On the afternoon of April 22nd, AICoin researchers conducted a live graphic and text sharing session titled "How to Monitor On-Chain Token Flow? (Free Membership)" in the AICoin PC-end - Group Chat - Live. Below is a summary of the live content.

I. The Importance of Monitoring On-Chain Token Flow

1. Pursuing Transparency and Clarity

Monitoring on-chain tokens provides users with a clearer and more transparent view, allowing real-time tracking and analysis of transaction activities on the blockchain network. Without monitoring on-chain activities, users would not know if the transaction activities actually occurred.

2. Proof of Reserve for On-Chain Tokens and the Real Flow of On-Chain Tokens

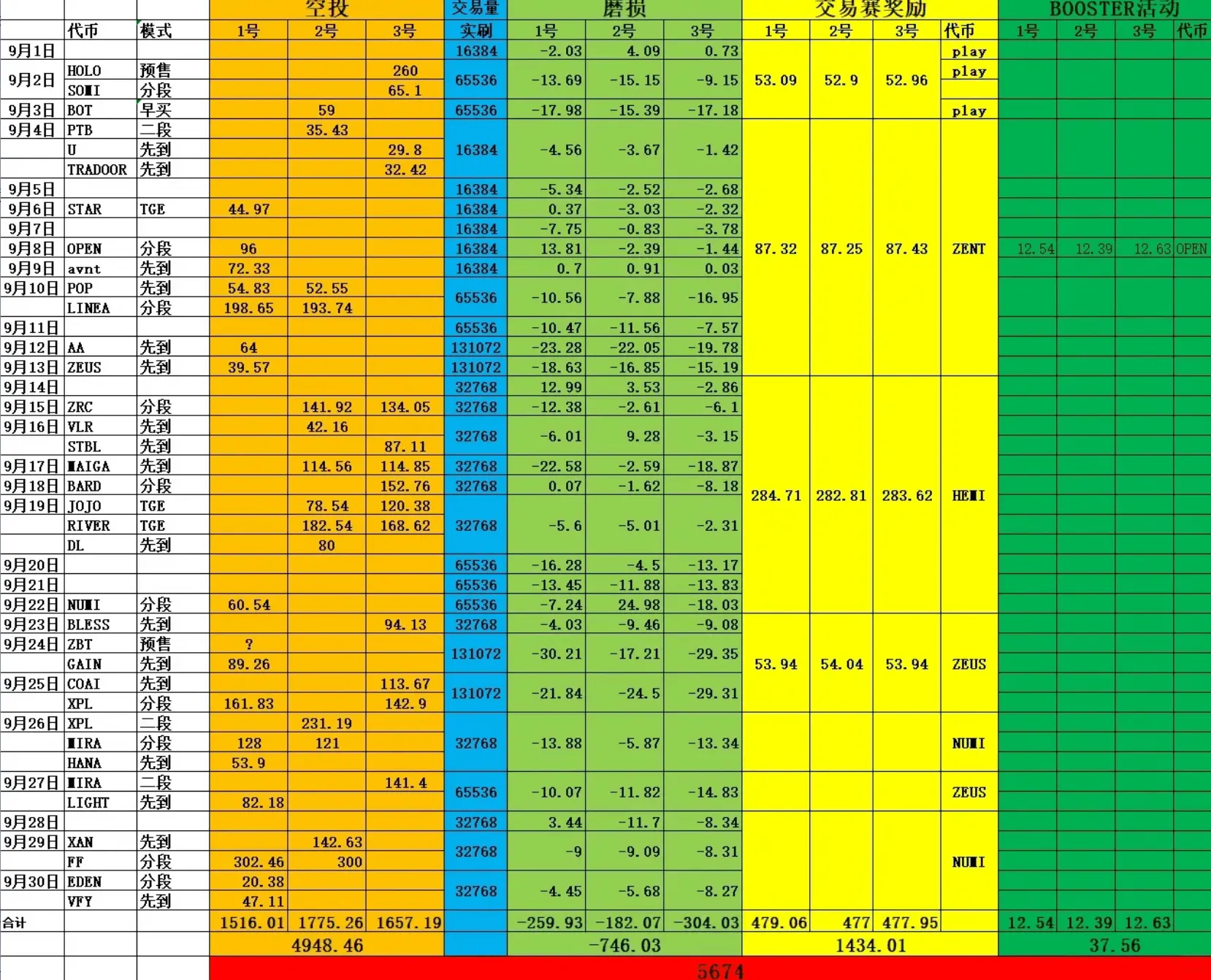

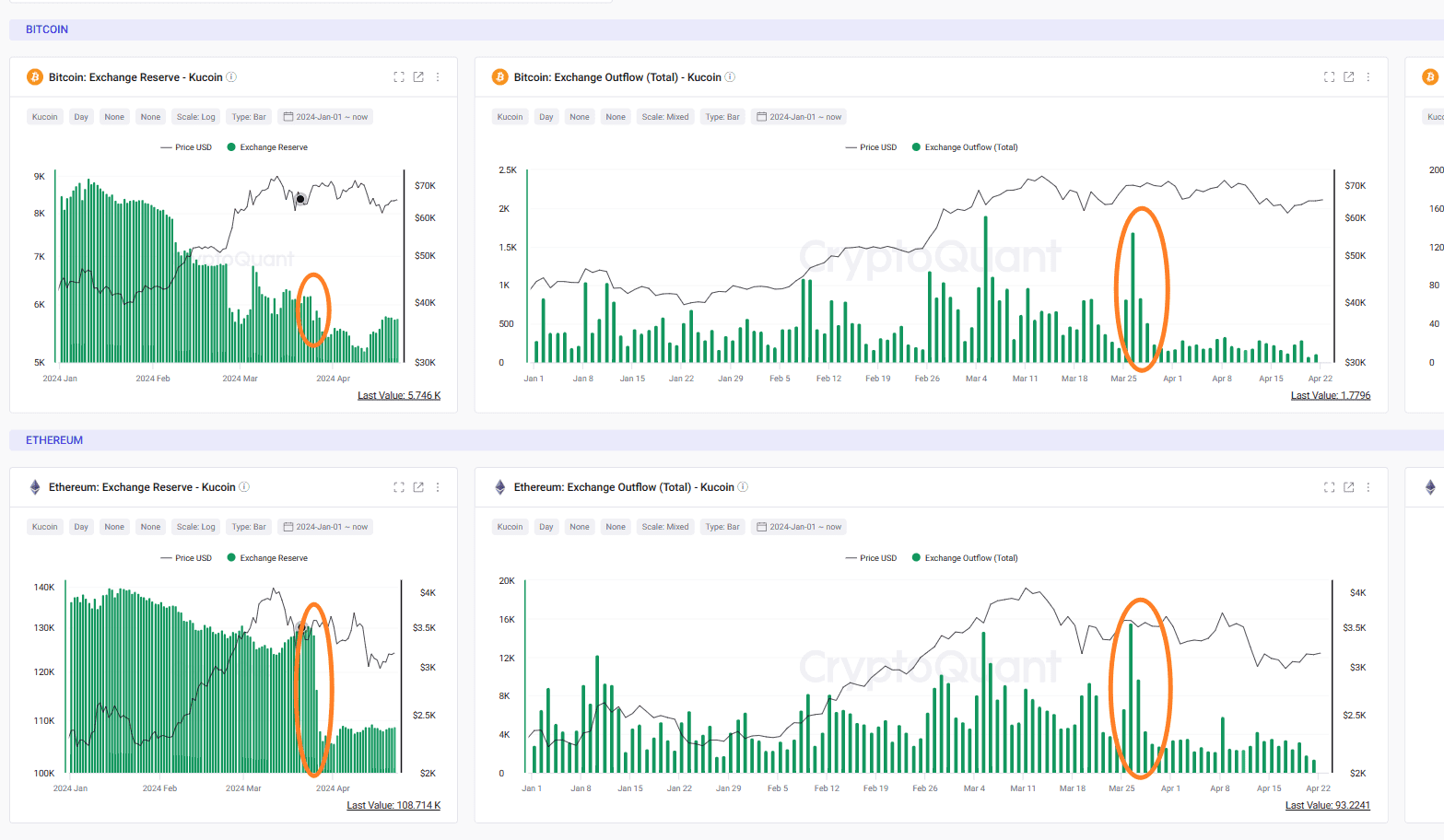

For example, the recent U.S. accusation against Kucoin for violating anti-money laundering laws (March 26) led to market FUD, resulting in significant outflows of BTC, ETH, and stablecoins from Kucoin-related addresses.

The dashboard created by CryptoQuant above illustrates the significant impact of FUD on an exchange. On March 26, there was an outflow of 1693 BTC (approximately $12 million) and 15575 ETH (approximately $56 million), as well as stablecoins (nearly $30 million). This was just from one piece of news about the U.S. accusation.

3. Identifying New Trends and Opportunities through On-Chain Tokens

Tokens from newly launched projects and meme coins often appear on-chain (DEX) before being listed on CEX, presenting trading opportunities. Users can also find more information related to meme coins on-chain, such as the listing announcement from Gate below:

Subsequently, these tokens can be queried on DEX through Dexscreener or ave.ai, DEX aggregators.

For example, RING AI, where we found the RING/WETH trading pair, with the initial price on the candlestick chart dated March 11. To learn more about a meme coin, on-chain data can be used to find information about contract deployers, holders, and more.

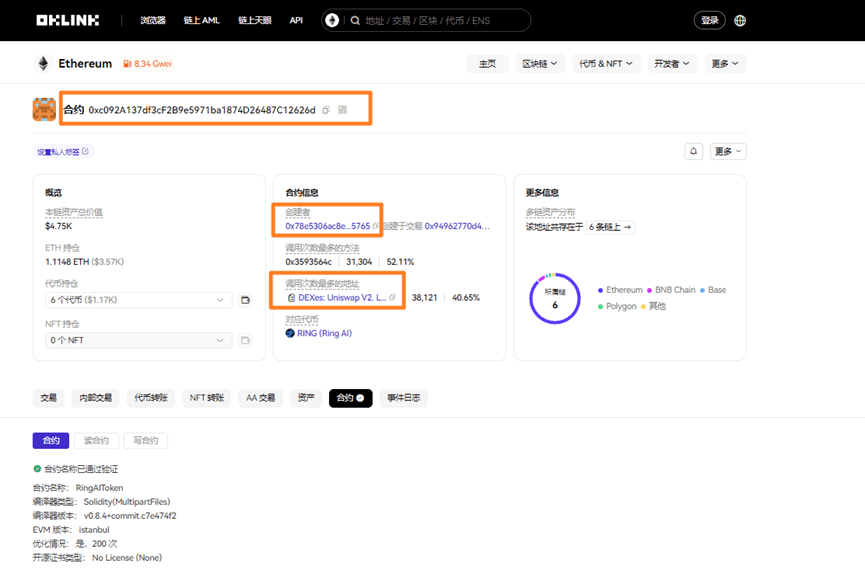

Below is the contract deployer information from OKLINK, providing some project data.

4. Managing Position Risks

The flow of tokens in the pool is crucial. Many meme coins on-chain suffer losses because others are waiting for someone else to take over, and now mainly use bots to buy.

By monitoring the flow of on-chain tokens, we can better understand our counterparties and other market participants, and better manage the risks of our positions, such as monitoring: project pool data (RUG…), whale data for individual tokens (potential market manipulation), project team unlocks, and large holders' sell-offs, etc.

II. How to Use a Blockchain Explorer

1. Concept of a Blockchain Explorer

A blockchain explorer is an online tool that allows users to view and search for all information on the blockchain network, including transaction details, block content, and address information. It is similar to an internet search engine but specifically for blockchain data. Common examples include Etherscan, OKLINK, etc.

2. Specific Operations

(1) Querying Information

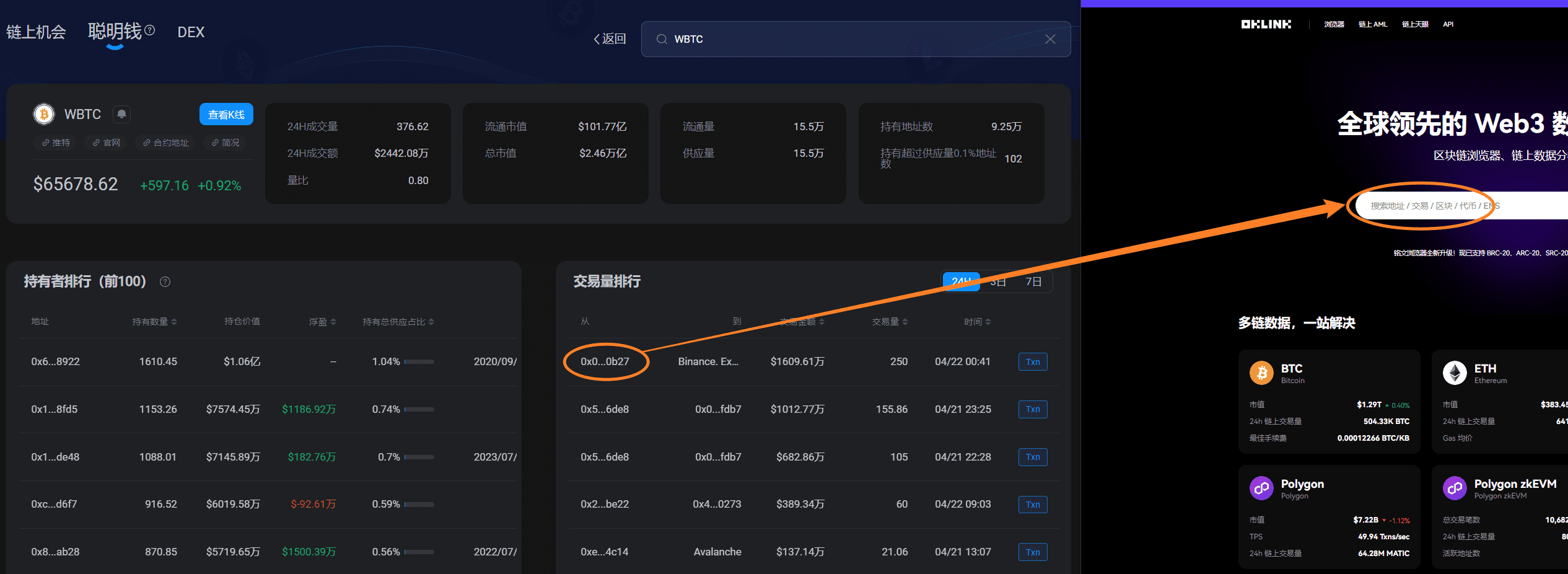

Different blockchains have different explorers. Taking OKLINK as an example:

By entering any address (Address) or hash value (TX), we can query relevant information about the address, contract, token, quantity, time, etc. For example, on the ETH chain, the address 0x555…6323 received 10,000 MUBI on 2024-4-13-12:00.

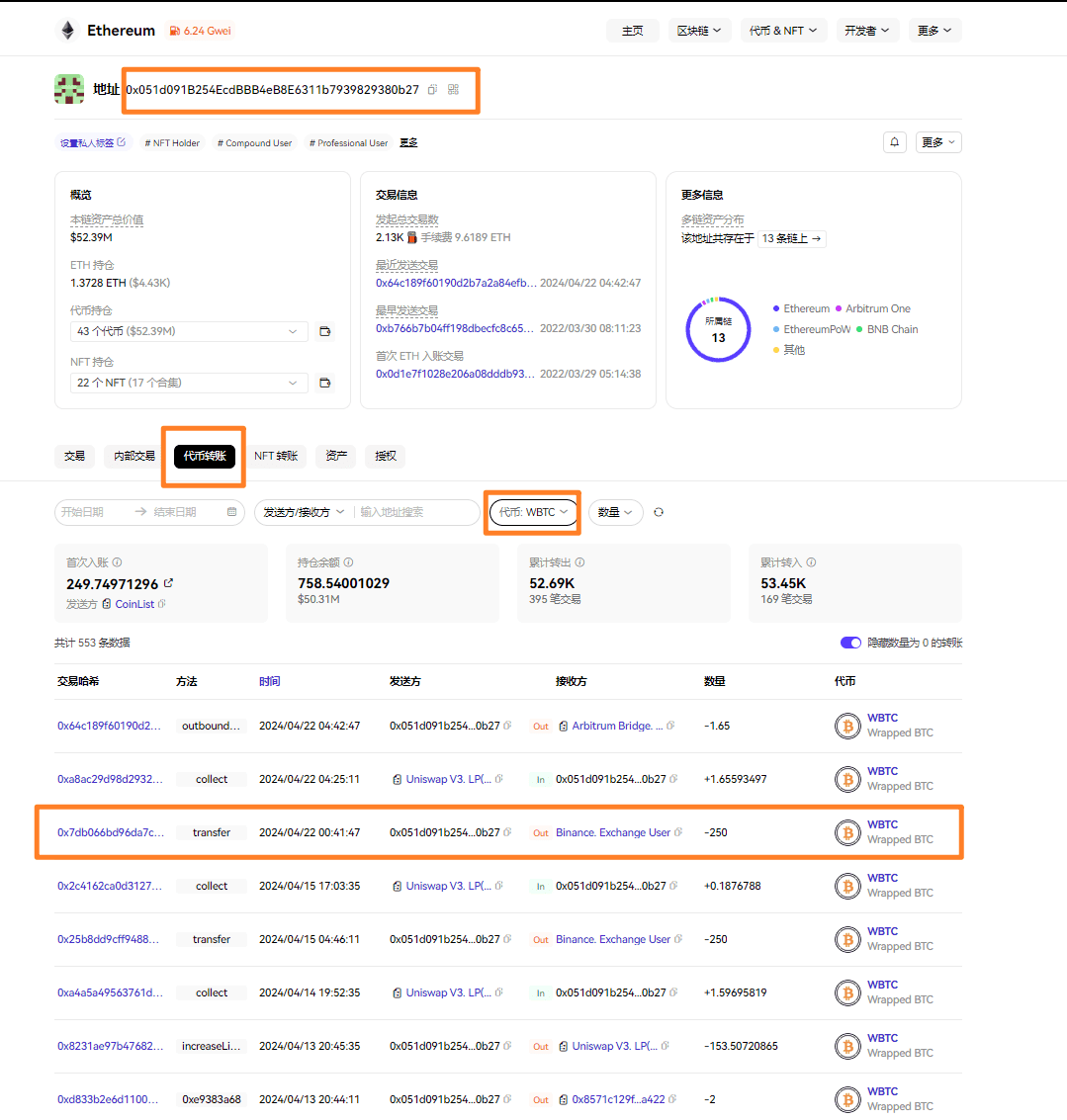

Through OKLINK, it was found that the address "0x051d091B254EcdBBB4eB8E6311b7939829380b27" recently transferred 500 WBTC to Binance, requiring additional data confirmation to determine if it was for selling off.

For example, corresponding stablecoin outflows from CEX or spot trading volume comparisons.

(2) Determining Whether to Sell

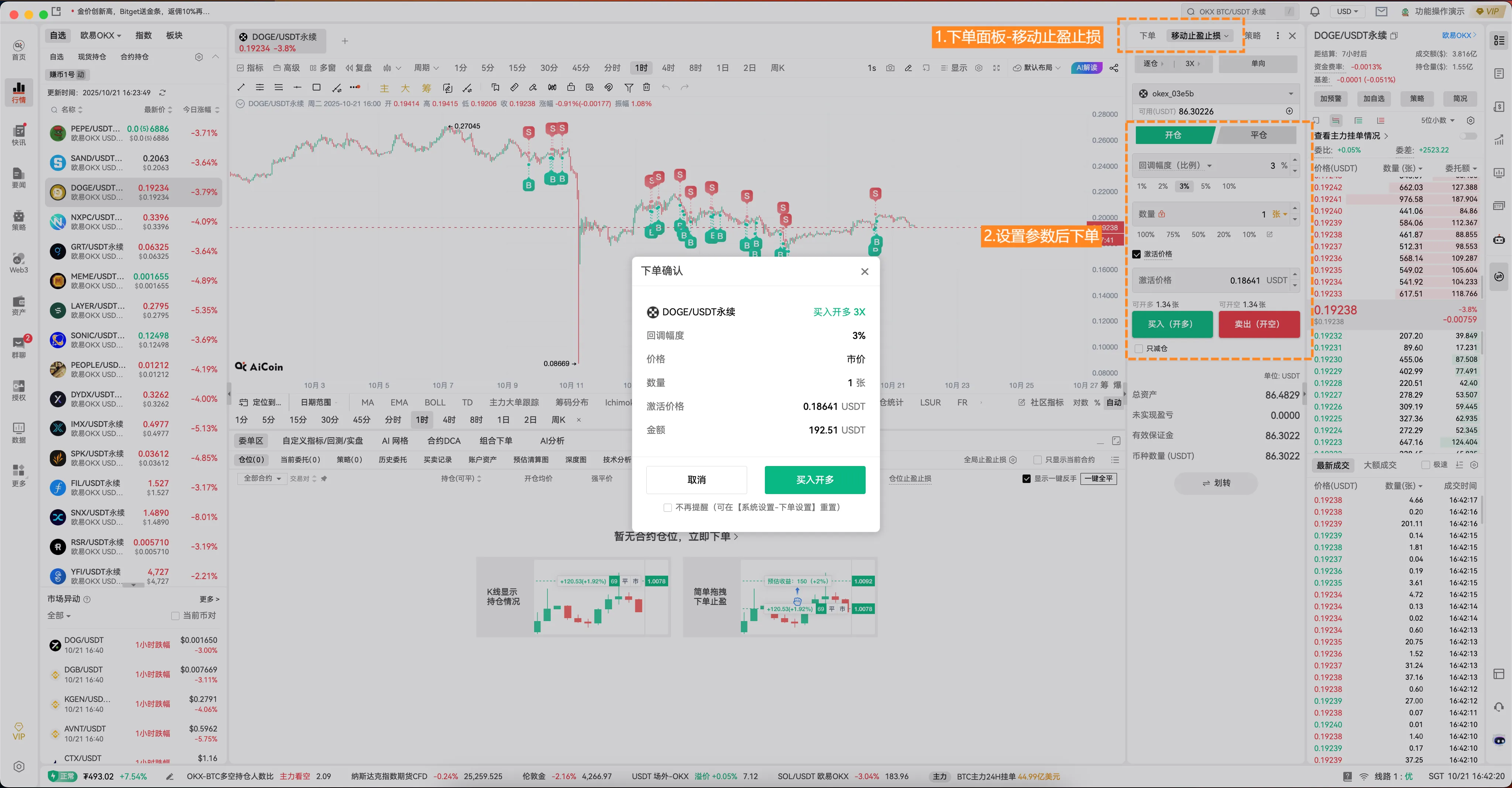

To determine if a sale has occurred, a useful tip is to use AICoin.

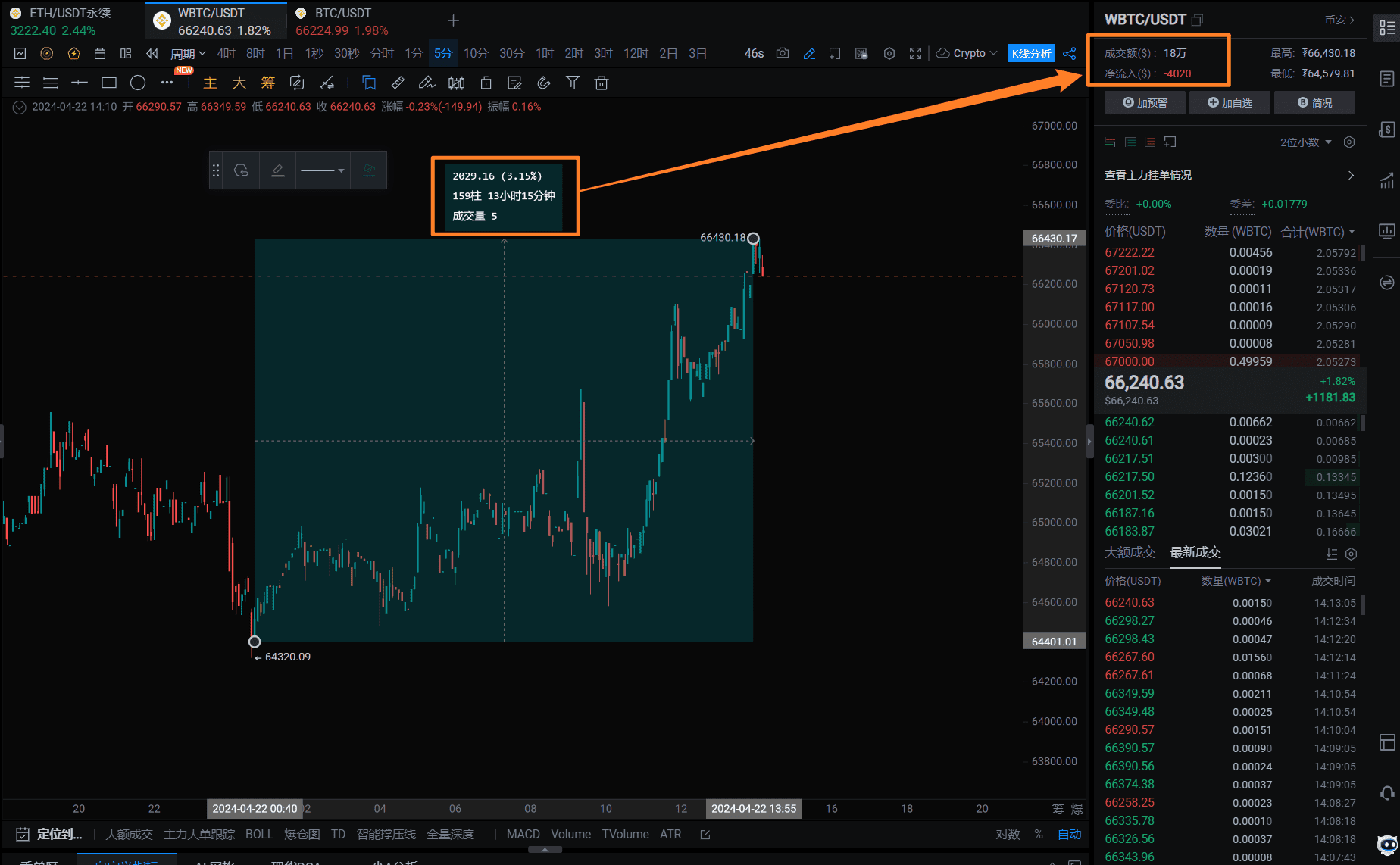

This address transferred 250 WBTC to Binance around 0:42, but the Binance WBTC spot trading volume was less than 20 afterward, indicating that no sale occurred.

Another method is to observe stablecoin outflows from exchanges to the address, primarily based on the corresponding fiat value.

It should be noted that some chains currently do not support this, so related transaction records may not be found.

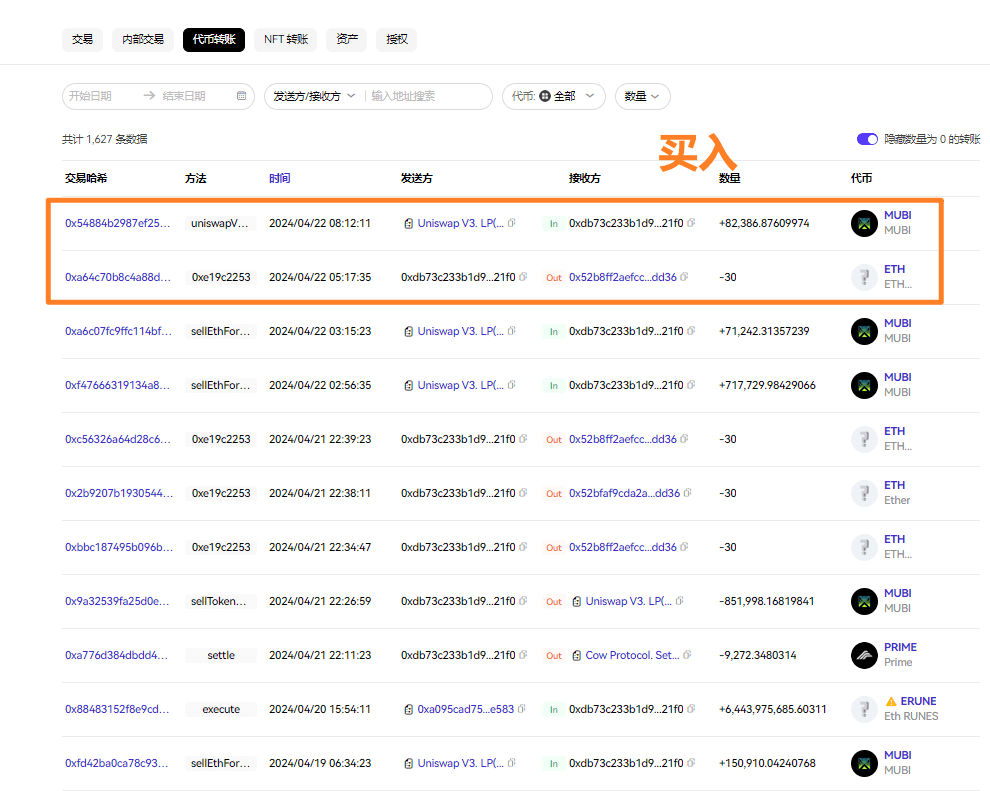

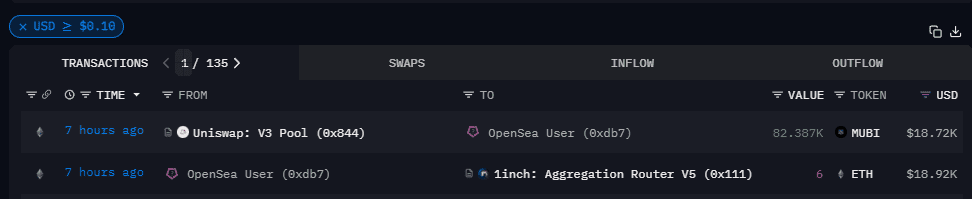

DEX transaction records are clearer, with most being spot transactions. If there is a corresponding fiat value, buying and selling records will be easier to understand.

Common patterns include:

Buy: WETH or USDC into the pool, meme coins or altcoins flowing into the wallet address;

Sell: Meme coins into the pool, USDC or WETH flowing into the wallet.

Because most DEXs use AMM (Automated Market Maker), inflows and outflows are easily visible.

III. Entity Tags

1. Concept

The concept of an entity is relatively abstract, corresponding to centralized entities in the real world, such as banks, companies, individuals, foundations, etc., mainly determined by public information or on-chain transaction records to establish its label (identity/ID). Usually, labels are used to determine which institutions are buying and selling.

2. Common Labels

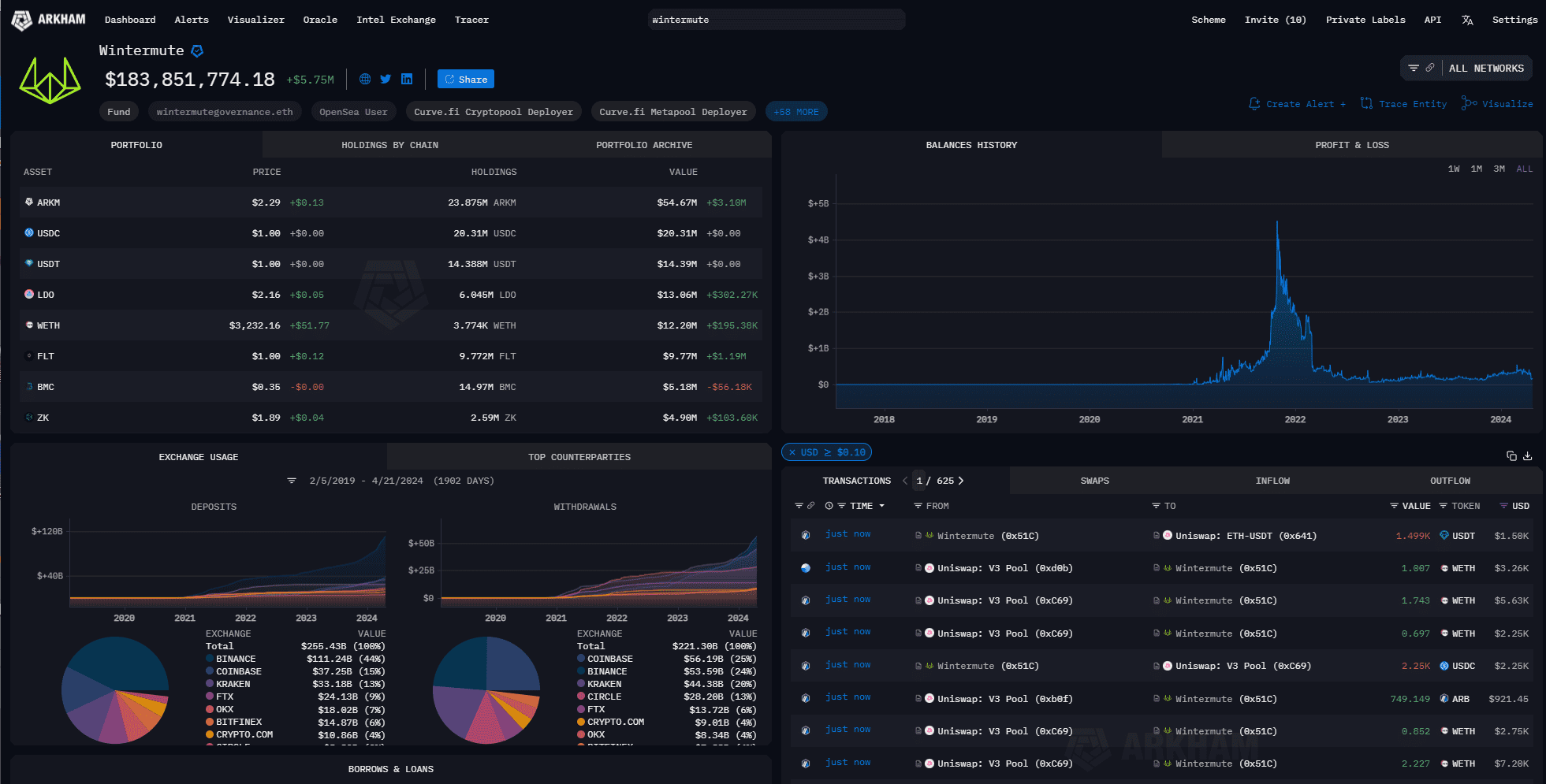

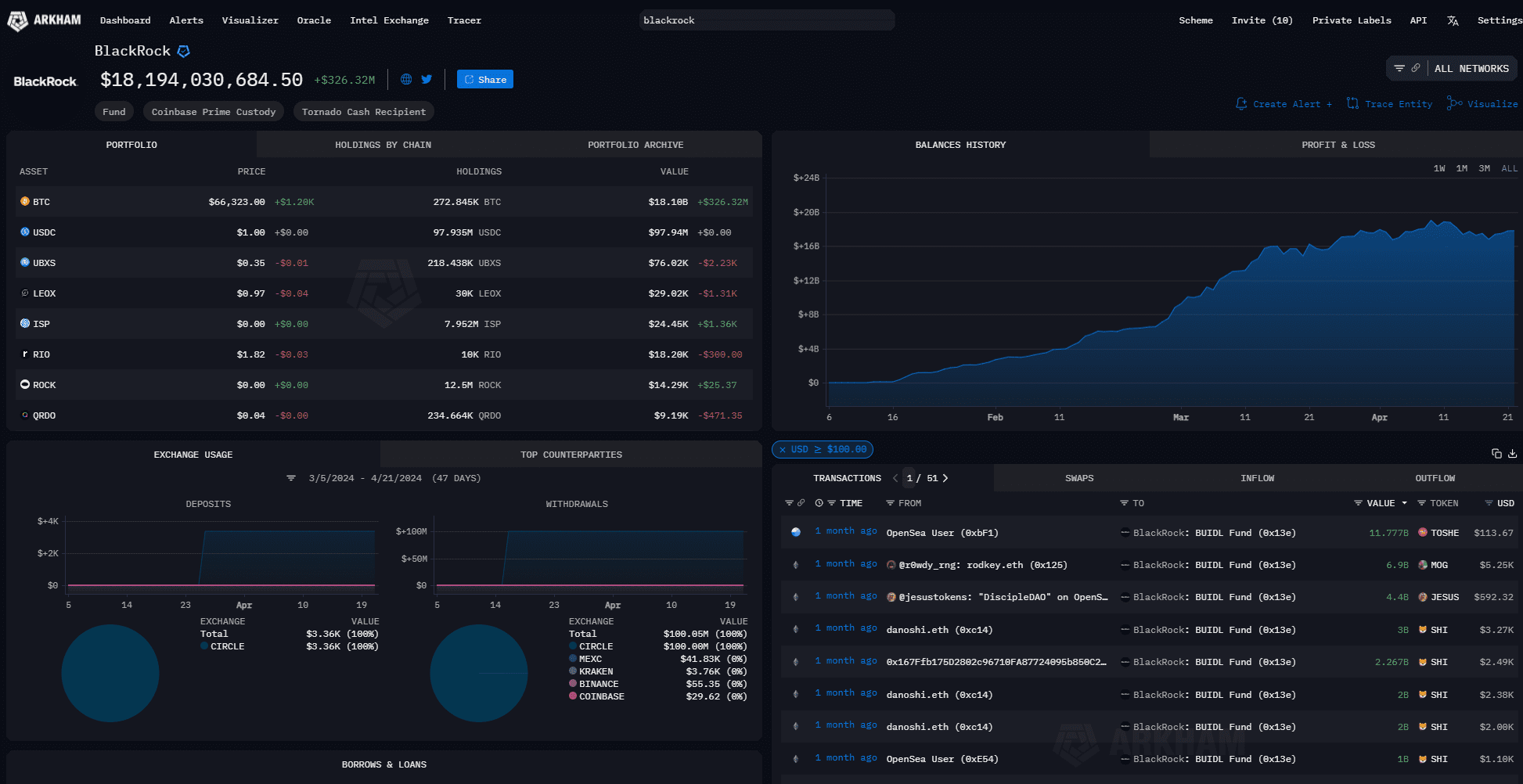

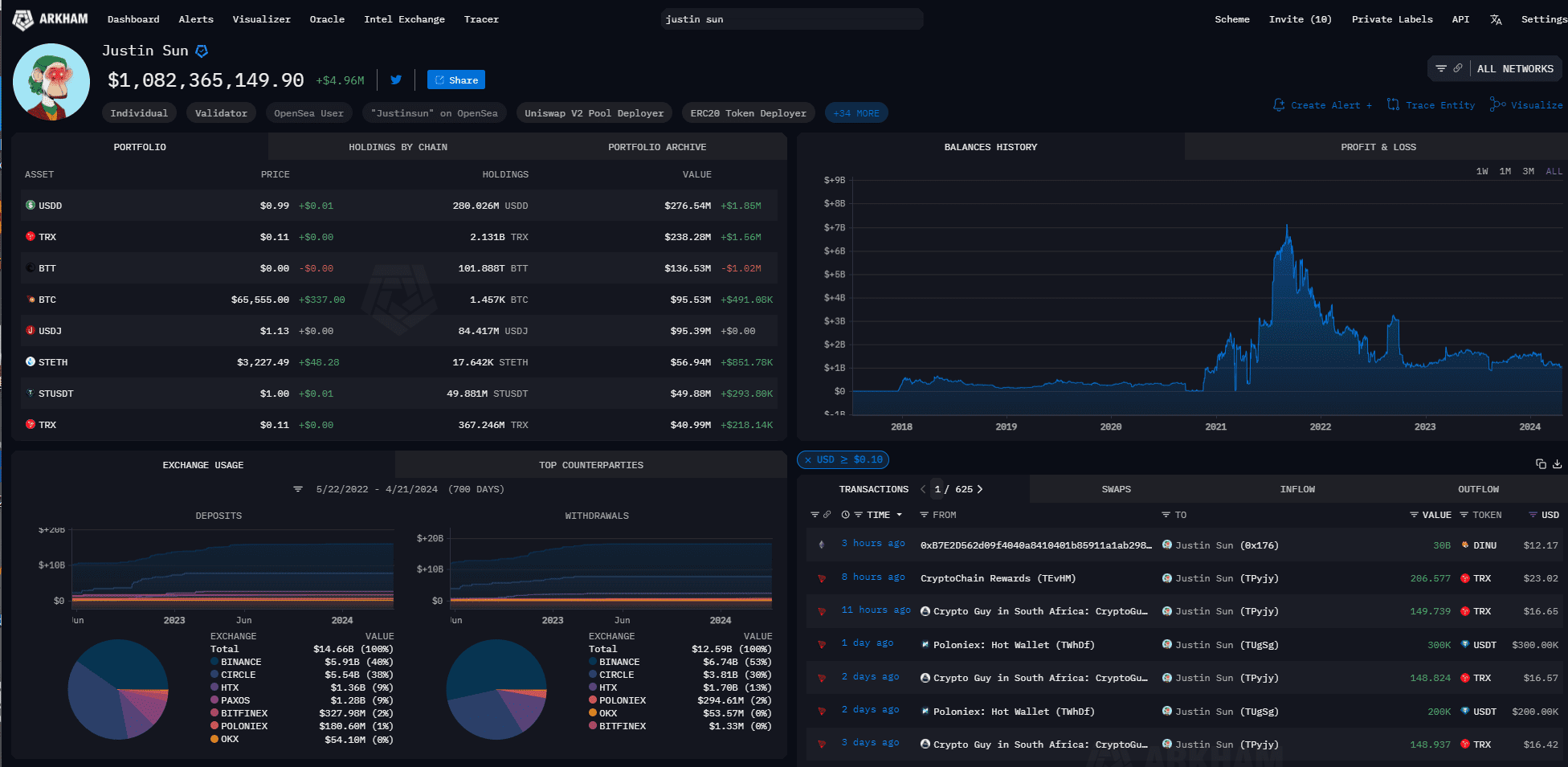

Currently, the commonly used label tool for the public is Arkham, the project behind ARKM.

Common label categories include:

(1) Exchanges: CEX (Binance, OKX, Coinbase, Bitget, Kucoin, FTX, etc.), DEX (Uniswap, Pancakeswap, Sushiswap, etc.)

(2) Market Makers: Wintermute, Jump, GSR Markets, DWF Labs, Tokka Labs, etc.

(3) Institutions: BlackRock, Grayscale, Fidelity, Invesco, etc.

(4) Celebrities: Vitalik Buterin, Donald Trump, Uniswap founder Hayden Adams, Justin Sun, etc.

3. Role

Through labels, token movements can be discovered, mainly considering entity labels, currencies, amounts, etc.; smart money addresses, whales, project parties… these addresses can all be monitored through on-chain flow.

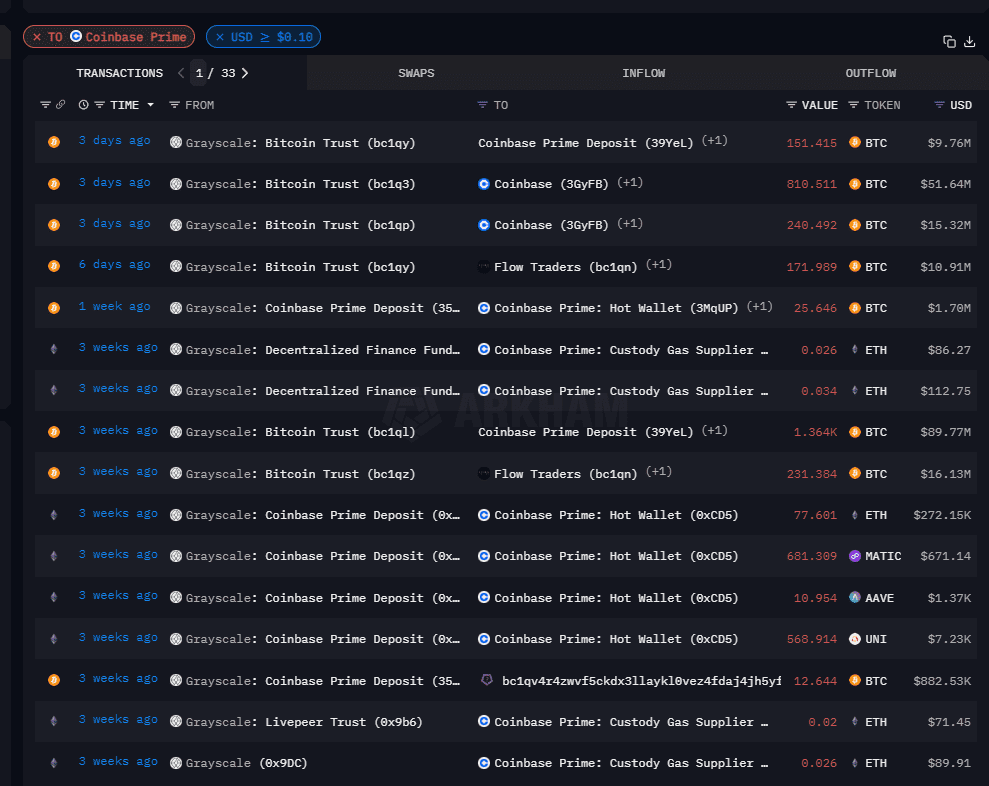

For example, it can be seen that Grayscale is selling BTC every day, and it can be discovered that when Grayscale transfers to Coinbase, it generally means a sell-off, but it is Grayscale selling the BTC from the previous trading day.

This needs to be combined with net outflow data and Grayscale's holdings data to see that there is still a layer between on-chain and exchanges.

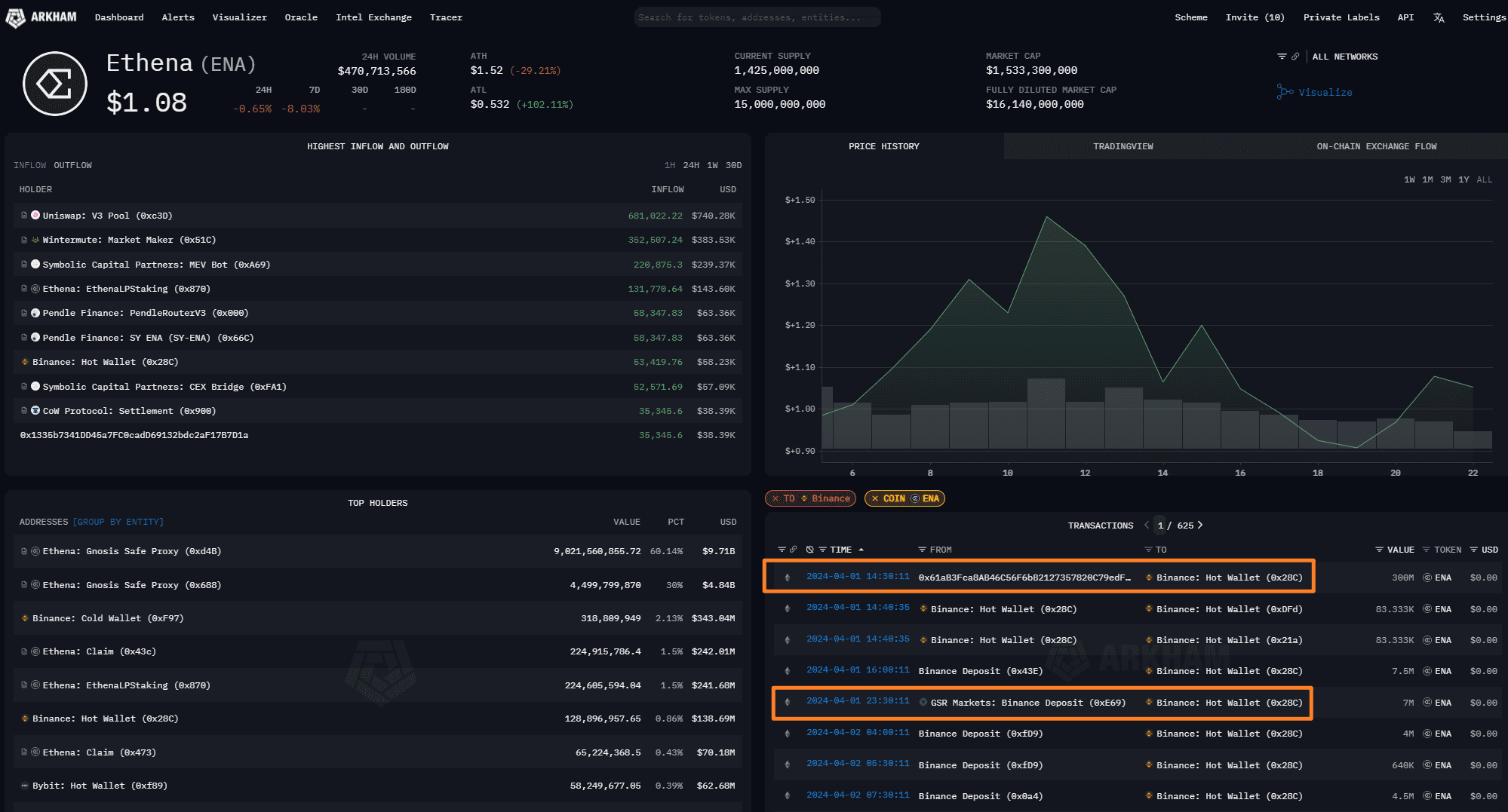

4. New Token Movements

After knowing the new token contract address, it can be seen which exchange and market maker the token will choose. Sometimes there is no announcement on the official website, but there is already some test information about token transfers on-chain, although the frequency is very low.

For example, for ENA, the first deposit to Binance was on April 1, and the associated market maker address is GSR, and another is smart money.

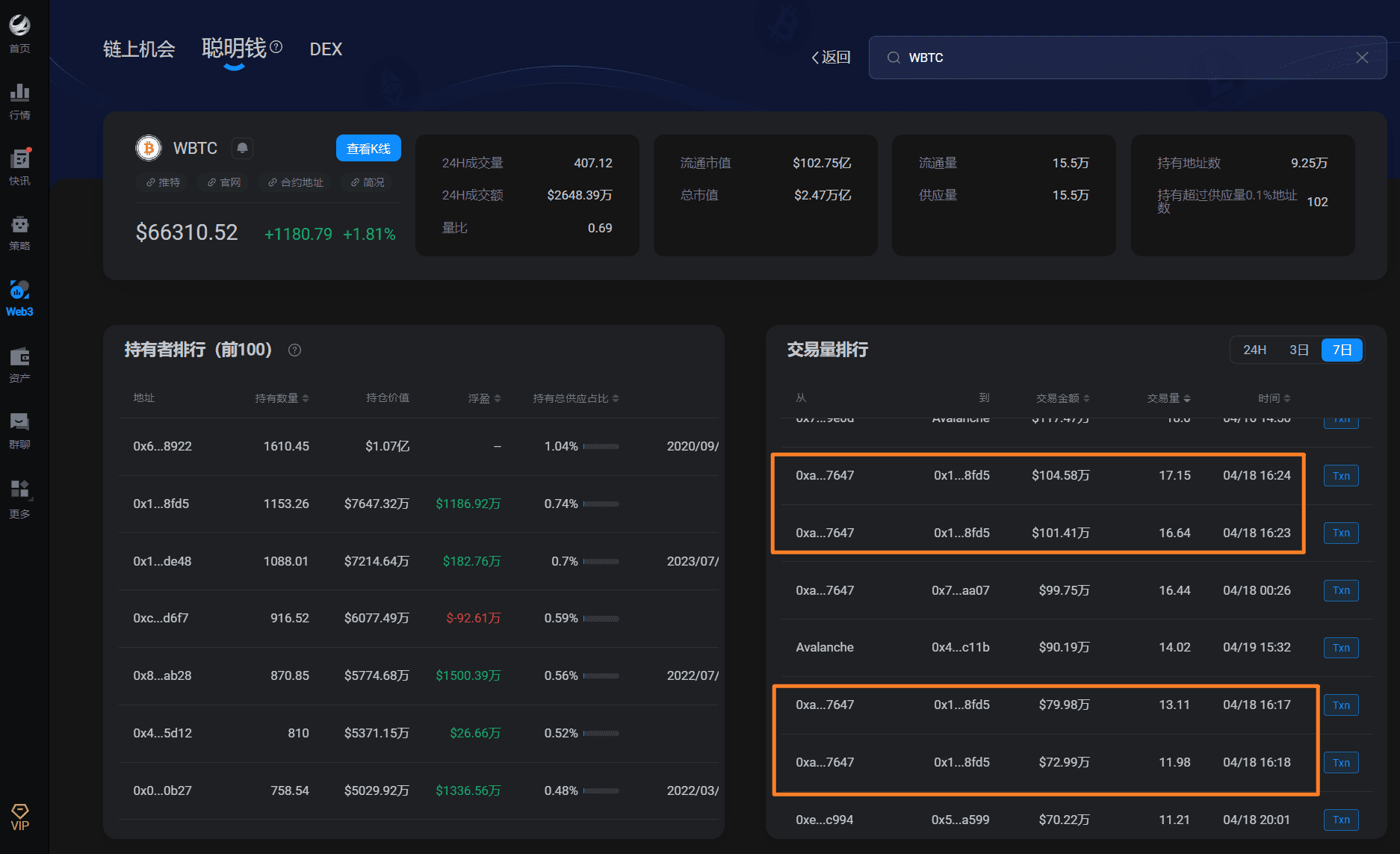

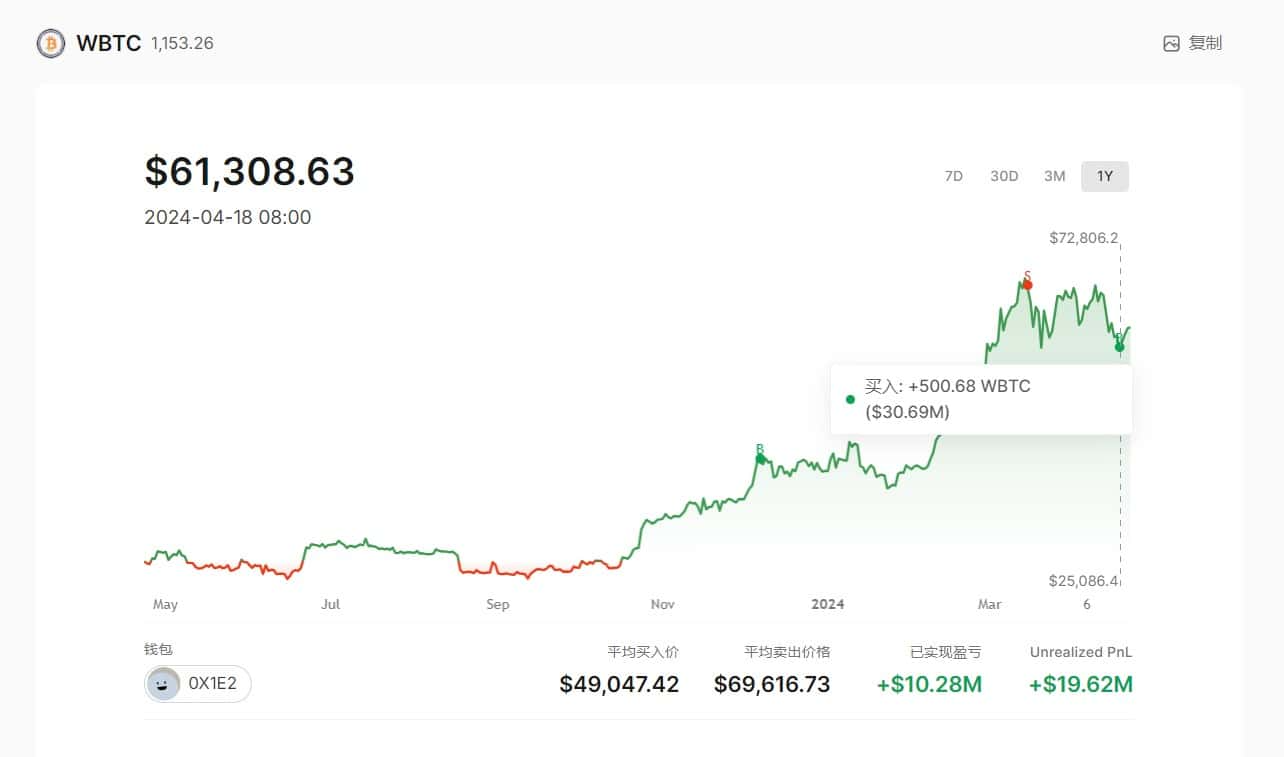

The address [0x1E227979f0b5BC691a70DEAed2e0F39a6F538FD5] bought 500 WBTC near the low point of the BTC price ($61400) last week, and it can be monitored when this address buys and sells.

Through the transaction records, it can be seen that this address has realized a profit of nearly 10 million and an unrealized profit of 19 million. That is, it has already sold and brought in a profit of 10 million, but has not sold yet, and there is an unrealized profit of 19 million in the account.

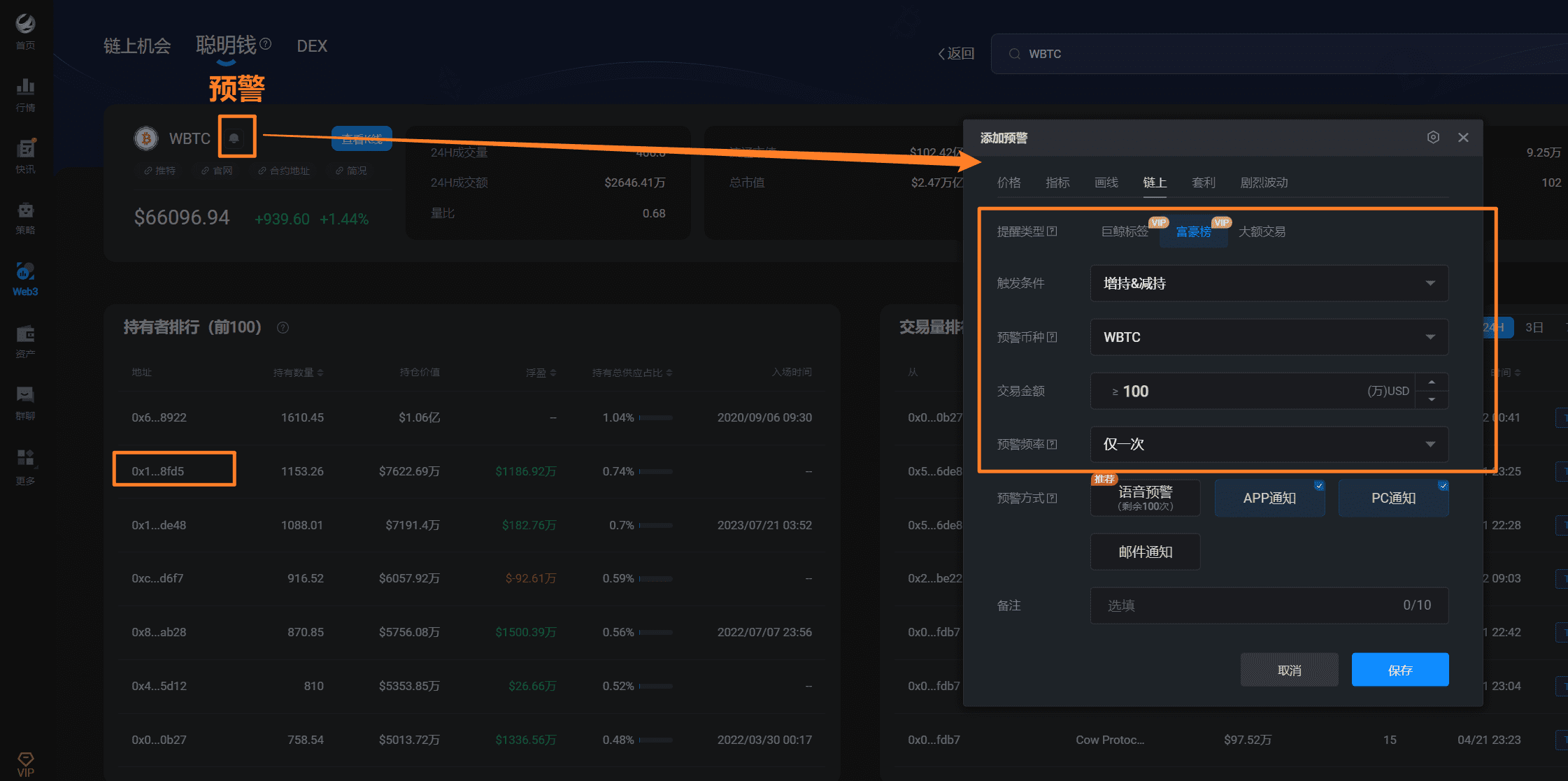

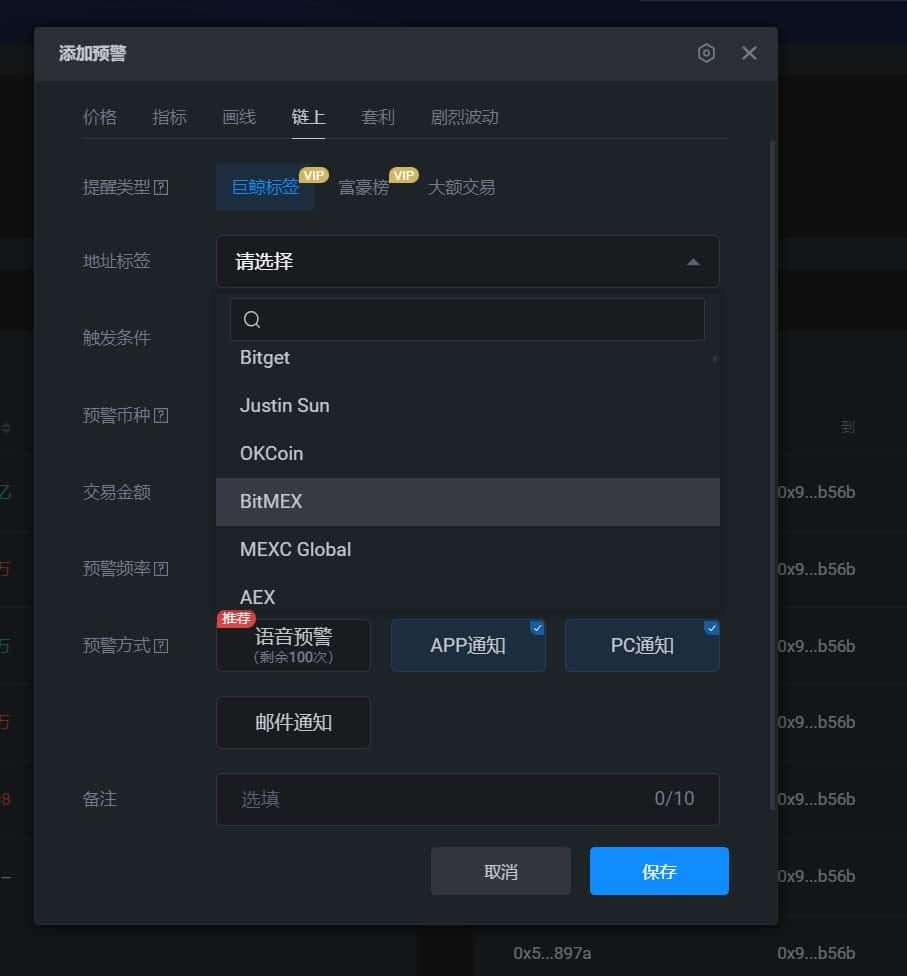

5. Related Alerts

The address [0x1E227979f0b5BC691a70DEAed2e0F39a6F538FD5] is currently ranked second on the WBTC rich list, holding 1153.26 WBTC, with a balance of over $70 million. Alerts can be set up through the rich list for notification.

Smart money operations and buying and selling points can only be used as part of the reference. In addition, in trending markets, many people will hoard spot positions, so the average cost of long and short positions needs to be considered.

Monitoring method: Determine entity labels, currencies, corresponding quantities, and amounts for monitoring.

Rich list monitoring method:

Whale label monitoring:

The PRO version supports chip distribution, large single main force display, AI index writing, and analysis by Xiao A, and more. Click the link to learn more and experience it: https://aicoin.app/zh-CN/vip/chartpro

Recommended Reading

“The halving is coming, custom indicators + Xiao A's double-edged sword!”

“Selected meme coins, discovering hidden investment opportunities against the market!”

For more live content, please follow AICoin's "News/Information - Live Review" section, and feel free to download AICoin PC-end

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。