On the evening of May 7th, AICoin researchers conducted a live graphic and textual sharing of the "Pin Bar Profit Signal Strategy (with Membership)" in the AICoin PC-end Group Chat Live. Below is a summary of the live content.

I. Principle of Pin Bar Signal Formation

An upward pin bar is generally formed by oversupply, while a downward pin bar is formed when there is undersupply. Therefore, an upward pin bar generally indicates a bearish trend, while a downward pin bar generally indicates a bullish trend.

(1) Benefits

It can provide warning alerts, automated trading, and assist individuals in monitoring the market. It is recommended to use a 5-minute cycle.

(2) Performance of Pin Bar Signals under BTC:

Red upward pin bar indicates shorting; green downward pin bar indicates going long.

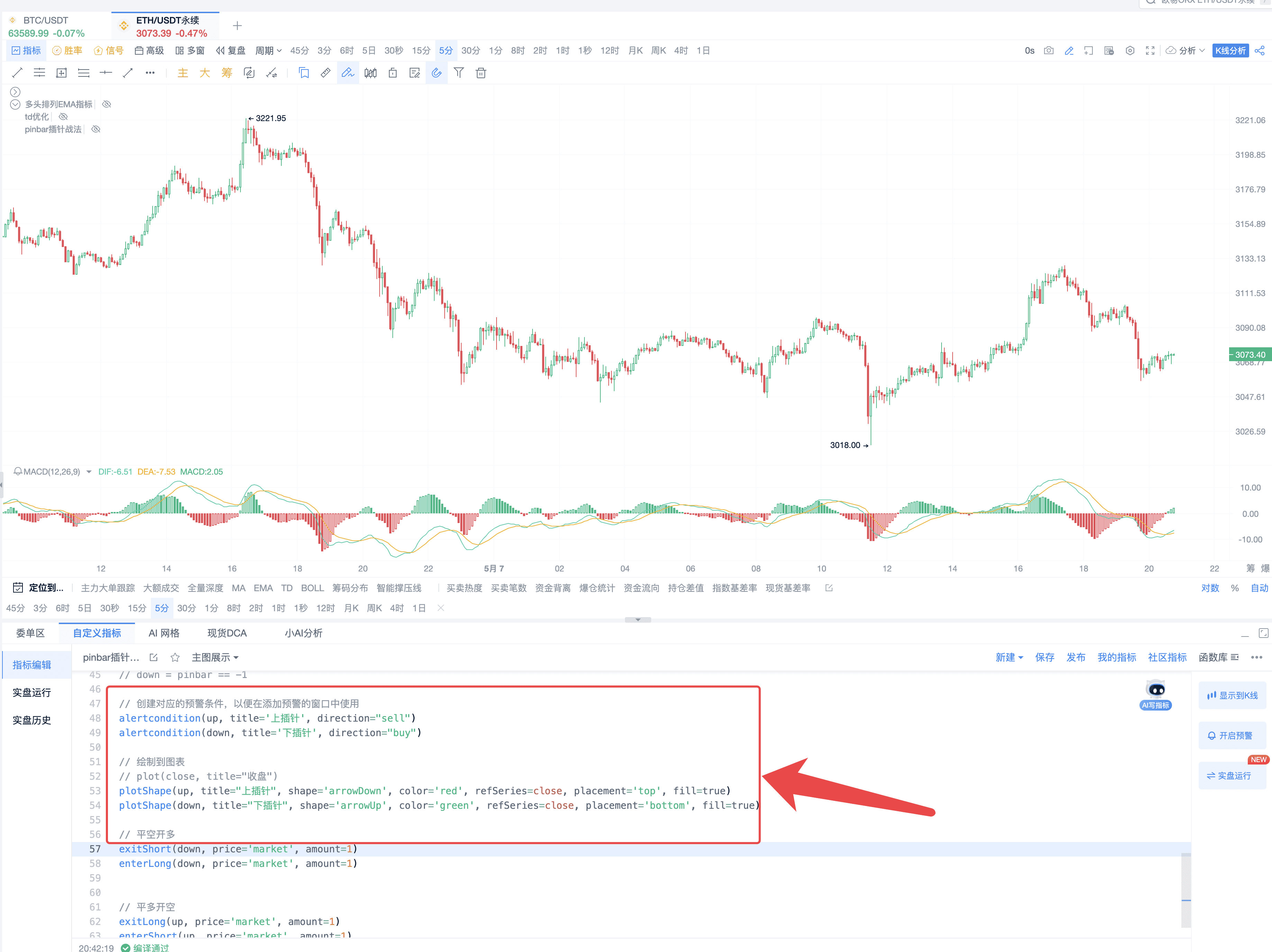

(3) Performance of Pin Bar Signals under ETH:

(4) Focus Points

First point: Whether there are shadows, for example:

Second point: Amplitude

Third point: Performance of the entity

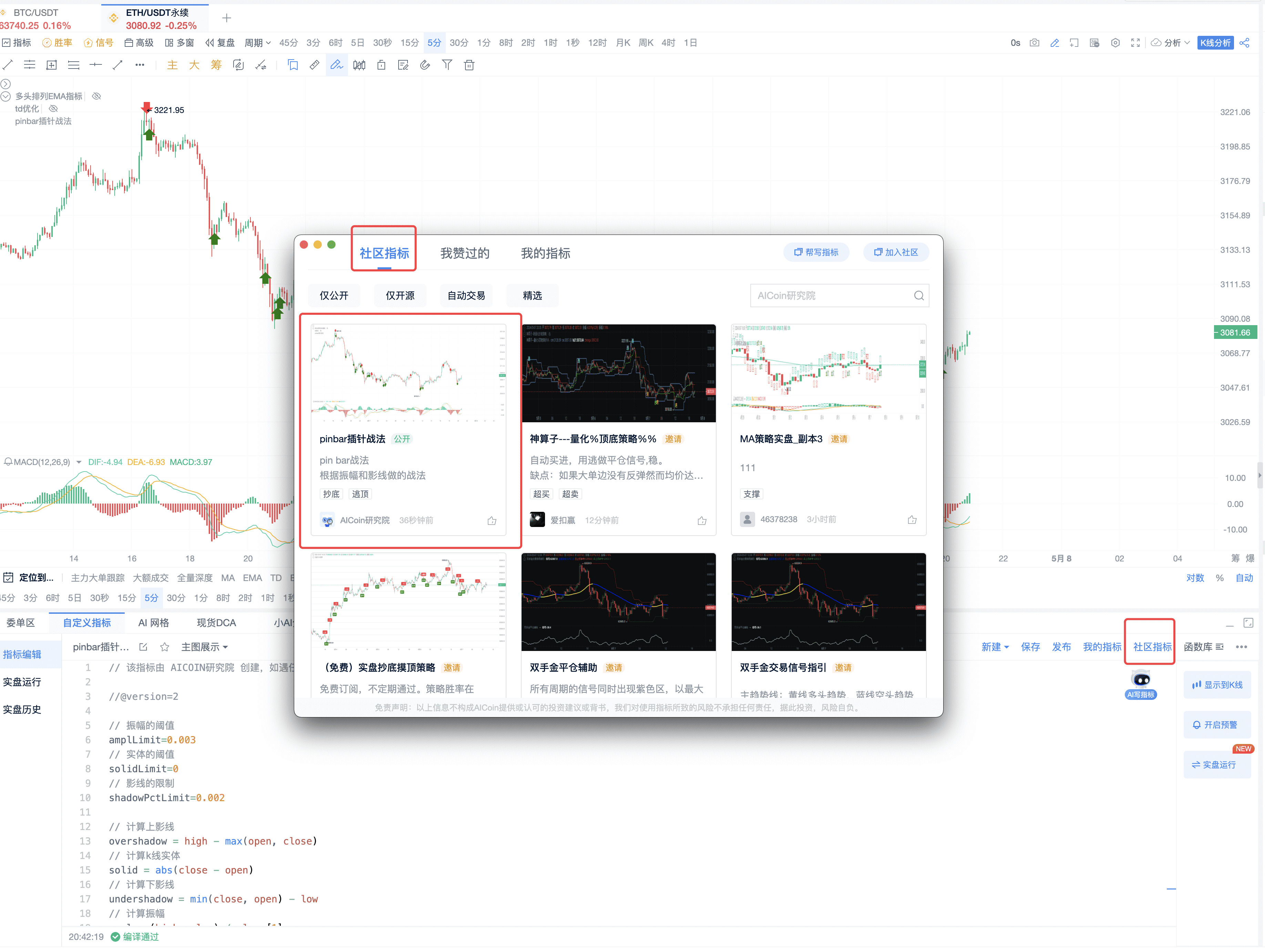

II. Building Pin Bar Signal Indicators

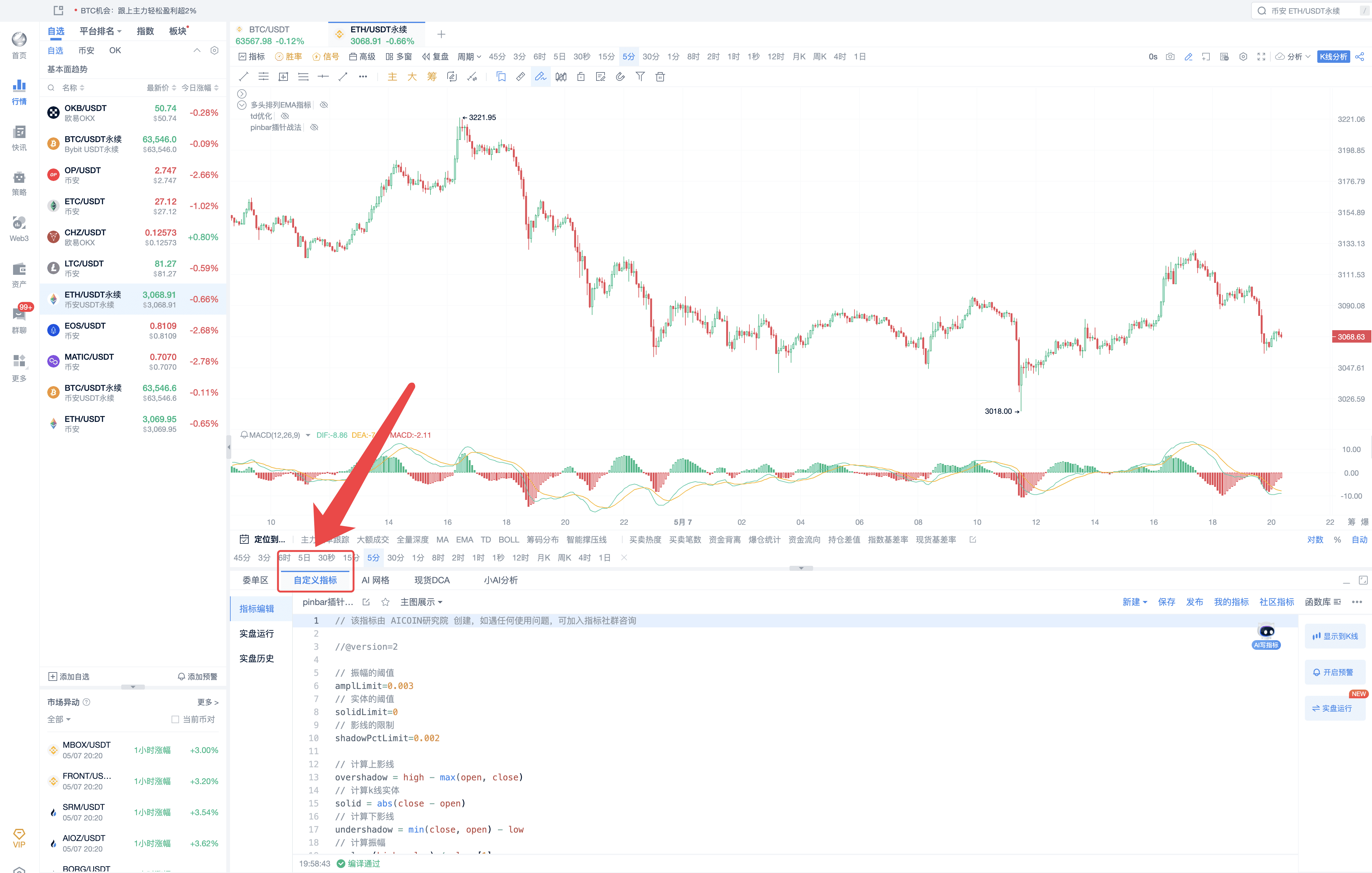

(1) Open the custom indicator below the k-line

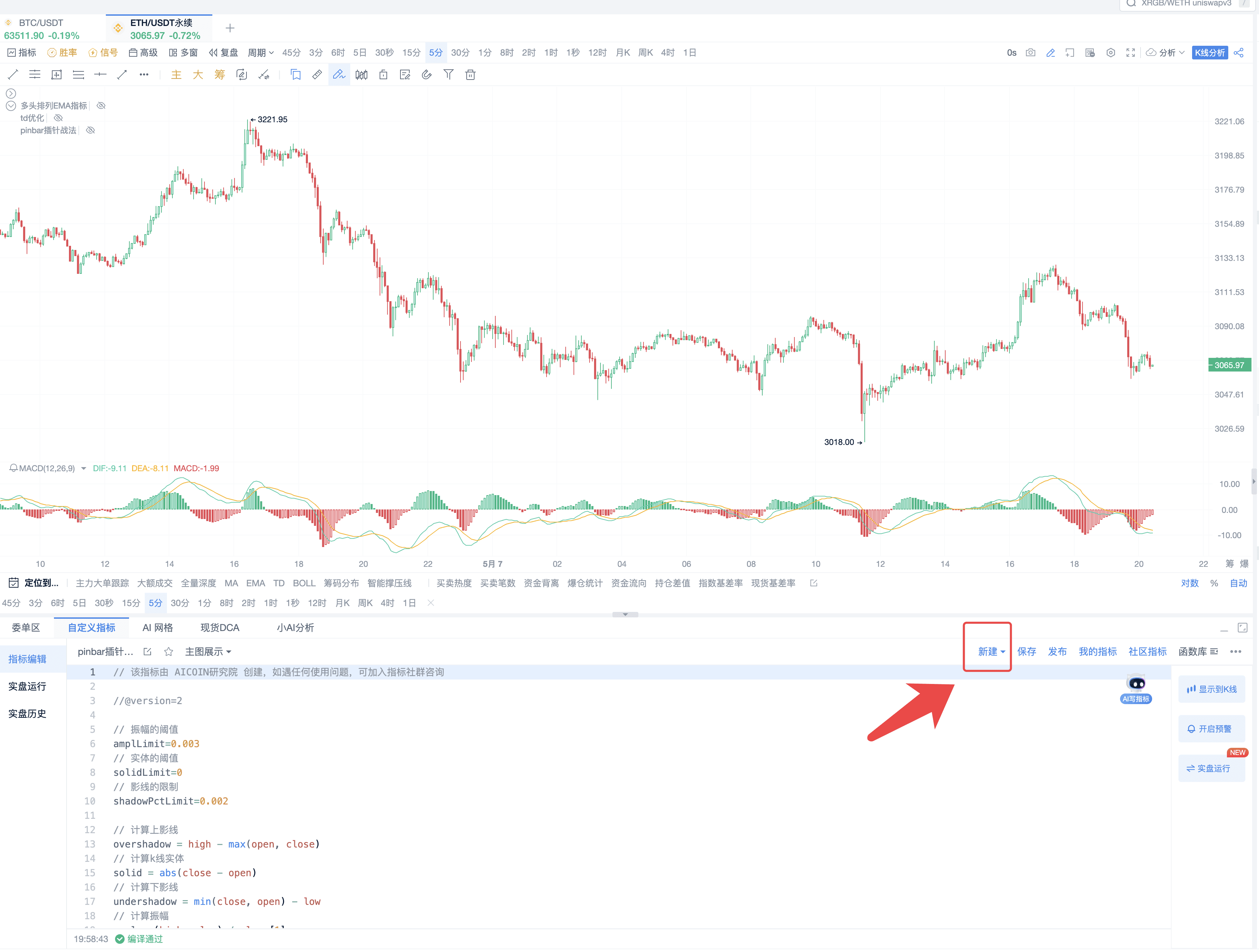

(2) Click on "New"

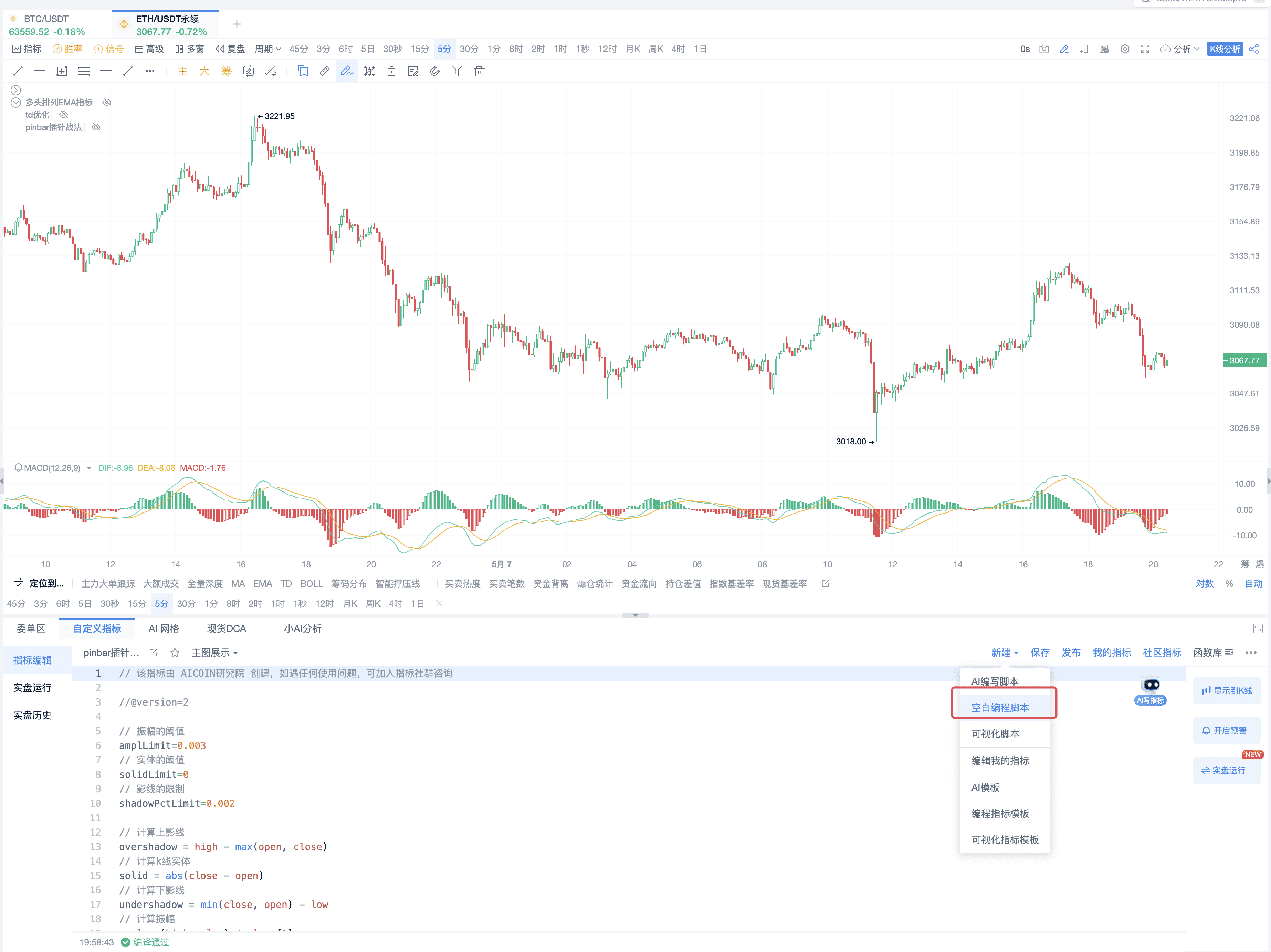

(3) Create a new blank programming script

(4) Copy the algorithm to the editor and save

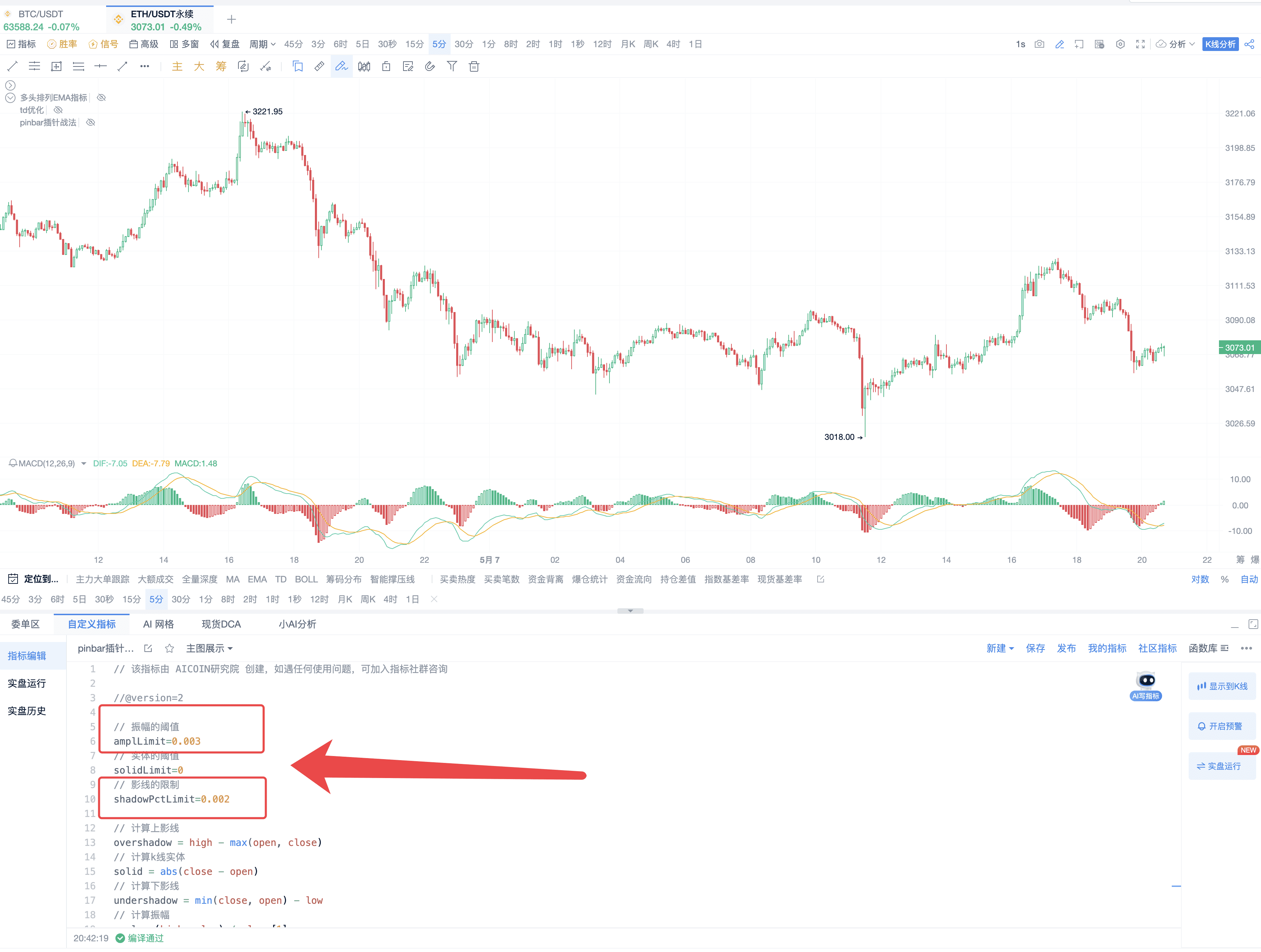

// This indicator is created by AICOIN Research Institute. For any usage issues, you can join the indicator community for consultation

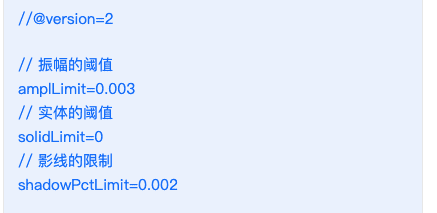

//@version=2

// Amplitude threshold

amplLimit=0.003

// Entity threshold

solidLimit=0

// Shadow limit

shadowPctLimit=0.002

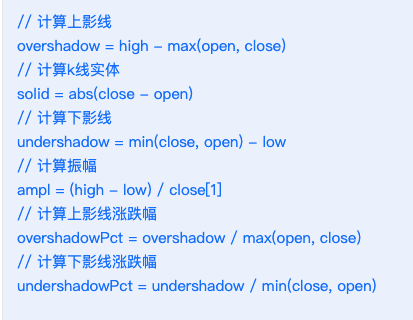

// Calculate upper shadow

overshadow = high - max(open, close)

// Calculate k-line entity

solid = abs(close - open)

// Calculate lower shadow

undershadow = min(close, open) - low

// Calculate amplitude

ampl = (high - low) / close[1]

// Calculate upper shadow percentage change

overshadowPct = overshadow / max(open, close)

// Calculate lower shadow percentage change

undershadowPct = undershadow / min(close, open)

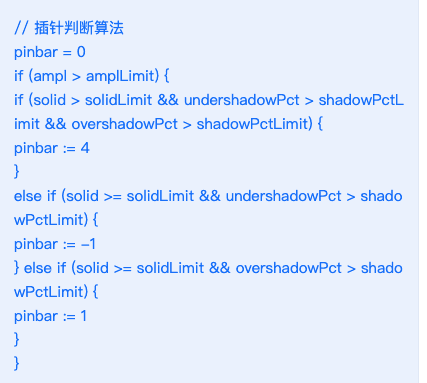

// Pin bar judgment algorithm

pinbar = 0

if (ampl > amplLimit) {

if (solid > solidLimit && undershadowPct > shadowPctLimit && overshadowPct > shadowPctLimit) {

pinbar := 4

}

else if (solid >= solidLimit && undershadowPct > shadowPctLimit) {

pinbar := -1

} else if (solid >= solidLimit && overshadowPct > shadowPctLimit) {

pinbar := 1

}

}

// 1 indicates upward pin bar

// -1 indicates downward pin bar

// 4 indicates both upward and downward pin bars

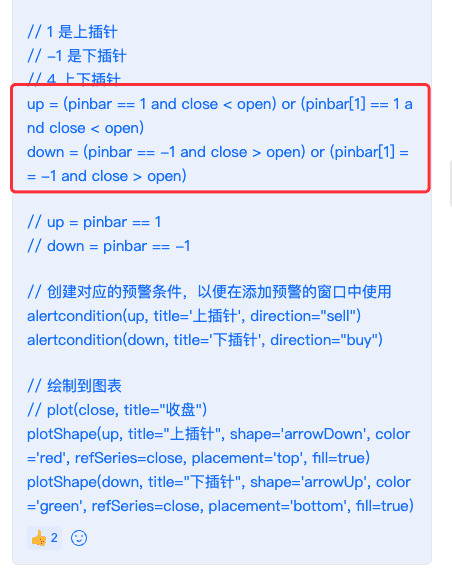

up = (pinbar 1 and close < open) or (pinbar[1] 1 and close < open)

down = (pinbar -1 and close > open) or (pinbar[1] -1 and close > open)

// up = pinbar == 1

// down = pinbar == -1

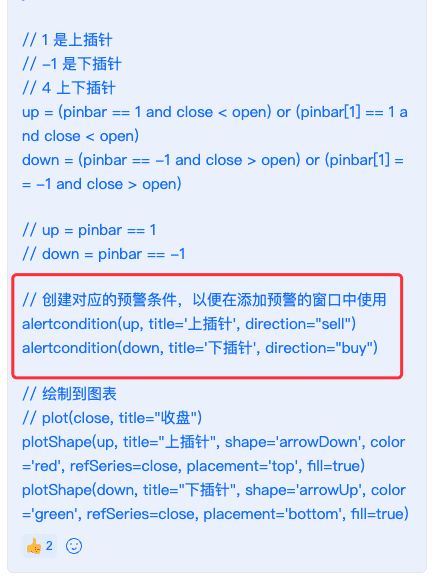

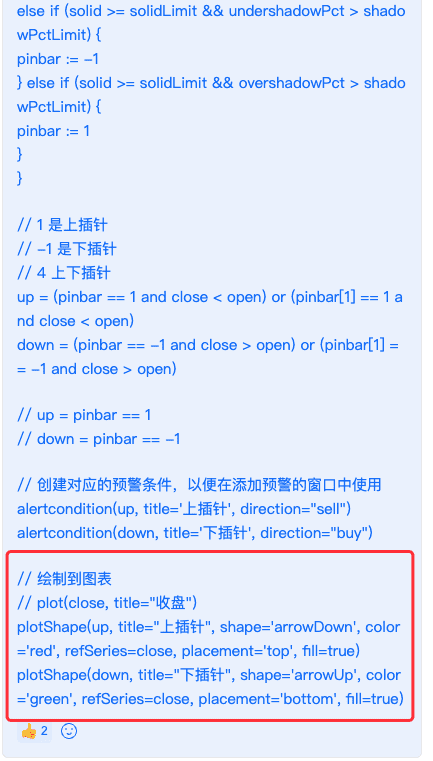

// Create corresponding alert conditions for use in the alert window

alertcondition(up, title='Upward Pin Bar', direction="sell")

alertcondition(down, title='Downward Pin Bar', direction="buy")

// Plot on the chart

// plot(close, title="Close")

plotShape(up, title="Upward Pin Bar", shape='arrowDown', color='red', refSeries=close, placement='top', fill=true)

plotShape(down, title="Downward Pin Bar", shape='arrowUp', color='green', refSeries=close, placement='bottom', fill=true)

(5) Automatic trading section, add if needed

// Close short and open long

exitShort(down, price='market', amount=1)

enterLong(down, price='market', amount=1)

// Close long and open short

exitLong(up, price='market', amount=1)

enterShort(up, price='market', amount=1)

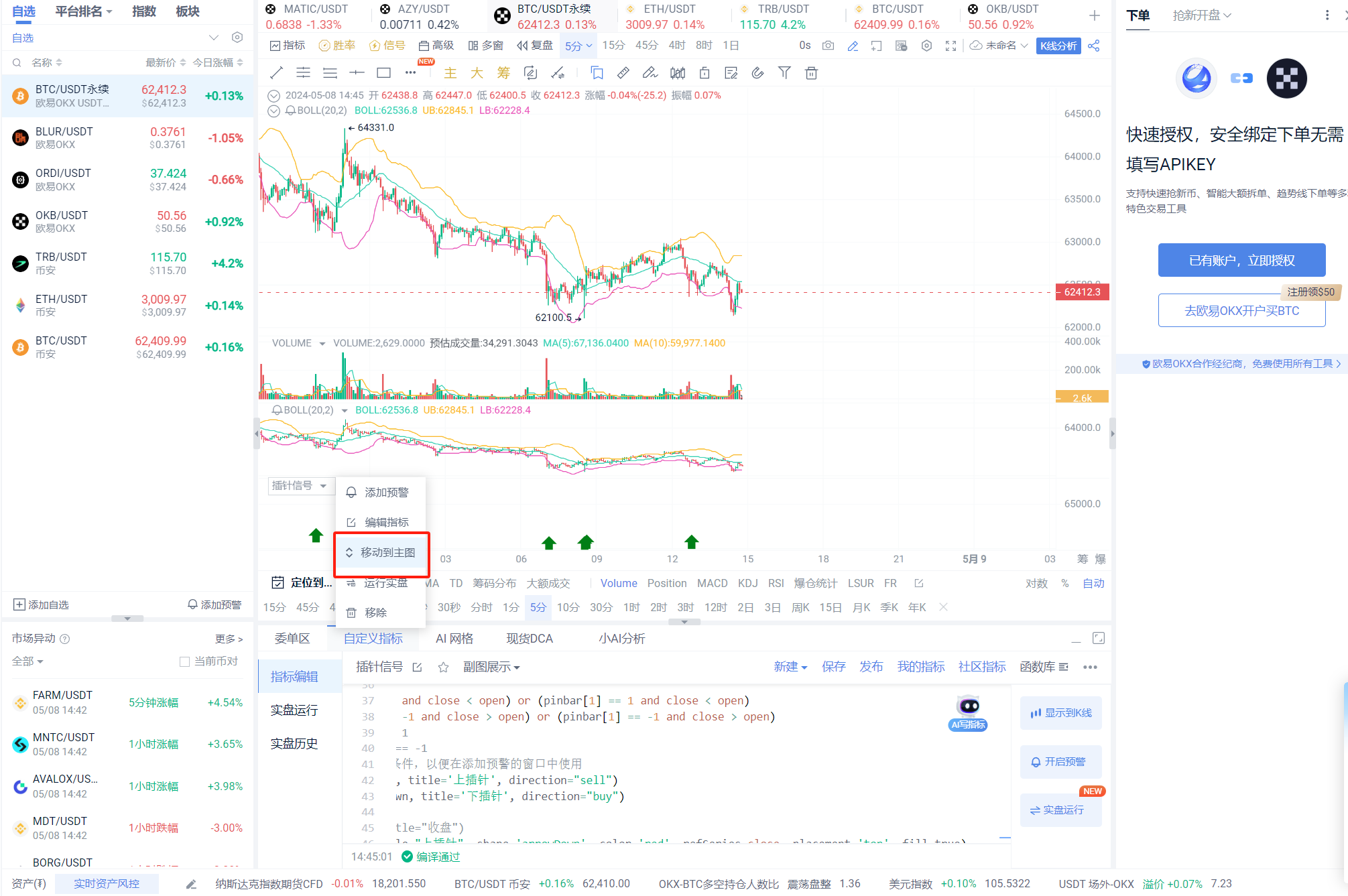

(6) Select to move to the main chart

III. Algorithm Analysis

(1) Definition of this pin bar strategy

This means: Once the k-line amplitude reaches 0.003, and the shadow ratio reaches 0.002, which is 0.2%.

(2) Perform calculations on different k-line elements, including: shadows, entities, amplitudes, and upper and lower shadow amplitudes.

(3) Perform three-level judgments

First-level judgment: Pin bar with upper and lower shadows

Second-level judgment: Downward pin bar

Third-level judgment: Upward pin bar

(4) Combine k-line open and close directions to make signal judgments

(5)Setting up alert conditions for convenient alert reminders (receive notifications on mobile, computer, and voice)

(6)Displaying signals on the chart

(7)Customize your own exclusive indicators

You can adjust the limits of amplitude and shadow based on your own observations and analysis.

If you prefer to adjust the reminders for buying on upward pin bars, you can do so here.

(8)Find this strategy in the Indicator Plaza

For PRO members and signal alert members, these are high-quality tools tailored for lazy friends, and custom indicators can help any AICoin user plan their trades and trade their plans. For more custom indicator strategy displays and multiple alert reminders, feel free to experience the custom indicator membership for free for a limited time by subscribing to the signal alert/PRO K-line. Click the link below to subscribe and experience: https://aicoin.com/en/vip/chartpro

Recommended Reading

For more live content, please follow the AICoin "News/Information-Live Review" section, and feel free to download the AICoin PC-end app.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。