trading, so a box range trading strategy can be adopted.

Due to the significant increase in price, an adjustment may occur, so it is necessary to wait for opportunities to rebound within the adjustment range.

Please refer to these suggestions when trading.

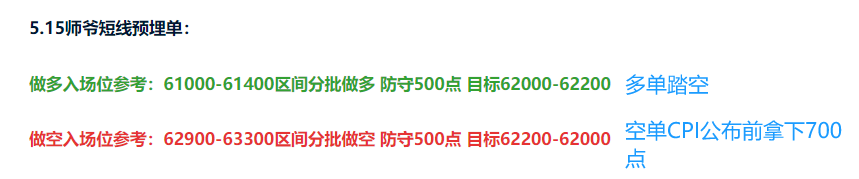

Short-term pre-set orders by Chen on May 16:

Long entry reference: Batch long positions in the range of $64,600-$65,000, defend 500 points, target $65,700-$66,170

Short entry reference: Batch short positions in the range of $66,700-$67,100, defend 500 points, target $66,100-$65,700

This article is exclusively planned and published by Chen (WeChat public account: 币神师爷陈). If you need to learn more about real-time investment strategies, untangling, spot contract trading techniques, operational skills, and candlestick knowledge, you can add Chen to learn and communicate, hoping to help you find what you want in the currency circle. Focusing on BTC, ETH, and altcoin spot contracts for many years, there is no 100% method, only 100% trend following; daily updates on macro analysis articles across the network, mainstream coin and altcoin technical indicator analysis, and spot mid-to-long-term replay price prediction videos.

Friendly reminder: Only the column public account (shown in the image above) is written by Chen. The end of the article and other advertisements in the comments section are unrelated to the author. Please carefully distinguish between true and false. Thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。