With the halving approaching, this year's three major bullish factors, "spot Bitcoin ETF, Bitcoin halving, and Fed rate cuts," are about to be realized.

Author: River

In 2024, the first of the three most anticipated bullish factors of the year—spot Bitcoin ETF, Bitcoin halving, and Fed rate cuts—has already been implemented, propelling Bitcoin to break through $70,000 and reach a historic high.

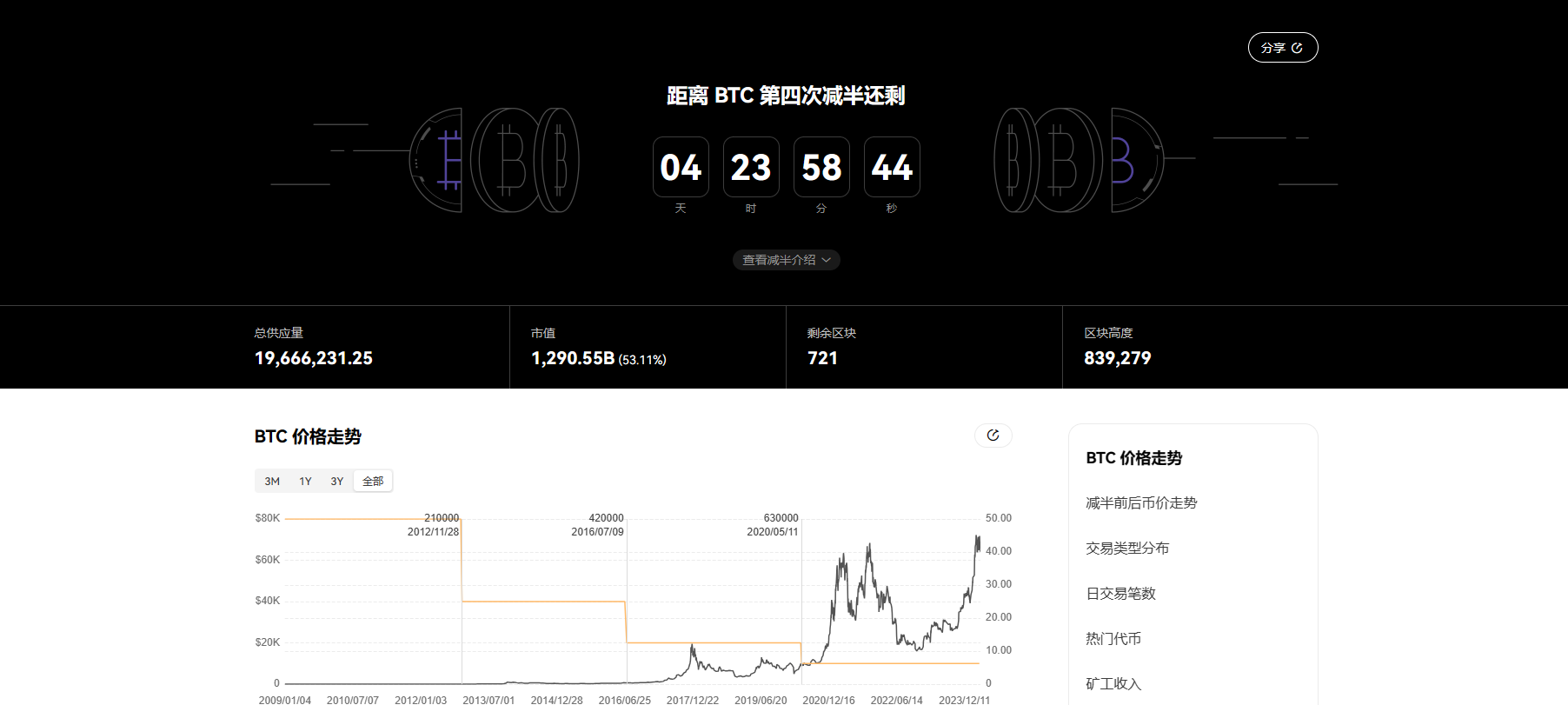

Now, with the halving approaching, two of this year's three major bullish factors are about to be realized, which may have an impact on the evolution of the market. According to OKLink statistics, there are less than 5 days left until the fourth Bitcoin halving, which is expected to occur on April 20, 2024, when the block reward will decrease from 6.25 BTC to 3.125 BTC.

As one of the most important narratives in the crypto industry, "Bitcoin halving" has always been a significant stimulating event that the market has great expectations for. As the current halving cycle approaches its end, what expectations should we have in 2024, and what new variables have emerged in the market?

How does the halving affect the crypto market?

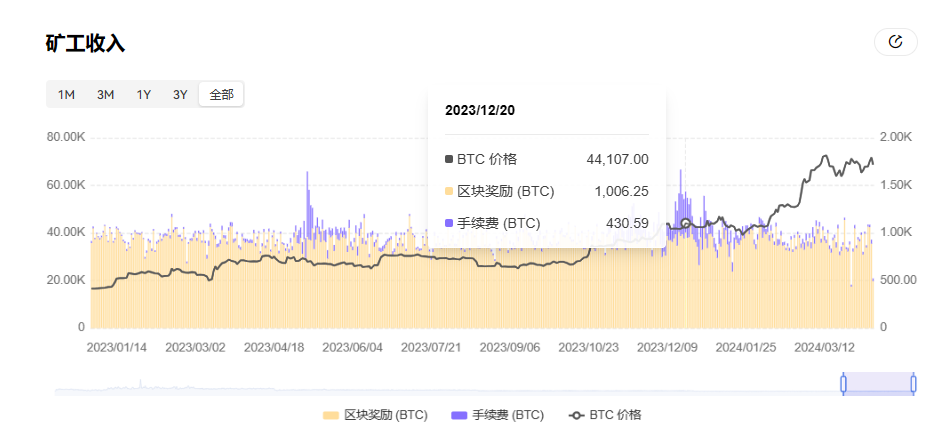

We can briefly understand the basics of Bitcoin halving: the mechanism design of Bitcoin determines the exceptionally important role of miners, who are the cornerstone of the entire system's transaction operation. Currently, miners' income mainly comes from two parts—block rewards and transaction fees.

The block reward started at 50 bitcoins and halves every four years. It has already halved three times to 6.25 bitcoins, and the fourth halving is less than 5 days away. By 2140, Bitcoin will no longer have block rewards.

However, transaction fees will continue to exist, so miners' income will become very singular in the future, relying solely on transaction fee rewards. This is why the crypto industry has always been one of the most cyclical industries.

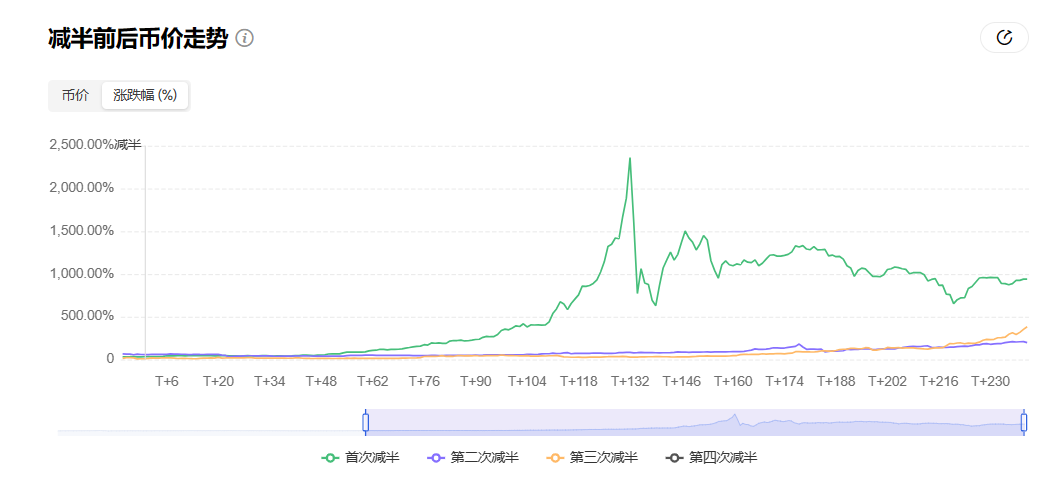

From a historical perspective, each halving has been a grand event, especially the first halving of Bitcoin, which saw an astonishing increase of several times. Using OKLink's "price trend before and after halving" statistics as an example:

- The first halving (November 28, 2012) occurred 132 days before, and BTC's cumulative increase reached a high of 2361%, setting a historic high.

- The second halving (July 9, 2016) occurred 1 year and 5 months later (during which there was a prosperous ICO boom and the disruptive "9·4" incident, so the cycle was longer), and BTC's cumulative increase reached a high of 2804%, setting a historic high.

However, since the start of the third halving in 2020, due to the significant increase in the number of industry practitioners, market attention, and the improvement of supporting infrastructure compared to before, Bitcoin is no longer limited to a niche product in the geek community. Its scale and scope have made it difficult to achieve a several-fold increase, and it has only risen by about 7 times compared to the halving point.

In summary:

Before the first halving, geeks in the industry were more concerned about the potential of Bitcoin as electronic cash.

During the second halving cycle, the focus on Bitcoin shifted to its properties as a payment tool, sparking a series of debates (the subsequent BCH fork was almost the top trend in the industry).

In the third halving cycle, Bitcoin had become an alternative asset, and the focus shifted to the layout of traditional institutions and capital.

So, although the price change was not as significant as in the previous two halvings, the hype surrounding the third halving of Bitcoin was unprecedented. At the same time, the overall global political and economic environment at the time also affected its performance:

Under the influence of macro factors, from March 12 to March 13, two months before the halving on May 11, Bitcoin plummeted from $7,600 to $5,500 and then further to $3,600, evaporating a total market value of $55 billion and causing over 20 billion RMB in forced liquidation, accurately achieving "price halving."

However, after the halving in May, the DeFi summer kicked off a new bull market cycle, and Bitcoin surged to $60,000, nearly 7 times higher than the halving point.

Overall, based on historical experience, in the six months to a year after the halving, BTC is highly likely to start a new bull market cycle. Although it may be difficult to achieve an increase of more than 10 times the current scale, surpassing the integer-level thresholds of $100,000 or even $200,000 is still highly anticipated.

New variables beyond the halving

However, at the same time, with Bitcoin having experienced three halvings, the block reward reduced to 6.25 bitcoins, and the total mined quantity exceeding 19 million, many situations and things need to be reconsidered from a new perspective.

Especially, compared to the previous halvings, there have been some noteworthy new variables in the entire industry and Bitcoin itself.

Intensification of the mining arms race

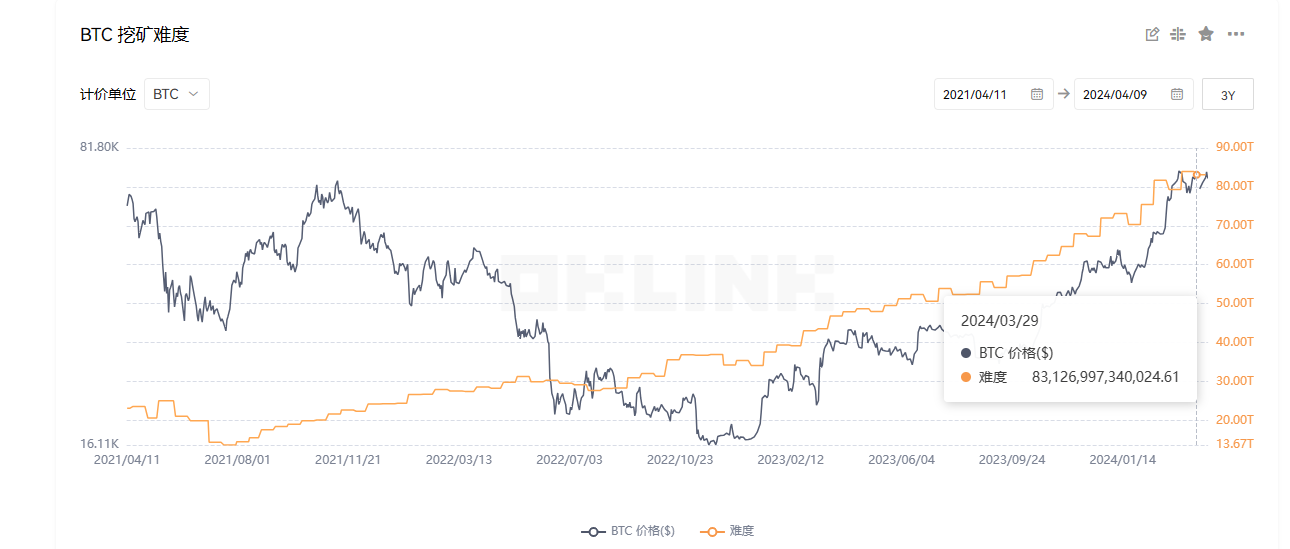

It is well known that capital in the industry has always liked to collectively bet on the "halving event." The continuously growing hash rate, new hardware, and the upcoming halving will determine the overall growth of the industry and Bitcoin, especially now:

As of the latest mining difficulty adjustment for Bitcoin at block height 836,640—the mining difficulty has reached 83.13T, almost doubling from a year ago.

In this context, the hash rate of the entire network, which has doubled in the past year, combined with the 50% reduction in the amount of Bitcoin miners can mine due to the halving in 10 days, means that miners must increase their hash rate investment to mine enough BTC to cover their expenses and maintain stable cash flow.

This will further lead to a significant increase in network hash rate, and mining difficulty will have to be adjusted upwards to maintain a stable BTC production rate, thereby squeezing out miners with higher costs from the market.

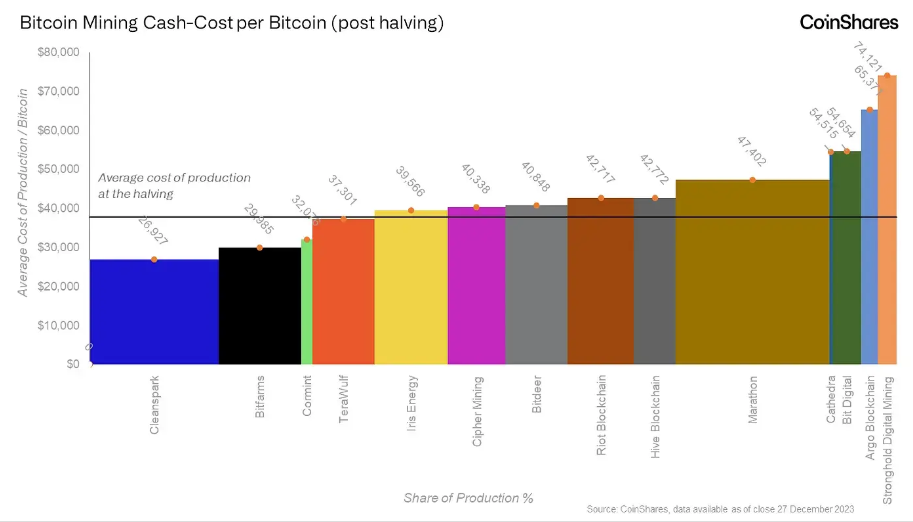

According to a CoinShares research report, when the halving is completed in 10 days, the average cost of Bitcoin production for miners may increase significantly, with a median cost of over $42,000. However, due to the recent surge in Bitcoin prices over the past two months, the production costs of most miners are currently lower than the market price.

Therefore, it is not ruled out that there may be exceptions in this halving, where the network hash rate will increase at a steeper rate—since the first Bitcoin halving in 2012, as well as the subsequent halvings in 2016 and 2020, the hash rate usually drops by about 9% after the halving, which typically lasts for about six months, and then recovers midway, followed by a surge in activity about a year before the next halving.

This cycle is logical: to maintain competitiveness in the expected halving, miners increase capital expenditure, resulting in a hash rate significantly higher than the trend. After the halving, miners' direct income decreases, affecting their capital expenditure cycle.

Essentially, miners are engaged in an arms race to purchase and increase as many machines as possible. The variable of "market price > mining cost" in this halving will have a significant impact on the mining market and the secondary market of Bitcoin, and it requires continuous observation.

Internal evolution of the Bitcoin ecosystem

According to Bitcoin's halving rule, the block reward started at 50 bitcoins and halves every four years. It has already halved three times to 6.25 bitcoins, and this will continue until 2140 when Bitcoin will no longer have block rewards.

However, transaction fees will continue to exist. Therefore, with each round of halving, the block reward will gradually decrease and approach zero, making miners' income very singular in the future, relying solely on transaction fee rewards.

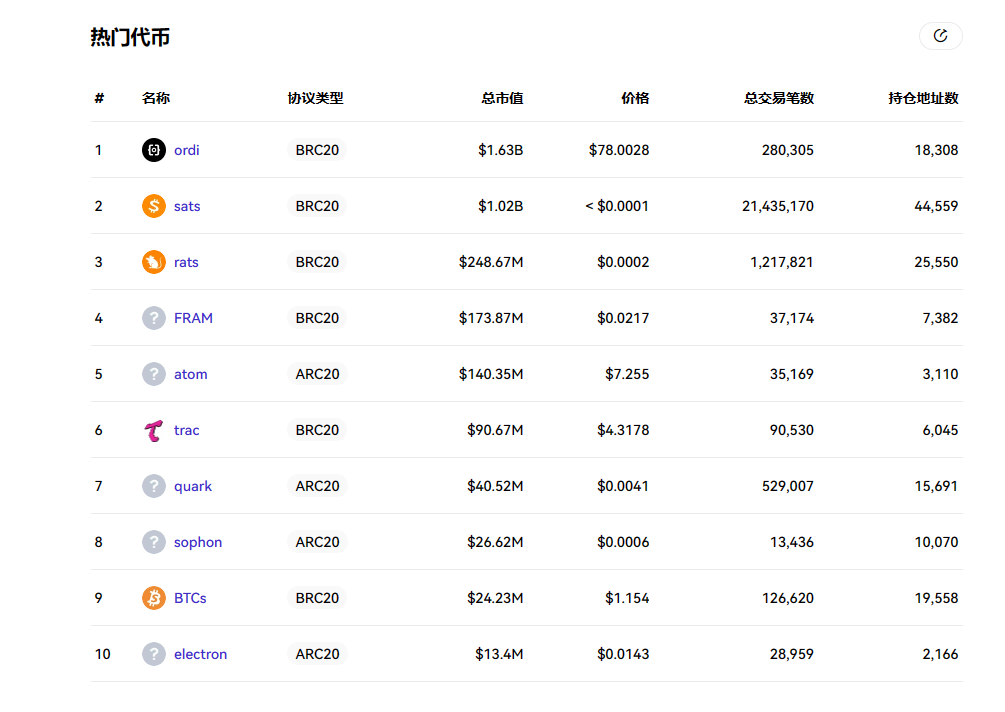

Since 2023, the prosperity of the Bitcoin ecosystem, especially BRC20, has sparked a new wave of "BitcoinFi," reaching a new peak in the activity of internal transactions within the Bitcoin ecosystem, thereby boosting the surge in Bitcoin's transaction fee income. Currently, the total market value of just three new assets—ORDI, SATS, and RATS—is close to $3 billion, with over 90,000 total holding addresses.

This wave of Ordinals has introduced a massive amount of funds, users, and developers into the Bitcoin ecosystem through the Pionex channel. If Bitcoin used to only have "doctrinal cognition" and a total market value advantage, the wave of Pionex has significantly increased the richness of new assets in the Bitcoin ecosystem. The demand for new assets is eternal, and it indirectly increases the number of developers and user base.

In this context, protocol innovations such as Ordinals, along with leading projects like ORDI and SATS, have deeply influenced the fee model of the Bitcoin network—most directly, it has completely changed the economic and incentive models of Bitcoin.

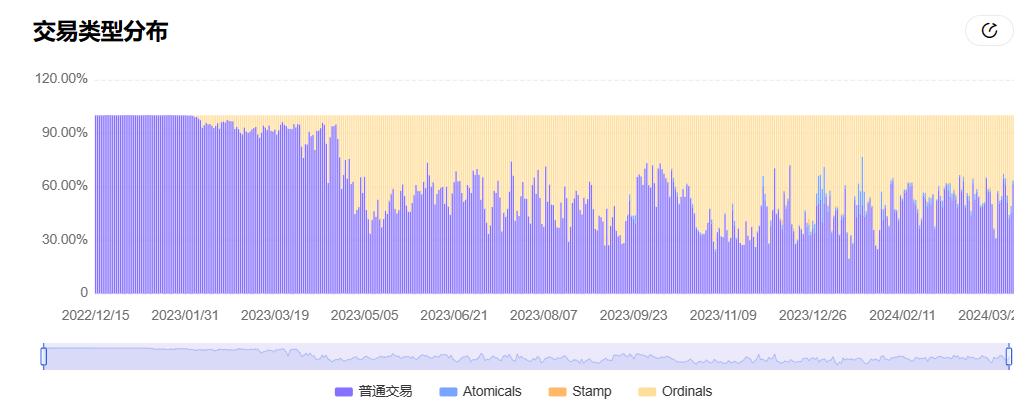

The latest data from OKLink shows that the proportion of Ordinals transactions on the Bitcoin chain's total transactions has steadily increased from 0 at the beginning of 2023 to now stabilize at over 50%.

This has also propelled BTC mining fee income to nearly a 5-year high. It's important to note that historical average data for miner fee income has often accounted for only about 2%, but at the end of last year, it even reached 40% (although it has fallen in the past three months).

As subsequent block rewards gradually decrease to zero, the importance of transaction fees will continue to increase until it becomes the sole source of income.

So, this round of BRC20 is like a preview, and regardless of its success, with the subsequent Bitcoin halving, the variables on this path will inevitably profoundly change the overall fee model of Bitcoin.

Conclusion

Overall, we are now at the end of a new round of the halving cycle. This may be the first (or second) time that the majority of practitioners and investors in this round have personally witnessed and experienced the "halving event" of Bitcoin.

The past is just a prologue. As one of the most important narratives in the crypto industry, "Bitcoin halving" has always been a tonic to boost market confidence. The footsteps of the bull market are uncertain, and it is still unknown how Bitcoin and this round of the cycle will unfold after the halving.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。