Investors must closely monitor the behavior of long-term holders, as they are now the dominant force.

By Lucas Kiely, Chief Investment Officer at Yield App, CoinTelegraph

Translated by Baishui, Golden Finance

The time for Bitcoin halving is passing, and the frenzy around ETF seems to be accelerating the arrival of Bitcoin halving. In fact, the major event is only a few weeks away. Therefore, it is not surprising that halving has become a topic of discussion for cryptocurrency investors and the media. However, despite the predictable trading behavior that we can still expect after the important day, we are now in a very different market that requires different trading strategies.

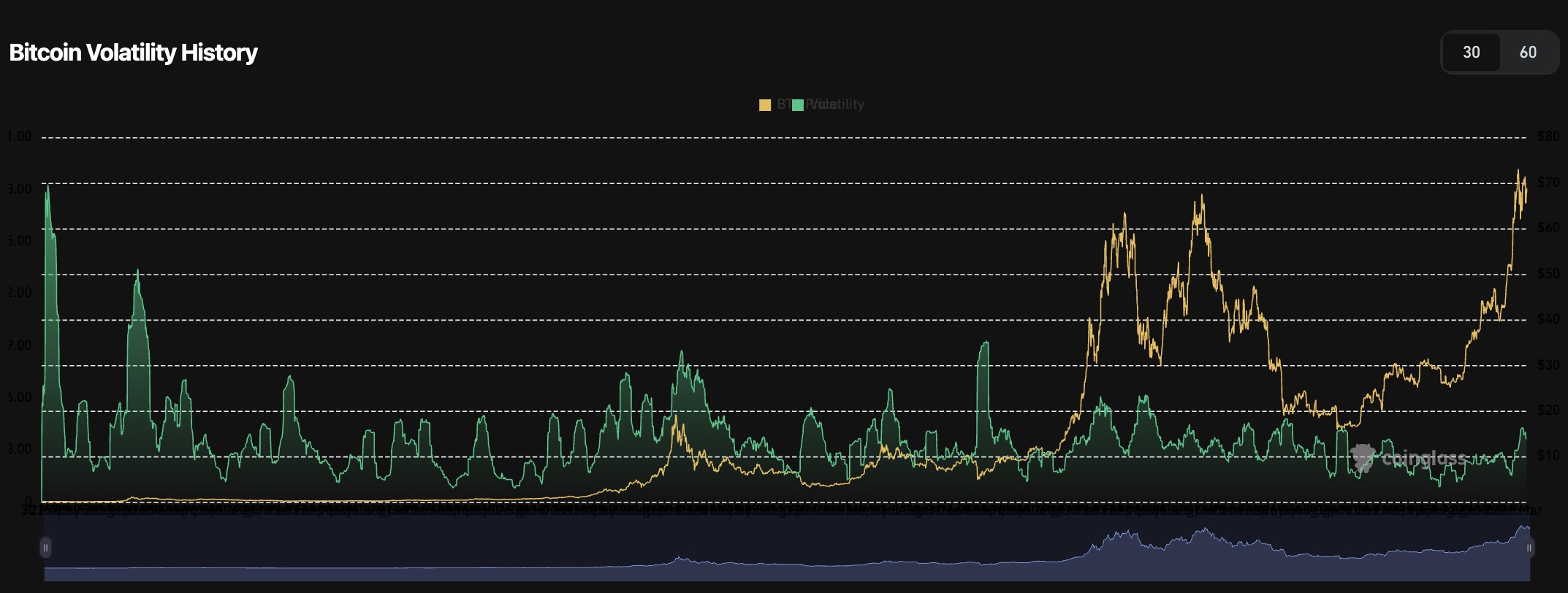

In the past three cycles, halving has been accompanied by a significant surge in volatility. We usually expect a 30%-40% sell-off within an average of 480 days after halving, followed by a sharp rise to a new all-time high. But this time, the arrival of spot Bitcoin ETF has changed everything.

To understand the future price movement of Bitcoin, we need to pay closer attention to the volatility of this asset. Over the past few months, as the excitement leading up to halving has intensified, we have seen the expected pullback. However, by the standards of previous cycles, these pullbacks have been relatively weak. This time, the adjustment in Bitcoin's price has been much smaller, not exceeding 25%. In fact, the latest decline was only about 15% before BTC rebounded to the $70,000 mark again.

This milder sell-off after halving suggests that the rebound will be weaker. Undoubtedly, Bitcoin will experience routine sell-offs after halving and will definitely set a new all-time high. Similarly, for traditional investors, the returns still seem to be exciting. But do not expect to see a price increase of over 600% as we did after the last halving in 2020. Those days are over.

So why is this happening? There are two factors at play here. First, the proportion of long-term Bitcoin holders has reached a record of about 14 million Bitcoins, accounting for over 70% of the total circulation of 19,670,043 Bitcoins. Over the past few months, as more and more holders adopt a "diamond hands" approach, a record number of Bitcoins have been withdrawn from exchanges into cold wallets.

But what has truly led to a significant shift in the situation is the arrival of spot Bitcoin ETF. Currently, the ETF has absorbed more BTC supply from the market than miners. Since its launch, the spot BTC ETF has been absorbing an average of about 10,000 BTC per day, while miners only produce 900 BTC per day. This has exacerbated scarcity and led to price increases.

Crucially, this also means that long-term volatility has significantly decreased, as ETF investors have a longer-term perspective compared to regular cryptocurrency traders. Although volatility has surged recently with the approach of halving, it is still far lower than the levels seen during previous halving periods. CoinGlass data shows that the 30-day historical volatility of BTC/USD has dropped from nearly 18% in April 2013 to around 4% at the time of writing. You would expect to see this percentage in a U.S. stock fund prospectus, not on a cryptocurrency price chart.

This is because the investors entering the spot Bitcoin ETF now are the same retail and institutional investors who have poured trillions of dollars into S&P 500 ETFs. They are long-term holders, with a minimum investment period of three years, and their decisions to buy or sell investments depend on long-term driving factors such as macroeconomic conditions, structural market changes, and long-term return potential.

So what does this mean for investors looking to profit from halving? They must think more like traditional equity investors rather than cryptocurrency investors. They must replace Messari with Morningstar (a global traditional fund data provider) to measure the ups and downs of the assets managed by the spot Bitcoin ETF. They must closely monitor the behavior of long-term holders, as they are now the dominant force.

If they want a 600% return, they will have to look elsewhere. This is not what we will see after Bitcoin halving. However, the trade-off will be a more stable and reliable return that does not overly distort the typical balanced investment portfolio's volatility. For most investors, this is more attractive than an asset with a 50/50 chance of skyrocketing or disappearing completely.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。