Persistence.one ($XPRT) is one of the first Cosmos application chains to enable IBC, CosmWasm, and Liquidity Staking Module (LSM). By continuously focusing on POS and liquidity staking-related products, it has built a framework for liquidity staking and restaking in the Cosmos ecosystem.

On December 5, 2023, the Cosmos community voted to allocate 600,000 ATOMs to pSTAKE for liquidity staking growth. pSTAKE shares 15% of its liquidity staking income with the Cosmos Hub.

➤ Persistence

❚ Ecosystem

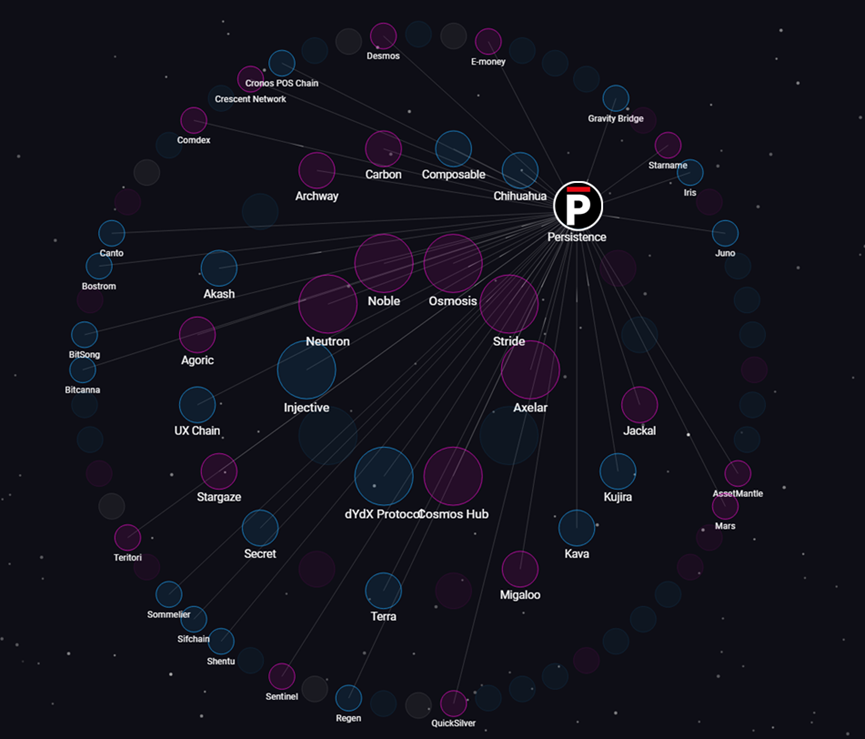

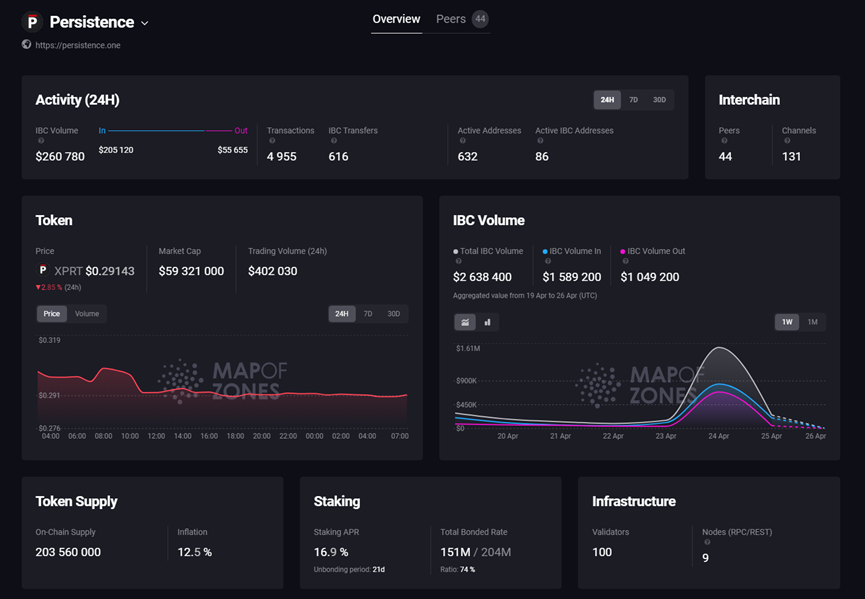

The Map of Zones visual data chart illustrates the influence of Persistence in the Cosmos ecosystem:

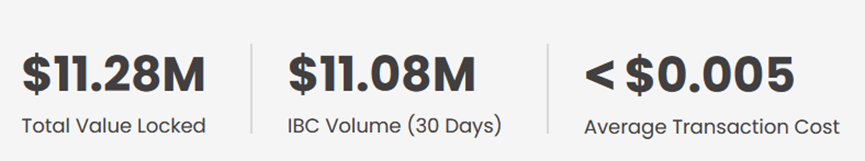

According to official data, Persistence's ecosystem TVL is $14.78 million, with an IBC trading volume of $15 million in the past 30 days and an average transaction cost of less than $0.005.

Data from Map of Zones shows that Persistence.one has established 121 channels with 44 other zones in the Interchain network. This indicates that it is a highly interconnected node capable of interacting with many other zones through multiple channels.

74.7% of the network's tokens ($XPRT) are staked, which typically indicates higher security and participation in the network. The staking annualized return rate is 16.7%.

Persistence's infrastructure consists of 6 nodes and 100 validators, collectively ensuring the decentralization and security of the network.

In the above ecosystem data, IBC (Inter-Blockchain Communication) is a core protocol in the Cosmos ecosystem used to achieve interoperability between different blockchains. Through IBC, independent blockchains can seamlessly transfer tokens and other data types, making it possible to build cross-chain applications. The IBC transaction volume reflects the scale of value inflow and outflow from the Persistence chain to external sources.

In the past 24 hours, Persistence's IBC transaction volume was $260,800, with 4,955 transactions, including 616 IBC transactions. There were 932 active addresses, with 86 active IBC addresses. Notably, the inflow through IBC has consistently exceeded the outflow, indicating increasing value flowing into Persistence for staking participation.

The staking platform pSTAKE is an important product for the Persistence chain and the Cosmos ecosystem.

❚ Technical Support

Persistence supports the CosmWasm framework, allowing developers to write secure and interoperable smart contracts in Rust. Additionally, DApps developed using the CosmWasm framework can run cross-chain through IBC, providing convenient, secure, and efficient technical support for liquidity staking.

Persistence is connected to 54 Cosmos application chains through IBC for trustless communication, transfer, staking, and restaking of tokens, laying the ecological foundation for staking and restaking in the Cosmos ecosystem.

Interchain Accounts (ICA) are utilized to enable ICA Liquid Staking, allowing an on-chain account to perform operations on another chain, enhancing the efficiency and flexibility of staking and restaking.

➤ Liquidity Staking

❚ Cosmos Ecosystem Staking and Network Security

In the Ethereum ecosystem, the threshold for validator nodes is staking 32 ETH or more. Platforms like Lido enable users to stake small amounts of ETH, aggregating these funds to allocate in 32 ETH units to validator node operators, thereby promoting an increase in the number of Ethereum validator nodes and enhancing the security and decentralization of the Ethereum network.

In the Cosmos ecosystem, liquidity staking involves two roles: validators and delegators.

Delegators, or stakers, can choose the validator node to delegate to when staking.

Validators run hardware and Cosmos SDK-based blockchain applications to achieve consensus with other validators, proposing and validating new blocks on the chain.

If a validator engages in negative behavior, the delegators of the validator node will face corresponding penalties. In cases of improper behavior, including prolonged or intentional offline activity, the staked deposit of the delegators will be destroyed or reduced by 0.1%. In cases of extremely malicious behavior, such as double-signing violations, where a validator signs a given block height more than once, the staked deposit will be reduced by 5%.

It is evident that the essence of liquidity staking in the Cosmos ecosystem is to prevent malicious behavior through economic incentives and potential penalties. Validators and delegators share responsibility in maintaining network efficiency and security while receiving token rewards.

❚ pSTAKE Staking

pSTAKE ($PSTAKE) is part of the investment portfolio of Binance Labs and Coinbase Ventures.

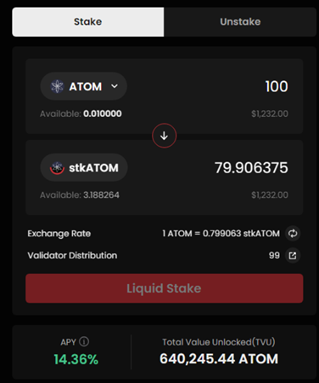

pSTAKE provides a streamlined staking process for the Cosmos ecosystem. Users only need to select the token to stake and the chain they are on to begin staking.

Upon completion of staking, the pSTAKE protocol issues the corresponding staking equity tokens to the wallet. For example, staking ATOM will yield stkATOM.

• Automatic Compound Interest

Using stkATOM as an example, the user's daily staking income is in ATOM, which is automatically reinvested for additional returns. As the returns are reinvested, each stkATOM corresponds to an increase in staked ATOM, allowing users to receive more ATOM when unstaking. Therefore, the staking income for users is reflected in the growth ratio of stkATOM/ATOM.

• Unstaking

When users unstake, they need to wait 21-25 days, or they can pay a 1% fee for instant unstaking. Upon unstaking, the corresponding stk assets are destroyed.

• Staking Yield

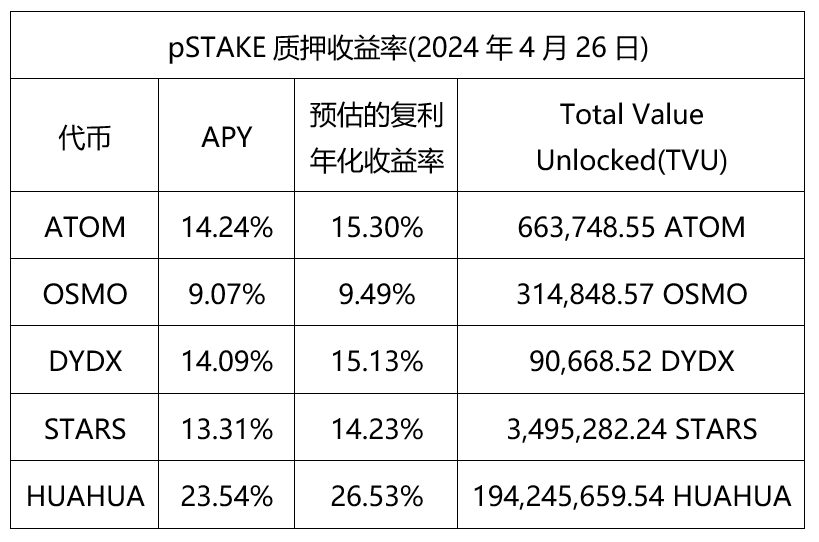

The assets supported by pSTAKE for staking and their current yield situation are as follows:

The estimated compound annualized yield is calculated based on the current day's yield rate remaining unchanged.

• Notes

pSTAKE currently supports staking of ATOM on Cosmos Hub, OSMO on Osmosis chain, DYDX on dYdX chain, STARS on Stargaze, HUAHUA on Chihuahua, and the five tokens minted on the Persistence chain.

When users choose to stake tokens from the native chain, the staking process on pSTAKE involves two steps: cross-chain asset transfer to the Persistence chain through IBC, followed by staking the assets using the Persistence chain's liquidity staking module.

Therefore, regardless of which chain's assets are staked on pSTAKE, users need to hold a certain amount of Persistence chain's base token—$XPRT—as GAS. The GAS on the Persistence chain is very low.

• Staking Derivatives

Persistence and even the Cosmos ecosystem have launched more stk asset derivative products.

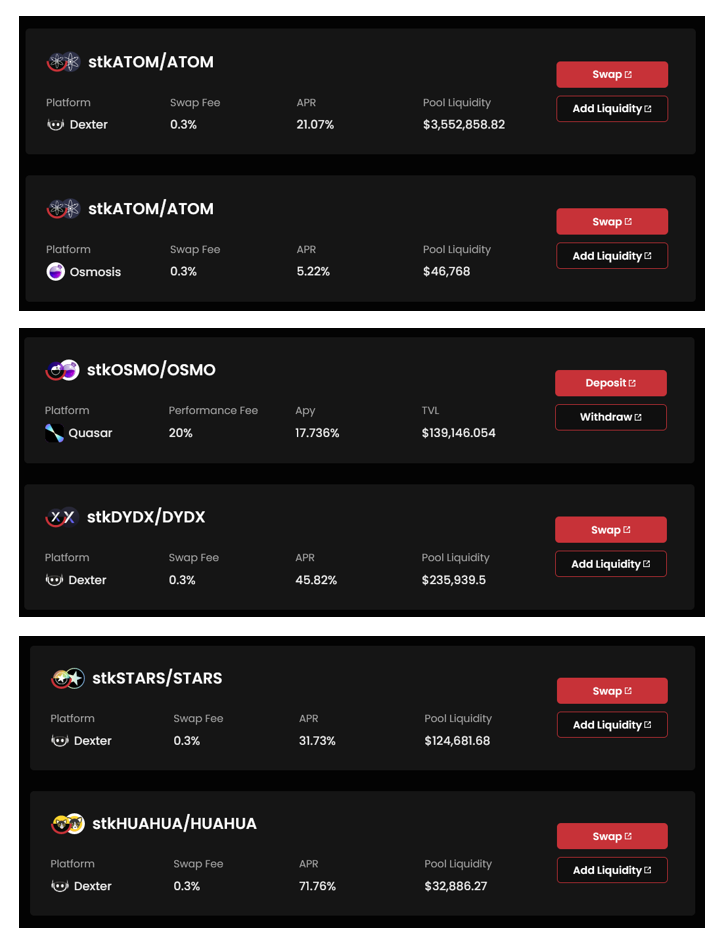

For example, in DEX products, stkATOM can be directly exchanged for ATOM without unstaking or paying a 1% fee. Additionally, combining stk assets with native assets can add liquidity in DEX and achieve higher yield. For instance, in Dexter under Persistence, the expected annualized yield for stkDYDX+DYDX is 45.82%.

❚ $XPRT Staking

As an independent blockchain, Persistence also requires staking to enhance network security.

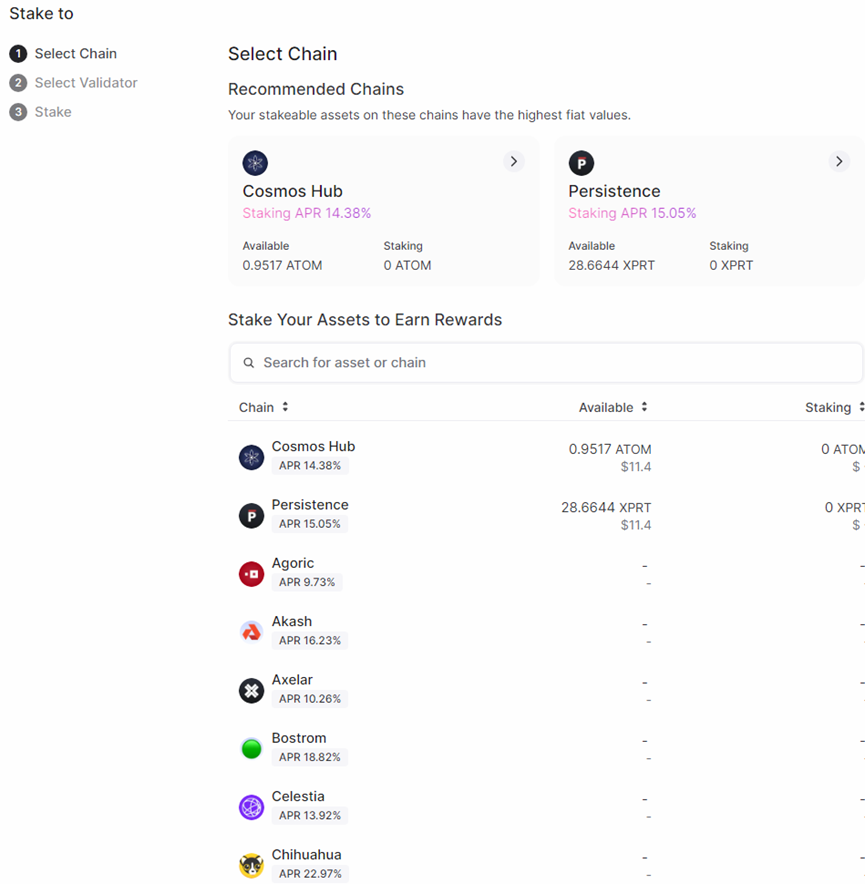

Staking $XPRT is convenient in the Persistence official or Keplr wallet.

After selecting the Persistence network, users can choose the validator node to stake $XPRT.

❚ Staking Security

As a liquidity staking platform, Persistence is an important cornerstone of security in the Cosmos ecosystem.

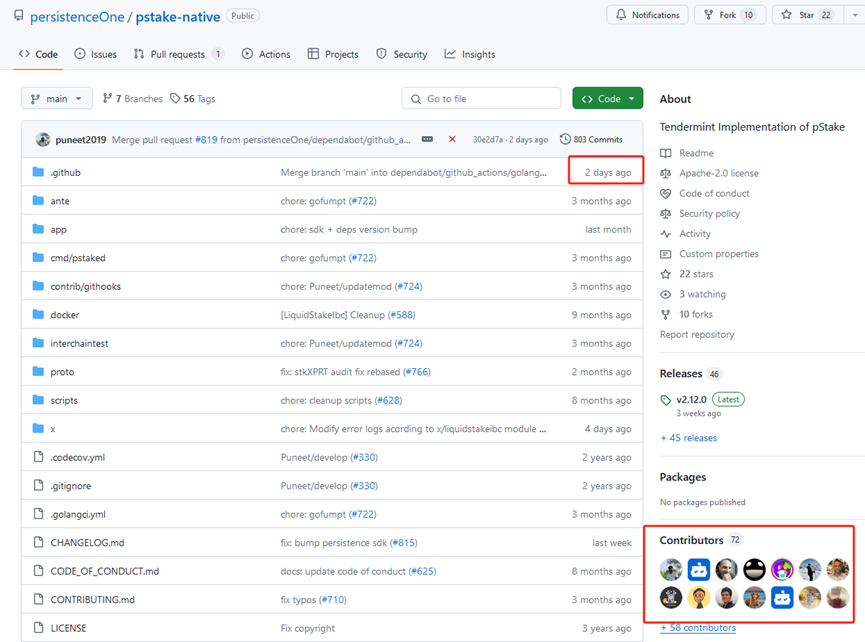

Both Persistence and pSTAKE are open-source programs, ensuring security. The pSTAKE program has contributions from 72 developers, with the most recent code commit being 2 days ago.

Furthermore, Persistence and pSTAKE collaborate with multiple security institutions to provide comprehensive support for the security of staking and restaking. These security institutions include:

- Well-known blockchain and crypto security and audit firms: Halborn, PeckShield, Certora, Hexens, and Notional

- Global security research and consulting company: Trail of Bits

- Smart contract and related security audit and consulting firms: Solidified, ConsenSys Diligence, Oak Security

- Leading DeFi bug bounty platform: Immunefi

- Blockchain security real-time monitoring and alert network: Forta

➤ Restaking

According to the Persistence blog, the project team is building Restaking infrastructure in Cosmos, allowing users to deposit liquidity staking tokens (stkATOM, stTIA, stkDYDX, etc.) into Persistence through pSTAKE, Stride, and Quicksilver. This enables them to restake their assets and secure additional chains while earning additional rewards.

The Persistence restaking module supports staking requests for various assets, including staking equity tokens, stablecoins, LP tokens, etc.

❚ Restaking Alliance

The Persistence restaking module is developed based on the Alliance module. Alliance is an open-source Cosmos SDK module built by Terraform Labs, enabling assets to be staked from one blockchain to another, creating mutually beneficial relationships through cross-chain staking.

For example, after staking $XPRT, the stakers of stkATOM and stkTIA respectively join the Persistence restaking asset alliance after staking the corresponding assets on Persistence. Stakers of stkATOM and stkTIA can receive restaking rewards, as well as $XPRT.

The restaking alliance shares staking rewards, with stakers of various assets allocated rewards based on the asset's reward weight. The reward weight for $XPRT is 1, and the reward weight for other assets is determined and adjusted through decentralized governance.

For example, assuming the reward weights for stkATOM and stkTIA are 0.4 and 0.2, if the restaking asset alliance only includes $XPRT, stkATOM, and stkTIA, the reward distribution for these three asset stakers would be:

$XPRT: 62.5% stkATOM: 25% stkTIA: 12.5%

This restaking asset alliance reward distribution mechanism forms a community of interest, benefiting the security and decentralization of the Cosmos ecosystem.

❚ Source of Restaking Rewards

The tokens used for restaking are locked and proportionally minted into native tokens, which are then staked in the staking module as delegators. For example, stkATOM and stTIA staked by users are locked by the Persistence restaking module and proportionally minted into $XPRT. These $XPRT tokens are staked to validators, and the staking rewards are distributed to stkATOM and stTIA stakers.

This is the source of restaking rewards for Persistence, further strengthening the security and liquidity of the Cosmos ecosystem.

➤ Conclusion

Persistence provides effective and secure economic infrastructure for liquidity staking and restaking in the Cosmos ecosystem. Through innovative restaking solutions, Persistence is gradually deepening its influence in the Cosmos ecosystem, bringing higher security, asset liquidity, and ecosystem participation.

Persistence has established an economic alliance for restakers through innovative restaking solutions. This alliance forms a cross-chain community of interest, enhancing mutual security and decentralization while increasing the security of the restaking alliance in the Cosmos ecosystem.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。