Produced by | OKG Research

Author | Jason Jiang

OKLink data from Pionex shows that Bitcoin successfully completed its fourth halving at block height 840,000 (8:09 on April 20, 2024, Beijing time), reducing the Bitcoin mining reward from 6.25 BTC to 3.125 BTC. After this halving, the Bitcoin inflation rate will also decrease from 1.75% to 0.85%, expected to be only about half of the gold supply growth rate, making it a truly scarcer asset than gold.

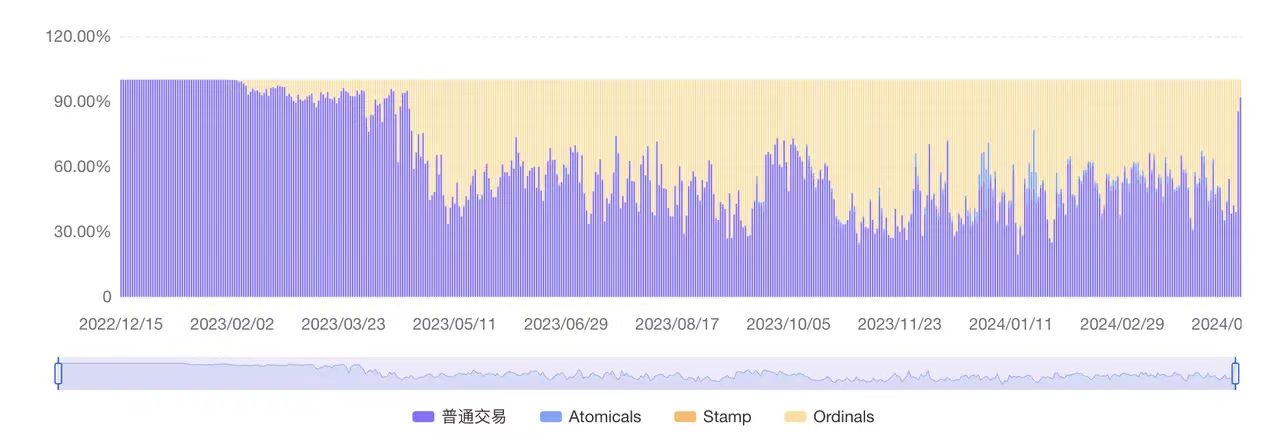

The short-term income of the Bitcoin mining community is theoretically directly affected after the halving. However, due to the simultaneous launch of Bitcoin runes with the halving, the rapid increase in on-chain transaction fees in the past two days has led to miners not feeling the negative impact of the halving in the first 100 blocks after the halving, but rather receiving more than before: on April 20 alone, the on-chain transaction fees generated by the rune event accounted for as much as 57.7%; the transaction fees generated by block 840,000 reached 37.626 BTC, about 6 times the block reward before the halving. Since the completion of this Bitcoin halving, the proportion of transaction fees in miner income has approached 60% (as of 18:00 on April 22, 2024).

Source: Pionex

However, as time passes and block rewards continue to decrease, the issue of incentivizing miners to continue participating in and protecting the blockchain network remains urgent. There are two ways to increase miner enthusiasm during the halving period: one is to ensure that the scarcity of Bitcoin with fixed block rewards increases its value; the other is to improve the variable part of the miner income structure, namely transaction fees. The former is difficult to predict and cannot fundamentally solve the problem (only continuous growth can meet the demand, which is clearly not realistic), while the latter is a more reasonable and effective solution.

As early as the Bitcoin white paper, Satoshi Nakamoto mentioned: "Once a certain number of bitcoins start circulating freely, transaction fees can fully serve as incentives. At that time, the Bitcoin network will be completely immune to the chronic problem of inflation in the traditional economic world." It can be seen that the reduction of Bitcoin block rewards and the increase in transaction fees are the inherent logic determined in the design of the Bitcoin protocol.

In fact, with the continuous growth of the Bitcoin ecosystem since 2023, the activity of the Bitcoin network is very different from the last halving, and the proportion of transaction fees in miner income is steadily increasing. According to OKLink data from Pionex, Bitcoin Ordinals transactions account for about 40% of the current Bitcoin network transactions, and the transaction fees brought by Ordinals transactions have accounted for over 20% of miner income, bringing miners over $200 million in income to date.

Source: Pionex

Even though the main part of miner income will still come from block rewards most of the time, the heat brought by runes after this halving may also be difficult to sustain for a long time. However, the temporary phenomenon it creates at least proves that the growth in on-chain activities brought by the Bitcoin network, without considering block rewards, is theoretically sufficient to continuously positively incentivize the miner community.

If we want to sustain this phenomenon, the necessary prerequisite is that on-chain activities are active enough and that users are willing to pay substantial fees for these activities. In the past, Bitcoin transactions solely for the purpose of transfer were clearly not enough to make up for the income gap caused by the halving, so more on-chain applications like Bitcoin runes that can attract market attention and create incremental value are needed. Only with these innovative and valuable applications constantly emerging, can the activity of the Bitcoin ecosystem continue to increase, benefiting different groups including miners, users, and institutions.

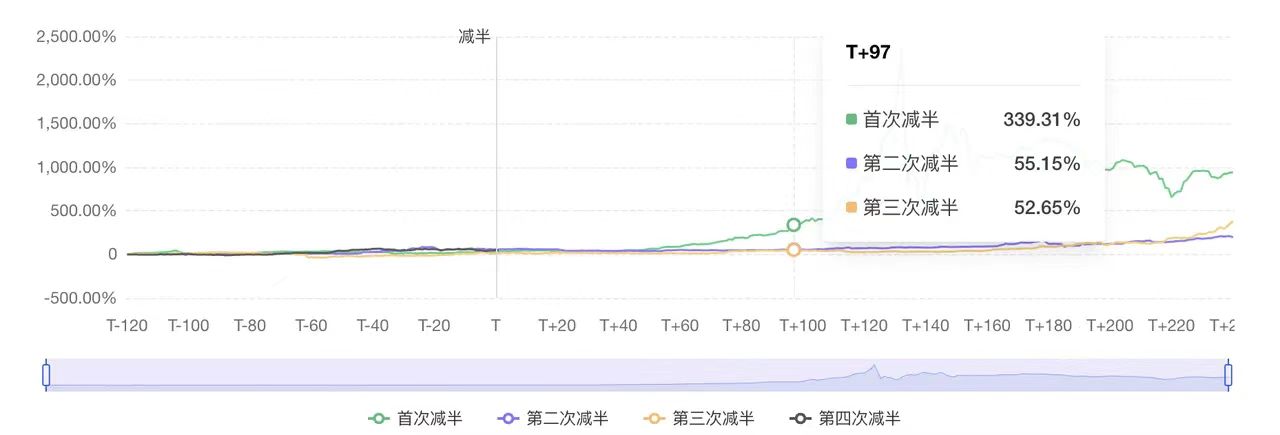

From this perspective, the author believes that the Bitcoin halving will to some extent drive the development of the Bitcoin on-chain ecosystem, or become a "catalyst" for ecosystem innovation acceleration. However, as the Bitcoin ecosystem continues to thrive, the future impact of Bitcoin halving on the market will become smaller and smaller. Although we will still pay attention to the halving, it may only become a landmark event indicating the cycle change, rather than a key factor affecting price trends.

Source: Pionex

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。