Original Author: Portal_Kay

X/推: @portal_kay

On the day when the Runes protocol went live last Saturday, many FUD posts about Runes appeared. Actually, FUD is not a big deal, it just shows that the popularity of Runes is extremely high, naturally attracting a lot of attention. However, most of the FUD is a bit nonsensical, so I want to explain it.

Overall, the content of FUD about Runes can mainly be divided into two categories:

- FUD about the settings of the Runes protocol;

- FUD about the value of the Runes assets.

FUD about the settings of the Runes protocol

1. Does Runes make asset issuance more centralized?

After the protocol went live on the morning of April 20th, the most discussed were the first 10 Runes. However, after everyone had a look, it seemed difficult to understand. Either the project team pre-mined 100%, or they reserved a large portion for themselves. Doesn't this mean it's reverting back to centralized issuance?

My view on this issue is: It's not more centralized, but rather more diverse.

The first 10 Runes only have 0 pre-mined by Casey himself, the rest have different degrees of reservation. This is not a problem with the Runes protocol, but rather the choice of the deployers.

After experiencing BRC-20 and various BRC-XXX protocols in the BTC ecosystem, Casey actually learned from the experiences of various protocols (especially BRC-20), and gradually optimized the Runes protocol before it finally went live. Runes initially planned for two types of issuance: Fixed Cap and Fair Launch. In a later upgrade, deployers were allowed to reserve a pre-mine quota based on Fair Launch.

Therefore, the Runes protocol can support more diverse asset issuance scenarios:

- Issuing meme coins, 100% Fair Mint, all based on community consensus;

- Project teams issuing project governance tokens, distributed to investors, ecosystems, and various stakeholders according to token economics planning;

- Reward tokens for a project, 100% pre-mined and airdropped to the community users;

- Project teams and community co-building projects, with the project team reserving a portion for operational needs, and the remaining portion Fair Minted by the community;

- …

In fact, I believe that asset issuance driven by project teams will be an inevitable trend in ecosystem development. It's actually a very low probability for a truly ownerless token to sustainably operate. How many tokens can rely solely on the natural consensus of the community? In more common cases, isn't it a project team working diligently to build, ultimately allowing the project to have a sustainable narrative and the value of the assets to gradually rise?

2. Other FUD about the Runes token

The characters are so long, who can remember them?

When I first learned about the Runes protocol, I also thought this setting was not good. But on the one hand, the length of the name is not the fundamental issue, and I quickly adapted after becoming familiar with it. On the other hand, long characters can also have their own unique gameplay. Don't believe it? Just look at this ORDINALS•ARE•DEAD that even Leonidas tweeted.

Runes must be sold one by one, what's the difference from NFT?

In fact, the Runes protocol itself supports very convenient operations for assets, it's just that the protocol has just come out and various trading platforms have not had time to develop support. Casey also specifically tweeted to explain some differences between Runes trading and BRC-20 token trading. From the tweet, it can be seen that Runes can support the transfer of any quantity, and does not necessarily have to be sold one whole at a time.

Casey's tweet: Differences between Runes trading and BRC-20 token trading

FUD about the value of the Runes assets

1. The Runes bought at 2000 gas, are they now at a loss?

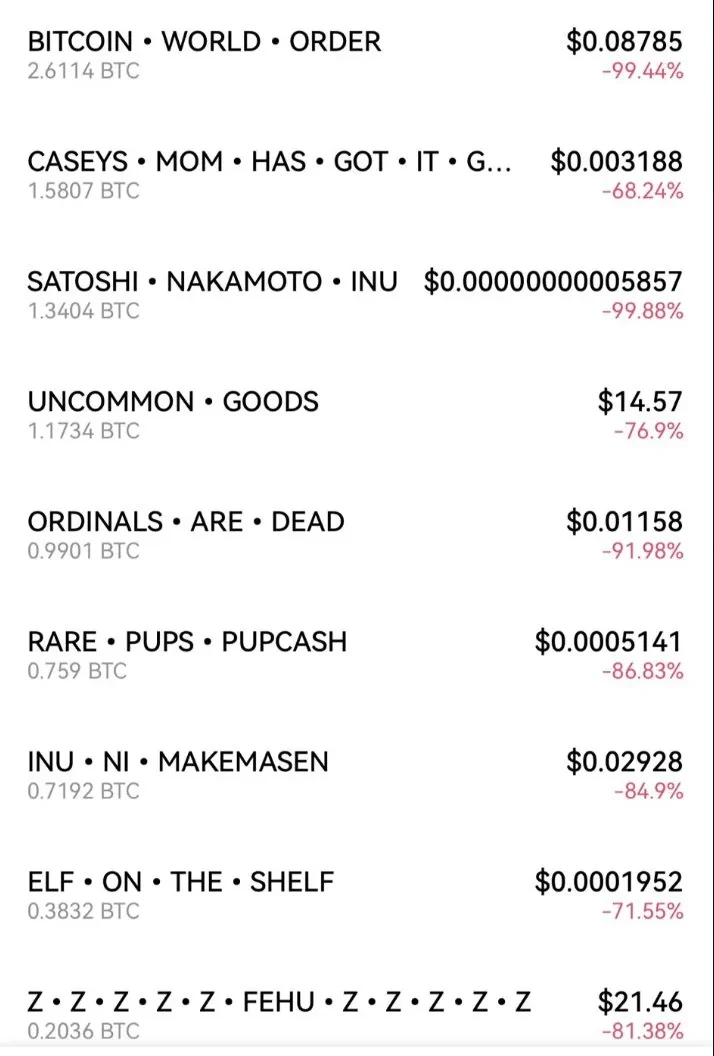

On the first day of the protocol going live, there was a screenshot of the OKX Runes market that was widely circulated. Then KOLs who tweeted would add a sentence or two like "Is this what you want from Runes?" "You only bought this at 2000 gas?" with similar mocking rhetoric. However, the statistical method of this screenshot is actually incorrect. OK probably got the starting prices of these newly listed Runes wrong, which caused the calculation of the price change to be wrong.

So, are those who participated in the initial Runes launch on April 20th all at a loss? Below are a few targets that were deployed and had good returns on the first day (Note: "Unisat transaction price" is a relatively moderate price). Of course, this does not mean that blindly buying after the release of all Runes projects can make money. Ultimately, solid research is still needed to find good targets.

In fact, this type of FUD mainly stems from two reasons:

The poster mainly holds BRC-20 or EVM ecosystem assets, and when they see the hype around Runes, a large amount of traffic and funds are attracted, they instinctively start to reject it. This is a case of letting personal interests determine one's mindset, because they are heavily invested in other assets, they naturally worry about Runes siphoning funds from other sectors. This kind of FUD can basically be ignored, because their interests are there, and this is not something that can be reasoned with.

Human nature naturally rejects new things. The Runes protocol is a new thing for many people, and if they haven't looked at some information before, it will naturally be unfamiliar to them. People naturally have a tendency to reject unfamiliar things, which is understandable. However, as crypto players, rejecting new things often means missing out on money-making opportunities.

What are people really FUDing about?

After organizing these FUD contents, I suddenly felt that these might just be superficial. So fundamentally, what are people really FUDing about? I guess, what people are really FUDing about is: the excessive issuance of assets with no fresh narrative!

After experiencing the wave of BTC assets driven by BRC-20 over the past year, people are no longer willing to FOMO for asset issuances with no new ideas. After all, a bunch of Ordinals small pictures went to zero, various BRC-20 inscriptions that were hyped at the time have disappeared, and there are not many BRC-XXX protocol assets that people remember. In the end, everyone understands that air is still air, and most of it will eventually go to zero.

And currently, the BTC ecosystem is in such an awkward period, where strong consensus asset protocols have emerged, but the landing applications have not yet been born. Asset protocols are ultimately just a medium for carrying value, and only when assets flow in DeFi, GameFi, and other landing applications, can they have a certain practical value.

However, all signs indicate that this awkward period should end soon. Various applications are in the early stages of birth, and now it's like the dawn before the explosion of the BTC ecosystem… Please give the BTC ecosystem a little patience.

Disclaimer: This article is for reference only and should not be used as legal, tax, investment, financial, or any other advice, and does not represent the position of RunesCC.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。