Original author: Michael Zhao, grayscale

Original translation: Kate, Mars Finance

The launch of Bitcoin spot ETF in the US market has sparked new interest from traditional investors in the largest public chain. For native cryptocurrency investors, attention to Bitcoin has also increased, but for different reasons: developer activity and investment recovery.

Unlike Ethereum, Bitcoin's programming language does not support complex functionality. However, the success of Ordinal Inscriptions has spawned a new wave of development aimed at introducing smart contracts to the blockchain and increasing transaction throughput.

Although Bitcoin's current main use is as a valuable asset store and digital substitute for gold, the network can also be used for other purposes, including payments, data storage, and computation. If development activity brings new use cases and more adoption, we expect it to increase Bitcoin's total potential market value.

In the future, we expect to see more decentralized finance (DeFi) applications using Bitcoin, more Bitcoin miner partnerships to protect these new extended chains, and increased competition as Bitcoin becomes a viable smart contract platform.

Grayscale Research has noticed that most of the excitement in the past few months has been focused on Bitcoin developers. Today, the Bitcoin builder community is similar to the early stages of Ethereum in early 2017, when decentralized applications had just emerged. As of May 2024, Bitcoin is the largest public chain by market value and the oldest existing blockchain, primarily serving as a transfer platform, consistent with its original purpose. Unlike smart contract platforms such as Ethereum, which use a richer programming language to facilitate decentralized finance and other advanced applications, Bitcoin scripts have traditionally been limited to facilitating direct transactions without supporting complex functionality.

Despite many efforts to enhance the network over the past decade, value transfer remains the primary function of Bitcoin, until the launch of Ordinals at the end of 2022. Ordinals introduced NFTs (non-fungible tokens) to Bitcoin, marking a significant shift in user and developer perspectives. With the successful integration of Ordinals, more users and developers now view Bitcoin as an experimental ground. This is reflected in two key aspects. First, it broadens the functionality of Bitcoin. The growing ecosystem of Bitcoin's second-layer solutions is prompting exploration of other possibilities for the Bitcoin network. Second, as activity on the main chain continues to upgrade and transaction fees rise, efforts are being made to increase the main chain's transaction throughput.

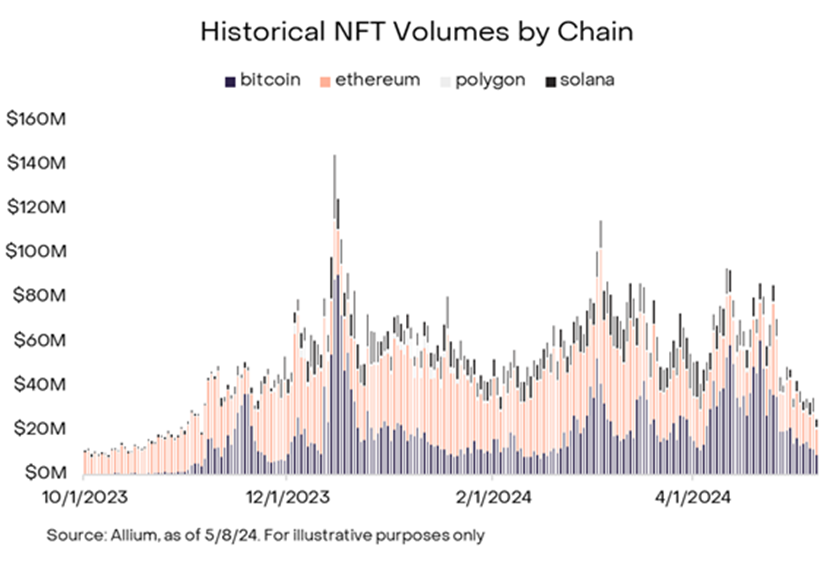

Figure 1: Bitcoin NFT trading volume continues to dominate

Expanding Bitcoin

The idea of needing additional scaling solutions for Bitcoin has been known from the start, as emphasized by cryptographer and early Bitcoin adopter Hal Finney:

"Bitcoin itself cannot scale to have every single financial transaction in the world broadcast to everyone and included in the blockchain. We need a layer two network for efficiency." - Hal Finney (December 30, 2010)

We have seen two main ways of expanding Bitcoin:

Functional diversity involves expanding the range of activities and applications feasible within the Bitcoin network. This includes exploring and implementing new features, protocols, and technologies to extend Bitcoin's utility beyond simple value transfer, potentially including smart contracts, decentralized finance applications, and NFTs.

Transaction throughput focuses on increasing the total number of transactions processed on the Bitcoin blockchain. This includes optimizing network protocols, improving block sizes, and implementing scalability solutions to facilitate greater transaction volume within a given timeframe.

Before the introduction of Ordinals, several Bitcoin scaling solutions already existed:

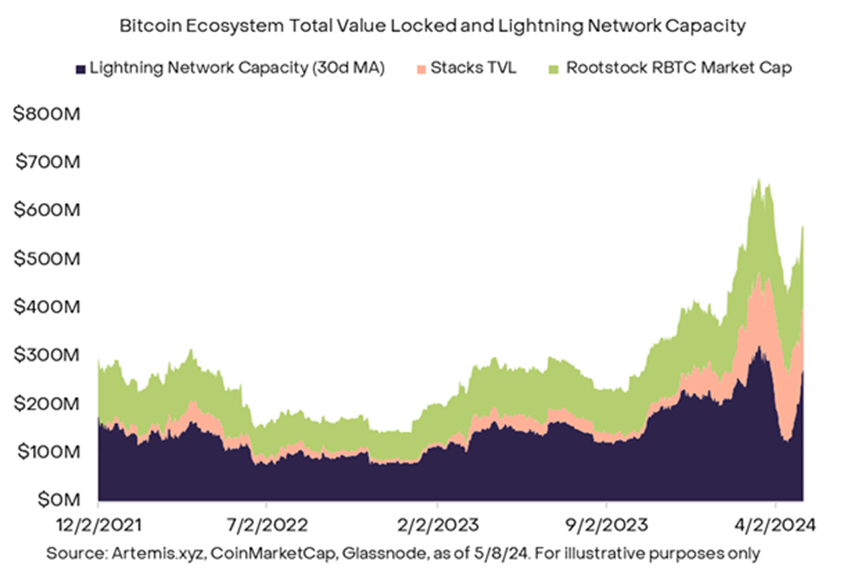

Lightning Network: In terms of historical adoption and funding, the Lightning Network is considered one of the most popular Bitcoin scaling solutions, functioning as a protocol designed to facilitate fast and cost-effective peer-to-peer payment transactions.

Stacks: Operating as a sidechain running parallel to the Bitcoin main chain, Stacks can execute more complex applications such as DeFi and NFTs. With Nakamoto's upgrade expected to be completed in the coming months, Stacks will be secured by Bitcoin's hash rate.

Rootstock: A sidechain compatible with the Ethereum Virtual Machine (EVM), Rootstock allows developers to use Ethereum-compatible smart contracts on a network protected by a portion of Bitcoin's hash power through a process called merge-mining.

Figure 2: The existing second-layer ecosystem of Bitcoin has been growing

While these solutions have existed for years, the introduction of Ordinals at the end of 2022 can be seen as a catalyst for the latest generation of Bitcoin development. Two upgrades to Bitcoin's core software have facilitated Ordinals: SegWit (July 2017), which increased the theoretical block size from 1MB to 4MB, and Taproot (November 2021), which made it easier for users to embed arbitrary data into the witness data part of Bitcoin blocks.

Ordinals essentially introduce a way to bring non-fungibility to Bitcoin by assigning a unique number to each satoshi (the smallest unit of Bitcoin). By referencing these numbers, images, music, or other arbitrary data can be linked to the witness part of a transaction. By the end of 2023, Bitcoin became the largest NFT platform compared to all other chains, based on the Allium data we used in Table 1.

While the initial user experience lags behind chains like Ethereum and Solana, users may be drawn to NFTs on Bitcoin, in part due to the scarcity of block space relative to other layer one solutions, most of which do not directly store files on the main chain. Coupled with the novelty, the popularity of Ordinals prompts participants—including users and developers—to consider, "What else can Bitcoin achieve?"

Next-generation Bitcoin applications

In the Bitcoin ecosystem, there are currently several innovative projects under development.

BitVM: One of the most anticipated developments is BitVM, which enables optimistic Bitcoin rollups using only Bitcoin script, something that was previously thought to be impossible. Similar to Ethereum's optimistic rollup, Bitcoin's rollup moves transaction execution off-chain, resulting in faster and cheaper transactions. While still in the early stages, projects like Build on Bitcoin aim to incorporate BitVM into future settlements.

Spiderchains (Botanix Labs): Spiderchains refer to a second-layer chain that uses staked Bitcoin in decentralized multi-signature wallets, providing a different security standard than solutions like Stacks and Rootstock. For example, Botanix Labs is developing an EVM-compatible Spiderchains to facilitate bridging from Bitcoin's first layer to Botanix's second layer.

Bitcoin Rehypothecation Solution (Babylon): Similar to Eigenlayer, Babylon leverages the security of the underlying Bitcoin network for other validated services. Given Bitcoin's high hash rate as of May 9, 2024, it can provide strong security for applications seeking to leverage Bitcoin's secure budget.

Bitcoin-specific DeFi Applications: Projects focusing on stablecoins, lending, and other DeFi applications supported by Bitcoin aim to replicate the functionality seen on Ethereum within the Bitcoin ecosystem.

Taproot Assets: Formerly known as Taro, Taproot Assets is a Bitcoin layer developed by Lightning Labs for issuing assets on Bitcoin. Taproot Assets embed metadata into Bitcoin's unspent transaction outputs using the Taproot upgrade. With major participants like Coinbase activating Lightning transactions, Taproot Assets may gain attention.

While these developments are promising, it's worth noting that there is no clear frontrunner in terms of attention. According to DefiLlama data, as of May 9, 2024, the total value locked in these new projects accounts for only 0.2% of Bitcoin's total market value.

With numerous projects vying for attention and liquidity, the Pareto principle suggests that only a few projects will become successful in the coming years, similar to patterns observed on other smart contract platforms. The Grayscale Research team will continue to closely monitor these developments to understand emerging trends and opportunities in the Bitcoin ecosystem.

Bitcoin's Larger Potential Market

So, what does all this mean for Bitcoin?

Stepping back, Bitcoin's total potential market depends on various narratives: store of value, medium of exchange, settlement layer, alternative monetary system, and more. This has been extensively discussed in past research.

We believe that faster transaction speeds and greater programmability on top of Bitcoin are additive to this potential market equation. Increased transaction throughput will strengthen the settlement layer narrative, while increased programmability will position Bitcoin as a new market for smart contract platforms.

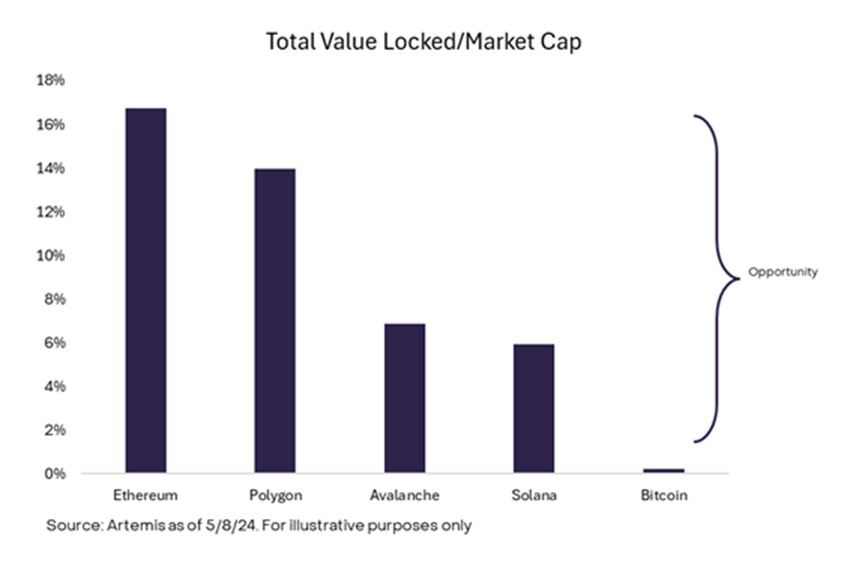

As Bitcoin is a relatively new entrant to the smart contract platform market, one way to map out Bitcoin's opportunities is to compare its utilization and market value ratio with other smart contract platforms. Despite being the largest cryptocurrency by market value, Bitcoin's total value locked (TVL) is still relatively small, serving as a representation of its utilization. When comparing Bitcoin's TVL to market value ratio with smaller chains, it is relatively and absolutely low.

For example, as of May 2024, Ethereum currently has approximately $50 billion locked in its ecosystem, with an additional $7.5 billion for layer two solutions, totaling $57.5 billion. Ethereum's market value is around $360 billion. This means that approximately 17% of Ethereum's total market value is used for applications. In contrast, Bitcoin has only about $2.4 billion locked in applications, with a market value of $1.2 trillion. This means that only 0.2% of Bitcoin's market value is used for applications.

Figure 3: There is still significant opportunity in Bitcoin's existing market

From an investment perspective, considering the combination of interested users and developers with historically untapped markets, we are very excited about the outcome.

Developments Bring New Risks

While the increased development activity in the Bitcoin ecosystem creates opportunities, it may also bring new risks. We see two main challenges. First, increased activity may lead to higher fees. Criticism of Bitcoin development comes from the aversion to high transaction fees. Recently, speculation-driven activity has led to an increase in Bitcoin transaction fees, making traditional Bitcoin transaction costs unaffordable for some users. The opposing view is that fees ultimately serve to supplement miner income. With the ongoing development of Bitcoin scaling solutions, it should help create new solutions for users with lower transaction fees rather than introduce a problem.

Second, some Bitcoin users express concerns about value dilution. For example, if the Bitcoin network is used for more things, will its value as a medium of exchange be diminished? The influx of new projects represents "graffiti" on the store of value chain, or does it prompt its evolution into something more akin to jewelry?

In our view, the essence of Bitcoin lies in its decentralization and the freedom it provides for users to use Bitcoin in various ways, including integrating art or implementing stablecoins. The expansion of these use cases broadens Bitcoin's appeal and brings new markets and audiences, consistent with the fundamental purpose of Bitcoin to empower individuals with financial sovereignty and choice. Nevertheless, we expect the debate around expanding Bitcoin use cases to continue.

The Next 15 Years

Bitcoin has only about 15 years of history, and users and developers are still exploring its potential applications. Given the nascent state of the Bitcoin second-layer space, it is still early to assess the development trajectory of most projects. However, Grayscale Research has witnessed similar ecosystem expansions on other smart contract platforms and noted a trend towards projects that serve as primitives.

We also note that security handling for most current solutions is trending. Looking ahead, we have some predictions for these new Bitcoin-based protocols and scaling solutions:

Expansion of DeFi primitives: We expect the first applications to gain significant traction on Bitcoin to mirror the trajectory seen on Ethereum, providing a set of DeFi primitives in the lending/borrowing and exchange protocol space. If we assume that assets other than Bitcoin will begin to settle on the Bitcoin network, there will be a demand for using these assets. As seen in the development on other smart contract platforms, these applications typically gain the majority of early liquidity.

Growth in miner partnerships with second-layer projects: The security of these scaling solutions may receive support from Bitcoin miner hash power, providing additional income sources for miners. Given the lack of a reliable solution in the market to fully utilize Bitcoin's hash power at present, we believe that continuing merge-mining, where scaling solutions leverage a portion of mining hash power, will become more common in these new projects in the mid-term, prior to the implementation of BitVM. We have seen this in past second-layer projects like Rootstock and current projects like BoB.

Competition in the smart contract platform space: With these developments, we believe that Bitcoin will become a significant competitor in the smart contract platform space. Given the high demand for Bitcoin on EVM chains, we see potential demand for Bitcoin-backed collateral projects like Bitcoin stablecoins.

Today, Bitcoin primarily serves as a store of value and a digital substitute for physical gold. Even within this "limited" use case, it seems to have already achieved success in our view. Its market value has grown to over $1 trillion and has spawned an entirely new asset class. However, Grayscale Research believes that we are still in the early stages of the Bitcoin story.

Developers are only now discovering how to get more out of the first public chain and how to most effectively transact with Bitcoin.

If the latest wave of development leads to more adoption of these use cases, it will mean a larger potential market and potentially higher market value over time.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。