1-hour BTC:

Currently, on the 1-hour timeframe, Bitcoin is in an upward trend and has been experiencing a small range of pullback rebounds from last night to this morning.

For the bullish trend, the master believes that the first net inflow of Grayscale ETF has led to a rebound in the market funds, indicating a decrease in selling pressure on Bitcoin and an increase in demand.

The first resistance for the day is at 64060, and the second resistance is at 64400. The third retest of the first resistance has failed, so multiple failures to break through the resistance zone above may lead to selling pressure.

Although the short-term market is in an upward trend, it is important to note that if there is another breakthrough after the upward trend, it may attract more short positions. Therefore, the bullish strategy should only be considered for ultra-short-term trading.

The first support on the 1-hour timeframe is at 63540, and the second support is at 63120. For the short-term downside target, it may reach the first support line. Although there may be a rebound before reaching the first support line, the master is more optimistic about the formation of the lower shadow of the candlestick, so the first support is considered an important short-term support.

If the price breaks the trend line, we need to immediately switch to a bearish mindset and look for opportunities to go long on the rebound at the support level.

In today's trading, the 1-hour trend shows an oscillating upward trend, so the master will maintain a bullish mindset in the short term. However, if the price breaks the upward trend line in the chart, we can consider a bearish mindset in the short term and focus on the support strength below the downtrend line.

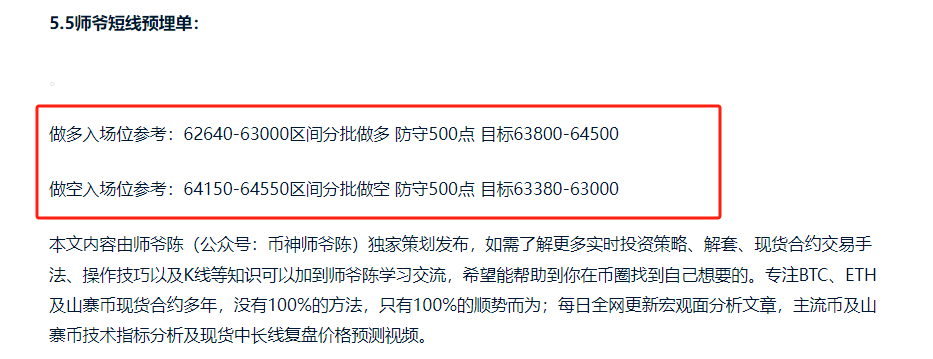

5.6 Master's Short-term Pending Orders:

Long entry reference: Buy in batches in the 63100-63500 range, defend 500 points, target 64100-64600

Short entry reference: Sell in batches in the 64400-64800 range, defend 500 points, target 63540-63200 (light position)

This article is exclusively planned and published by Master Chen (WeChat public account: 币神师爷陈). If you want to learn more about real-time investment strategies, untangling, spot contract trading techniques, operational skills, and candlestick knowledge, you can add Master Chen for learning and communication. I hope to help you find what you want in the currency circle. Focusing on BTC, ETH, and altcoin spot contracts for many years, there is no 100% method, only 100% follow the trend; daily updates on macro analysis articles across the network, technical analysis of mainstream coins and altcoins, and spot mid-to-long-term replay price prediction videos.

Gentle reminder: This article is only written by Master Chen in the column public account (as shown in the picture above). The end of the article and other advertisements in the comment section are not related to the author. Please distinguish carefully between true and false. Thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。