As a senior figure in the cryptocurrency circle, I have always been committed to providing helpful advice to everyone, hoping that people will take fewer detours and make fewer mistakes in this market. Although I am earnest in my advice, the path of investment still needs to be explored by oneself, and learning is endless. The experience gained is the real wealth!

Strength does not need to be overly displayed; the key is to gain more recognition from others. On the investment path, it is more important to do well for oneself than to prove one's strength to others. Whether it's a donkey or a horse, you'll know once you take it out for a walk.

I am a warrior striving to protect the "leeks" in the cryptocurrency circle. I wish my fans to achieve financial freedom in 2024. Let's cheer together!

Cryptocurrency Academician: Bitcoin (BTC) latest market analysis reference for April 20, 2024: Long and short both gain 4600 points

Bitcoin took down 4500 points the day before yesterday, and yesterday directly achieved the current price. How much did the long and short gain yesterday? Before the morning plunge yesterday, I mentioned the short at 63500, and after reaching the target of 62100, I do not recommend chasing the short. Finally, the market plunged above 59500, and we positioned ourselves at the integer level of 60000, with a stop loss at 59500, and finally took down 63500, gaining 3500 points. The combined long and short gains over the past two days amount to 4600 points. How much of this space did everyone grasp?

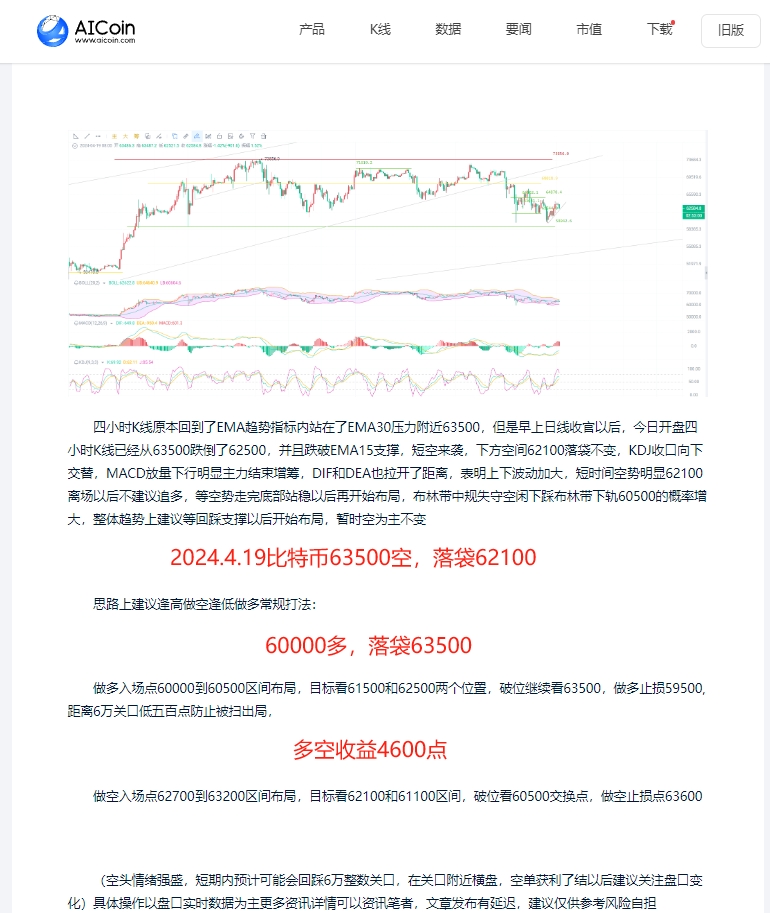

Let's look at today's market changes. As of the time of writing, Bitcoin's current price is near the 64000 mark. It can be seen that yesterday's daily K-line closed with a very long lower shadow, near the lowest point of 59560 and the highest point of 65450, with a fluctuation of over 5000 points, which can be described as a market where long and short both gain. Currently, the K-line is above the trend indicator EMA60. Since the 13th, it has almost reached the EMA60 trend indicator every day, indicating that this position is in a chip-intensive area.

The overall trend is still bearish. Unless the market does not break through the integer level of 66000, there will be further retracement. How much space is available in this range and how much needs to be defended? Currently, KDJ is converging near 65100, and the MACD has been shrinking for the third day with increased volume. After the DIF and DEA fell into the 0 axis and opened up the distance, they began to shrink. The Bollinger Bands also showed a trend of stopping the decline, with the lower support coming to 61000 and the middle band pressure reaching around 66600. The strategy can be to position long at around 63000.

The four-hour interval has returned to the inside of the EMA trend indicator, and after the previous network bearish trend ended, it finally began to shrink. This is also a good indicator of a raised bottom, from the original 61500 to the current 63000 mark. KDJ is converging downward, and the K-line is at the 64000 mark, indicating a downward alternating diffusion range. After reaching 65500 and starting to fall back, the dense area of the market is at the 64000 mark. The DIF and DEA have approached the 0 axis, which means that if it pushes towards the 65000 mark today, they will cross the 0 axis and take the opportunity to support the market to stretch and impact the upper level of 66000. The Bollinger Bands have opened up, and the K-line has risen above the middle band at 63000, with the pressure now turning into support, and the upper band pressure reaching 65600. The overall strategy is mainly focused on being long at a low level.

The strategy suggests being primarily long with short as a supplement:

- For short positions, the entry point is between 66000 and 66500, targeting the two major supports of 65100 and 63800. The stop loss for short positions is at 67100.

- For long positions, the entry point is between 62800 and 63300, targeting the range of 64500 and 65500 (breaking through 65500 can continue to look up to 66500). Currently, the market trend is more stable for long than short. Those who are cautious can go long on the retracement and not short.

Specific operations should be based on real-time market data, and for more information, please consult the author. The article is published with a delay, and it is recommended for reference only. All risks are at your own discretion.

This article is exclusively provided by the Cryptocurrency Academician and represents the exclusive views of the academician. Due to the timing of the article's release, the above views and suggestions are not real-time and are for reference only. Reprinting requires attribution. Please control your positions reasonably and do not overexpose or fully expose your positions. The academician also hopes that investors understand that the market is always right. If you make a mistake, you should summarize where your own problems are, and do not let the profits that should be in your hands fly away. There is no need to be smarter than the market in investment. When the trend comes, follow it; when there is no trend, observe and be patient. It is not too late to wait for the trend to become clear. Tomorrow's success comes from today's choices. Heaven rewards hard work, earth rewards kindness, people reward sincerity, business rewards trust, industry rewards precision, and art rewards heart. Gains and losses are all in the blink of an eye. Develop the habit of strictly setting stop-loss and take-profit for each trade. The Cryptocurrency Academician wishes you a pleasant investment!

Friendly reminder: The content above is created by the author's public account. The advertisements at the end of the article and in the comments section are not related to the author. Please discern carefully, and thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。