Mergers and acquisitions may become a key strategy, but should be avoided for the sole purpose of price manipulation or risk avoidance.

Translated by: TechFlow

Abstract

The Web3 industry is constantly changing, with new mainnet projects emerging, but some also disappearing rapidly. Recently, mergers between mainnets are becoming a new trend.

Mainnet mergers offer benefits such as enhanced competitiveness, talent retention, and increased value. However, caution is needed due to the vastness of the mainnet ecosystem and potential issues with delisting from exchanges.

In the fast-paced Web3 market, mergers and acquisitions may become a key strategy, but should be avoided for the sole purpose of price manipulation or risk avoidance.

1. Introduction

In the Web3 industry, mergers and acquisitions (M&A) between mainnets have recently emerged as a new trend. Each mainnet is seeking to generate synergies by merging with other mainnets with different assets and experiences, or by quickly enhancing competitiveness through the acquisition of validated technical capabilities.

The Web3 industry is characterized by rapid development, with market trends emerging and disappearing quickly, unprecedented in pace of change. New mainnet projects emerge every day, and those that cannot adapt quickly may quickly become marginalized and outdated. Data from Coingecko shows that an average of 5,300 new token projects are launched every day, highlighting the rapid pace of the market, with projects constantly emerging and disappearing. Although token projects are different from mainnet projects, it is reasonable to speculate that trends in the token project field also to some extent influence the dynamics of the mainnet market.

As competition in the Web3 industry intensifies, mergers and acquisitions are becoming strategic means for projects to enhance competitiveness and ensure survival. It is expected that the frequency and diversity of mergers and acquisitions between mainnets will significantly impact the industry's development trajectory. This report analyzes recent cases of mergers and acquisitions between mainnets and discusses the objectives behind these strategies and the expected outcomes they aim to achieve.

2. Mainnet Mergers and Acquisitions: A New Trend in the Web3 Industry

Recent mergers and acquisitions between mainnets can be categorized into three major strategies:

1) Horizontal integration. This involves a mainnet project acquiring or merging with competing mainnets within the same market to strengthen market influence.

2) Vertical integration. Aimed at reducing costs and maximizing synergies by merging with mainnets related to specific businesses or domains within the value chain.

3) Mixed integration. Mergers of mainnets with no direct business relevance to diversify operations and rapidly enhance capabilities in unfamiliar areas.

Vertical Integration

In May 2023, Vietnam's Coin98 announced the acquisition of TomoChain.

In March 2024, SingularityNET announced plans to merge with Fetch and Ocean Protocol.

Horizontal Integration

- In January 2024, Klaytn announced plans to merge with Finschia.

Mixed Integration

- In April 2024, Carry Protocol announced plans to merge with SLG.Games.

2.1 'Kaia': Integration Project of Klaytn and Finschia Foundation

The merger between Klaytn and Finschia Foundation represents the first case of mainnet integration. In January of this year, the two projects announced the launch of an integrated mainnet, now renamed 'Kaia'. Their goal is to create the largest blockchain in Asia by combining their respective ecosystems and assets, aiming to lead the global Web3 market.

This merger is considered to expand their dominant influence in the Web3 market (especially in Asia) by merging competing mainnets. Its significance lies in the comprehensive integration of human, material, and technical resources. Kaia is expected to be jointly operated by personnel from Klaytn and Finschia Foundation, while integrating their respective assets. Significant examples include Klaytn's exclusive on-chain assets and real-world assets (RWA), as well as Finschia's games and other content assets based on LINE FRIENDS IP.

Utilizing Klaytn's EVM-based and Finschia's Cosmos-based expertise, the team plans to develop an integrated mainnet that supports EVM and CosmWasm compatibility. This initiative is expected to create a vast ecosystem within the Web3 industry, fostering a highly advanced mainnet.

Through this comprehensive integration, Klaytn and Finschia will closely collaborate to maximize each other's strengths and compensate for their respective weaknesses. They will also leverage the assets of partners Kakao and LINE to further consolidate their dominant position in the Asian market. In an industry where institutional investment is increasing and development is accelerating, this merger is considered a timely strategic move. There is great anticipation for the changes and innovations this merger will bring to the global Web3 ecosystem, extending beyond Asia.

2.2 Major Project 'ASI' of Web3 Artificial Intelligence Alliance

In March, Web3 projects in the field of artificial intelligence, SingularityNET, Fetch, and Ocean Protocol announced their merger plans. After receiving approval in a governance vote in April, they are about to launch a new token project called 'ASI (Artificial Super Intelligence)'. This merger differs slightly from the integration of Klaytn and Finschia, as they are creating a new project to expand their plans while retaining the independence of each foundation.

The projects involved in the ASI plan are not direct competitors, but through vertical integration, they are connected to complementary projects in the value chain of the artificial intelligence industry. They plan to merge existing tokens into the ASI token and use a Cosmos-based chain (a hard fork of Fetch's mainnet) to vertically integrate the technology stacks held by each project. The main goal is to create synergies and accelerate the development of decentralized AI technology.

At the same time, the leadership, teams, communities, and financial resources of the participating ASI projects are expected to remain unchanged. This approach is more akin to a strategic partnership, rather than a complete merger, indicating an intention to create synergies through collaboration while retaining the identity and unique features of each project.

The ASI project aims to advance decentralized AI technology based on Web3 through vertical integration in the artificial intelligence industry. By setting goals that individual projects may find difficult to achieve, they intend to drive innovation by leveraging the comprehensive advantages of each participating entity. As the fusion of Web3 and AI as a key driver of future technological advancement gains attention, the development of the ASI project is expected to be a significant milestone in establishing a decentralized artificial intelligence ecosystem.

2.3 Convergence of Advertising and Gaming Industries: Horizontal Expansion of the 'GAME Build' Project

In April, the blockchain-based reward advertising platform Carry Protocol and the Web3 gaming platform SLG.Games announced their merger plans. After a governance vote, they announced the launch of a new token project called 'Game Build'. By integrating their expertise in blockchain technology, advertising, and game development, their goal is to generate synergies within the Web3 gaming ecosystem and drive innovation.

The merger of these two projects is an example of horizontal integration, aiming to complement each other's capabilities. Carry Protocol plans to collaborate by leveraging its expertise in blockchain technology and advertising, while SLG.Games will contribute its expertise in game development and blockchain integration. The goal is to introduce a blockchain-based advertising platform and development tools designed specifically for the gaming industry. Additionally, the Game Build project envisions providing advertising solutions optimized for Web3 games and developer-friendly all-in-one infrastructure.

The success of the Game Build project depends on how effectively Carry Protocol and SLG.Games merge their expertise to create synergies. Observing the changes and innovations their collaboration brings to the gaming industry is crucial.

2.4 Acquiring Mainnet Technology through the Purchase of TomoChain by Coin98

In May of last year, the Vietnamese Web3 platform Coin98 acquired the local mainnet TomoChain. This was seen as a strategy by Coin98, lacking experience in mainnet development, to quickly ensure technological competitiveness and maximize synergies by acquiring the mature technical capabilities of TomoChain.

After acquiring TomoChain, Coin98 rebranded it as Viction, making it a core part of its ecosystem. Coin98 plans to use Viction's technology and resources to cultivate a developer-friendly environment and create synergies by integrating it with various services, such as its Web3 wallet. This integration is expected to become a unique advantage for Coin98 in the competitive Web3 industry. However, the actual impact of the changes so far has been mainly superficial, including the rebranding of the native token, and its actual effects are yet to be observed.

The focus of industry attention is on the potential changes and impact that the collaboration between Coin98 and TomoChain will bring to the Web3 industry. If this acquisition can successfully integrate and leverage the strengths of both companies, it has the potential to establish a new model for protecting mainnet technology and expanding ecosystems.

3. What are the Purposes of Mainnet Mergers?

The case studies so far indicate that mergers between mainnets are becoming a significant trend in the Web3 industry. These trends are driven by various objectives, which can be analyzed into three main factors:

Strengthening business and technological competitiveness

Acquiring professional talent

External expansion of project value

First, strengthening business and technological competitiveness. Through mergers and acquisitions, mainnets can expand geographically or enter new business areas. The 'Kaia' project of Klaytn and Finschia is an example of this strategy. Klaytn and Finschia have competitive advantages in different regions and business areas, with Klaytn excelling in infrastructure-driven industries and Finschia excelling in content-driven industries. Their merger aims to expand their respective business areas, address weaknesses, accelerate growth and development, and quickly increase market share.

Additionally, this can also be a strategic move for technological advancement. By acquiring a mainnet with specialized technical capabilities, companies can quickly enhance their own technology. Coin98's acquisition of TomoChain is a typical example. Their goal is to acquire advanced mainnet technology through this acquisition and expand their wallet ecosystem. This approach is efficient in both time and cost, becoming a key strategy in the competitive Web3 industry.

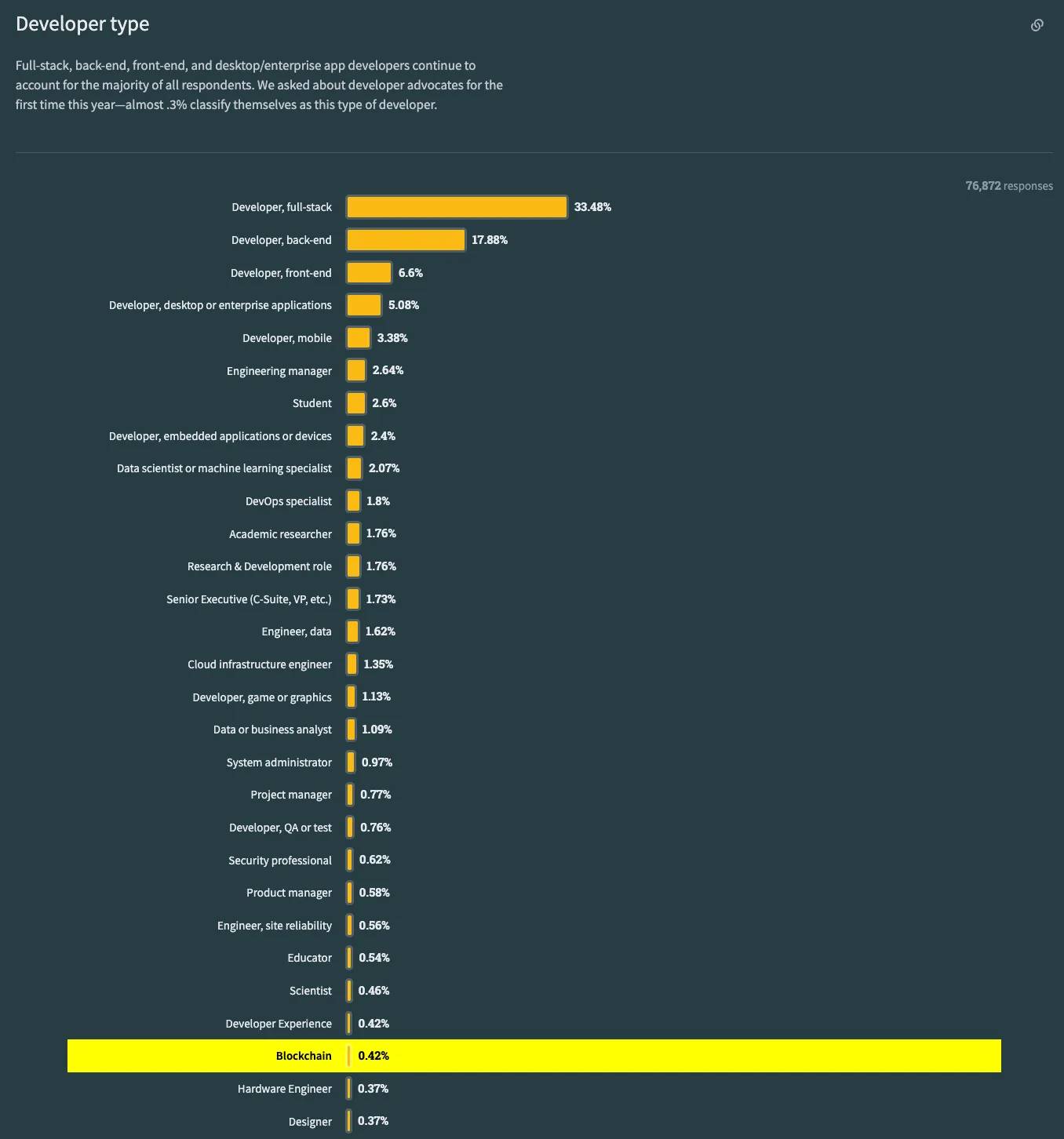

Secondly, the objective of acquiring professional talent. The Web3 industry is a rapidly evolving field of cutting-edge technology, and acquiring capable talent significantly impacts the growth and development of projects. Especially scarce are talents directly involved in designing and developing mainnets, such as core blockchain developers. According to the 2023 Stack Overflow survey, only 0.42% of all developers are blockchain developers, indicating a severe shortage of professional talent. Therefore, mergers between mainnets are also aimed at acquiring these valuable talents.

Lastly, the objective of external expansion of project value. In the Web3 industry, market capitalization and total value locked (TVL) are important indicators for evaluating mainnets and are considered measures of reputation. These metrics significantly increase the brand awareness of mainnets and strengthen their market position. Projects with high market value or TVL attract more attention and capital inflow. Therefore, mainnets adopt the strategy of mergers and acquisitions to quickly increase their enterprise value. By combining the liquidity and capital of each mainnet, they can quickly increase TVL and strengthen their market position, making mergers and acquisitions an attractive choice.

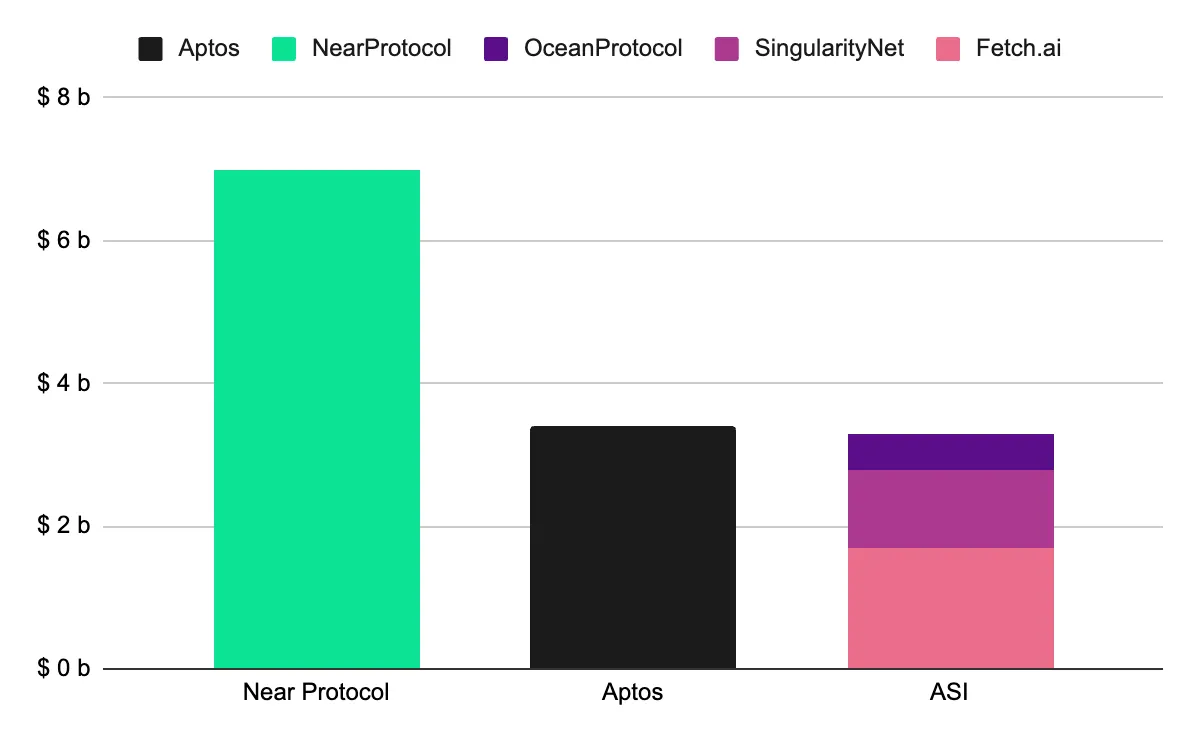

In fact, the merger of the three projects SingularityNET, Fetch, and Ocean Protocol quickly entered the top 30 in market capitalization rankings. This example demonstrates that mergers and acquisitions can be an effective strategy to accelerate external growth of mainnets and expand industry influence.

In this way, mergers and acquisitions between mainnets are becoming key strategies for companies in the Web3 industry to overcome growth limitations and enhance competitiveness. These measures, aimed at expanding business scope, advancing technology, and acquiring professional talent, are expected to continue and significantly impact the future development of the Web3 industry.

4. What are the Considerations for Mainnet Mergers?

Merging mainnet projects is similar to the risks encountered in the Web2 industry, specifically, merging mainnets involves integrating vast ecosystems and cultures, making the process more complex and requiring careful handling.

Challenges in integrating human and material resources

Challenges in integrating communities and ecosystems

Listing issues on exchanges

First, the challenge of integrating human and material resources must be handled with care. This process reflects the issues typically encountered in company mergers and acquisitions. A notable example is the merger of Mercedes and Chrysler, known as the "merger of the century", which ultimately failed despite widespread market attention. This merger was thwarted by cultural conflicts and different working styles. Similar issues may arise in mainnet merger cases, requiring careful management and foresight.

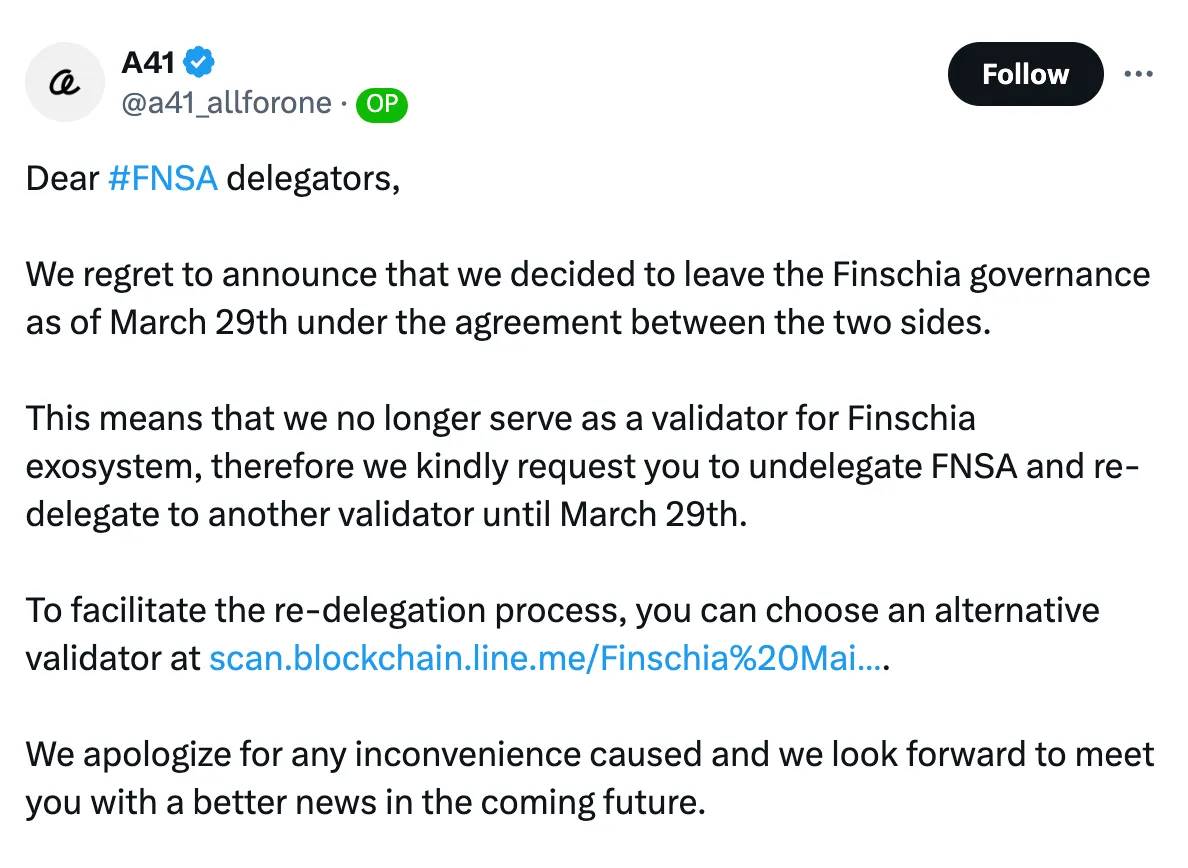

Secondly, integrating communities and ecosystems brings significant challenges. Unlike Web2 companies, mainnets include ecosystems and communities of various dApps and governance participants. Therefore, internal and external integration with stakeholders is crucial. A notable example is the opposition from the community and governance participants during the merger process of Klaytn and Finschia. As mainnets operate within a decentralized structure, reaching consensus not only internally but also among a broader ecosystem of stakeholders is crucial. Therefore, it is crucial to ensure a smooth process when deciding on a merger and to recognize potential issues if the integration is mishandled.

For mainnets, the listing of their tokens on exchanges is crucial. However, the process of token conversion or issuing new integrated tokens during mainnet integration may not go smoothly on exchanges. In fact, most exchanges are very cautious about token conversions and the issuance of new tokens resulting from mergers. Delisting and relisting may take a long time, potentially reducing competitiveness during the process.

In conclusion, the integration process after mainnet mergers and acquisitions is crucial. Unlike Web2 companies, mainnets must obtain consensus from a more diverse and complex set of stakeholders and handle exchange listing issues strictly. Successful mainnet mergers and acquisitions require carefully prepared strategies and implementation plans to effectively address these challenges.

5. Conclusion

It is expected that mergers and acquisitions between mainnets will become the new standard in the Web3 industry. With the continued growth in the number of blockchain projects, only a few mainnets will eventually gain favor in the market. Therefore, frequent mergers and acquisitions are expected to fill gaps and strengthen advantages.

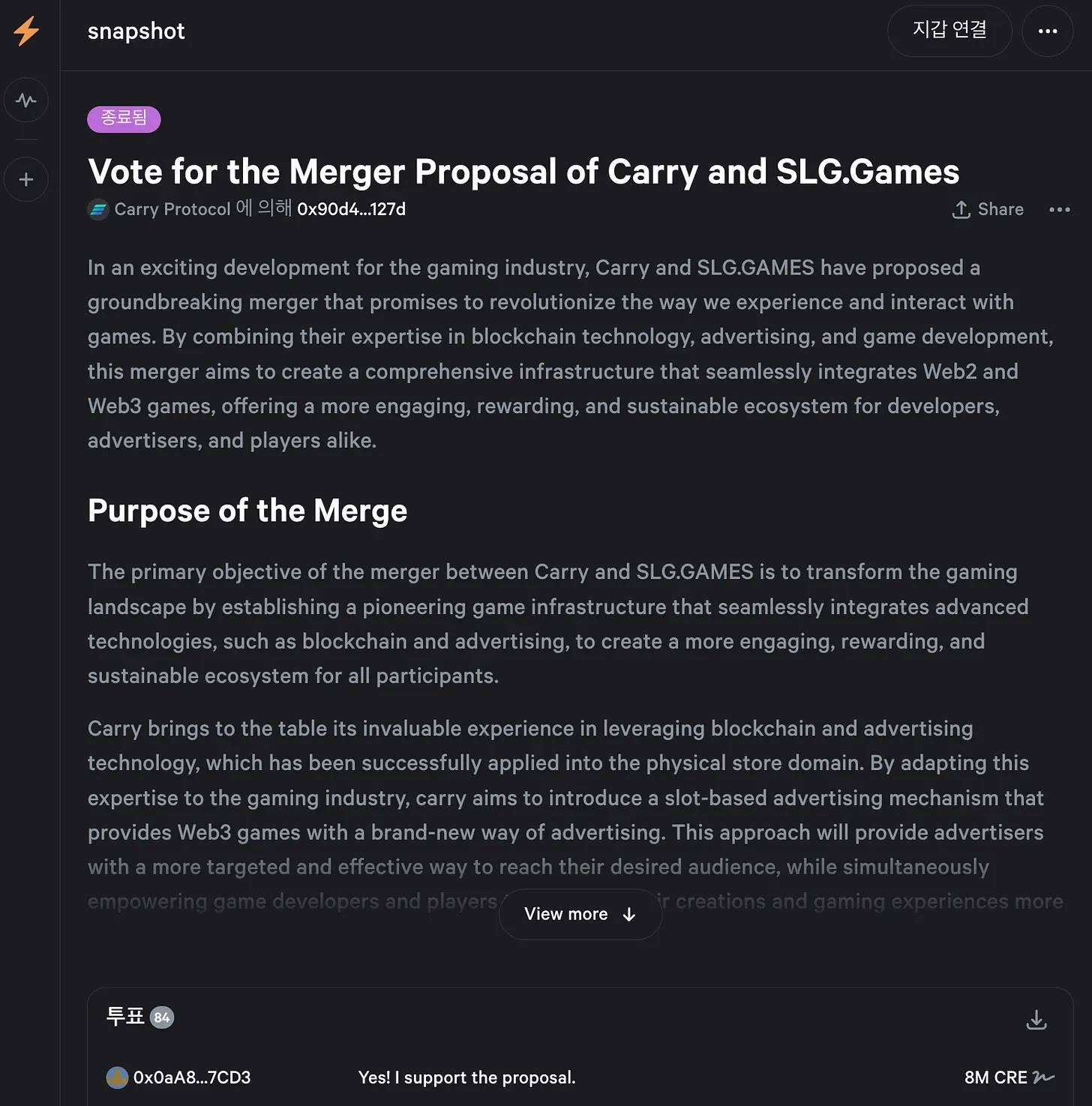

However, this process should not be used as an event aimed at short-term gains, nor should it be used as a means to evade responsibility or risk. As seen in the case of the merger between Klaytn and Finschia, proactive communication, persuasion, and long-term preparation are necessary before this process. In most current project mergers, governance voting has been poorly conducted, and the voter turnout has been low. For example, in the merger proposal between Carry Protocol and SLG.Games, only about 100 wallet addresses participated in the vote, indicating that it did not fully reflect the opinions of all token holders.

Nevertheless, with the accumulation of more cases and the establishment of new strategies and narratives, these chaotic situations are expected to improve. In conclusion, mainnet mergers and acquisitions are a key strategy for overcoming growth limitations and accelerating development, crucial for the dynamic Web3 industry. Whether recent merger cases can become successful precedents is worth observing.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。