On the afternoon of May 13th, AICoin researchers conducted a live graphic and text sharing session titled "Will the Altseason Come? (with Membership Giveaway)" in the AICoin PC-end Group Chat Live. Below is a summary of the live content.

I. Concept Definition

1. Altcoin

In the cryptocurrency market, "Altcoin" refers to all cryptocurrencies other than Bitcoin.

2. Altseason

Altseason refers to a period when altcoins experience significant price increases outperforming Bitcoin.

Judgment method:

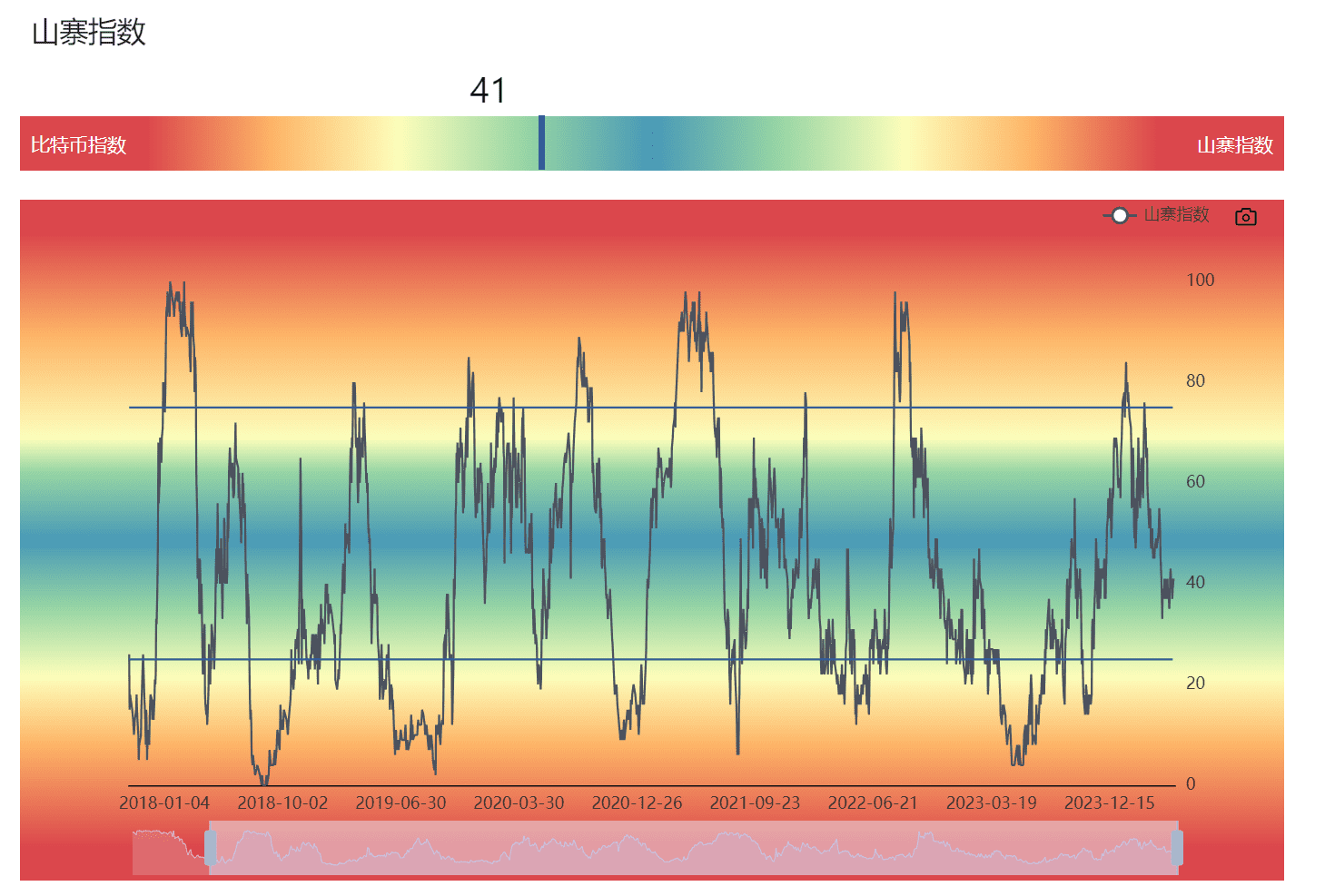

The above image shows the Altcoin Season Index: If 75% of the top 50 tokens outperformed Bitcoin in the previous quarter (90 days), it indicates the arrival of the Altseason.

Currently, the Altcoin Index is at 41, indicating a stronger influence of BTC in the market. If it exceeds 75, it means that a major altcoin rally is imminent.

II. Overall Altcoin Market

1. BTC Still Dominates

The main driving factor of this market is the launch of the spot BTC ETF in the US stock market, which is channeling funds from traditional finance into the cryptocurrency market, leading to its recovery.

From January to March, BTC's share of the cryptocurrency market remained around 50% and continued to rise. The net inflow data of several spot BTC ETFs totaled approximately $12 billion, indicating that the market's dominant factor has been focused on BTC. It may take a long time for the Altcoin Index to reach 75.

Based on the net inflow data of ETFs after January 2024, the last Altseason mainly focused on projects in the DeFi field.

Currently, BTC and ETH remain the focus of the market.

The current concepts (Inscription, Rune, Re-staking, RWA, DePin, AI) do not have revolutionary projects similar to the last DeFi Summer that could expand the circle.

The main focus is still on DEX and liquidity staking projects.

2. On-chain Fees

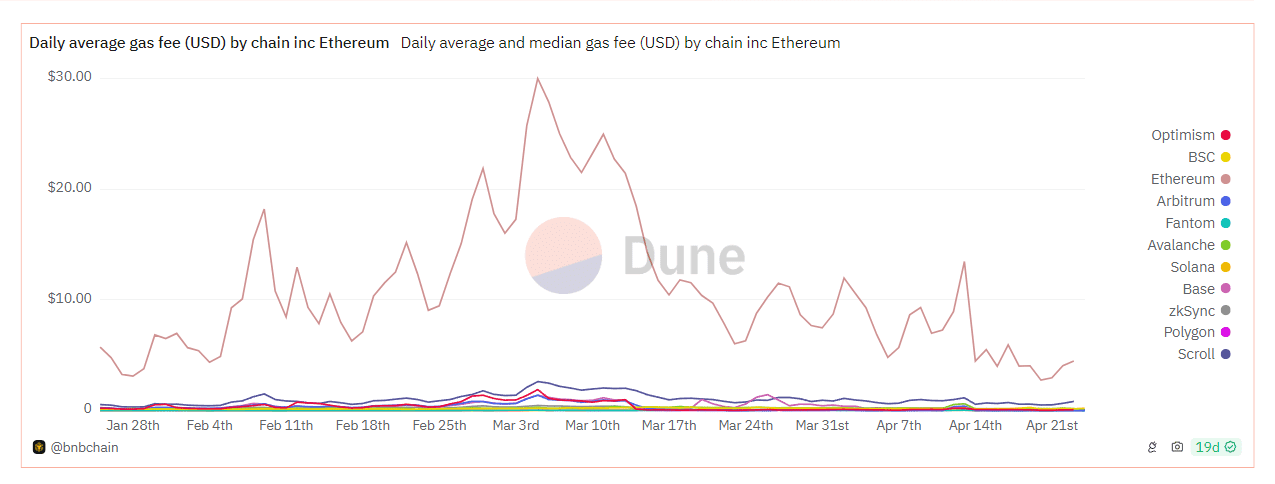

The gas fee on the Ethereum mainnet has dropped to 3-6 Gwei ($0.18-$0.36).

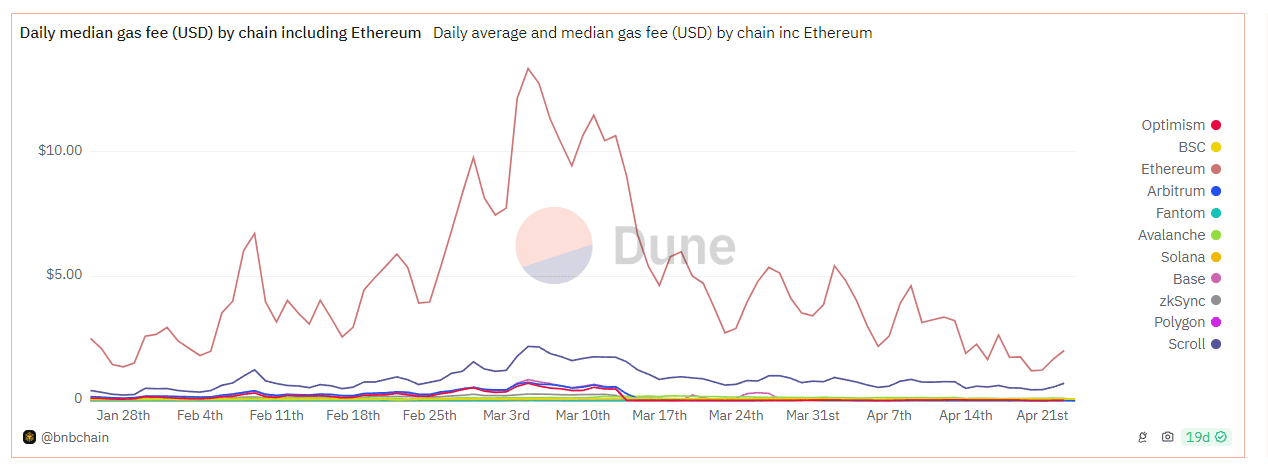

This is the USD valuation of gas fees on major public chains, which has dropped significantly since March. It indicates a decrease in on-chain transaction activity on the Ethereum mainnet, and the congestion situation has improved.

Although the London upgrade led to a significant drop in L2 fees, the ETH gas fee dropped from a high of 122 Gwei in March to around 20 Gwei. It has now reached a low point in May, dropping to 3-6 Gwei, indicating a significant decrease in the demand for transfer transactions.

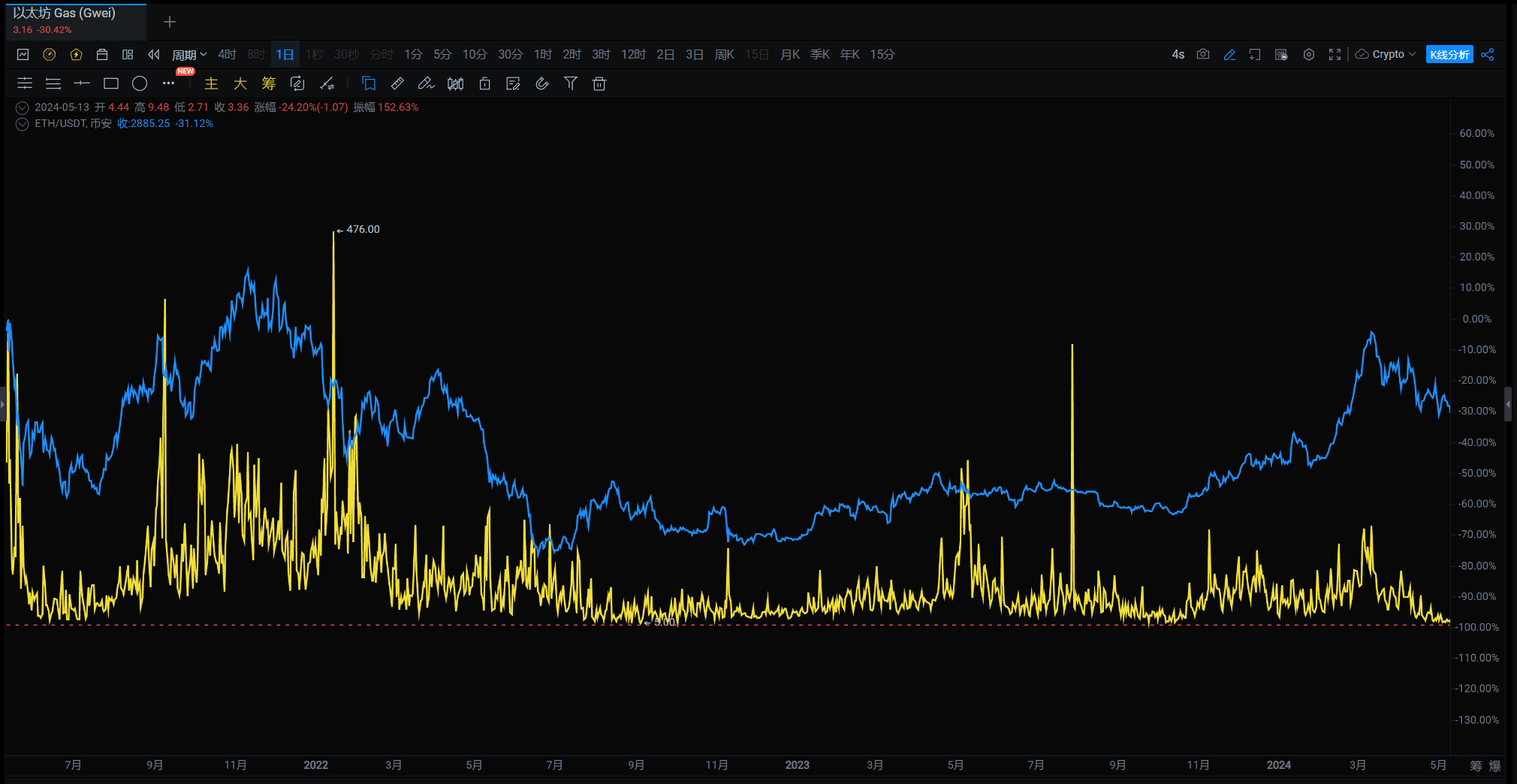

Blue represents the trend of ETH, and yellow represents ETH gas fees.

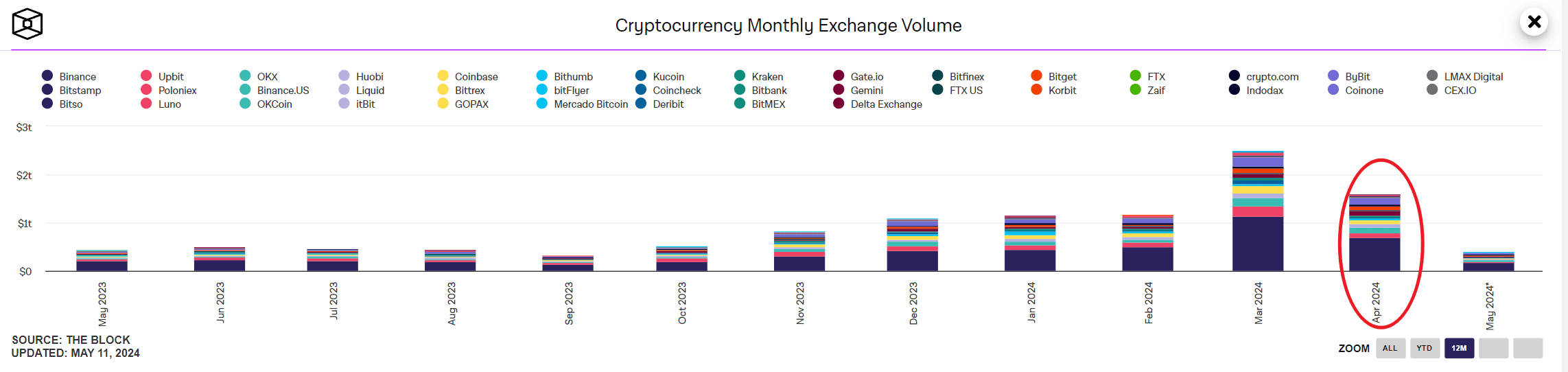

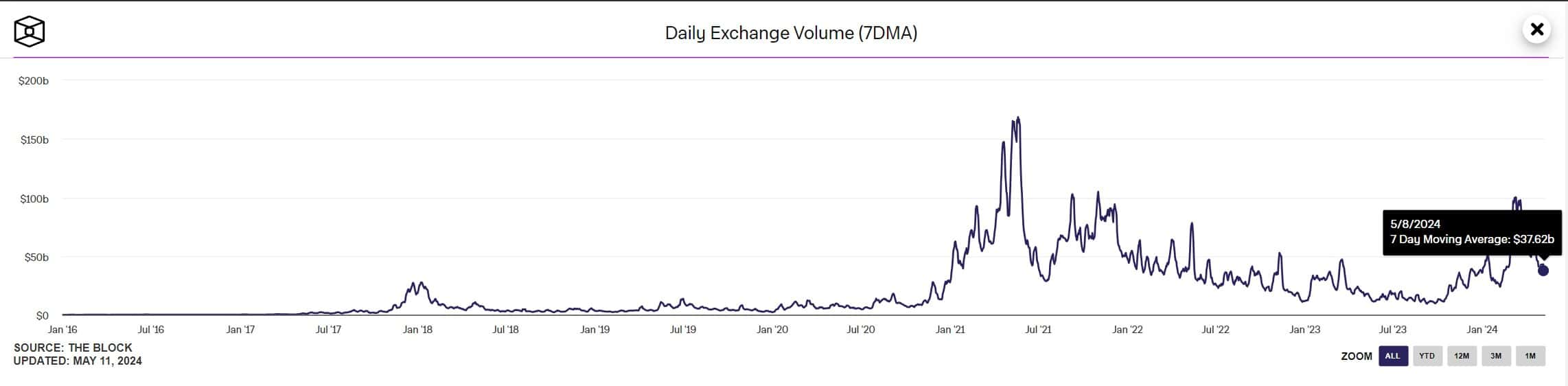

3. Exchange Trading Volume

Data from The Block shows that the monthly spot trading volume of CEX in April ($1.6T) decreased by about 35% compared to March ($2.49T).

Looking at the daily average spot trading volume of exchanges, the recent downward trend is also evident, and the market's profit-making effect is not as significant as it was from January to March.

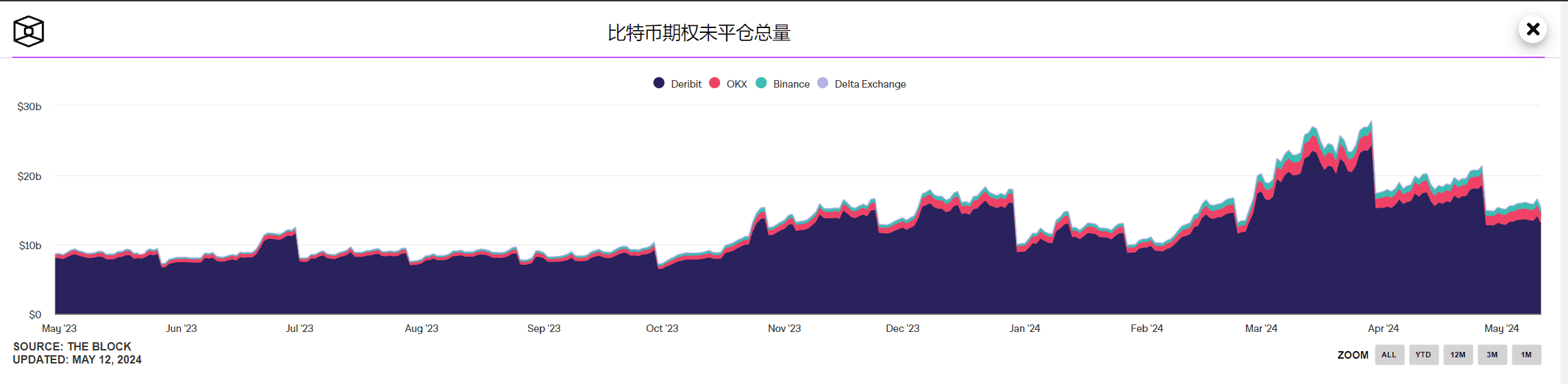

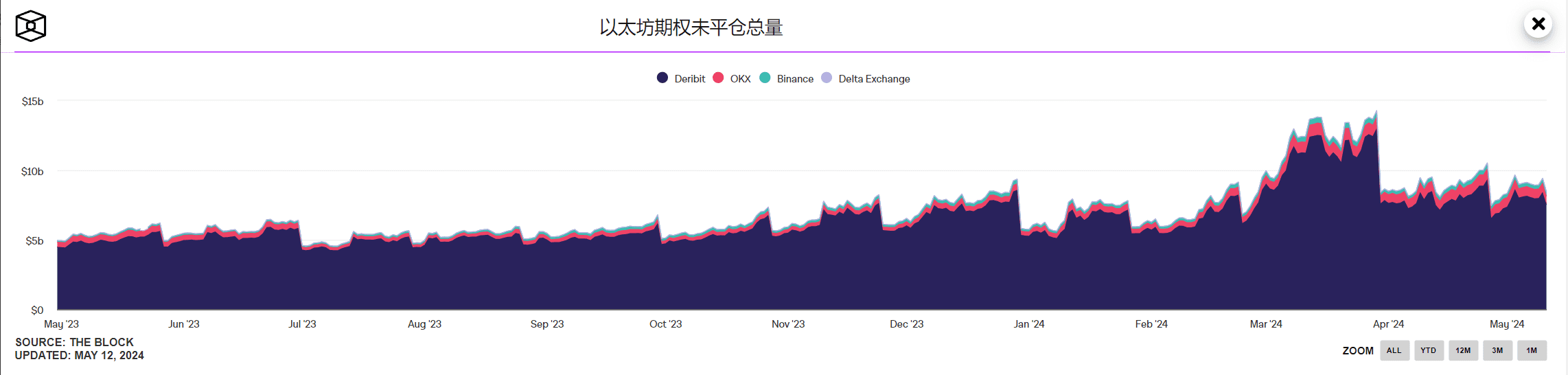

From derivative data, the total open interest of BTC options and ETH options on Deribit, Binance, OKX, and Delta Exchange has experienced significant retracement.

4. New Project Situation

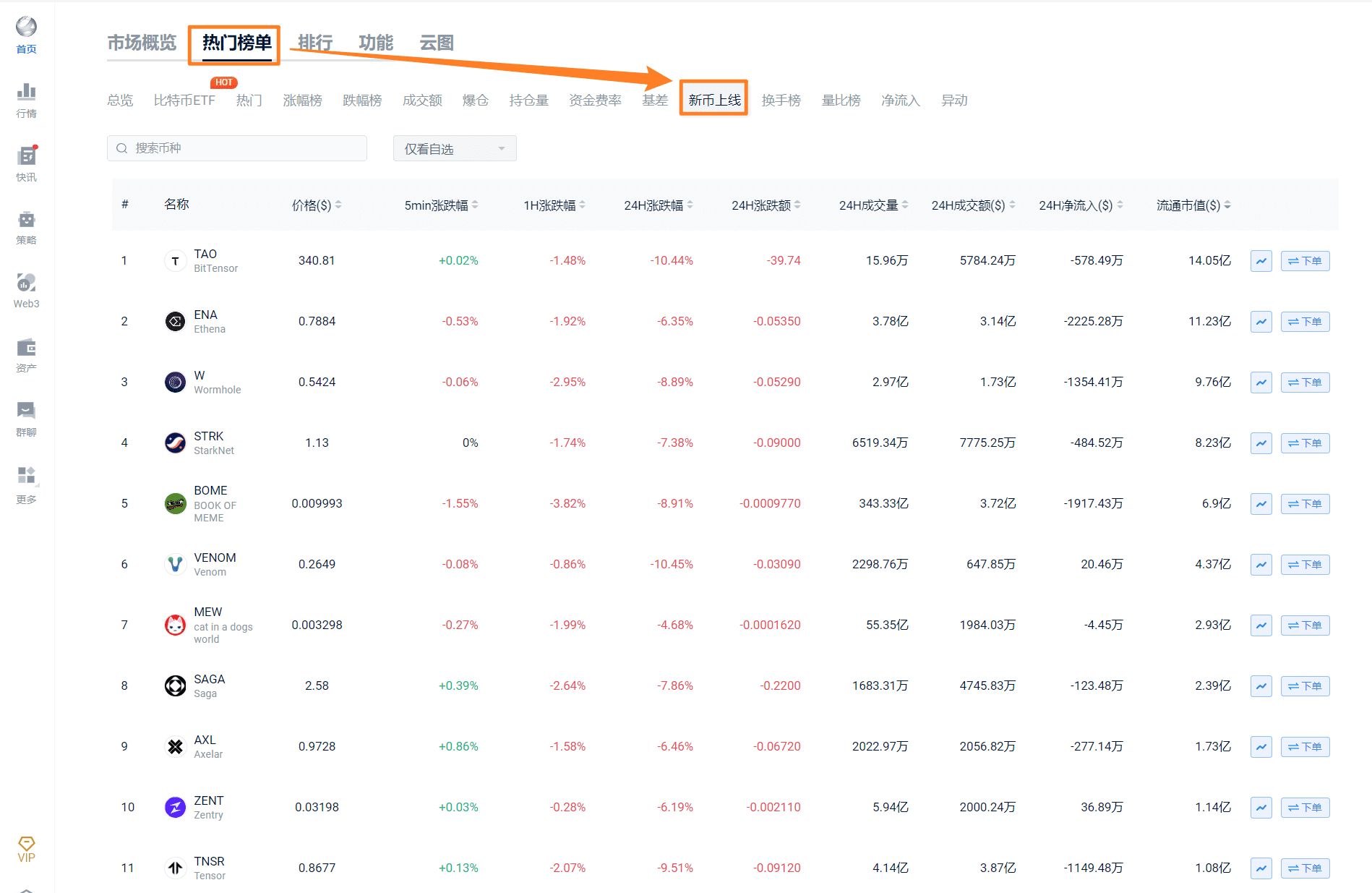

Binance and OKX's listing of 24 new coins has resulted in poor returns, indicating a noticeable decline in quality compared to projects launched in 2023:

In terms of returns, popular projects that have fallen below the issue price include: STRK, TAO, W, AEVO, MERL

5. Token Unlocking (Massive Selling Pressure)

The unlocking of tokens, combined with the significantly increased number of projects compared to 2021, has resulted in substantial selling pressure on the market due to the high market capitalization of the projects.

III. Sectors

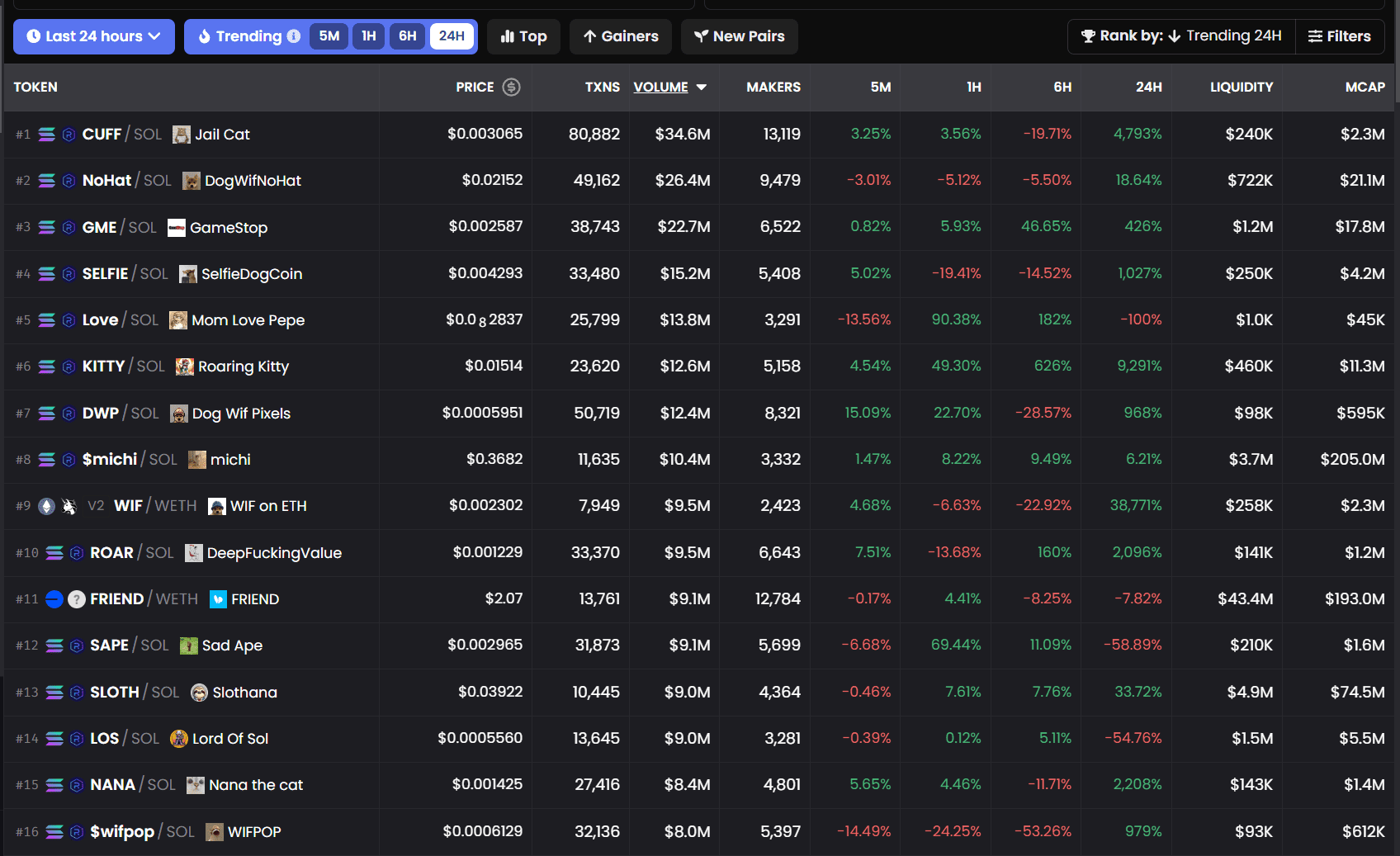

Memecoins on the Solana blockchain have shifted the flow from ETH to Solana in the Dogecoin market. Whether it's Dogecoin trading pairs or DEX trading volume and bot trading volume, Solana currently occupies the majority of the Dogecoin market share.

In the short term, attention can be focused on the coins recently listed on Upbit and Bithumb in South Korea (Kimchi premium).

Projects to consider include So-Fi (Farcaster). Caution is advised for the widespread issuance of unreleased coins, as they generally have lock-up periods and various peculiar point allocation rules.

The current three hot topics are: US elections, interest rate cuts, AI

IV. Recommended Indicators

1. ETH/BTC Exchange Rate

Pay attention to the trend reversal of the ETH/BTC exchange rate. An increase in the exchange rate indicates a relatively strong trend for altcoins.

2. Altcoin Index

75 or above indicates an altcoin market, while between 40-75 requires more attention.

3. Federal Reserve Interest Rate

Although there may not be many opportunities for a short-term interest rate cut, the market is constantly changing.

Federal Reserve data: https://www.aicoin.com/zh-CN/data

PRO membership and Signal Alert membership are high-quality tools tailored for lazy friends, and custom indicators can help any AICoin user plan their trades and trade their plans. If you want to see more custom indicator strategy displays and multiple alert reminders, feel free to activate the Signal Alert/PRO version K-line, both of which offer a limited-time free trial of the custom indicator membership. Click the link below to activate the trial: https://aicoin.com/en/vip/chartpro

Recommended Reading

- "Profitable Signal Strategy"

- "Halving Effect? Middle East Situation? - Comprehensive Strategy for Turbulent Markets"

- "How Beginners Can Trade Coins Correctly"

For more live content, please follow AICoin's "News/Information-Live Review" section, and feel free to download AICoin PC-end.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。