BTC 4-hour:

Currently, the price of Bitcoin is stable at around $62,000 in the absence of market bullish news. The lack of significant positive or negative news has led to a sideways market and reduced volatility.

From a macro perspective, factors such as the potential return of Donald Trump to the presidency and de-dollarization could have a relatively positive impact on Bitcoin.

Furthermore, based on the Bitcoin chart, it has not yet broken through the downtrend line, leading to a decrease in support levels. Without further bullish news, the price of Bitcoin may slowly decline after oscillation.

The short-term first resistance level can be referenced at $63,760, and the second resistance at $64,550. If the current price can form a higher low during a rebound and close, the possibility of breaking the first resistance will significantly increase.

Therefore, when the price of Bitcoin reaches the psychological resistance level of $64,000, a short-term adjustment may occur, and we can consider the first resistance as an area for appropriate profit-taking for long positions.

According to yesterday's analysis, Bitcoin has already broken through the 120-day moving average, which has increased the likelihood of a short-term bearish view.

The first support level is around $62,160, and the second support is around $60,250. If the first support level, which was formed yesterday, is breached, the bearish view will be maintained.

At the same time, it's important to pay attention to the support of the 60-day moving average. If it is breached, it will open a downward channel to $61,000. Additionally, after the failure of the high point test, the low point of Bitcoin is also decreasing. Therefore, the first support and the 60-day moving average are crucial support areas during a rebound.

In today's trading, due to the chart showing a rebound after a decline, the short-term rebound view will be maintained. The first support and the 60-day moving average will be considered key support levels and areas for technical rebound. However, if the candlestick shows a large bearish line breaking the support, the view will be changed to bearish.

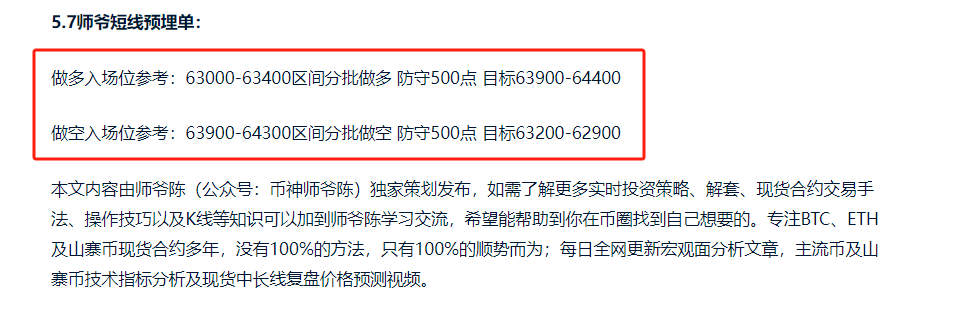

5.8 Short-term Pre-set Orders by Master Chen:

Long entry reference: Buy in batches in the range of 61800-62200, with a 500-point defense, and a target of 62900-63700.

Short entry reference: Sell in batches in the range of 63000-63400, with a 500-point defense, and a target of 62200-61800.

This content is exclusively planned and published by Master Chen (WeChat public account: 币神师爷陈). If you need to learn more about real-time investment strategies, untangling, spot contract trading techniques, operational skills, and candlestick knowledge, you can add Master Chen for learning and communication. Hopefully, it can help you find what you want in the cryptocurrency circle. Focusing on BTC, ETH, and altcoin spot contracts for many years, there is no 100% method, only 100% going with the trend; daily macro analysis articles updated across the web, technical indicator analysis of mainstream coins and altcoins, and spot mid-to-long-term replay price prediction videos.

Friendly reminder: Only the column public account (as shown in the image above) is written by Master Chen. The end of the article and other advertisements in the comments section are unrelated to the author. Please discern carefully between true and false. Thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。