Author: Xiyou, ChainCatcher

Editor: Marco, ChainCatcher

In the early morning of April 20th, at block height 840,000, Bitcoin completed its fourth halving. After the halving, the mining reward for each block decreased from the original 6.25 BTC to 3.125 BTC.

In the week before the halving, the price of BTC plummeted from $70,000 to $59,600, hitting the lowest price since March. At the time of writing, the price of BTC has stabilized around $63,000, with a cumulative 10% decrease in the past 7 days.

The essence of Bitcoin halving is to control the speed of Bitcoin supply and the inflation rate by programmatically reducing the production rate of Bitcoin, thereby reducing the issuance speed of new Bitcoins and decreasing the supply of its tokens, leading to a lower inflation rate.

After this halving, miners will reduce their daily supply to the market from about 900 BTC to approximately 450 BTC, and the BTC issuance speed will decrease from 1.8% to 0.83%.

Due to the reduction in supply, the imbalance of BTC supply and demand in the market may exacerbate the scarcity of Bitcoin and drive the price upwards.

After the first three Bitcoin halvings, BTC prices experienced varying degrees of significant increases, closely related to the bull market cycle of the entire crypto market. Therefore, "Bitcoin halving" is also considered a catalyst for the crypto bull market and holds significant implications for the development of the entire crypto market.

Chris Gannatti, global head of Bitcoin ETF asset management company WisdomTree, once stated that "Bitcoin halving is one of the most significant events in the crypto field this year."

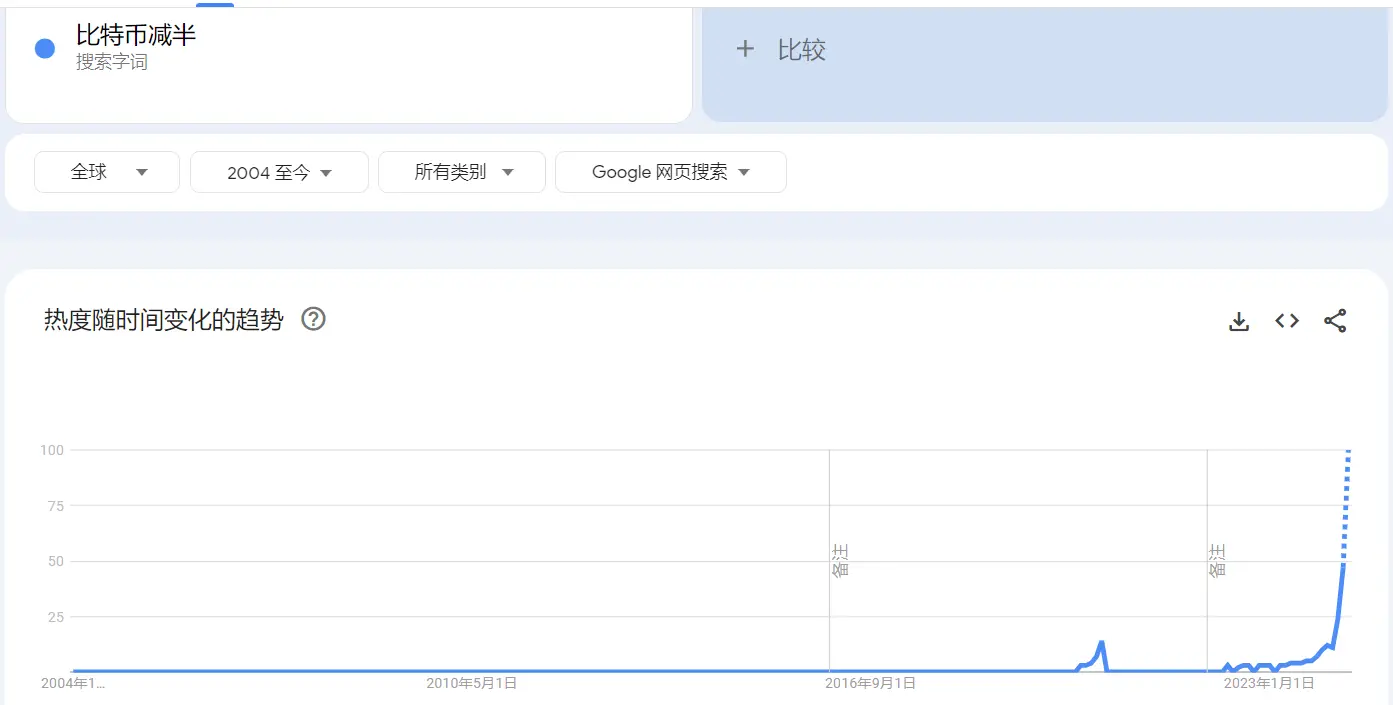

Google search data shows that the search volume for "Bitcoin halving" has reached a historical high, far exceeding the previous historical high set in May 2020.

Halving Every 4 Years, Will Bitcoin's Rise Still Come as Expected?

Every time the Bitcoin blockchain generates 210,000 blocks, the Bitcoin block reward will halve. The Bitcoin network generates a new block on average every 10 minutes, so this halving occurs approximately every 4 years.

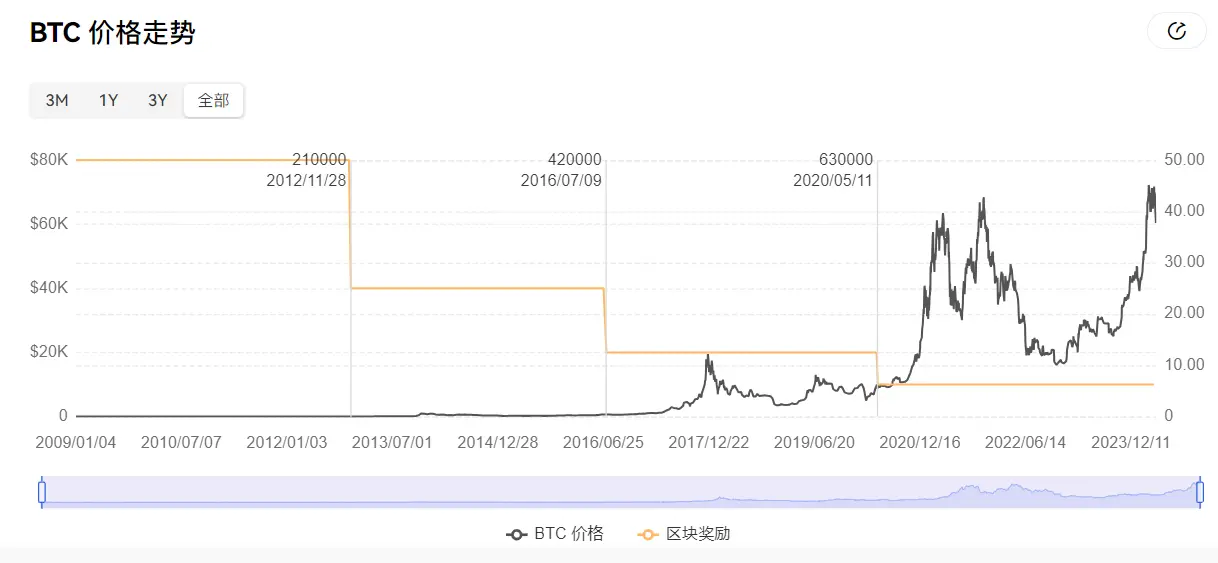

As of today, Bitcoin has completed 4 halvings, in 2012, 2016, and 2020, respectively. Starting from the original block reward of 50 BTC, the first halving reduced it to 25 BTC, the second halving to 12.5 BTC, the third halving to 6.25 BTC, and the fourth halving to 3.125 BTC today.

Looking back at the historical data of the three halvings, after each Bitcoin halving, the BTC price has rapidly risen within 6-18 months, reaching historical highs. Therefore, the impact of halving on the price trend and subsequent market conditions of Bitcoin has attracted industry attention and is referred to as an industry cycle.

The first halving was completed on November 28, 2012, and the BTC price surged from $12 at the time of halving to $1,242, an increase of over 100 times.

The second halving occurred on July 9, 2016, and the BTC price rose from $648 to $19,800, an increase of 4158%.

The third halving was completed on May 12, 2020, and the BTC price rose from $8,181 to $64,895, an increase of 693%.

The fourth halving was completed on April 20, 2024, with the price of Bitcoin at around $63,000. Will it kick off a new round of rapid price increases as expected, similar to the previous three times?

Regarding the impact of this halving on the future trend of Bitcoin, the general industry view is that the initial impact on the Bitcoin price after the halving is not significant, but it is favorable in the long term. From a supply and demand perspective, the halving reduces the speed of Bitcoin issuance and the halving of miner block rewards can also alleviate the speed of new Bitcoins entering the market. With reduced supply and stable or growing demand, conditions for a rise in Bitcoin price have been created.

Currently, many well-known figures in the crypto market hold optimistic views on the future trend of Bitcoin after this halving and have made bullish predictions.

Plan B indicated that based on the analysis of Bitcoin's supply and halving expectations, the price range of Bitcoin after 2024 will be between $100,000 and $1 million, and predicted that the price of Bitcoin may soar to $532,000 by 2025.

Anthony Scaramucci, founder of Skybridge Capital, stated in January of this year that the price of Bitcoin may reach $170,000 or more within a year and a half after the halving, with a long-term outlook that the market value of Bitcoin will reach half of the market value of gold.

Michael Novogratz, CEO of Galaxy Digital, is betting that Bitcoin will rise significantly, and after the halving, Bitcoin may reach $150,000.

On the contrary, there are industry professionals who hold a bearish view on the future of Bitcoin. They believe that the correlation between Bitcoin halving and price increases does not imply causality, and it is challenging to model these events based solely on historical analysis. The trend of Bitcoin prices is also influenced by market sentiment, adoption trends, global market liquidity, and macroeconomic policies, among other comprehensive factors.

In addition, from a supply and demand perspective, approximately 19.7 million BTC have been mined, and the remaining unmined Bitcoins are approximately 13 million (21 million - 19.7 million), which is a very small proportion. The halving of Bitcoin has already weakened the supply of Bitcoin and cannot be the main driving force for the rise in Bitcoin prices.

Michael Zhao, a researcher at Grayscale, has warned that although historical precedents indicate price increases, they do not guarantee that the price of Bitcoin will definitely rise. He pointed out that external macroeconomic factors have played an important role in the past surge in Bitcoin prices, and halving is just one of the many factors affecting the price of Bitcoin.

Arthur Hayes, co-founder of BitMEX, stated in the latest article "Heatwave" released in April that he agrees that halving will push up the price of Bitcoin in the medium to long term. However, he predicted that the price of Bitcoin will enter a period of turbulence before and after the halving, and forecasted that the price of Bitcoin will plummet after the halving.

On the Eve of Halving, Mining Stocks Plunge

In addition to price trends, cryptocurrency miners are the group most affected by the halving of Bitcoin rewards, as the halving will sharply reduce the input-output ratio of the Bitcoin mining industry. The halving of block rewards means that the number of BTC rewards for newly mined blocks will directly decrease by half, making Bitcoin miners a target every 4 years. In the case of unchanged BTC prices, with investment and operating costs remaining the same while mining returns decrease, the investment return period for mining machines will be extended. Coupled with the outbreak of current geopolitical conflicts and the uncertainty of energy costs, the survival pressure of the mining industry has also increased significantly.

Mark Palmer, an analyst at Benchmar, warned before the halving that most publicly traded Bitcoin mining companies have already initiated or announced plans to increase their power and computing capabilities as a means of adjusting their income and gross profit situation.

Bloomberg predicts that the entire cryptocurrency mining industry will incur losses of approximately $10 billion after this halving.

Before the halving, the stock prices of leading listed mining companies, such as Marathon Digital Holdings (MARA), Riot Platforms (RIOT), Iris Energy (IREN), and CleanSpark (CLSK), have all experienced continuous declines for three days. The largest publicly traded Bitcoin mining company, Marathon Digital Holdings, has seen a drop of over 20% in its stock price in the past month, while Riot Platforms has dropped nearly 25%.

However, CleanSpark, a mining company, emphasized in an interview that Bitcoin halving does not equate to halving of mining company income, as Bitcoin mining difficulty will decrease by as much as 15% after the halving, which will bring additional rewards to miners.

For this halving, a miner who has experienced three halving cycles expressed that the decrease in block rewards will lead to a reduction in miner income, but it has limited impact on large miners or mining companies. For the miners who can stay, it is actually a positive development, as it will increase their share in the entire mining market. This halving will further push mining towards specialization, refinement, efficiency, and concentration among major players. Small-scale family workshops or less advanced mining companies will be eliminated.

He emphasized that the profitability of mining is no longer solely from mining itself, and transaction fees on the Bitcoin chain may become a new source of income.

Regarding the current mining costs, he calculated that based on the S19Pro+Hyd model, with a hashrate of 198t and power consumption of 5445w, at a cost of $0.08 per kWh, the shutdown price of Bitcoin is around $65,056.

However, based on the historical performance of Bitcoin halvings, miners do not need to worry too much, as the halving corresponds to an increase in the scarcity of Bitcoin, and the increased income from the eventual rise in Bitcoin prices can easily cover the increased costs for mining companies.

In addition, since the launch of Ordinals in December last year, the Bitcoin ecosystem applications have entered a state of explosive growth, with various on-chain ecological products such as Bitcoin Layer2, Side chain, Rune protocol, and the prosperity on-chain will also bring transaction income to Bitcoin miners.

Halving Impact Weaker Than Bitcoin Spot ETF

However, this halving is different from the previous three times, as the entire crypto industry and Bitcoin itself are undergoing some interesting new changes. The Bitcoin market has become increasingly mature, with more exchanges, financial products, and traditional financial investors participating. On-chain ecological products such as Ordinals, Inscriptions, BRC20, Bitcoin Layer2, and others are flourishing, and users need to rethink and reevaluate Bitcoin as an asset from a new perspective.

"Cold Qing," an old OG who has experienced three Bitcoin halving cycles, shared his feelings about this halving.

He explained that the hype around the fourth Bitcoin halving is far less than the previous three times. The first two halvings in 2016 and 2020 received high attention in the crypto market, with various discussions about the halving flooding major communities, and news about the halving, AMAs, offline events, and even tokens like BCH and LTC being hyped up months in advance of their halvings. After the 2016 halving, there was the Ethereum ICO, and the DeFi Summer and public chain battles in 2020. However, the community's attention to the fourth Bitcoin halving seems to be low, with very little discussion among community users, and even the news reports about the Bitcoin halving are scattered and scarce.

Another OG stated that not only is there a lack of hype around this halving, the excitement around this round of Bitcoin price increase is also lower than usual. Bitcoin quietly broke through $70,000, and users seemed to become active only after surpassing $70,000.

In response, community user Lin stated that a major reason behind this is that the current round of price increase is mainly driven by Bitcoin spot ETFs, with institutions playing a major role and retail investors making up a smaller proportion.

Furthermore, with the development of blockchain technology in several bull markets, the crypto market has diversified from Bitcoin and Ethereum to various Layer1 and Layer2 solutions, LST, Bitcoin inscription ecology, DeFi, GameFi, AI, and other niche products. Bitcoin is no longer the only choice for users, and their attention has been divided.

Currently, the market capitalization of the crypto market is close to $2.5 trillion, with Bitcoin's market cap accounting for approximately 50% ($1.27 trillion), while the remaining 50% consists of assets in various niche sectors.

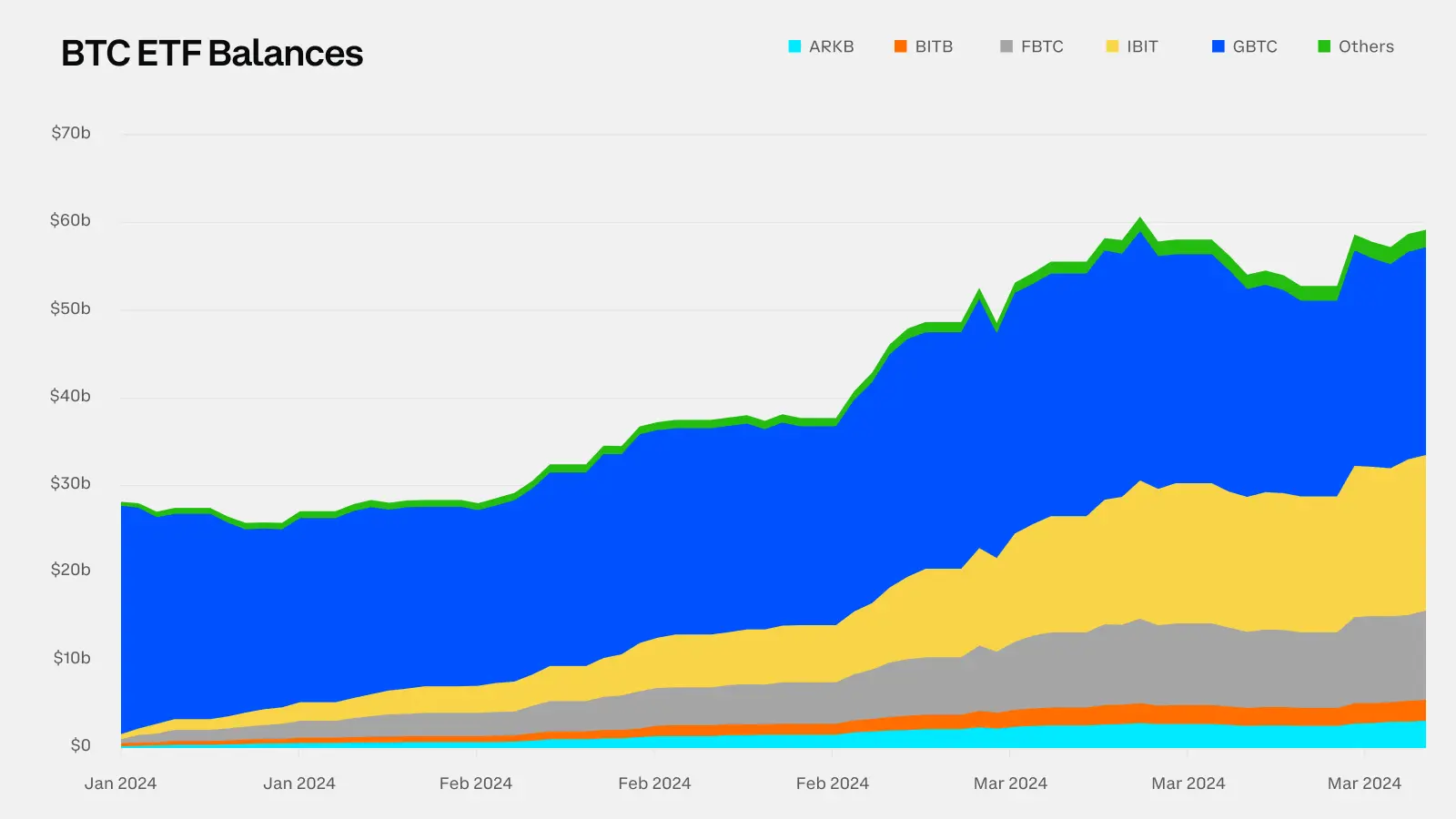

Compared to the previous halvings, the only difference in the fourth Bitcoin halving is the existence of Bitcoin spot ETFs, which have had an impact on the supply and demand dynamics of Bitcoin that even surpasses the halving. More and more institutional investors are beginning to include Bitcoin in their portfolios, and these institutional investors have more funds and resources. Their participation will trigger larger market fluctuations.

Since the approval of Bitcoin spot ETFs in the United States in January, the weekly inflow of funds into Bitcoin ETFs has ranged from $1.2 billion to as high as $2.5 billion, with a cumulative inflow of over $10 billion into the crypto market.

Currently, the daily average trading volume of ETFs for BTC spot is estimated to be between $4-50 billion, accounting for 15-20% of the total trading volume on centralized exchanges worldwide.

On April 19th, Hong Kong approved a Bitcoin spot ETF.

The launch of Bitcoin spot ETFs has greatly changed the supply and demand dynamics of BTC and established a new benchmark for BTC demand. Essentially, through large and sustained purchasing activities, ETFs have reduced the available supply of BTC in the market.

Glassnode charts show that the amount of Bitcoin absorbed by ETFs from the market far exceeds the amount of Bitcoin mined by miners every day.

The impact of newly mined and circulated Bitcoin is becoming increasingly small compared to the surging demand from ETFs.

Shen Yu also stated that the current market players are different from those in the past, and the main feature of this cycle is that incremental funds are mainly flowing into Bitcoin through ETFs and other channels.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。