Zhou Yanling: How will the Bitcoin Halving Affect the Cryptocurrency Market? Will the Trend Rise or Fall after the Halving?

As the halving event approaches, many people are very concerned about the impact of the halving on the future market trend. Almost every day, many fans or new friends come to find Yanling, and there will be one or two inquiries about my views on the halving. So today, Yanling will thoroughly analyze and share my views in this article.

Bitcoin Halving Time: The fourth halving is expected to occur in late April 2024

According to Satoshi Nakamoto's original design, the Bitcoin blockchain's mining reward will be halved every 210,000 blocks. Based on the current block generation speed (an average of one new block every 10 minutes), the fourth halving is expected to occur in late April 2024, as it actually depends on the block generation speed, and the specific date may vary slightly. Some estimate that the fourth halving will occur between April 18 and 23, but the date is for reference only.

Since its inception in 2009, Bitcoin has always been a leader in the field of digital currency, attracting countless investors' attention. The halving event of Bitcoin has been stirring the nerves of the entire cryptocurrency market. So, what will happen to the Bitcoin market after the halving?

First, we need to understand what Bitcoin halving is: Simply put, Bitcoin halving refers to the halving of block rewards in the Bitcoin network after a certain number of blocks are mined. This mechanism was designed by Bitcoin's founder, Satoshi Nakamoto, to control the supply of Bitcoin. The total amount of Bitcoin is limited to 21 million, and the halving event determines the speed at which these 21 million Bitcoins are distributed.

Bitcoin's mining reward is halved, and the Bitcoin production is halved: Bitcoin halving does not mean a halving of the overall Bitcoin quantity. The issuance limit of Bitcoin is 21 million, a fixed number that will not change. Bitcoin halving refers to a halving of the block rewards for Bitcoin mining. Bitcoin is a decentralized cryptocurrency that operates through blockchain, without a central authority controlling it. Miners participate in mining to assist in the operation of Bitcoin, and the main incentive for miners to participate in the Bitcoin network is the block reward. The total issuance limit of Bitcoin is 21 million, and the block reward cannot be issued indefinitely. The way to control the total amount is through a halving of the block reward every four years.

In essence, Bitcoin halving is a predetermined event embedded in the Bitcoin protocol, which reduces the mining reward for new blocks by 50%. This event occurs every 210,000 blocks, considering that the average block time is about 10 minutes, it occurs roughly every four years. Initially, the reward for mining a single block was 50 Bitcoins. It is expected that in the next halving event in April 2024, the number of Bitcoins will reach 3.125.

The principle behind Bitcoin halving is deeply rooted in the deflationary monetary policy of this cryptocurrency, designed by its pseudonymous creator, Satoshi Nakamoto. Unlike central banks that can issue fiat currency without limit, Bitcoin introduced a hard cap of 21 million coins. Many believe that this scarcity will maintain the value of Bitcoin over time. Halving is a mechanism to ensure this scarcity, making Bitcoin increasingly difficult to obtain.

The halving process is not just a technical issue; it is a key function that supports the fundamental principles of Bitcoin. By reducing the speed of new coin generation, the halving event extends the mining time of the total supply, thereby extending the life of the mining incentive structure. This gradual reduction in the supply issuance mimics the decline in the inflation rate, a concept known as the "Bitcoin deflationary model."

This deflationary approach stands in stark contrast to the traditional fiat currency system, where central banks can influence inflation and deflation by controlling the money supply. Bitcoin's predetermined issuance schedule introduces a certain level of predictability and transparency to its monetary policy, setting it apart from traditional currencies and linking it more closely to limited natural resources.

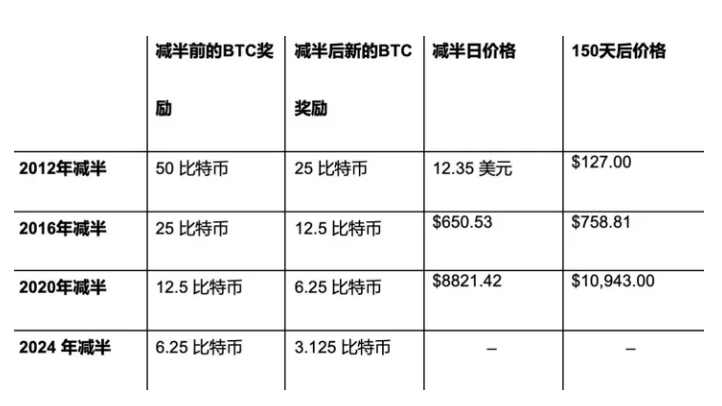

Yanling will review the history of Bitcoin halving: There have been three halving events in history

The first halving of Bitcoin occurred on November 28, 2012, and the price rose by about 90 times after the halving (lasting about a year).

The second halving of Bitcoin occurred on July 9, 2016, and the price rose by about 30 times after the halving (lasting about a year and five months).

The third halving of Bitcoin occurred on May 11, 2020, and the price rose by about 8 times after the halving (lasting about a year and six months).

The fourth halving of Bitcoin is expected to occur in late April 2024.

Since the birth of BTC in 2009, its underlying network has experienced three halving events, each marking an important milestone in its journey. The first halving occurred in November 2012, when the reward for mining a block decreased from 50 BTC to 25 BTC. It set a precedent for how the market and the mining industry would respond to the fundamental change in Bitcoin's new supply rate.

The second halving occurred in July 2016, further reducing the block reward to 12.5 Bitcoins. At the time of this event, Bitcoin was gaining more mainstream recognition and adoption, adding another layer of expectation and speculation about its potential impact. After the halving, the price of Bitcoin rose significantly. However, it is important to note that there are many factors that affect cryptocurrency prices, and attributing changes to a single event may be oversimplifying it, according to Yanling.

The third and most recent halving occurred in May 2020, amidst a global pandemic, reducing the mining reward to 6.25 Bitcoins. This event was unique due to the background of the world's efforts to cope with economic uncertainty. Many investors and enthusiasts saw Bitcoin as a potential hedge against inflation and financial instability. The next halving of Bitcoin is expected to occur in late April 2024.

Of course, past performance does not guarantee future results. Bitcoin has only been around for a little over a decade, and after the past three halvings, there have been multiple price increases. Will the fourth halving be the same? Will history simply repeat itself? No one can say for sure, but we can first consider why Bitcoin will rise after halving.

Why will Bitcoin rise after halving? Yanling believes there are mainly three factors: reduced supply, increased demand, and macro environment.

Bitcoin adopts the Proof of Work (PoW) consensus mechanism, which requires computational power for mining and dynamically adjusts the mining difficulty. As more people join Bitcoin mining, the mining difficulty continues to rise. What will happen when the mining difficulty rises? It means that miners need to invest more resources to mine, invest in higher-level mining machines, and incur higher electricity costs. However, with the halving of Bitcoin every four years, the block reward for miners is directly reduced by half. As costs gradually increase and the amount of Bitcoin that can be mined is halved, there is a saying that if the price of Bitcoin does not rise, mining will not be profitable. The price of Bitcoin must be higher than the cost of mining, so Bitcoin must rise! Yanling believes that this statement is not entirely correct. If the price of Bitcoin is lower than the cost of mining, miners can shut down their operations. As more miners shut down, the mining difficulty will decrease, and the cost of mining will be reduced, finding a new balance point.

- The cost of mining is not enough to explain the reason for the rise in Bitcoin, it still comes back to the nature of price fluctuations: supply and demand. Bitcoin halving means a reduction in Bitcoin supply, and if there is an increase in demand in the market, the imbalance of supply and demand will lead to a rise. The first halving was a long time ago, and after the second halving, there was an ICO boom, which brought a large amount of funds into the cryptocurrency field. After the third halving, there was the DeFi Summer, another wave of new blockchain applications that brought in a large amount of funds. The breakthrough development of the cryptocurrency industry has driven a significant increase in demand, coupled with the reduction in supply due to Bitcoin halving, which may be a more reasonable explanation. In addition, macro-environmental factors, the previous halving rally coincided with the massive liquidity injection by the Federal Reserve after the financial crisis, interest rate cuts + QE, and almost all risk assets in the world were rising at the same time.

Continuing from the previous paragraph, the fourth Bitcoin halving in 2024 indicates another reduction in Bitcoin supply, but whether it will rise or not depends on two other factors: Has demand increased? What is the macro-environment like?

The first condition for the start of a cryptocurrency bull market: New funds entering the cryptocurrency field

Demand will only increase if there is a new narrative. There needs to be new applications or an ecosystem explosion to drive more funds into the cryptocurrency market, pushing a significant increase in demand. The previous bull markets were driven by these narratives: ICO, the battle of public chains, DeFi, NFT… Narratives do not suddenly appear, but accumulate and brew over a period of time, and only erupt when the time is right. So, what potential narratives can we observe now? If we focus on the potential narratives that can bring in external funds, there are two major areas to closely monitor at the moment. The first is the approval of Bitcoin spot ETFs, which can bring in new funds for cryptocurrency investments. The second is RWA, real-world assets on the blockchain, asset tokenization, and how many real-world assets can be brought onto the blockchain. Both of these are new narratives that can bring in a large amount of funds into the cryptocurrency field. The previous narratives have not disappeared, they have just been dormant during the bear market, and the next wave may have another outbreak.

The second condition for the start of a cryptocurrency bull market: Macro-environmental alignment

In addition to narratives, the macro-environment must also be aligned. As cryptocurrencies gradually enter the traditional financial sector's field of vision, they are becoming an investment target that the mainstream investment sector will also consider. At this stage, it is becoming increasingly difficult for cryptocurrencies to have completely independent market trends, and their correlation with US stocks or other risk assets is increasing. The interest rate cycle of the Federal Reserve in the United States has just ended one wave, and the next cycle will start soon. How the next cycle will unfold is currently unknown and needs to be closely observed. In addition to the tightening or loosening of macro funds, there is also the attitude of various governments towards Bitcoin, whether more countries will list Bitcoin as legal tender, whether more financial services will accept Bitcoin as a payment tool, and whether more governments will accept cryptocurrencies as a form of asset, etc. These are all important factors that will affect changes in the cryptocurrency market.

So, in conclusion, the halving event is not the only factor that affects the rise in Bitcoin prices. The price of Bitcoin is also influenced by market demand, policies and regulations, technological innovation, and many other factors. The future is difficult to predict, and for us in the cryptocurrency investment community, the key is not to predict the market, but to make preparations for possible market trends. If the fourth halving event really triggers a cryptocurrency bull market, how can we position ourselves now? There are many different voices in the market about the direction of the market, and the Yanling team has collected and summarized the general opinions in the market, roughly divided into the following three factions:

- One group believes that after the Bitcoin halving, altcoins will enter a frenzy, lasting for two months, and this round of the bull market will end in June.

- Another group, based on historical experience, believes that there will be a major pullback next, and altcoins will explode at the end of 2024, replicating the previous market trend.

- Another group believes that after the Bitcoin halving, altcoins will rise but not in a frenzy, there will be a pullback for a few months, and Bitcoin will reach 200,000 by the end of the year, with altcoins peaking and being sold off.

So after summarizing all of the above, I wonder if everyone has taken it seriously. The halving event is an important milestone in the development of Bitcoin, and it will definitely have a certain impact on the Bitcoin market. However, while paying attention to the halving event, cryptocurrency investors also need to consider other factors comprehensively to make more comprehensive and accurate investment decisions. At the same time, investors also need to remain calm and rational, fully recognize the risks of Bitcoin investment, allocate assets reasonably, and achieve long-term stable investment returns. Looking ahead, with the continuous improvement of the Bitcoin ecosystem and the expansion of its application scenarios, Bitcoin is expected to continue to maintain its leading position in the field of digital currencies. However, when participating in Bitcoin investments, investors still need to remain cautious and vigilant, pay attention to market dynamics and policy changes, in order to adjust investment strategies in a timely manner and respond to potential risks and challenges.

So in the upcoming cryptocurrency market layout, Yanling wants to emphasize four points:

- Invest money that you can afford to lose (absolutely do not go all-in, only use spare money to participate).

- Buy coins with explosive potential (leave professional matters to professionals, if you don't know how to choose, you can ask Yanling).

- Manage asset security well (use secure exchanges, securely back up wallet private keys and mnemonic phrases).

- Continue to pay attention and be patient.

Finally, it is important to clarify that Bitcoin investment is not suitable for everyone. Before investing, everyone needs to fully understand their risk tolerance, investment goals, and financial planning, and make investment decisions that are suitable for themselves. At the same time, we need to maintain a learning attitude, constantly pay attention to new developments and opportunities in the field of digital currencies, in order to achieve better results on the investment path. Finally, I wish all cryptocurrency investors a smooth and prosperous journey in the cryptocurrency market, and may you all make a lot of profit!

【The above analysis and strategies are for reference only. Risks are self-borne. The article's review and publication may have a lag in strategy and lack timeliness. Specific operations are subject to Yanling's real-time strategy】

This article is exclusively authored by senior analyst Zhou Yanling (WeChat public account: Zhou Yanling). The author has been engaged in financial market investment research for more than ten years, mainly analyzing and guiding BTC, ETH, DOT, DOGE, LTC, FIL, EOS, XRP, BCH, ETC, BSV and other cryptocurrency contract/spot operations, with a solid theoretical foundation and practical experience. The author is good at combining technical and fundamental analysis, focusing on capital management and risk control, and has been recognized by a large number of investment friends for a friendly and responsible personality and decisive operations. If you need to know more about real-time investment strategies, trading techniques, operational skills, and candlestick knowledge, you can follow the teacher (WeChat public account: Zhou Yanling).

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。