On the afternoon of April 8th, AICoin researchers conducted a live graphic and text sharing session titled "Early Layout! Selecting Potential Altcoins in Sector Rotation (with Membership Giveaway)" in the AICoin PC-end Group Chat Live. Here is a summary of the live content.

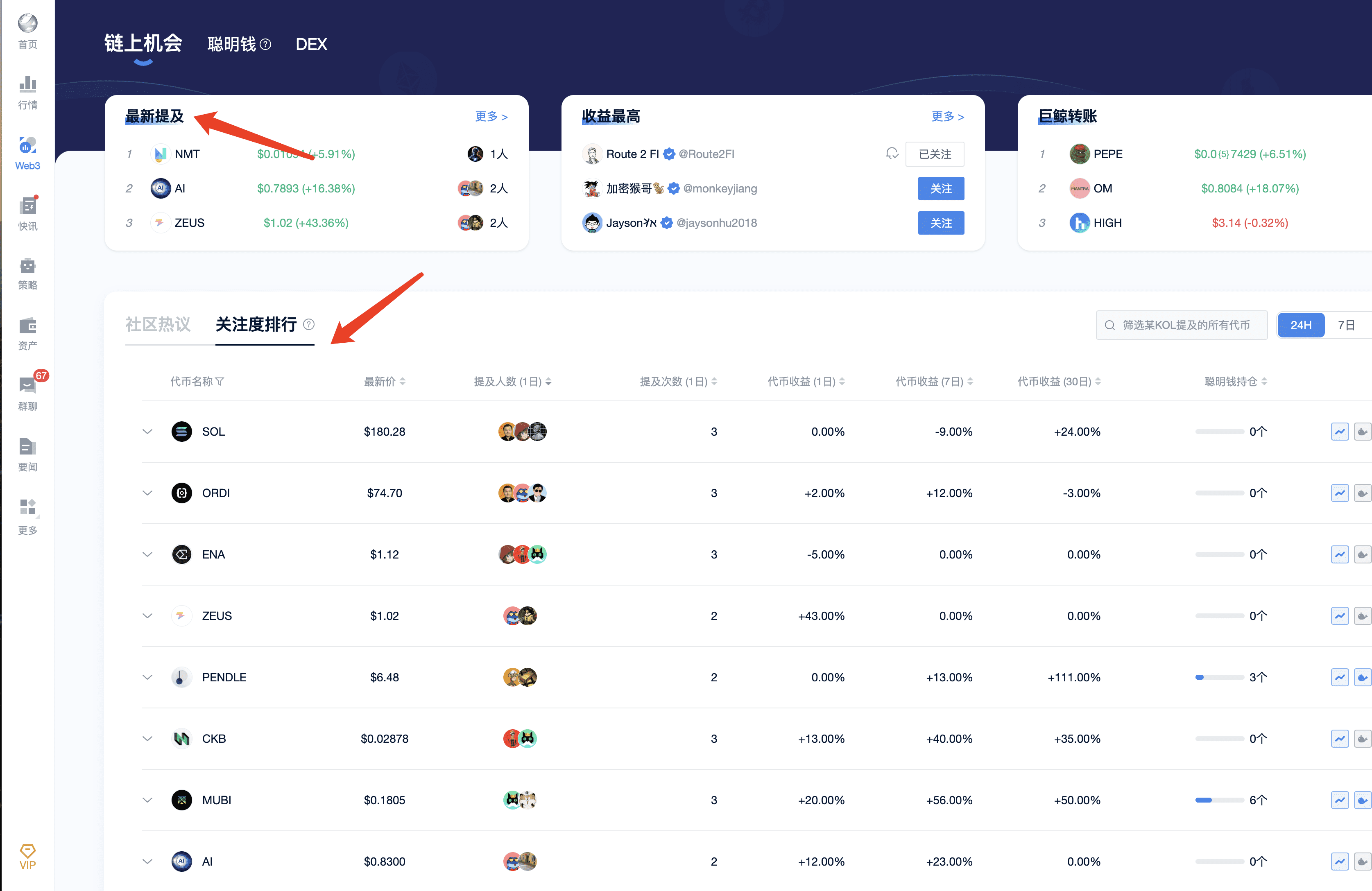

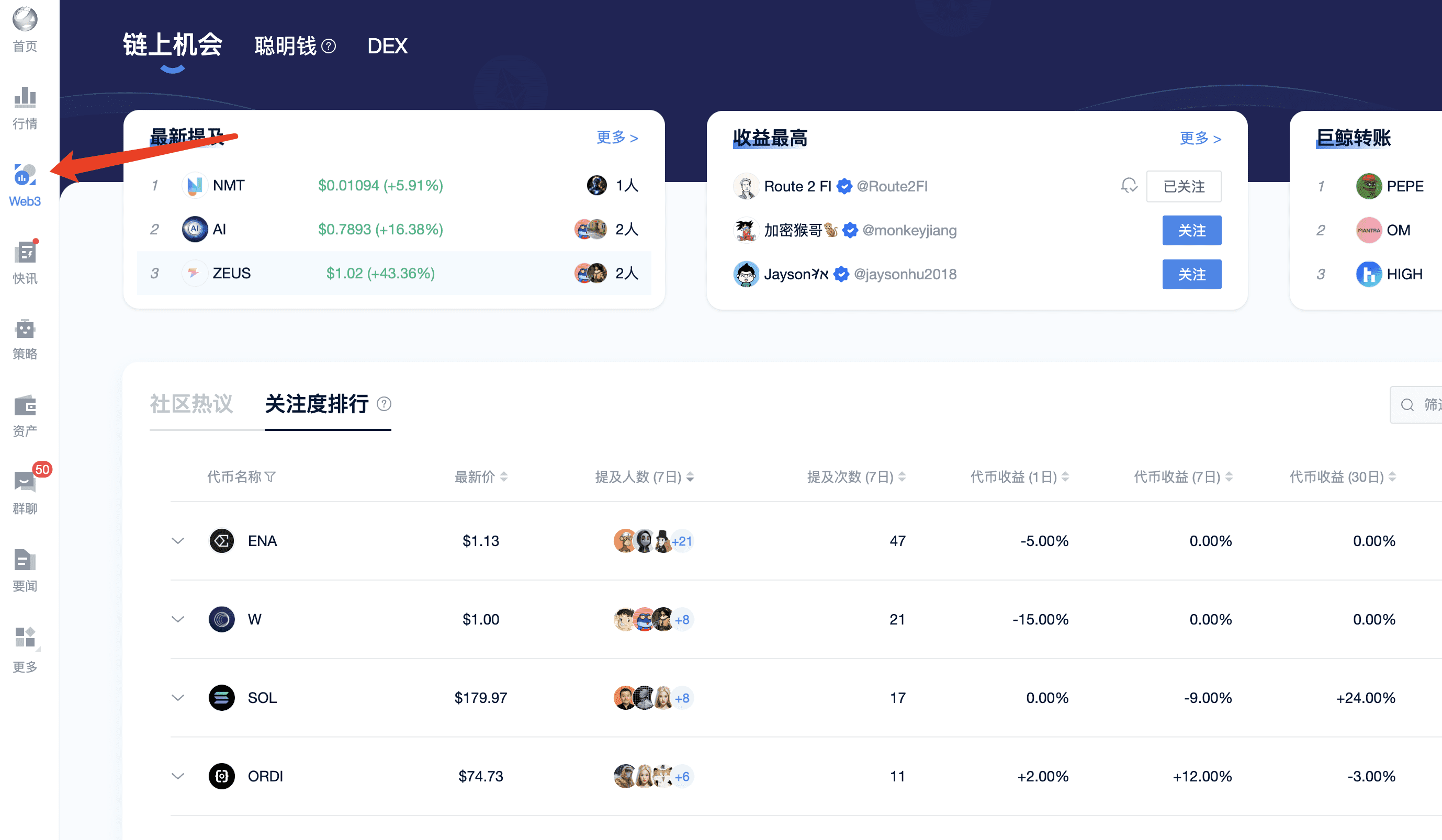

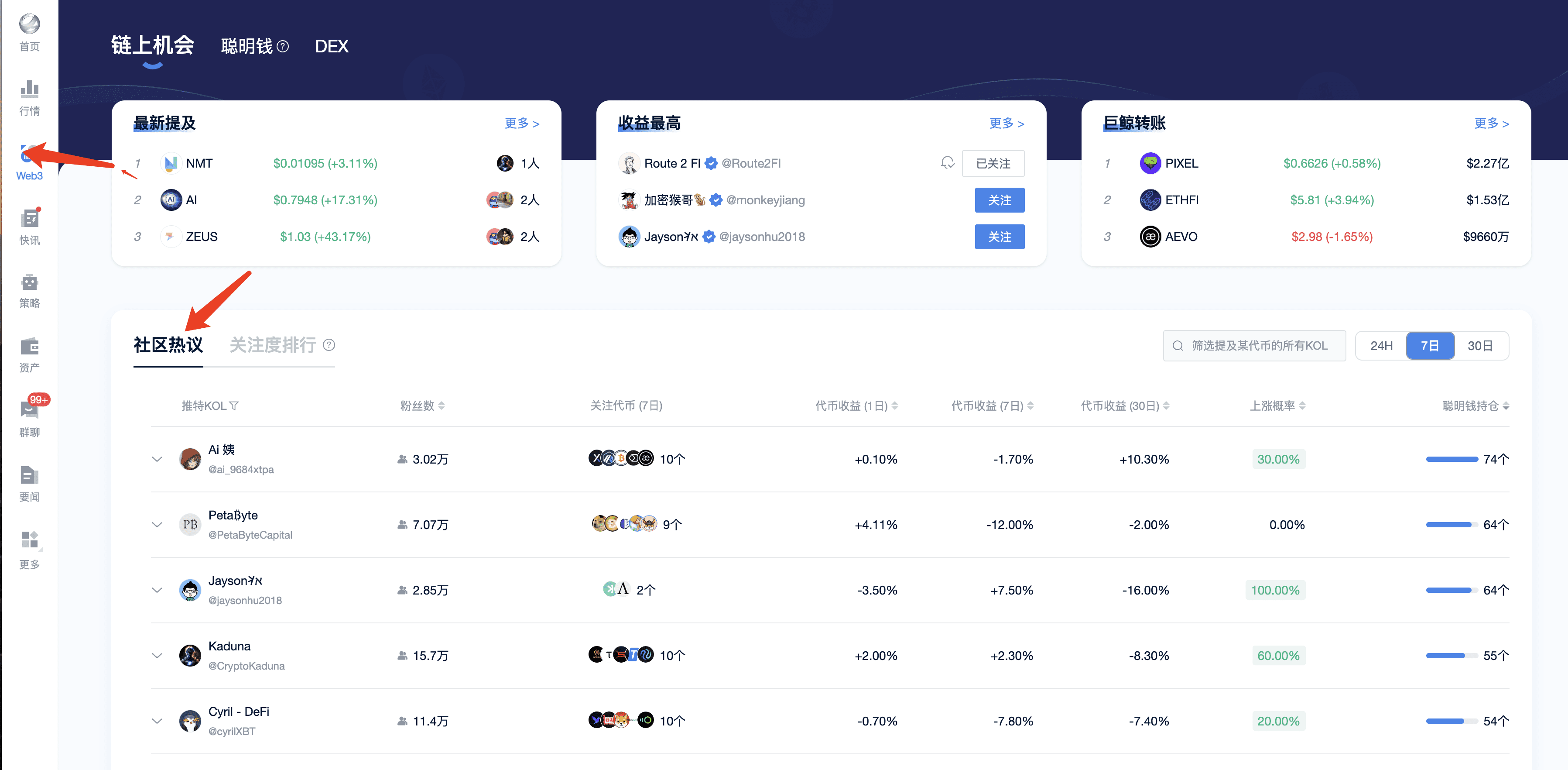

I. Open Web3

Upon viewing the list of currencies, sol, ordi, and ENA are currently the hottest sectors, representing solana, btc, and the defi ecosystem, respectively.

II. Hot Coin Analysis

The first step is to check the popularity of bake among KOLs.

The second step is to look at ordi, which is in the btc ecosystem sector. With recent halvings of bch and btc, there is speculation in the l2 sector of btc, making it worth early attention.

The third step is to analyze ENA, a recently popular algorithmic stablecoin similar to products like luna. Coins like ena and ethfi have recently surged, and it's essential to consider the protocol's ability to generate income for coin holders in the defi sector. These coins can provide dividends to holders, making them fundamentally sound and recently surging. Rwa is also a sector to watch in this bull market. By focusing on these hot sectors, one can look for leading tokens, such as those with high market value and coin holder income, to find entry opportunities.

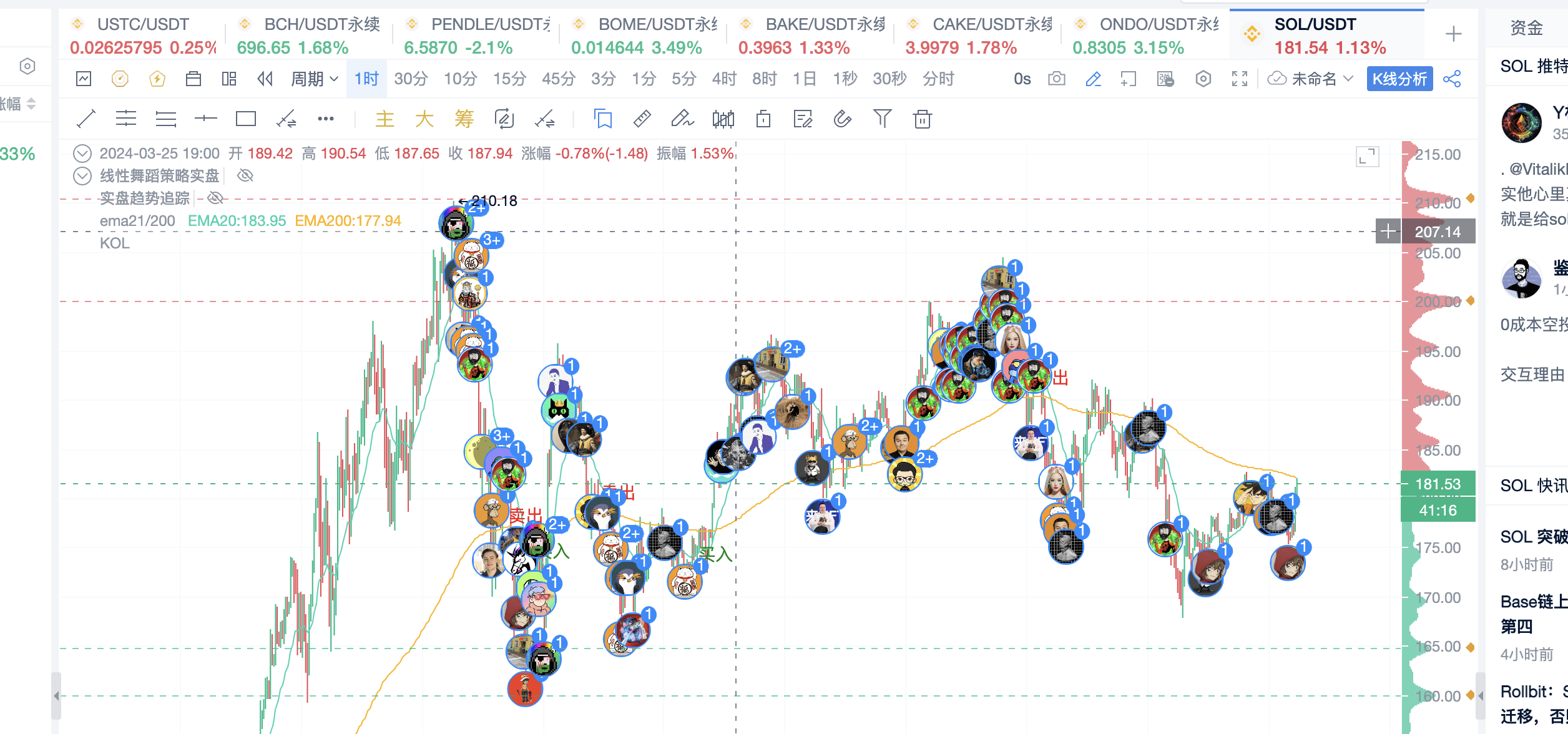

III. Specific Use of KOL Indicators

1. Select as shown in the image

2. Display the selected effect

By opening this, one can see many KOLs. Even after a straight-line surge, there are still many KOLs paying attention. At this point, chasing the market can still yield over 20% gains. It is recommended to note that recent popularity has declined.

The KOL indicator is a relative indicator on the right side. After being mentioned by KOLs, one can amplify their investment information. Access the same KOL indicator by becoming a member: https://aicoin.app/vip/chartpro

3. Look at sol

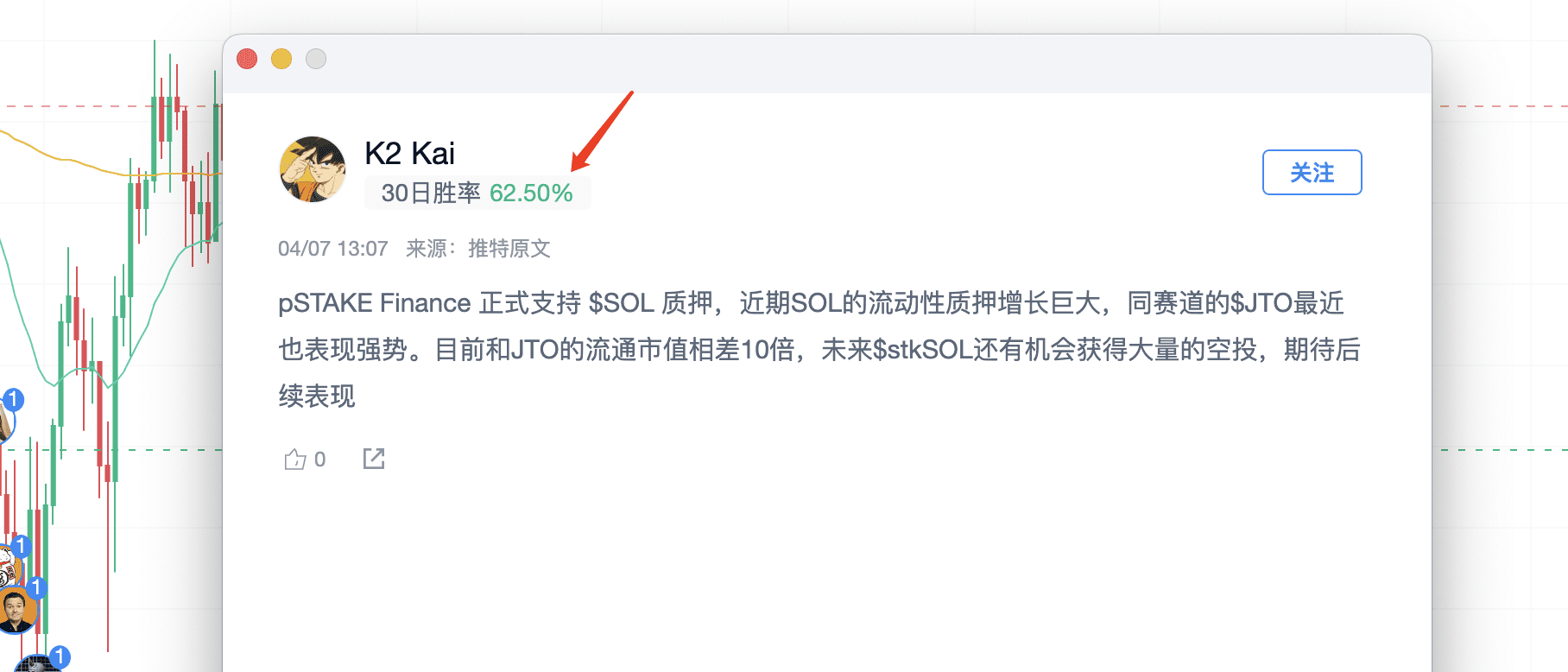

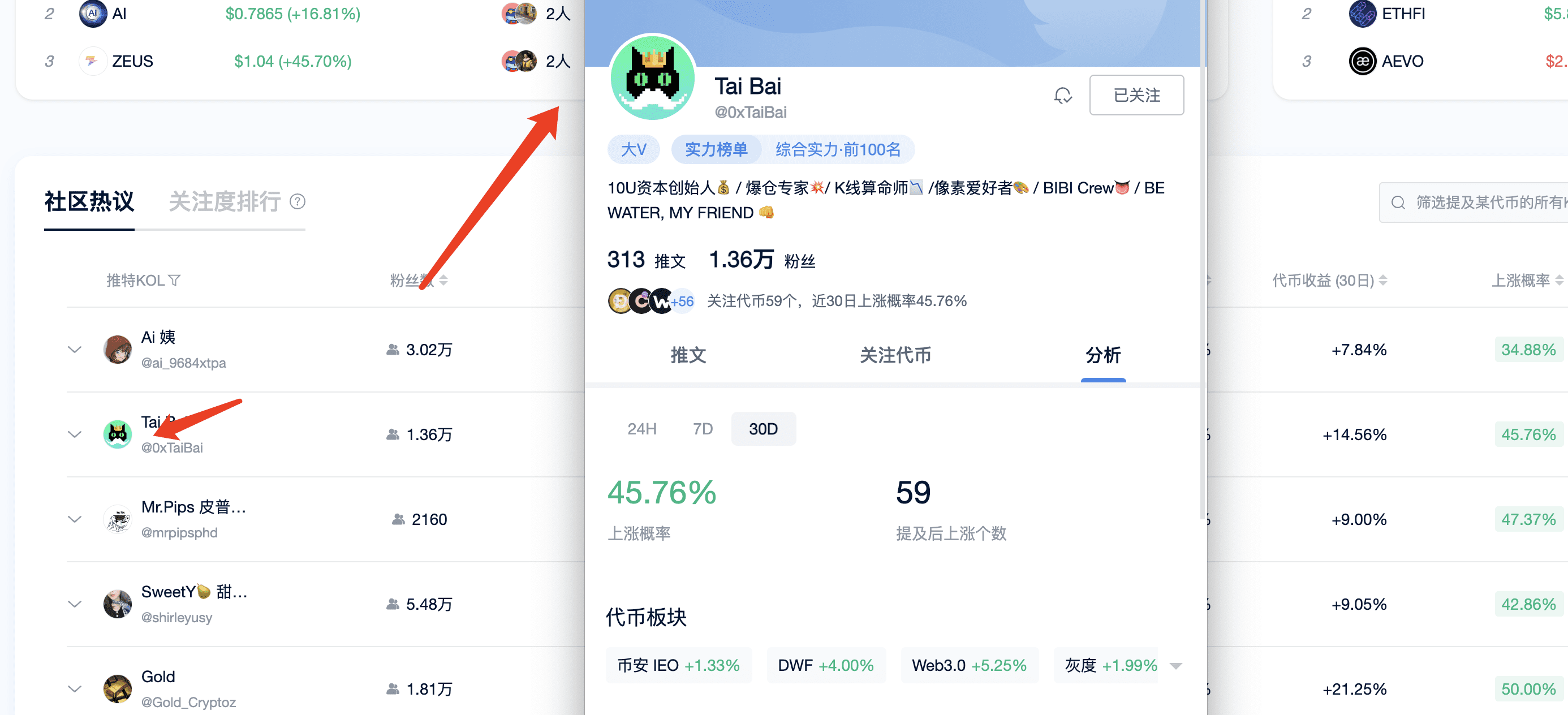

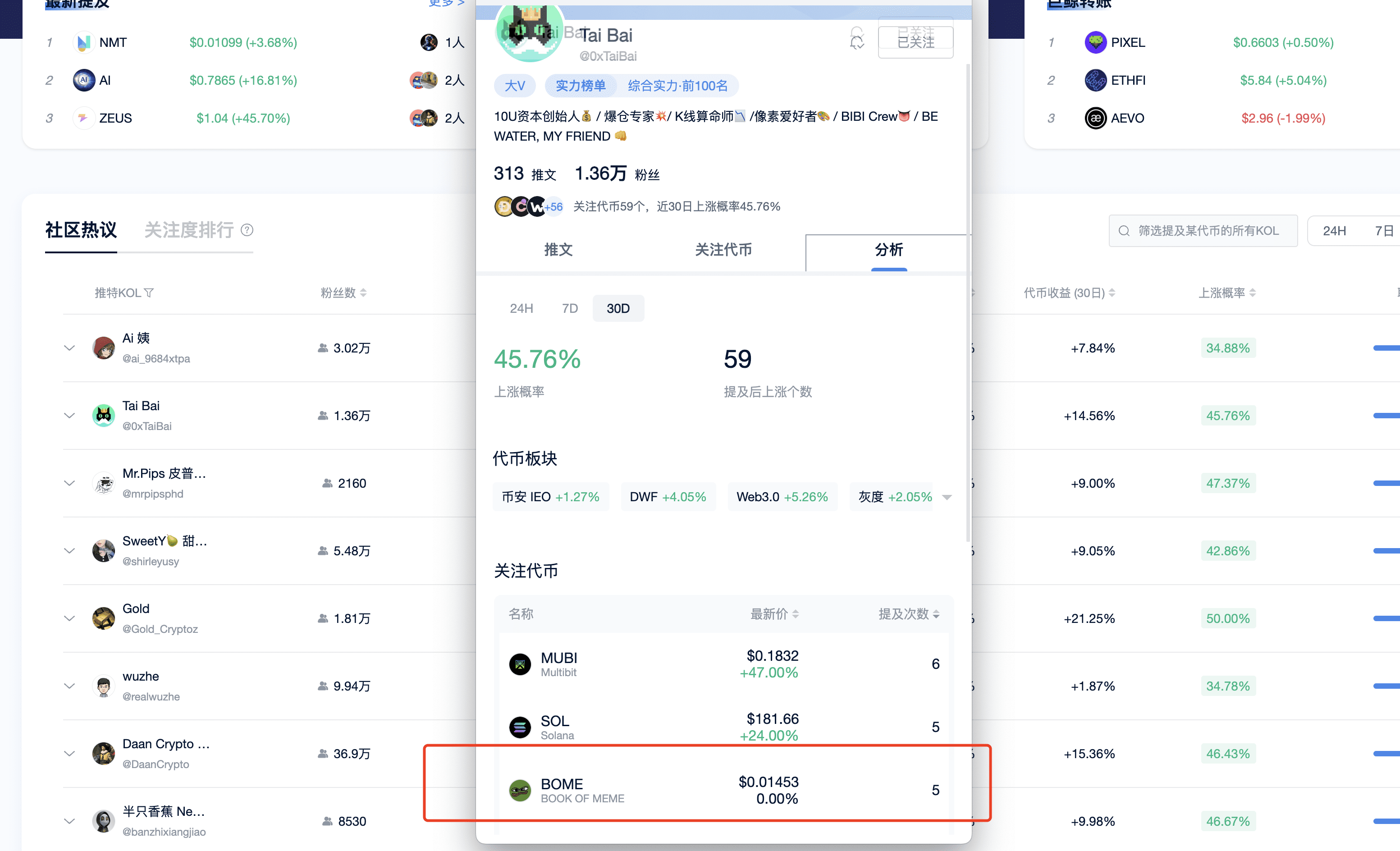

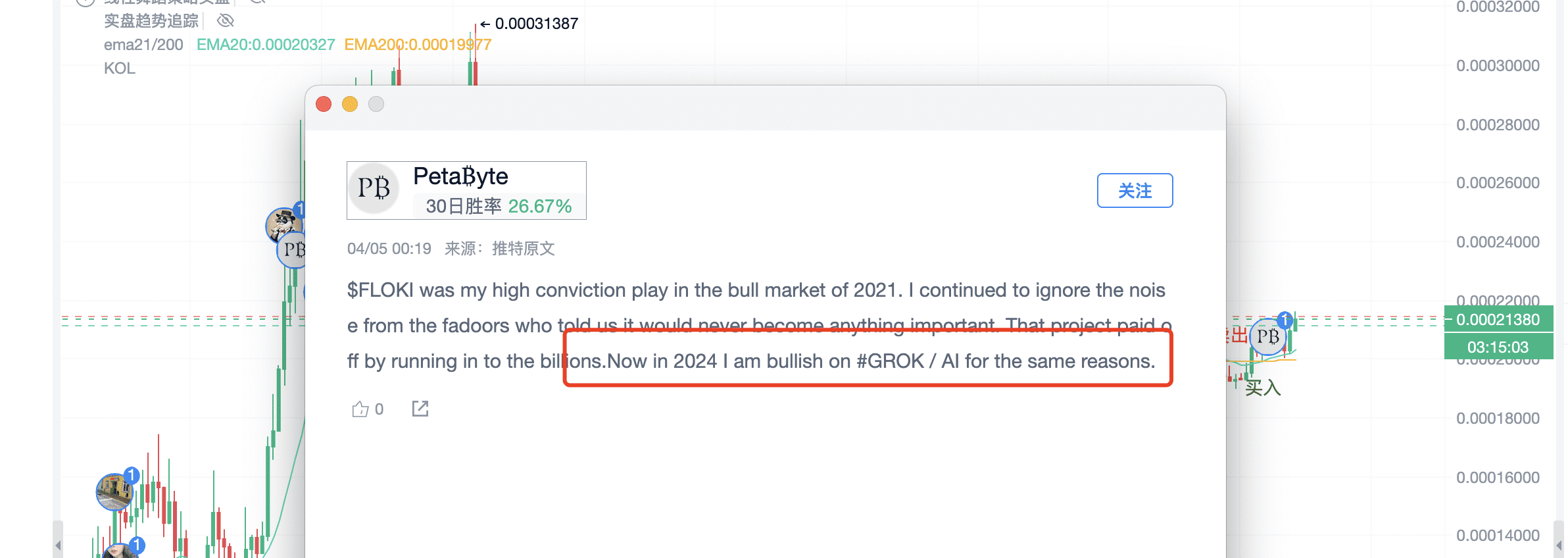

Randomly select a KOL avatar to see their evaluation. It can be observed that this KOL has a high win rate over the past 30 days.

Recommendation: It is mentioned that there is still room for an increase, so one can wait for a sol pullback to find an entry opportunity.

IV. Find High-Win-Rate KOLs

1. Select a 30-day period and pay attention to the coins mentioned by KOLs that have mostly risen, then follow them!

These KOLs have been carefully selected and are relatively high-quality big Vs, as shown in the image below, where 60 coins have been followed over 30 days.

The mentioned hot coins are mostly held by smart money holders, and one can see which coins they are following.

For example, this individual has repeatedly paid attention to mubi and bome.

This allows KOLs to express their views on the candlestick chart.

If uncertain, one can pay attention or enter the spot market.

2. Home Page—Three Steps to Find Golden Opportunities

This involves combining big Vs, on-chain data, and large transfers to automatically identify coins with short-term opportunities.

As shown in the image below, these are coins mentioned by KOLs that have risen. If they have already risen significantly, one can look for shorting opportunities in combination with indicators.

V. Practical Analysis Combined with Coin Types

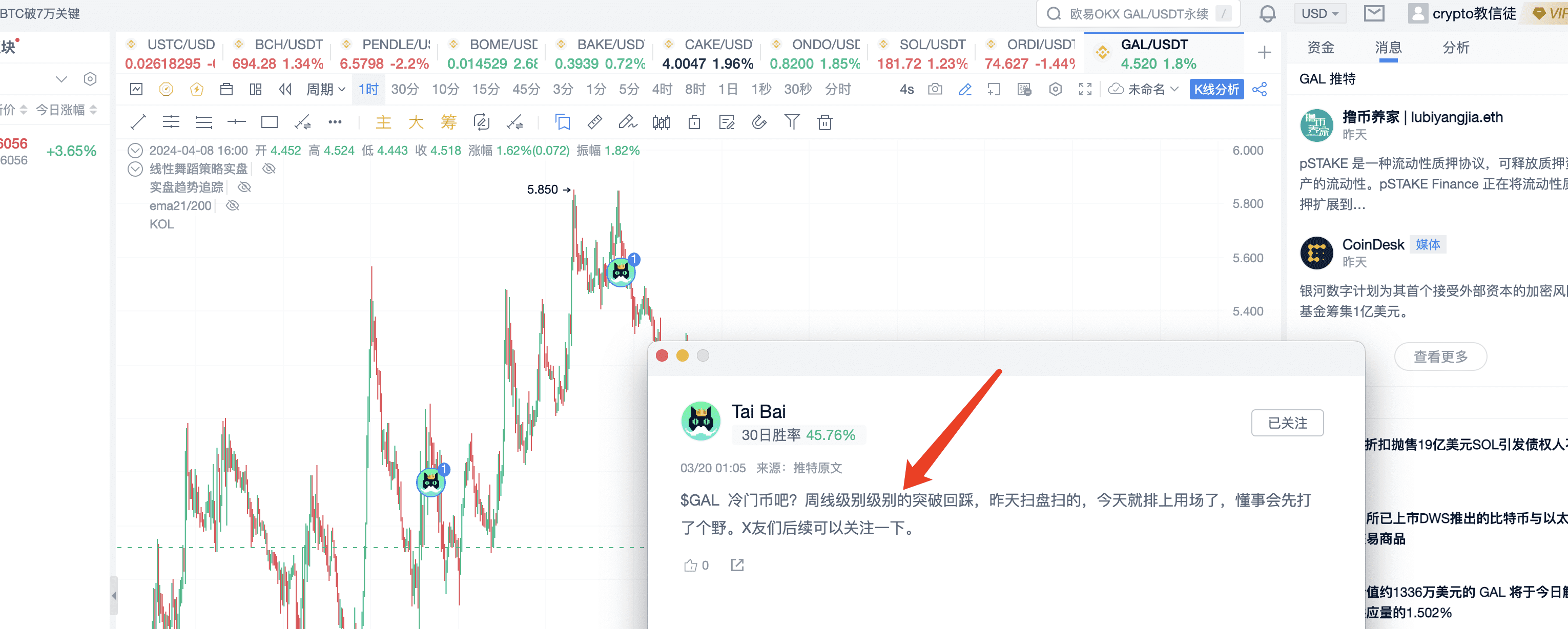

1. Analyze GAL

By looking at the candlestick chart, it can be seen that this coin has also been mentioned by KOLs with a high win rate.

It can be observed that gal, a less popular coin, needs to be monitored at the weekly level.

When looking at longer timeframes, it can be seen that there is still significant room for an uptrend from the last bull market. By combining indicators and ema, one can assess opportunities. In the image below, the coin is still a distance away from the four-hour golden cross ema21/200, so one can observe and wait until it reaches the golden cross 200.

2. Analyze polyx

The popularity is also good.

Analysis: It can be seen that there was a lot of KOL mention during the previous surge, but the recent popularity has declined, so it's not suitable to chase the rise. One can wait for polyx to return to the moving average and then assess the KOL's popularity before getting on board.

Seeing this KOL strongly recommending, it's important to click on the details to see the specific reasons. As shown in the image, this person has been following since 2021, but doesn't have a positive view in 2024.

Select another KOL to see

3. Analyze FIL

Only one KOL is paying attention

It can be seen that after the previous surge, it has been consistently declining.

FIL's ema21 has the opportunity for a golden cross

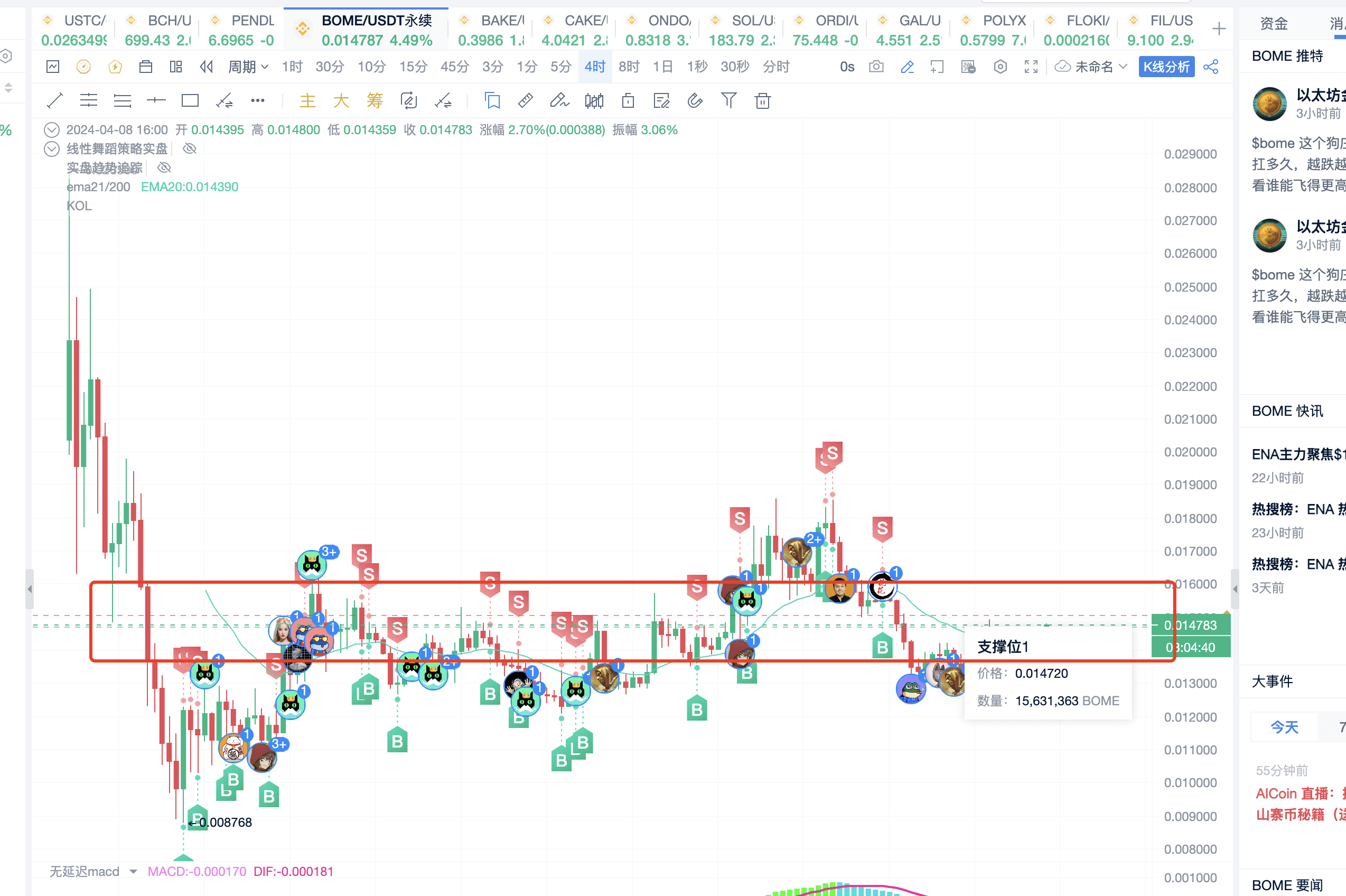

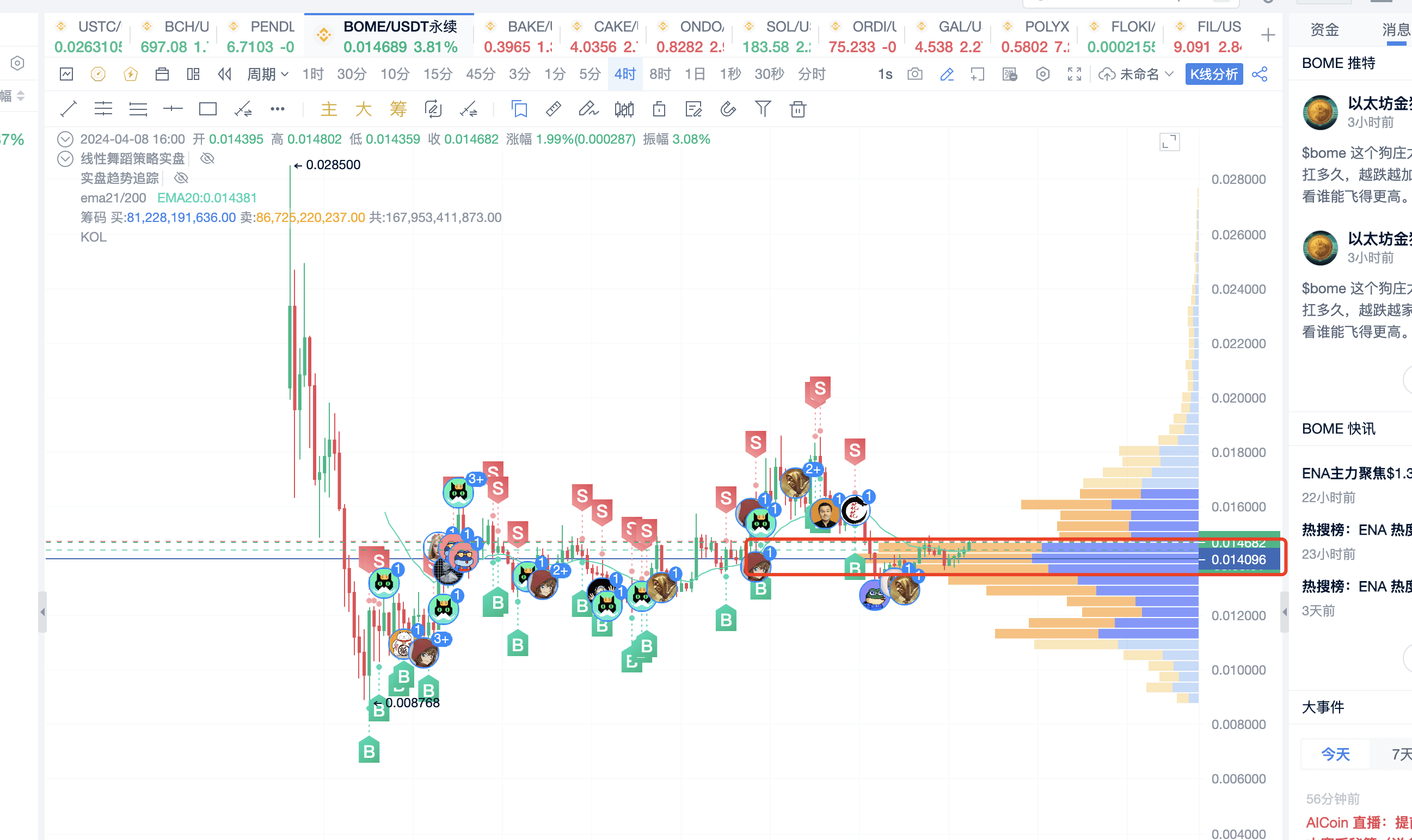

4. Analyze BOME

Check the high-win-rate KOL for popular coins

Multiple KOLs are saying it can be held for the long term. Combined with macd/ema analysis, one can look at the four-hour position and key support levels. It can be seen that it has been in consolidation.

Combined with the chip distribution, the holding cost is more than 20% above the current price.

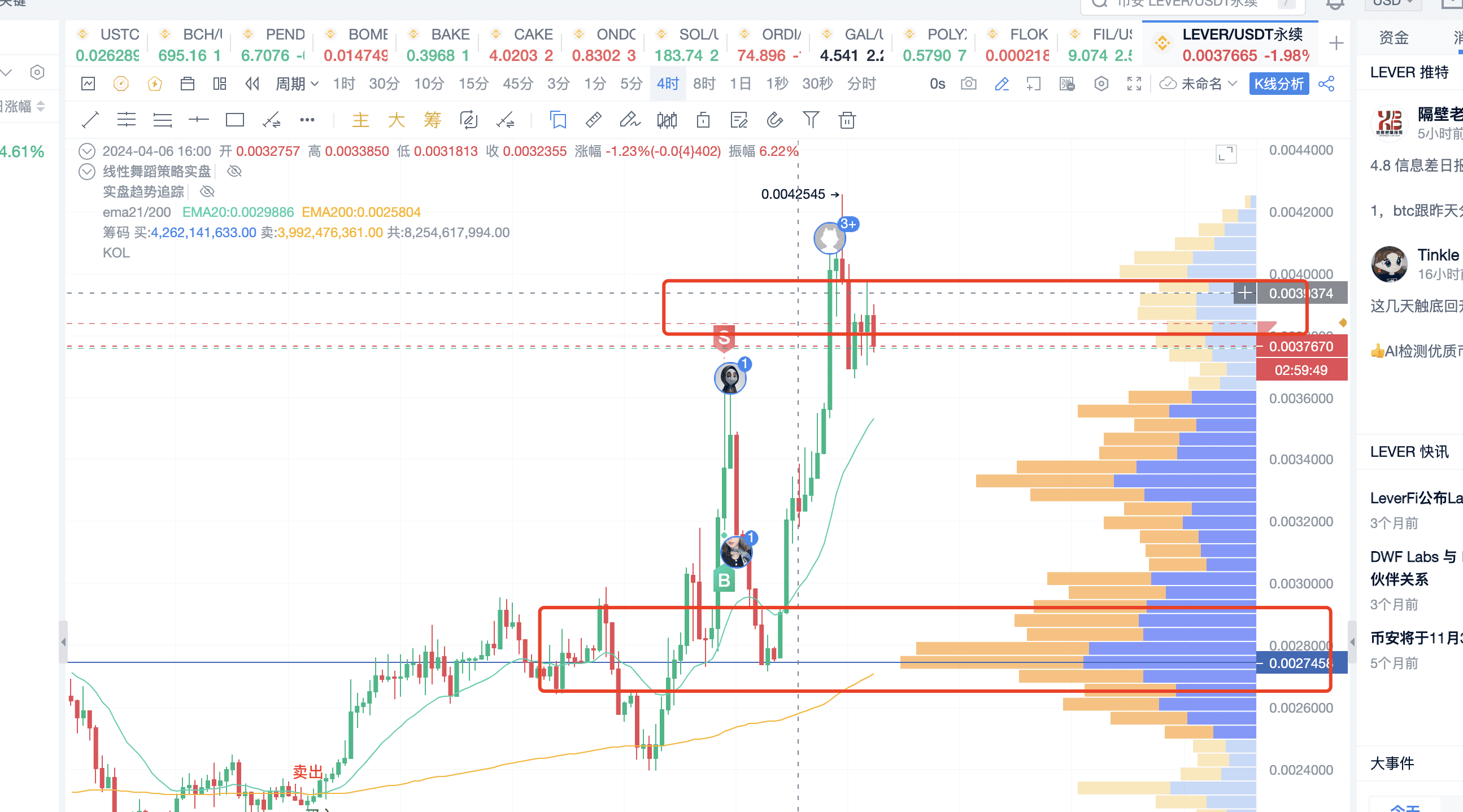

5. Analyze LEVER

Looking at the chip distribution, most of the holding costs are at the bottom, and it has been consistently declining in recent days.

Chip distribution, also known as volume-price distribution chart, essentially reflects the information of main force control, the fund situation of long and short games, and the change trend of market cost. Learn to identify main force behavior with chip distribution

By becoming a Pro member, you can view the volume-price distribution chart and KOL indicators: https://aicoin.app/en/vip/chartpro

For more live content, please follow AICoin's "News/Information-Live Review" section, and feel free to download AICoin PC-end

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。