Authors: Luccy, Sky, BlockBeats

On May 15th, according to Bloomberg, sources revealed that BlockTower Capital's main hedge fund had been hacked, with some funds depleted and the whereabouts of these funds still unknown. The hacker has not been arrested.

It is reported that BlockTower Capital has hired blockchain forensic analysts to determine the reason for the fund theft and recently notified its limited partners of the theft. However, BlockTower has declined to comment on the hack, and its Chief Information Officer and founder, Ari Paul, has not yet made any statements on the matter.

What is the relationship between BlockTower and MakerDAO?

BlockTower Capital was established in 2017 and has invested in companies including non-fungible token developer Dapper Labs, game studio Sky Mavis, and the failed stablecoin creator Terraform Labs. According to data provider PitchBook, the company manages $1.7 billion in assets.

BlockTower Capital focuses on investing in RWA credit assets. In January of this year, two executives of BlockTower Capital, in collaboration with Goldman Sachs, established a new crypto asset investment company called Neoclassic Capital, focusing on derivatives, tokenization of real-world assets, entertainment, gaming, and social sectors.

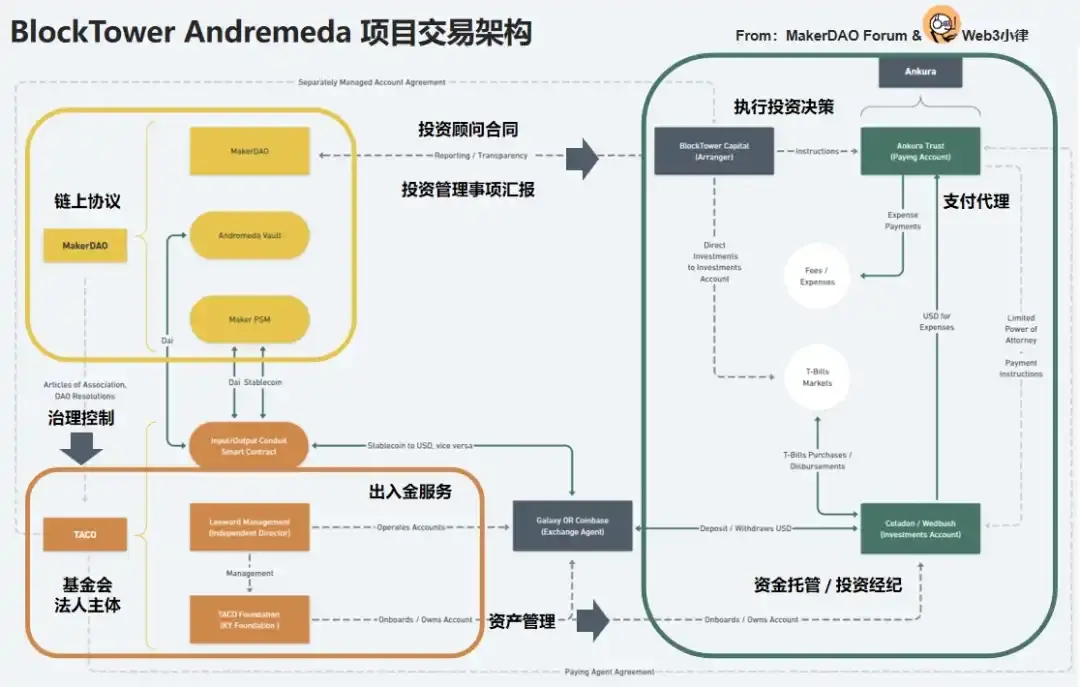

One of the most notable projects in the RWA initiatives initiated by BlockTower Capital is BlockTower Andremeda, whose execution is controlled by the TACO Foundation governed by MakerDAO.

Related reading: "Inventory of MakerDAO's popular RWA projects, analyzing the trading architecture of capturing off-chain assets in DeFi"

The TACO Foundation was established in 2022, and by the end of the same year, governance actions bundling eight proposals by MakerDAO were approved by the community, including the launch of the BlockTower real-world asset Vault. According to Article 4.16 of the Foundation's Articles of Association, the Foundation Director needs to make any resolutions or exercise any rights based on MakerDAO's governance resolutions.

As the investment advisor for BlockTower Andremeda, BlockTower Capital signed an investment advisory contract with the TACO Foundation to manage the foundation's various accounts and make investment decisions. MakerDAO then treats the TACO Foundation as a legal entity to handle off-chain investments and separates investment decisions and asset custody in the traditional financial sense to achieve risk control and compliance.

BlockTower's RWA architecture, image source from Web3 Xiao Lv

In addition to BlockTower Andremeda, the TACO Foundation also operates the BlockTower S3/S4 credit asset RWA project with a maximum asset management scale of $150 million.

One of MakerDAO's largest RWA projects

The narrative of RWA has always been associated with MakerDAO, and US Treasury bonds seem to be one of MakerDAO's main targets.

On September 8, 2023, the MakerDAO community proposed allocating $100 million to develop tokenized US Treasury bonds (T-Bill) products, including Flux fDAI as collateral for T-Bills, frictionless products such as Maple Cash USDC, and long-term products such as financial bIB01 and bIB TA.

Since 2022, MakerDAO has continuously increased its RWA assets. In October of the same year, MakerDAO purchased $500 million in bonds. On June 21, 2023, MakerDAO again purchased over $700 million in US Treasury bonds. According to DL News report, MakerDAO had expanded its physical asset investment portfolio to approximately $3.9 billion by the end of last year, mainly in US Treasury bonds.

Therefore, under the execution of the TACO Foundation, BlockTower Andremeda has also focused on US Treasury bond investments and continuously increased its RWA assets through BlockTower Andromeda. According to Makerburn data, BlockTower Andremeda is currently one of the largest RWA projects in terms of volume for MakerDAO.

Will it default?

Currently, MakerDAO has raised billions of dollars in RWA assets through various projects, with BlockTower accounting for nearly 1/10. If MakerDAO has not diverted user assets for other purposes like FTX (such as collateral arbitrage), 1/10 of the fund size would not fundamentally affect MakerDAO's solvency.

For MakerDAO, the issue at hand is how to replenish this 1/10 of user assets. If MakerDAO's profits exceed this 1/10 and are willing to replenish, this could turn out to be a good thing for MakerDAO. This is a bearish signal for MKR's token price, but it does not rule out the possibility that MakerDAO itself released the bearish news to offload its holdings.

According to TradingView data, at the time of writing, MKR's price experienced a short-term rally, rising by $600 from 8.51 in the morning to 3.41 in the afternoon.

Currently, both BlockTower and MakerDAO have not made any statements regarding the theft incident, and BlockBeats will continue to track the related developments.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。