Author: 1912212.eth, Foresight News

How to open up various income opportunities for Bitcoin holders has always been one of the directions explored by the industry. In the big cycle of the crypto bull market, it seems somewhat inefficient to just passively hold Bitcoin and wait for its price to appreciate.

Zest is a DeFi project specifically designed for Bitcoin and has recently received a $3.5 million seed round of financing, led by Tim Draper with participation from Binance Labs. Tim Draper, a Silicon Valley venture capital guru, has previously invested in well-known companies such as Baidu, Skype, and Hotmail, and has also made investments in Web3 projects such as Arkham, Coinbase, Gemini, Ledger, and Maker. It is worth mentioning that this is also the first investment by Binance Labs in the Stacks ecosystem. What are the specific features of Zest, a DeFi project based on Stacks and positioned as a Layer 2 solution for Bitcoin?

Introduction to Zest

Zest Protocol is a Bitcoin lending protocol based on Stacks. In the past, in the collateralized lending solutions for Bitcoin, users often needed to trust exchanges or custodians of wBTC. Zest, on the other hand, reduces counterparty risk by transparently holding capital and issuing loans on-chain. Bitcoin collateral users can view or transfer funds at any time without any third-party trust risk.

Zest's founder, TychoTycho, graduated from the University of Oxford and was listed on Forbes' 30 Under 30 list of outstanding young people. Before founding Zest, he was a core contributor and developer for Stacks. He also served as a senior executive at Trust Machinese, a developer of Bitcoin ecosystem applications. The impressive resume has garnered significant attention for Zest.

Operating Mechanism

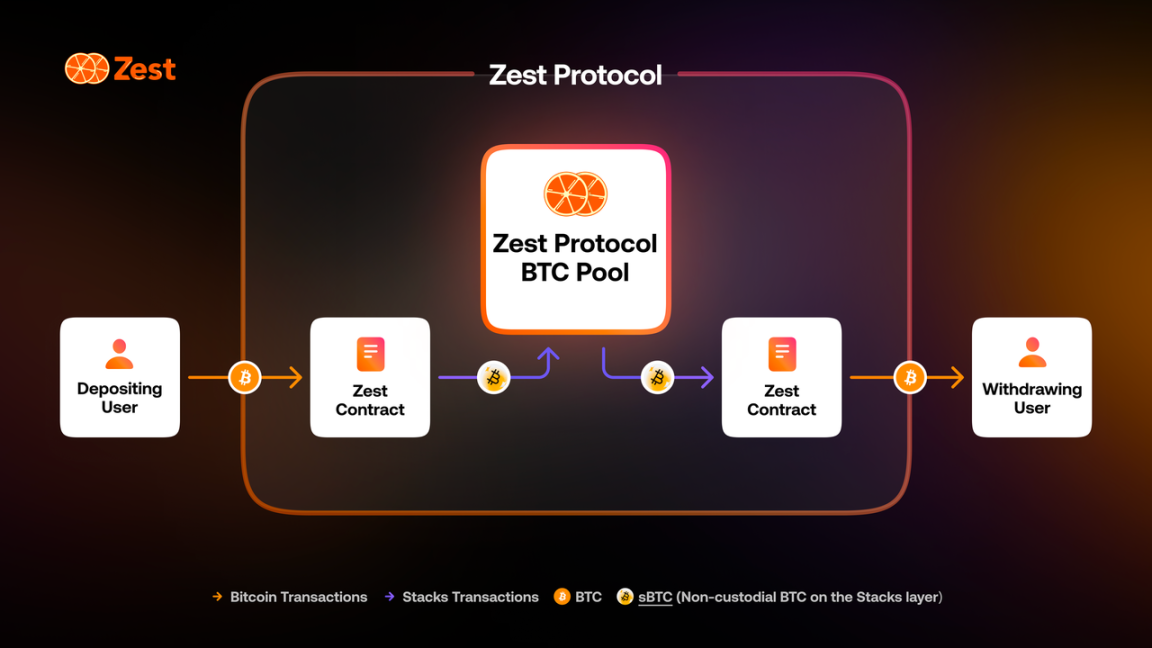

Zest primarily utilizes the Stacks Layer 2 architecture, allowing native BTC to be transferred to Stacks and become sBTC (to be launched in October 2023, a BTC version supported 1:1 on Stacks), while user operations interact with native BTC on the Bitcoin chain.

Although users' sBTC is stored in the Zest pool, an equivalent amount of BTC is held in the Bitcoin chain under the Stacks consensus mechanism's threshold signature script.

Furthermore, collateralized lending on Zest does not incur wrapping fees, whereas wBTC charges a portion of the fees for wrapping.

It is worth mentioning Clarity on Stacks, a smart contract that allows users to interact with BTC by reading its state from the Bitcoin chain. Zest's lending is based on Clarity and its design is inspired by Aave v3. However, due to the hard fork of Stacks' sBTC still pending until mid-year, its main functionality will only be observable after the upgrade.

In the design of the Zest mechanism, two types of roles play important roles for borrowers, namely, pool representatives and institutional borrowers.

Pool representatives are primarily responsible for managing the BTC lending pool on Zest. Each Bitcoin liquidity pool is managed by a pool representative. Pool representatives are responsible for negotiating loan terms with borrowers, conducting due diligence, and liquidating collateral in the event of default. Pool representatives review the reputation, expertise, and performance of borrowers to evaluate loan terms.

Once the borrower and the pool representative agree on the borrower's interest rate and collateral ratio, the pool representative will provide funds for the loan from the lending pool they manage. Pool representatives are appointed by the Zest Protocol DAO contract, and if their power is abused, the Zest Protocol DAO contract can freeze the pool and withdraw the loan.

The pool representative's authority includes creating Bitcoin pools to attract funds, permitting or denying loans, evaluating borrowers, and managing balances in the pool. In other words, before creating a lending pool, all pool representatives must be whitelisted.

When a user's identity is an institutional borrower, Zest allows them to borrow BTC using their balance sheet.

In addition, Zest specifically sets a grace period for all borrowing users. When the collateral value falls below the liquidation price, there is a 3-day grace period during which users can add collateral to avoid forced liquidation.

Currently, for every $1 worth of collateral per day, users earn 1 point. Additionally, they can also earn points by inviting friends through a referral link.

Last month, shortly after Zest deployed its mainnet, it was targeted in a hack. The attacker manipulated the value of collateral by repeatedly listing items in the collateral list, thereby taking out far more STX than they should have in 5 borrowing operations. The attacker stole a total of 324,000 STX, and although all losses will be compensated by Zest's treasury, it still caused some negative impact. Zest has since reopened after a security audit.

In the lending feature section, Zest has temporarily launched the Stacks market and is about to launch the BTC market. According to official data, it has already obtained a TVL of over $10 million. With the upcoming hard fork upgrade for sBTC, once the market enthusiasm is reignited, Zest may experience a strong growth period.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。