Article: Arnav’s Musings

Translator: DeepTechFlow

A team that wore huge and ridiculous bear masks to attend a crypto conference and successfully raised seed funding with a valuation of 420.69 million USD, all to build another L1, but this time centered around bears smoking marijuana. Yes, I completely understand the skepticism about this idea. In fact, when I first heard about this concept, I thought it was very foolish.

It wasn't until I spent time understanding the proof of liquidity and the power of the Bera community that my perspective changed - not only towards Berachain, but also towards how communities fundamentally nurture, sustain, and independently thrive.

Introduction

Berachain is an L1 compatible with the Ethereum Virtual Machine (EVM), built on the Cosmos SDK, originating from the 2021 Bong Bears NFT series. The proof of liquidity, born from these memes, is at the core of Berachain's mission.

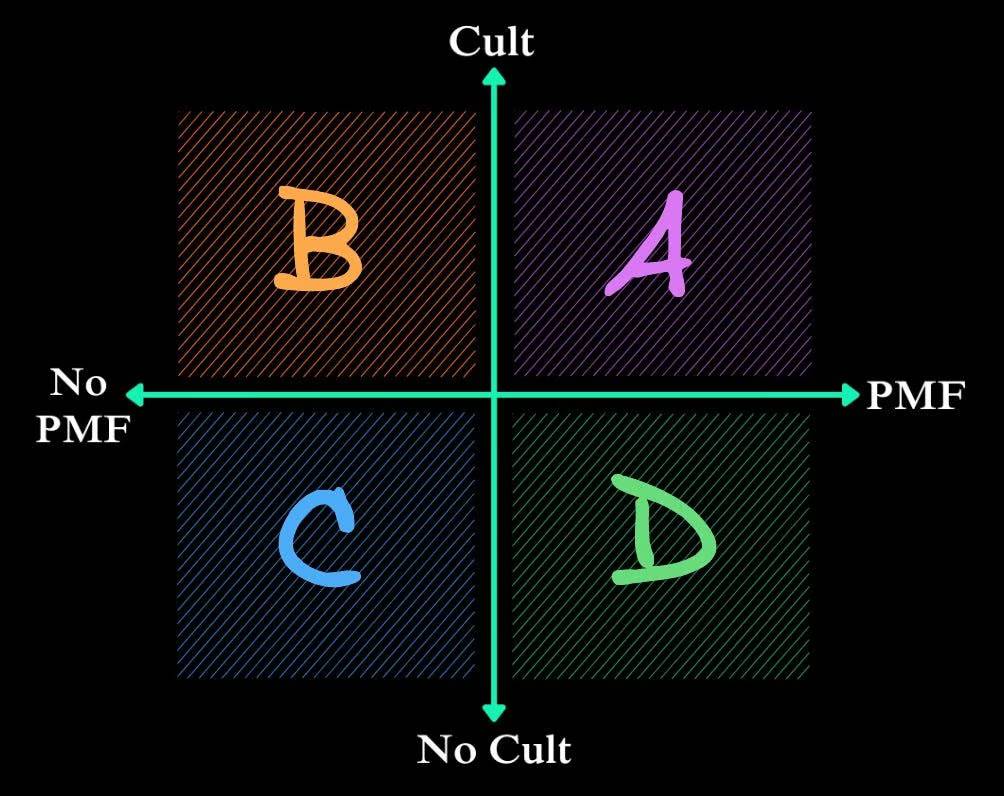

Before you express doubt about Berachain, ask yourself why you would invest in other tokens. Why do some tokens, despite having only a few users, maintain outrageously high fully diluted valuations (FDV)? The answer is simple, I believe all tokens fall within this range:

- Cult = Time + Effort + Money invested by the community in an asset

- PMF = Continuous demand for a given protocol (or speculation on PMF)

- Quadrant A = Sent to Valhalla

- Quadrant B = Most high FDV tokens in the current crypto space

- Quadrant C = You should probably pivot to AI

- Quadrant D = Many tokens that are about to become middleware/infrastructure

Many cryptocurrencies have FDVs in the tens of billions solely based on strong community support. Take Cardano for example, despite having no users and total value locked (TVL), its FDV is around 18 billion USD, yet the Cardano community somehow continues to grow, gaining recognition in the retail market. Other examples of assets primarily focused on memes (besides meme) include Litecoin, Cronos, and others.

Is this a bad thing? Just like internet protocols (HTTPS, TCP/IP, etc.), blockchain itself will eventually become synonymous, meaning the main difference between successful blockchains lies in branding. People trust brands, so a blockchain either becomes a brand or fades away.

Bera Community

It goes without saying that Berachain has one of the strongest brands in the cryptocurrency space. But just how strong is it?

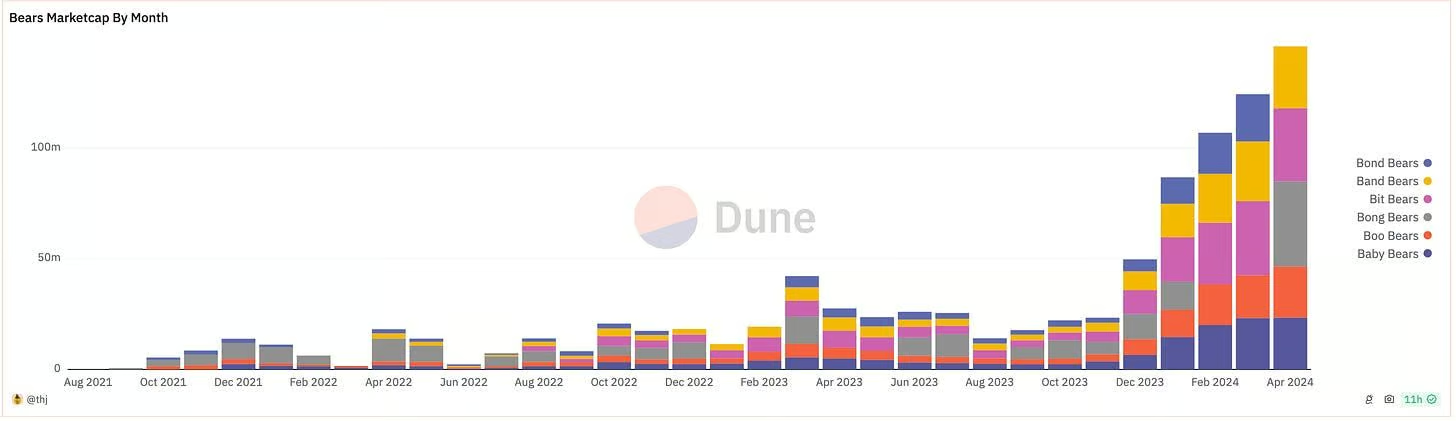

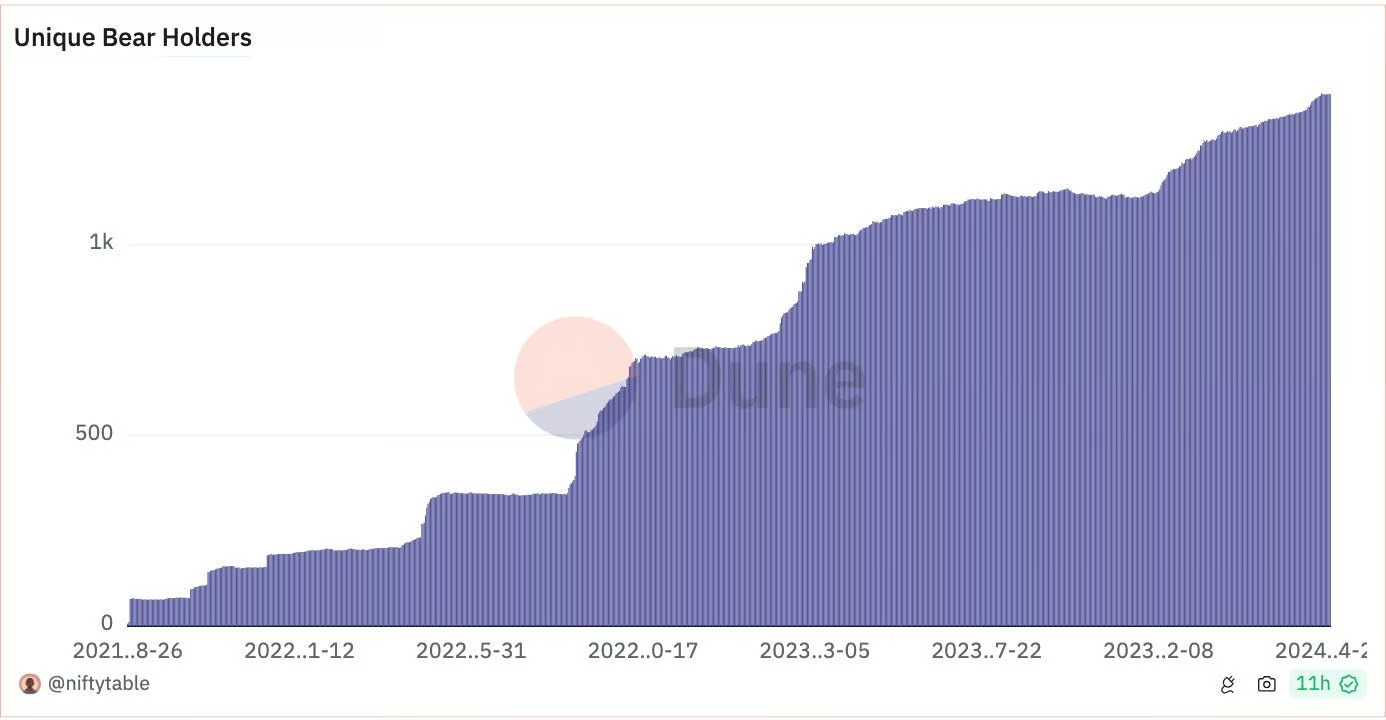

The market value of the Bong Bear Genesis series and its new version is over 150 million USD, with prices, quantities, and holdings steadily increasing over the past 2 years.

One interesting fact worth noting is that early holders received substantial returns (e.g., Chainlink, Axie, etc.), and your community thrived independently, almost forming its own life. Take "The Honey Jar" for example, a Berachain community operation project led by Janitoor. Jani was initially a major holder of Bong Bears and now operates a team of over 20 people, attracting over 100,000 users to join the Berachain ecosystem.

The Honey Jar

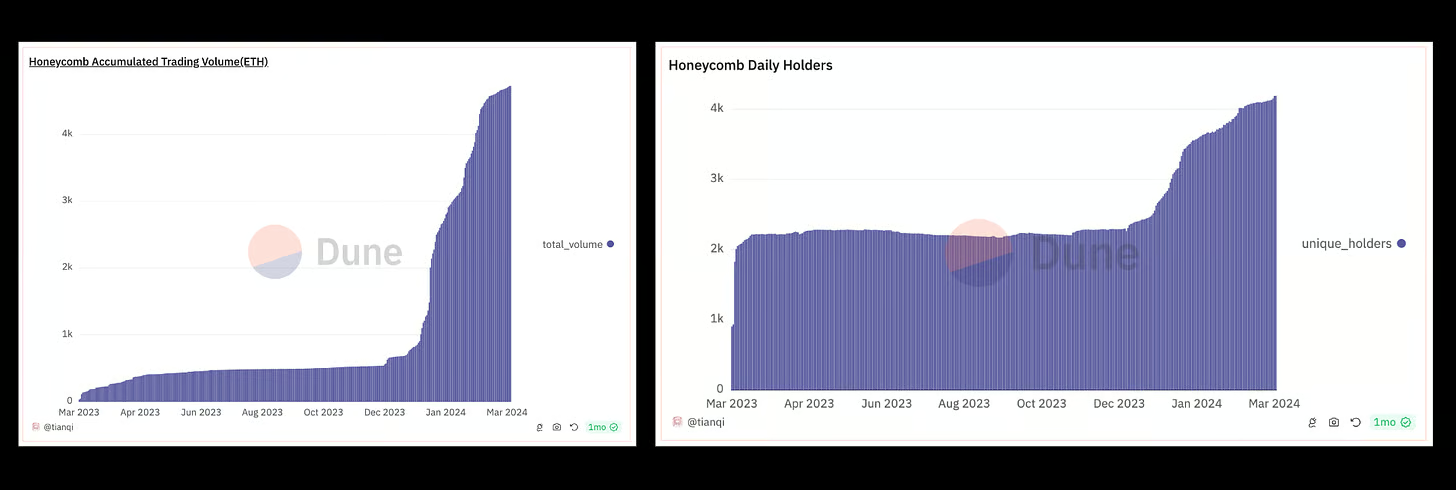

The Honey Jar, or THJ, is the core of the Berachain community, founded by Jani in January 2023. In the bear market, THJ, like any other project, worked hard, creating numerous legendary articles, competitions, podcasts, spaces, NFT minting, etc., gradually establishing one of the most productive communities in the crypto space. The core of this community is an NFT collection called "Honeycomb," consisting of 16,420 NFTs, serving as a "welfare aggregator" for the THJ ecosystem.

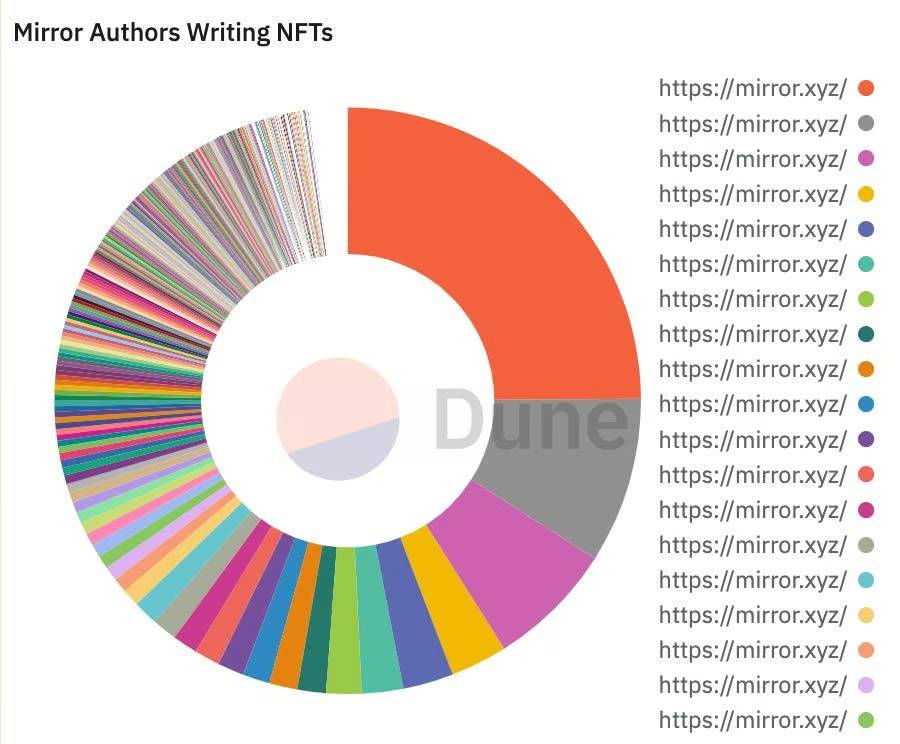

An interesting statistic about the NFT collection: 4,229 people received NFTs for free, with 1,569 people holding them for over a year, even though the price reached over 0.6 ETH. In addition to the NFT collection, the community also conducted many social experiments on Mirror and Zora, where community members could mint THJ legendary articles/assets. THJ quickly became the highest-earning author on Mirror, with over 25% of all Mirror fundraising being THJ assets.

The THJ community also dominates on Base and Optimism on Zora.

In essence, the THJ community (and the extended Berachain) proves a higher "cult" index than any other project: they are willing to invest a significant amount of time, energy, and money.

But why go through all this trouble before the mainnet?

Janitoor (@deepname99) stated, "THJ's strategy has always been to create outposts in large communities, protocols, and L1s, by allowing others to experience Beraculture and Berapil, giving them a chance to earn some fur in the game, to create a wormhole leading to Berachain ('Berachain is the target chain')."

Jani proposed this argument over a year ago, preparing for the influx of new users and capital, and providing them with rich content is crucial. A year later, this argument has been validated.

What's the insight? I can only say that few projects (if any) have a superweapon like THJ.

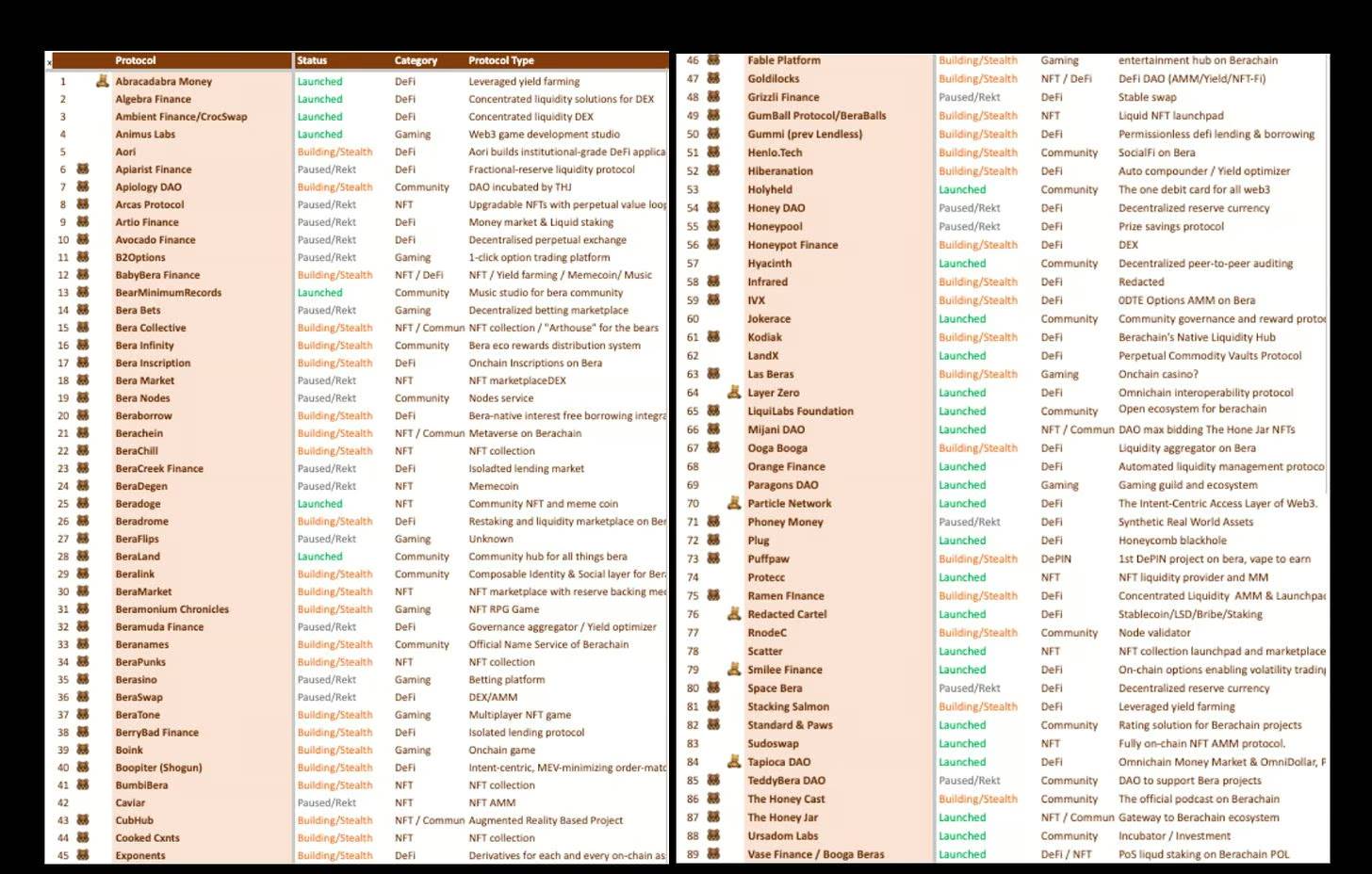

Ecosystem

There is a rich community consisting of over 60 exclusive Berachain projects: from re-staking protocols, independent games, money markets, NFT AMMs, liquidity aggregators, launchpads, and more. Additionally, there are many venture-backed native Berachain projects, including Infrared Finance, Kodiak, Beraborrow, Gummi, Beratone, and others.

Other examples of Berachain community efforts include The HoneyCast, a native Berachain podcast that has been recording for about 2 years; Beraland, a community-operated Berachain Discord hub/project aggregator, and more.

In addition to the thriving native Bera ecosystem, any existing EVM dApp can easily be ported to Berachain. Some multi-chain deployments include Ambient, Thetanuts, Concrete… and many more yet to be announced.

Of course, it's hard to talk about the Bera ecosystem without mentioning Berapalooza, which is the hottest event at ETH Denver and is now a core hotspot for Framework, leading the latest round of financing together.

Well, Berachain has memes, so what?

I won't sit here and pitch to you the groundbreaking EVM-compatible CometBFT chain. I believe establishing EVM compatibility and integrating existing tech stacks is key. However, I can say that Proof of Liquidity (PoL) is an intergenerational experiment in DeFi.

ELI5 Proof of Liquidity

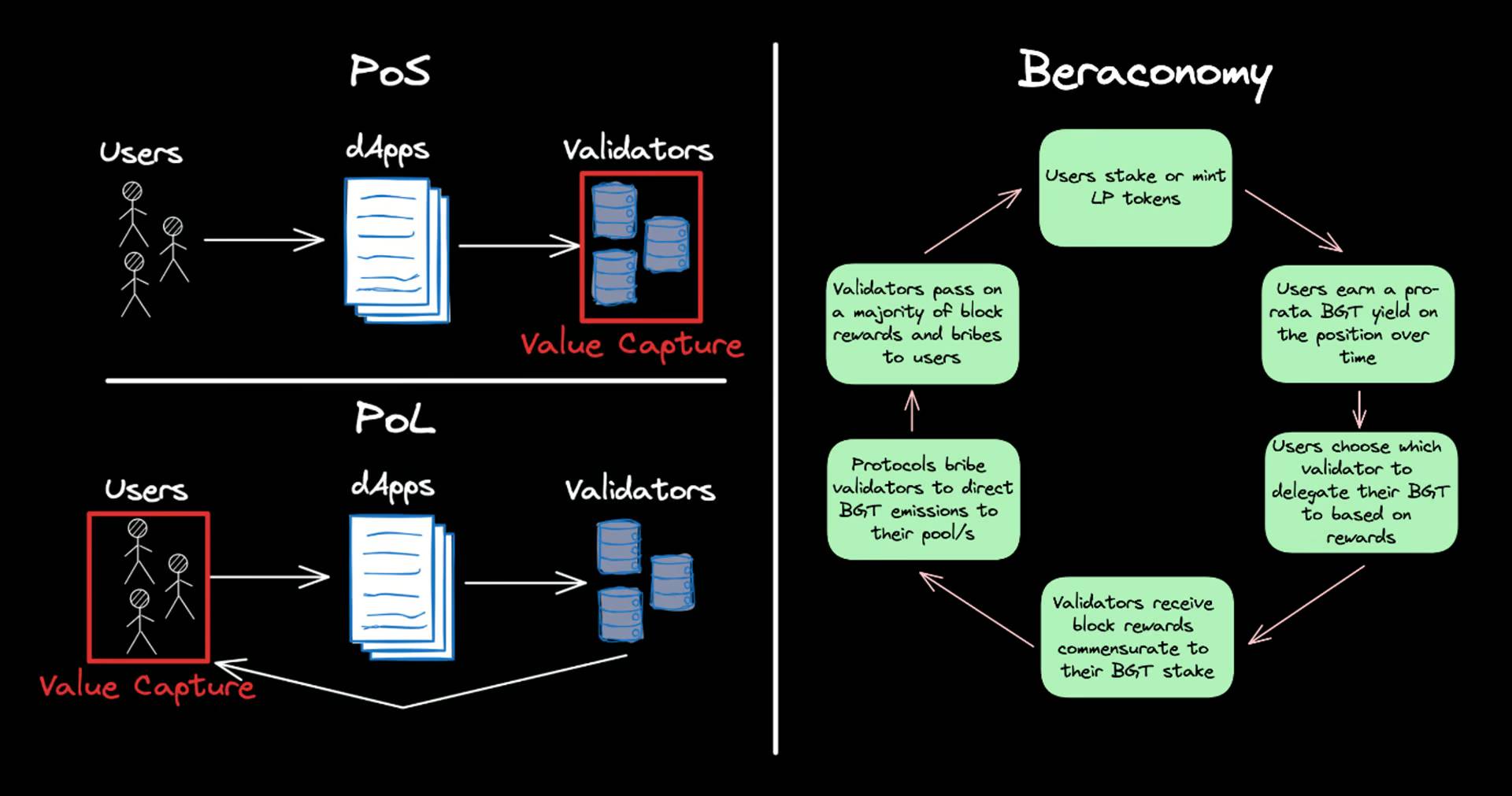

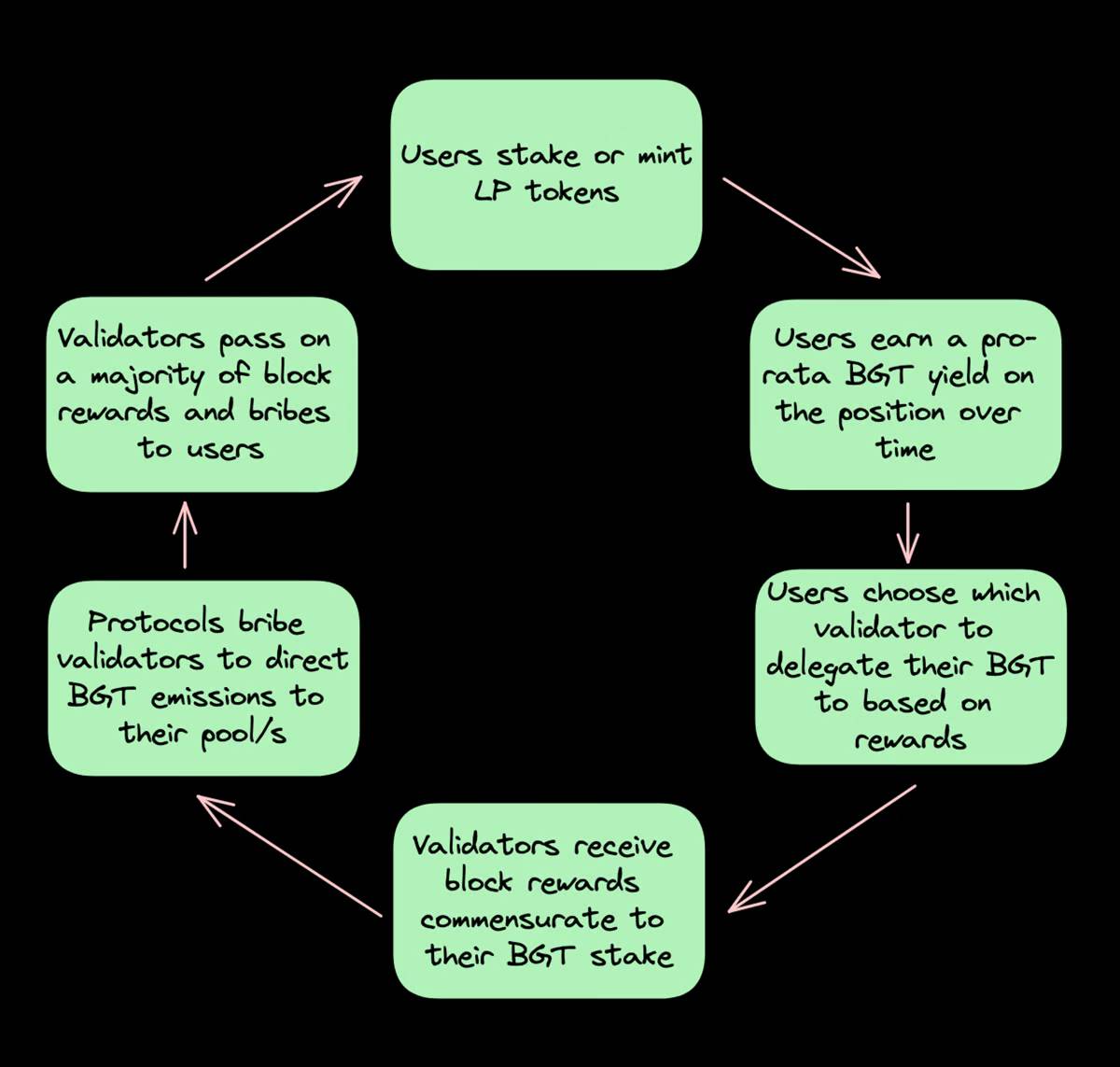

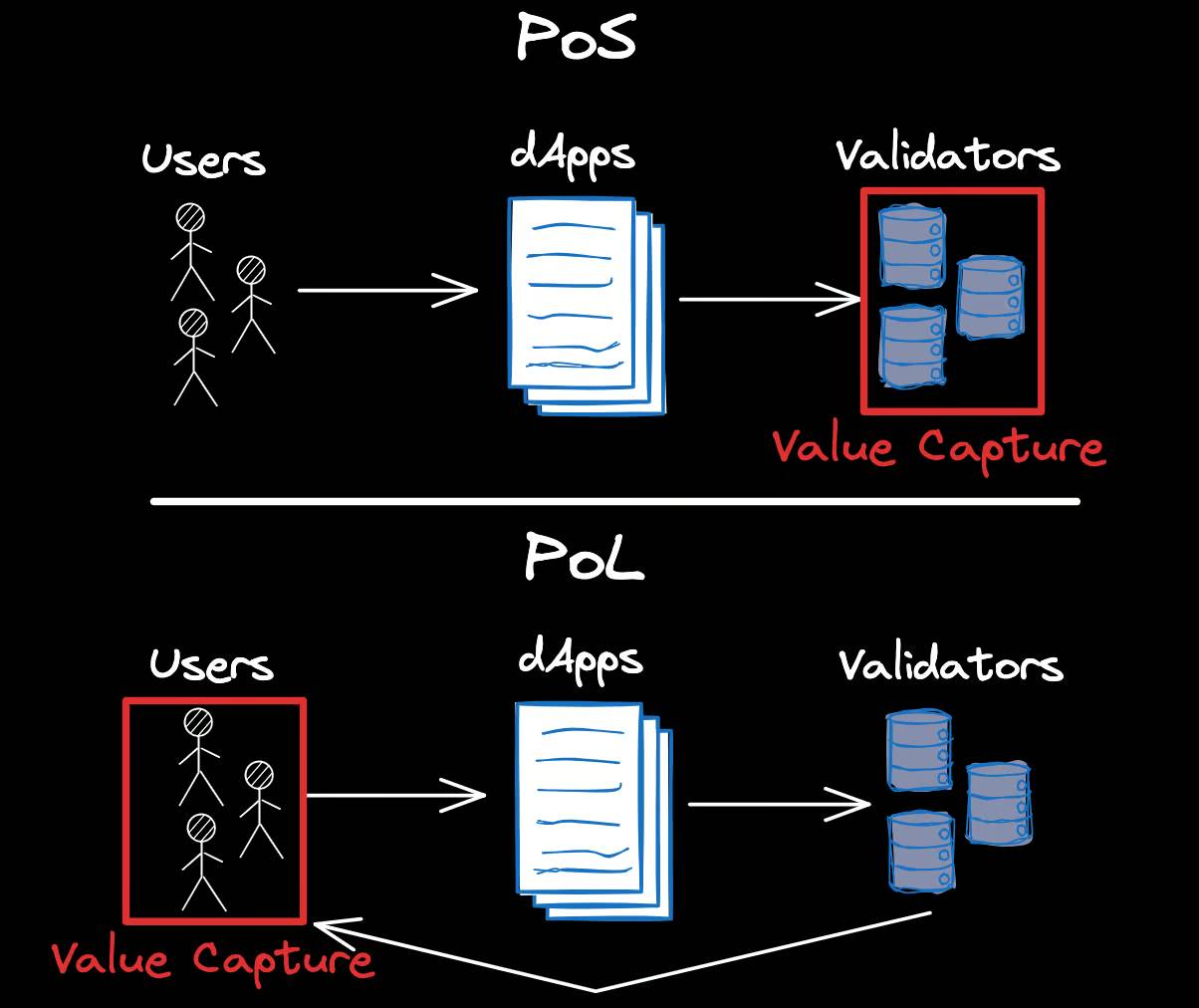

PoL is a novel reward mechanism designed to align users, dApps, and validators. In simple terms, users hold/mint LP tokens and earn BGT, which can be staked with validators who receive block rewards proportionate to their BGT stake. Therefore, security is directly linked to liquidity. For more details, please refer to:

Proof of Stake (PoS) networks still have some limitations:

- Increasing the economic security of the chain reduces ecosystem liquidity.

- Stake is concentrated in a few participants (LSTs/NoOps).

- Lack of coordination between dApps and underlying protocols.

PoL aims to address PoS-related issues by introducing a dual-token model that separates network tokens (BERA) from governance tokens (BGT). With this separation, we can:

- Systematically build liquidity while improving security, contributing to efficient trading and sustainable network growth.

- Align protocols and validators, enabling excellent coordination through incentives such as LP pools, bribes, governance tokens, etc.

The most exciting part of PoL is that it allows any dApp to "accelerate" its growth in a utilitarian way, a decision made by BGT holders (i.e., users) who initially provide "value" or liquidity to the ecosystem.

It should be clarified that the goals of ETH and Berachain are fundamentally different. ETH aims to be the WW3 anti-censorship layer for all value settlement, while Berachain aims to be the canvas for an infinite economic game. Additionally, Berachain has declared itself as an adjacent chain to ETH.

But won't the chain suffer from impermanent loss?

I've heard many people familiar with PoL say, won't Berachain suffer from impermanent loss due to network security relying on staking/minting LP tokens?

First, I want to say that there is no magic solution to the issue of LP profitability. DEX designs are rapidly improving, and we are also seeing the rise of MEV-conscious designs that return value to the application layer, but the issue of LP profitability fundamentally remains unresolved.

So will Berachain collapse over time? I don't think so, for the following reasons:

In addition to providing liquidity for DEX, there are other ways to earn BGT. Various venues will be whitelisted for BGT emissions, whether it's money markets, options protocols, etc. *Note that any dApp (whether native or not) can be whitelisted for BGT emissions.

Contrary to the MEV-Boost paradigm of proposer monopolies on ETH, PoL incentivizes validators (and even protocols) to return most of the profits to users. So while LPing itself may not be profitable, LPs may receive enough kickbacks through validator bribes or increased block rewards. Therefore, I believe Berachain is the canvas for an infinite economic game, as users' money will ultimately return to the users.

Finally, there are options to hedge impermanent loss on LPs generated by BGT. Smilee Finance and GammaSwapLabs have committed to providing such products on Berachain.

*Note that there will also be stable pools providing secure sources of income.

What if most of the liquidity leaves the ecosystem?

BGT production will not stop. Instead, it will flow to a smaller, more concentrated LP group at extremely high annual rates. Therefore, speculators are likely to keep Berachain in some kind of balance.

Unlike PoS networks where network rewards primarily accumulate to experienced actors, PoL brings value to its users, promoting long-term health of the DeFi ecosystem as it attracts liquidity.

Will Berachain work? I'm skeptical of the 100 billion FDV

Honestly, I don't know if Berachain will work. I have a few concerns:

I believe PoL can only work as expected in an efficient market.

Similar to LRT, I wonder how much behind-the-scenes trading will occur to gain more BGT authorization/emissions.

There may be equity concentration around a single LST provider.

But that's what I have to say. As someone who has worked in the DeFi space for over 6 years, Berachain is one of the largest and most pioneering DeFi experiments I've seen. While we don't yet know what game will be played, I'm very excited to see these Beras drive the development of cryptocurrencies.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。