Writing: Yinan

Renzo:

Renzo is an Ethereum re-staking protocol based on Eigenlayer. It simplifies the complexity of re-staking on Eigenlayer and provides users with an easier way to participate in the process. Renzo allows users to deposit Ether and Liquid Staking Tokens (LST) in exchange for ezETH, a liquid staking token (LRT) that can be used in DeFi applications.

In plain language: Users can stake their ETH or LST tokens in Renzo. Renzo will place the user's ETH or LST tokens into Eigenlayer. Since Eigenlayer has a lot of AVS and many composability options, it would be complex for users to operate. Renzo selects AVS for users to delegate, reducing the user's operational threshold, while providing users with annualized returns for staking ETH, Eigenlayer point rewards, and Renzo point rewards.

ezETH:

ezETH is a liquid re-staking token representing the user's re-staked position in Renzo. Users can deposit native ETH or LST and receive ezETH. For each LST or ETH deposited in Renzo, an equivalent amount of ezETH is minted.

Rewards

ezETH is a reward token similar to cTokens.

Rewards are expected to be distributed in the form of ETH, USDC, and Active Validation Service (AVS) reward tokens.

This means that the value of ezETH increases relative to the underlying LSTs as it earns more rewards in AVS tokens.

Withdrawal

Unstaking requires a minimum of 7 days, mainly due to EigenLayer's unstaking requirements, but may vary for each AVS.

Transfers

Please note that ezETH withdrawals are not currently supported. Provide liquidity on Balancer or sell ezETH.

Fees

Renzo allocates 100% of EigenLayer rewards to users. Fees will be distributed between the protocol reserve (treasury) and Renzo node operators.

Renzo Points:

Ways to Earn Points:

- Minting ezETH: Renzo rewards participants who mint ezETH and hold it in their wallet. Each ezETH held will earn 1 Renzo ezPoint per hour. Additionally, early participants will receive bonuses.

- Referral system: Earn additional Renzo points by inviting other users to deposit ETH. For each person who joins Renzo using your referral link, you will receive an additional 10% of the referred user's points.

Renzo users can earn income from: ETH staking returns, EigenLayer re-staking points, and Renzo points

- ETH staking yield, ETH staked in Renzo on the Ethereum mainnet at Figment

- Earn points from re-staking on EigenLayer, free and not subject to EigenLayer limits

- Renzo ezPoints, earned through ETH deposits and referrals

Project Progress:

On December 7, 2023, Renzo announced a partnership with Figment, the first node operator on Eigenlayer.

On December 18, 2023, Renzo Beta mainnet launched

On January 4, 2024, Renzo ezPoint point system went live

On January 16, 2024, announced $3.2 million in seed funding

On January 19, 2024, Renzo Balancer Pool launched

On January 22, 2024, Renzo launched on Altlayer

On January 24, 2024, Renzo announced a partnership with P2P.org

On January 30, 2024, Renzo announced support for mobile re-staking

On January 31, 2024, Renzo integrated with Pendle

On February 14, 2024, Renzo Balancer Tripool launched

On February 21, 2024, Renzo launched the first task series on Galxe

On February 22, 2024, Binance Labs announced investment in Renzo

On March 1, 2024, Renzo supported staking on the Arbitrum chain

On March 5, 2024, Renzo supported staking on the BNB Chain

On March 14, 2024, Renzo supported staking on the Mode chain

On March 15, 2024, Renzo supported staking on the Linea chain

On March 21, 2024, ChainLink supported ezETH pricing

On April 12, 2024, Renzo supported staking on the Base chain

On April 23, 2024, Renzo announced the launch of the $REZ token on Binance launchpool

On April 25, 2024, Renzo tokenomics update

Related Data:

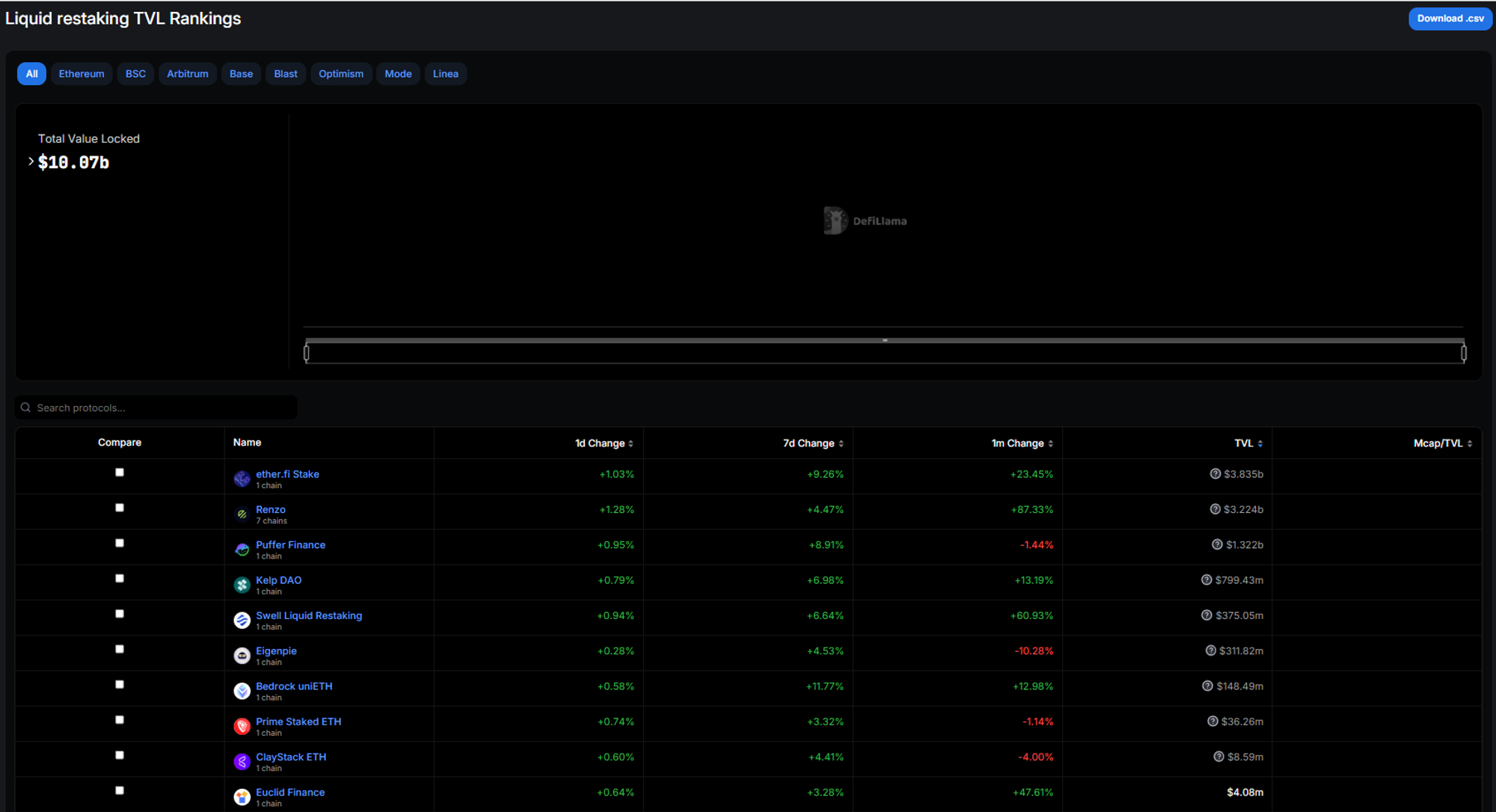

From the defillama's re-staking track TVL panel, the total TVL of the re-staking track is $10.07 billion, with Renzo's TVL at $3.231 billion, including Ethereum $2.424 billion, Arbitrum $281.83 million, Blast $210.48 million, Linea $167.2 million, Mode $139.26 million, BSC $4.63 million, Base $3.96 million, ranking second after Ethfi's $3.835 billion. The reason Renzo has such a high TVL is likely due to the influence of Binance's investment, along with Puffer in third place. These three projects account for 70% of the entire re-staking category's TVL. Currently, Renzo can be staked on the aforementioned 7 chains.

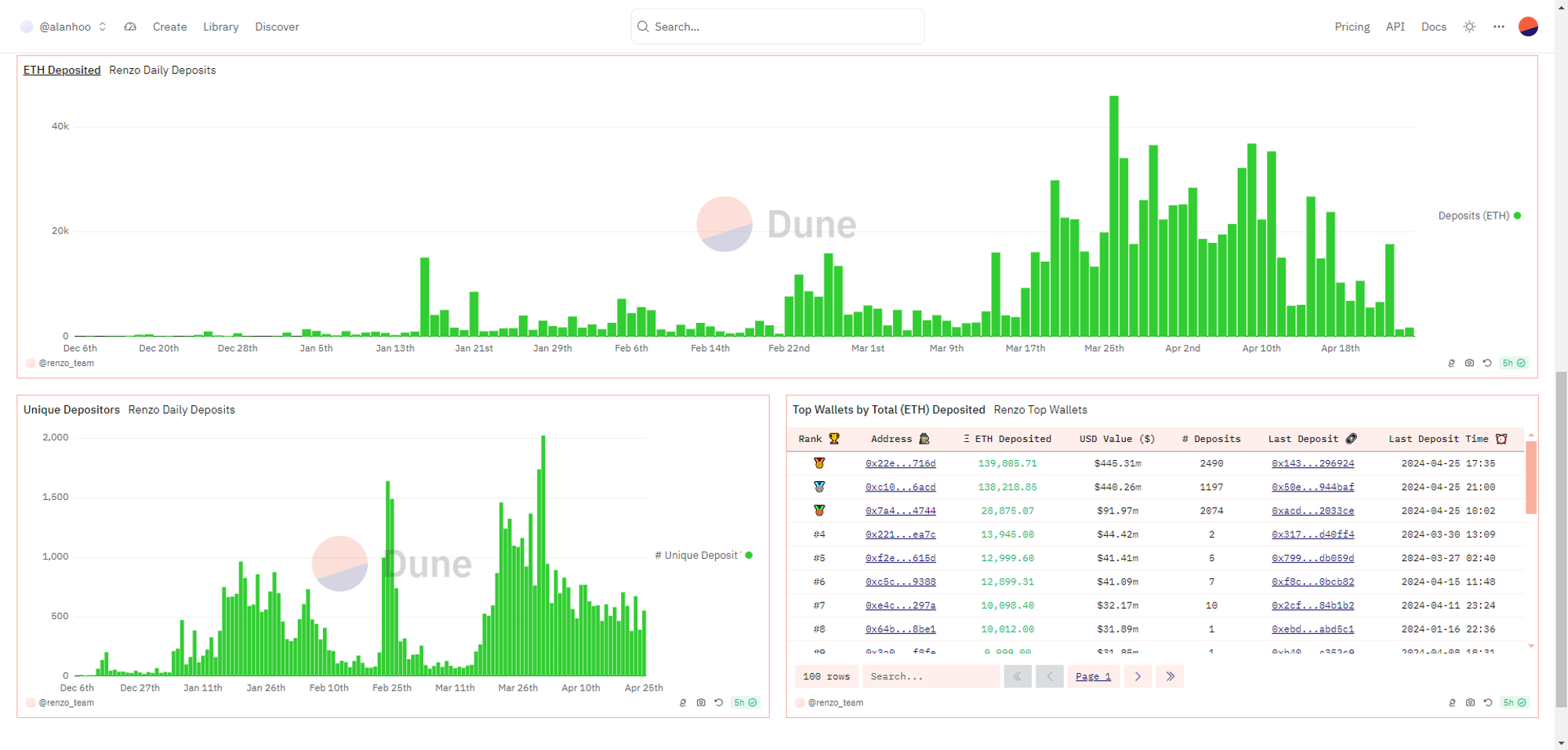

Renzo Project Data Panel:

View daily ETH deposits and wallet deposit amounts, and other data.

Link: https://dune.com/renzoprotocol/renzo

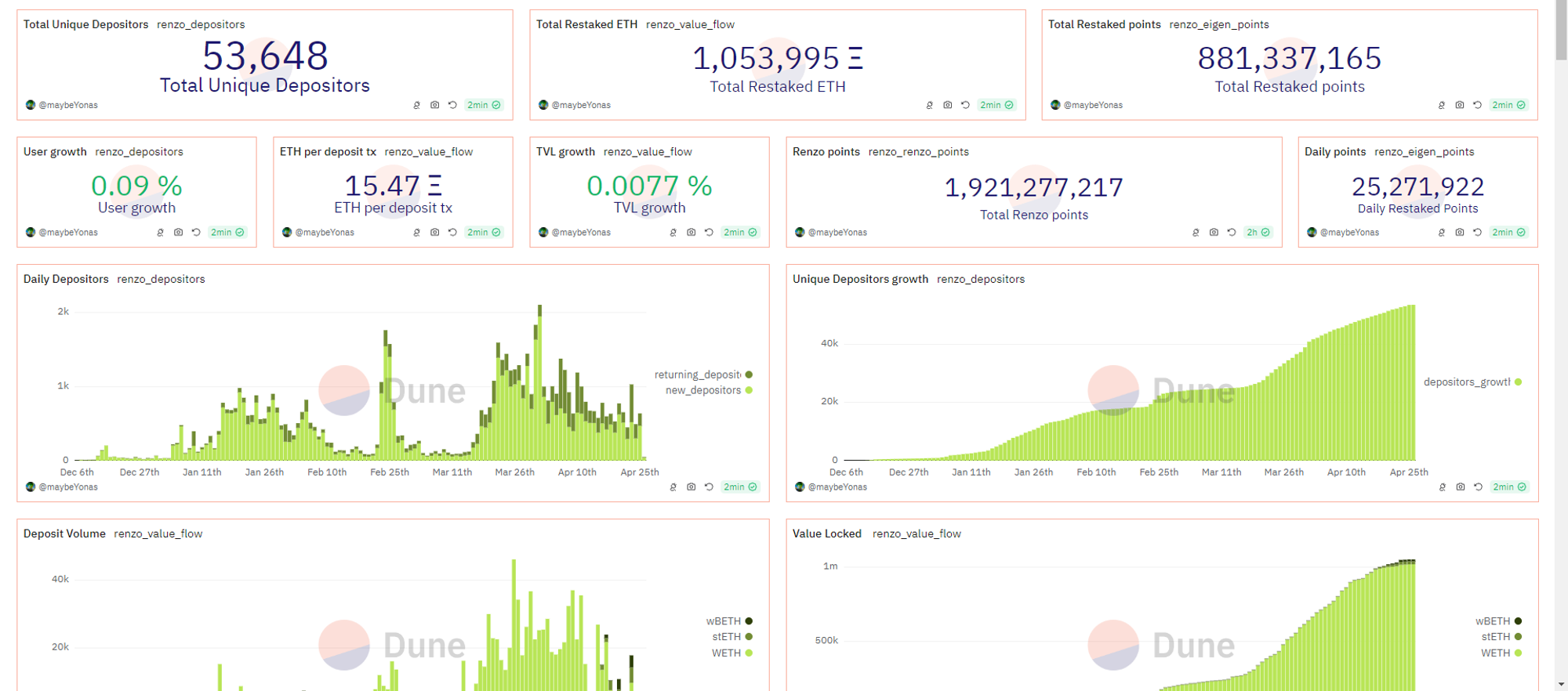

Renzo Points Panel:

View total Renzo points, points for each address, and protocol points.

Link: https://dune.com/maybeYonas/renzo-protocol

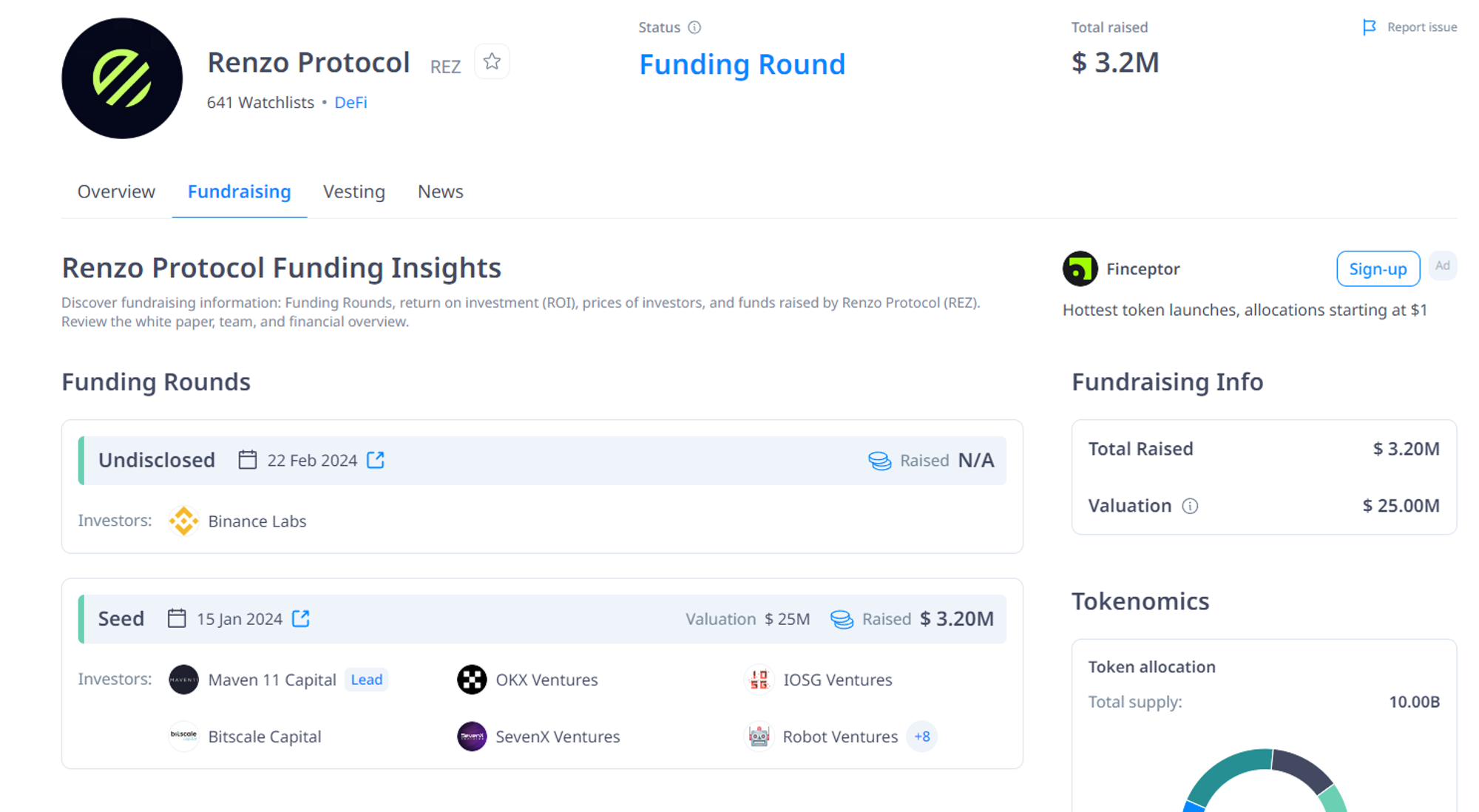

Funding Situation:

Renzo announced a funding of $3.2 million.

In January 2024, Renzo raised a seed round of funding at a valuation of $25 million, led by Maven11 Capital, with participation from Figment Capital, SevenX Ventures, IOSG Ventures, and several other investors.

In February 2024, Binance Labs announced an investment in Renzo, but the investment amount was not disclosed. The investment structure of Binance Labs is the same as the seed round, with a 1:1 ratio of equity to token warrants.

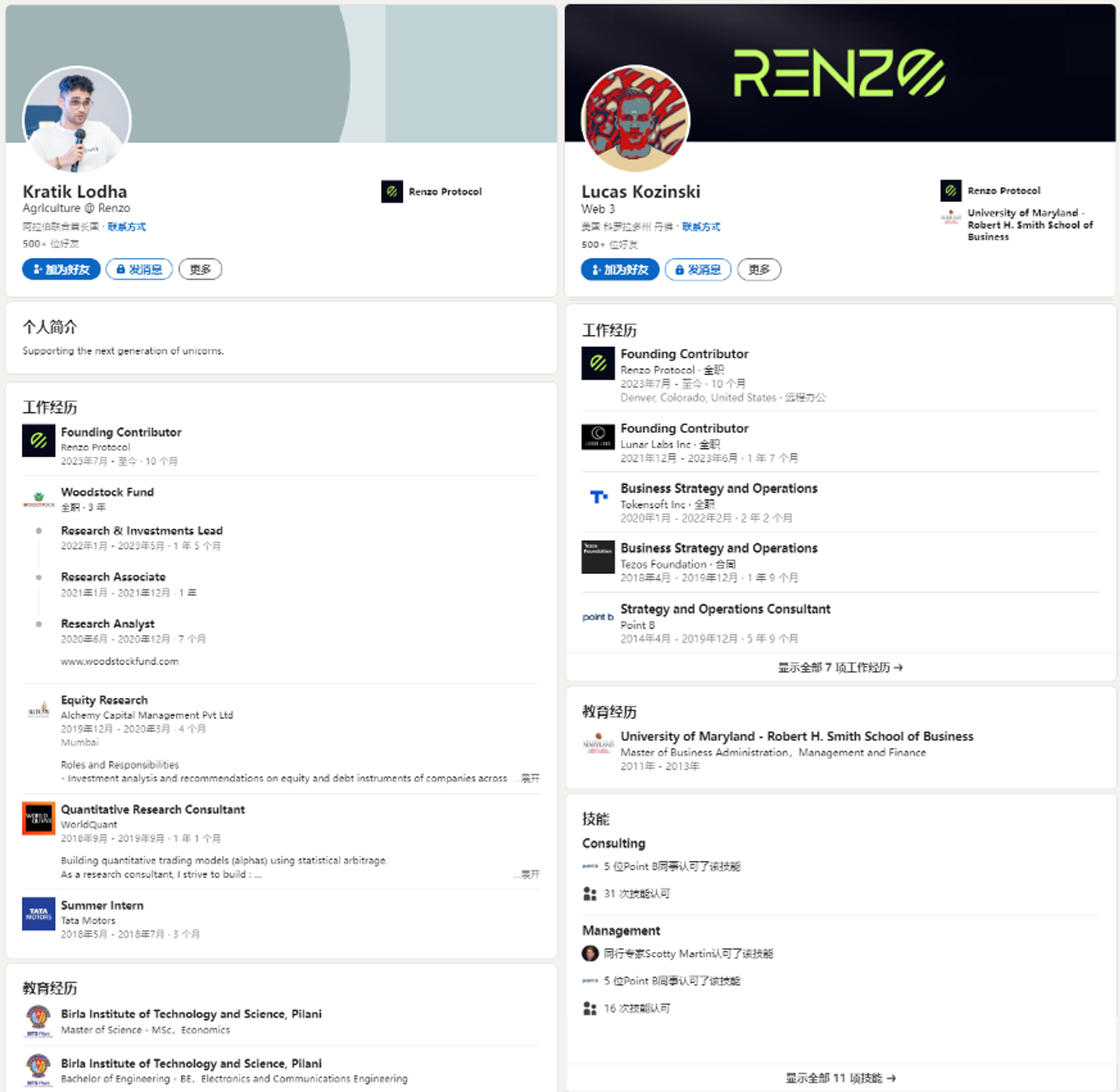

Project Team:

Kratik Lodha: Core contributor at Renzo

Lucas Kozinski: Core contributor at Renzo

Airdrop Rules:

The first season of the airdrop ended on April 26th.

User eligibility is based on the balance of ezPoints in the wallet at the time of the snapshot, regardless of their current ezETH balance.

REZ can be claimed starting from April 30, 2024. The largest wallet with over 500,000 ezPoints will unlock 50% at TGE, linearly vesting the remaining 50% over 3 months.

The minimum qualification for airdrop eligibility is 360 ezPoints per wallet. Over 99% of eligible wallets have fully unlocked at TGE.

The second season of rewards will begin on April 26, 2024.

Renzo's ezPoints will be linearly distributed to distribute 700 million REZ tokens on April 30th, accounting for 7% of the total supply, based on the cumulative ezPoints of each user.

Users can claim their REZ tokens at claim.renzoprotocol.com before April 30th. Airdrop wallets with lock-up periods can claim their tokens at the end of each month.

REZ Allocation Conditions

The first season airdrop will be linearly distributed based on the user's ezPoints balance.

Renzo has partnered with a third-party data analytics company to identify sybil wallets and determine the minimum ezPoints balance required for token distribution as of the snapshot date.

The largest wallet with over 500,000 ezPoints will unlock 50% at TGE and linearly vest the remaining 50% over 3 months.

Finally, a small portion of the initial 7% airdrop, 0.1% of the total supply, has been allocated to the following communities:

- Milady Maker

- SchizoPosters

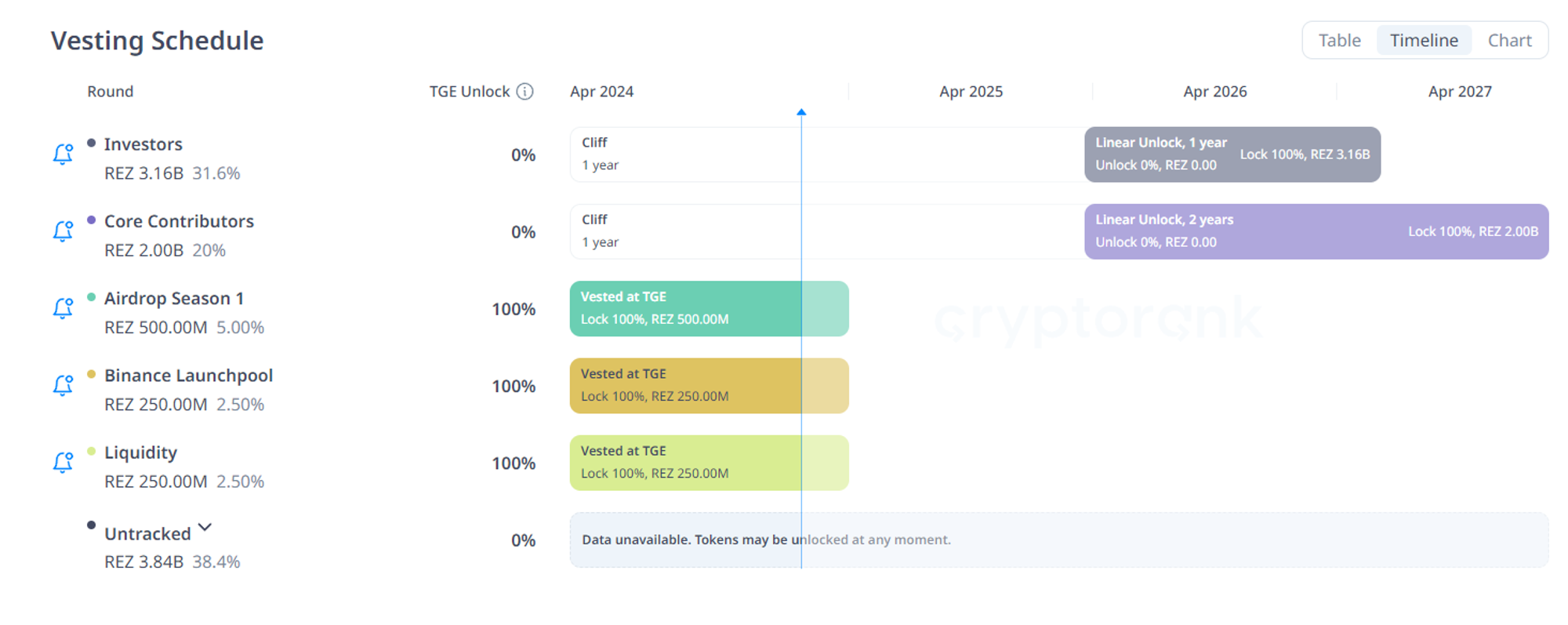

Tokenomics:

$REZ is the native utility and governance token of the Renzo protocol.

The total supply of $REZ is 10,000,000,000, with an initial circulation of 1,150,000,000 (approximately 11.50% of the total token supply) after listing.

Binance launchpool: 2.50%

Community airdrop: 12.00%

Team: 20.00%

Foundation: 12.44%

Investors and advisors: 31.56%

DAO treasury: 20.00%

Liquidity pool: 1.50%

Listing Status:

Binance will list $REZ spot trading on April 30, 2024 at 12:00 (UTC)

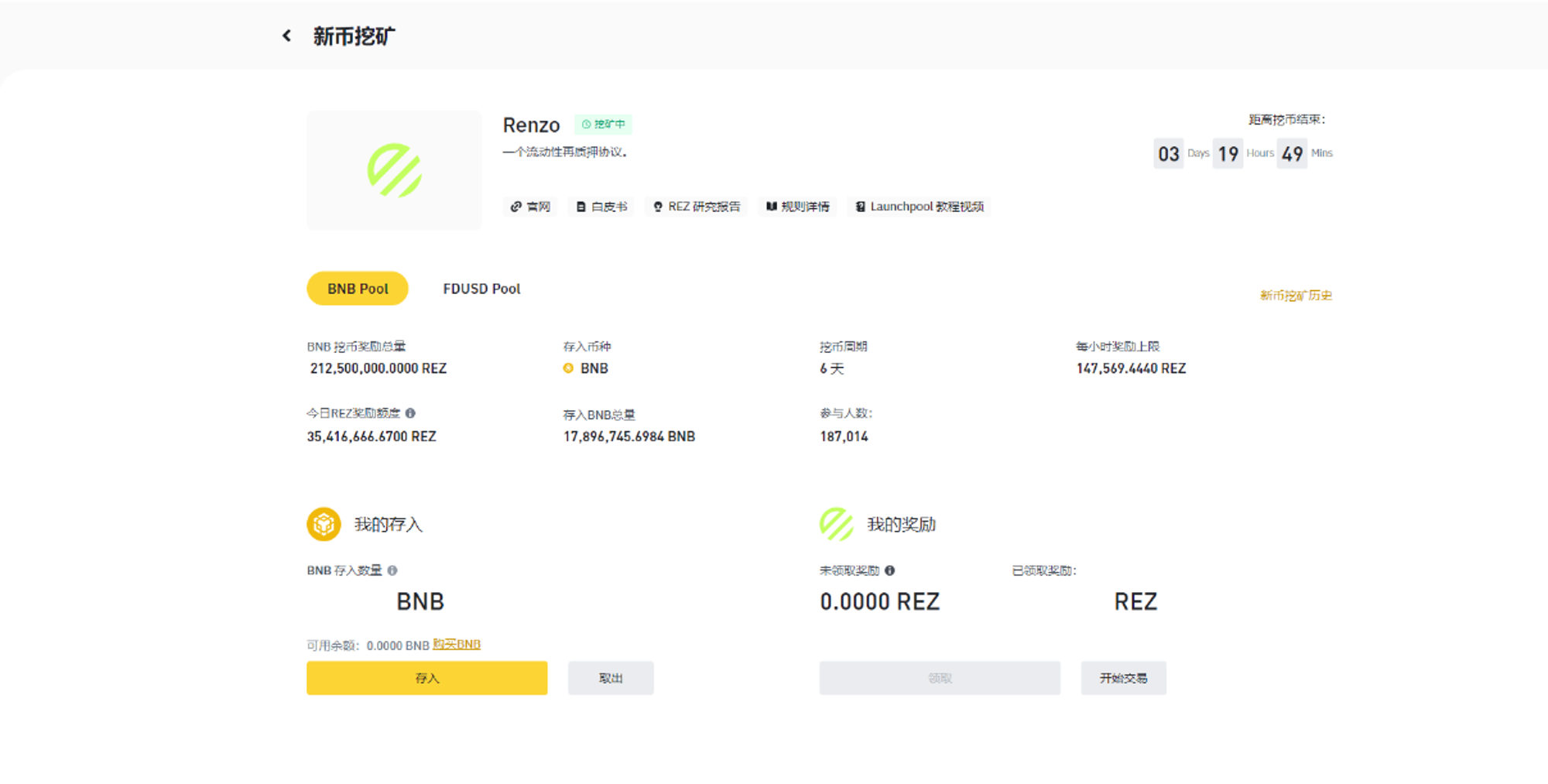

Currently, $REZ is being mined on the Binance launchpool, with 2.5% of the total token supply allocated. The mining period is 6 days, with 85% of $REZ allocated to the BNB pool and 15% to the FDUSD pool. The total participation in the BNB pool for this round of launchpool is 17,894,204.7008 BNB, with 187,047 participants. Holding BNB for mining is still profitable.

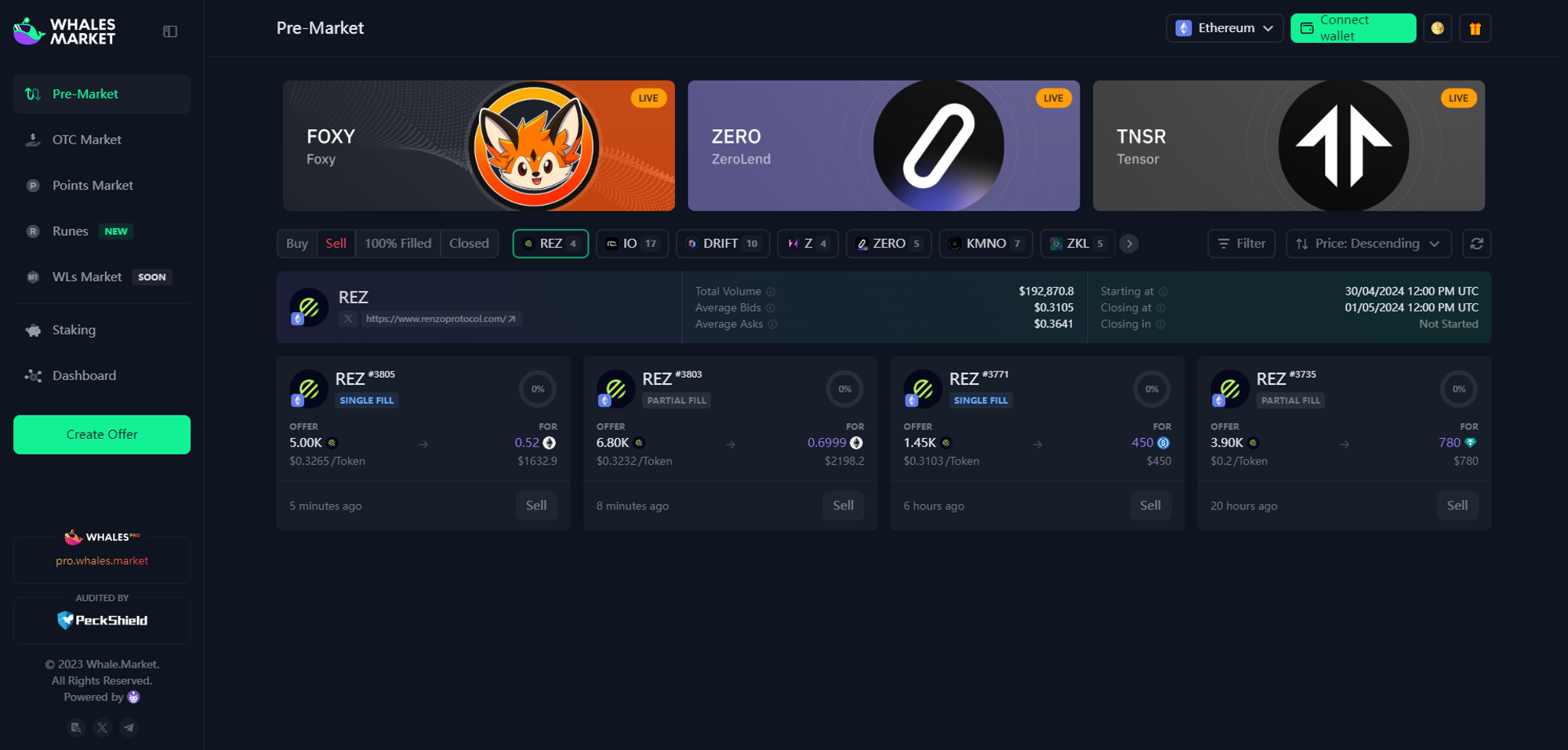

The off-exchange price of $REZ is currently around 0.3, but the buy-side depth is insufficient. However, it provides some reference.

With an initial circulation of 1,150,000,000, $REZ can be compared to Ethfi, which is also in the re-staking track, listed on Binance launchpool, and has an initial circulation of 11.5% of the total supply. Ethfi's TVL is higher than Renzo's, and Ethfi's funding is $32.3 million. Ethfi's social data is also stronger than Renzo's. Ethfi's listing price is around $3, corresponding to a circulating market value of around $350 million. If Renzo is valued similarly, its price would be around $0.3. However, I believe Renzo may be slightly lower than Ethfi, especially given the recent market conditions, so $0.3 will be an important reference point for my trading decisions.

Summary:

With Ethereum's transition to POS after the Shanghai upgrade, staking and re-staking have become a mainstream track. Lido dominates the ETH staking market with a market share of nearly 30% and a TVL of $29.558 billion, while Eigenlayer's TVL surpasses AAVE, firmly holding the top position in the re-staking track with a TVL of $15.374 billion. Renzo's focus is on developing products based on Eigenlayer, a popular track as evidenced by its TVL of over $30 billion, indicating strong investor interest. The team has disclosed only two core contributors, and the disclosed funding of $3.2 million seems relatively modest compared to the TVL. The high TVL is likely influenced by Binance Labs' investment. The adoption of ezETH is currently acceptable, with collaborations with multiple DeFi projects. However, the ratio of ezETH to WETH in the Balancer pool is quite high at 94.19%:5.81%, posing some impermanent loss risk. Another risk point is the inherent project risk of Eigenlayer and the reduction risk associated with AVS. Renzo is essentially an aggregation protocol based on Eigenlayer, and the use case for the native token $REZ is likely similar to other projects, primarily for governance and staking. One positive aspect of the protocol is its ability to assist AVS in validation, which could generate some income in the future if Eigenlayer and AVS adoption become more mainstream.

In conclusion, the project operates in a popular track with the aforementioned risks, and participating in the project involves balancing potential returns and potential risks, and then choosing whether to participate based on one's own risk preferences.

Related Links:

Official Website: https://www.renzoprotocol.com/

Twitter: https://twitter.com/RenzoProtocol

Discord: https://discord.com/invite/FMwGPDXXtf

Docs: https://docs.renzoprotocol.com/docs

$REZ Token Distribution Details: https://mirror.xyz/renzoprotocol.eth/gwO9wyZoOTg79yUw1hnS6q_eJGvfCj1CkmQFa8z32zU

Binance Research Report: https://www.binance.com/en/research/projects/renzo

Mirror: https://mirror.xyz/renzoprotocol.eth

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。