Author: Superscrypt

Translation: Plain Blockchain

When people start to get involved in cryptocurrency, they often buy Bitcoin or ETH (the largest cryptocurrencies with market values of $1.4 trillion and $247 billion, respectively) to gain some exposure. As they delve deeper into the cryptocurrency ecosystem and encounter DeFi, they quickly realize that there is much more to do besides holding crypto assets to generate income, which is the lifeblood of the crypto economy.

Early participants are expected to earn substantial returns and drive the spread of cross-chain liquidity, which can be considered the spice of the cryptocurrency.

Although there are already a wide variety of options for earning income, there are increasingly creative new methods emerging for users and investors to earn additional income.

In this article, we first analyze the ways in which Ethereum holders can currently earn income (if you are not a beginner, please skip this section), and then delve into the next evolution of crypto income and security—Restaking. Specifically, we will cover what it is, the risks we should be aware of, current ecosystem participants, and finally explore the next steps we hope to see in the Restaking ecosystem to unleash its full potential.

1. Current Staking Options

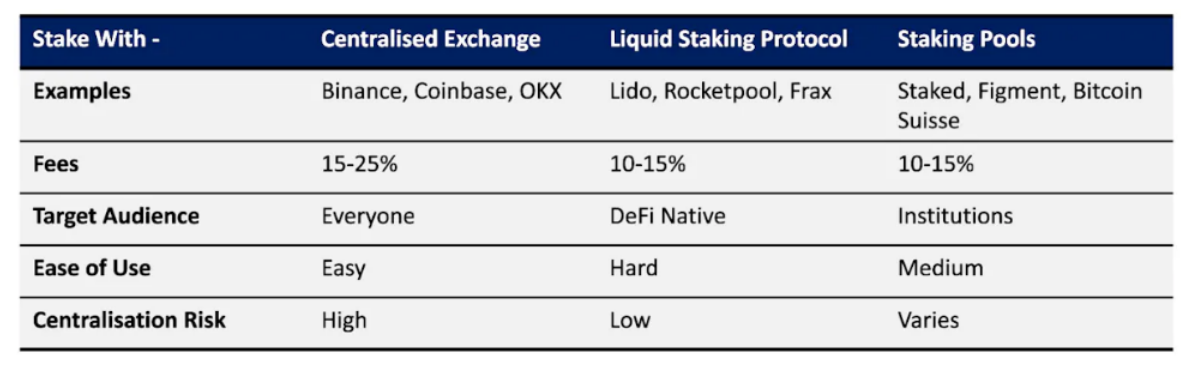

To stake native ETH and earn income, one must hold 32 ETH and run their own node. At the current price, this requires the holder to have $112,000, making the cost relatively high. In addition, there have been easier income options available early on, allowing anyone to stake ETH in any amount through:

1) Centralized exchanges (BN, Coinbase)

2) Staking pools (Staked.us, Figment); or

3) Liquid staking protocols (Lido, Rocketpool, Frax)

Through CEX, one can directly stake ETH with BN or Coinbase and earn rewards. This makes staking very easy for beginners to start earning income, but user assets face centralization and exchange platform risks—if the platform goes down, so does your ETH. If they choose to withhold assets, ordinary people are also powerless.

With staking pools, one can stake ETH with node operators who handle the technical backend and receive fees as a reward. This is aimed at institutional clients and, although still largely centralized, it is much better in terms of security.

Using Liquid Staking protocols, one can stake ETH in Lido or Rocketpool smart contracts. They aggregate ETH and launch validators to earn income, passing on a small fee to users. Unlike the previous options, when ETH is deposited into their contracts, users receive a Liquid Staking Token (LST) as a reward. This token represents a claim to their ETH and its staking yield.

Current staking options for cryptocurrencies such as ETH

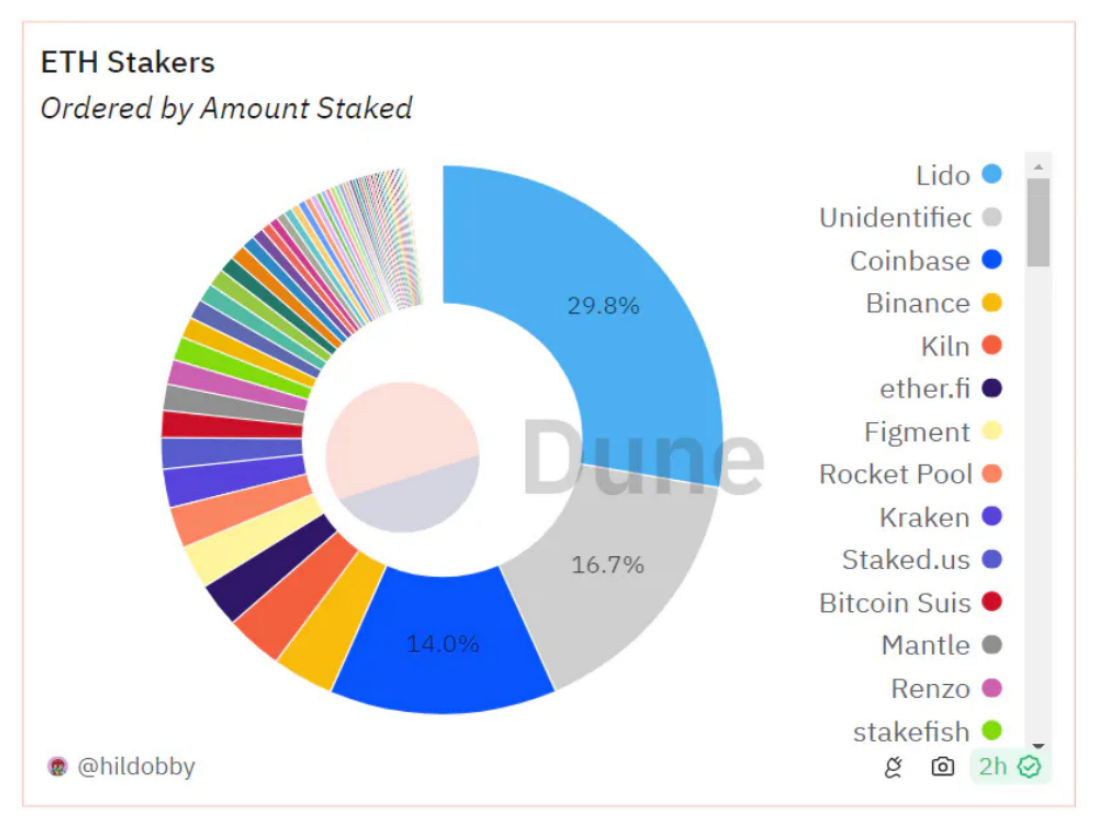

This Liquid Staking Token can then be used for other DeFi activities, such as using it as collateral to borrow in protocols like Aave. This allows users to increase their capital efficiency and earn returns from various sources. When it was first introduced, liquid staking was a key innovation and has since become a core building block (or "primitive") of DeFi. As of today, it accounts for 30% of ETH staking, making it the most popular form of staking, surpassing staking on centralized exchanges Coinbase and BN.

Source: https://dune.com/hildobby/eth2-staking

In the years following the introduction of LST, it naturally evolved into more complex ways of earning income and utilizing the staking concept. This is where the Restaking concept comes into play.

2. Restaking & EigenLayer

Restaking allows users to restake their staked ETH or LST in new pools that offer additional income. These pools secure other protocols, projects, and networks (such as aggregators, data availability layers, and oracles), and provide additional income. This is the evolution of current staking.

Through restaking, ETH holders can now earn more income by supporting numerous emerging projects, products, and protocols. The current core project of Restaking is EigenLayer—an infrastructure protocol driving this novel innovation and allowing Ethereum's proof-of-stake network to be flexibly used by other projects and protocols that wish to launch quickly and securely.

Whenever a new protocol is launched, they must build their own network for validation, usually using their own tokens for security, which have not yet had time to accumulate significant value and may be susceptible to 51% attacks. Due to limited resources and a smaller community, these newer protocols face challenges in achieving security and decentralization.

EigenLayer helps address this issue by acquiring a significant amount of value protecting the Ethereum network and applying some of that value to these new networks, but at a cost (in the form of additional income paid by new protocols).

What is the security number of ETH? In concept, Staking leverages some of the underlying security of ETH and applies it to another protocol, helping it inherit and "inherit" the security of Ethereum—an incredibly decentralized and economically secure system with a network value of $427 billion, 930,000 validators globally, 25% of which are staked. According to a paper published by Nuzzi in February 2024, attacking Ethereum would cost billions of dollars and be relatively difficult to overcome, making it "secure."

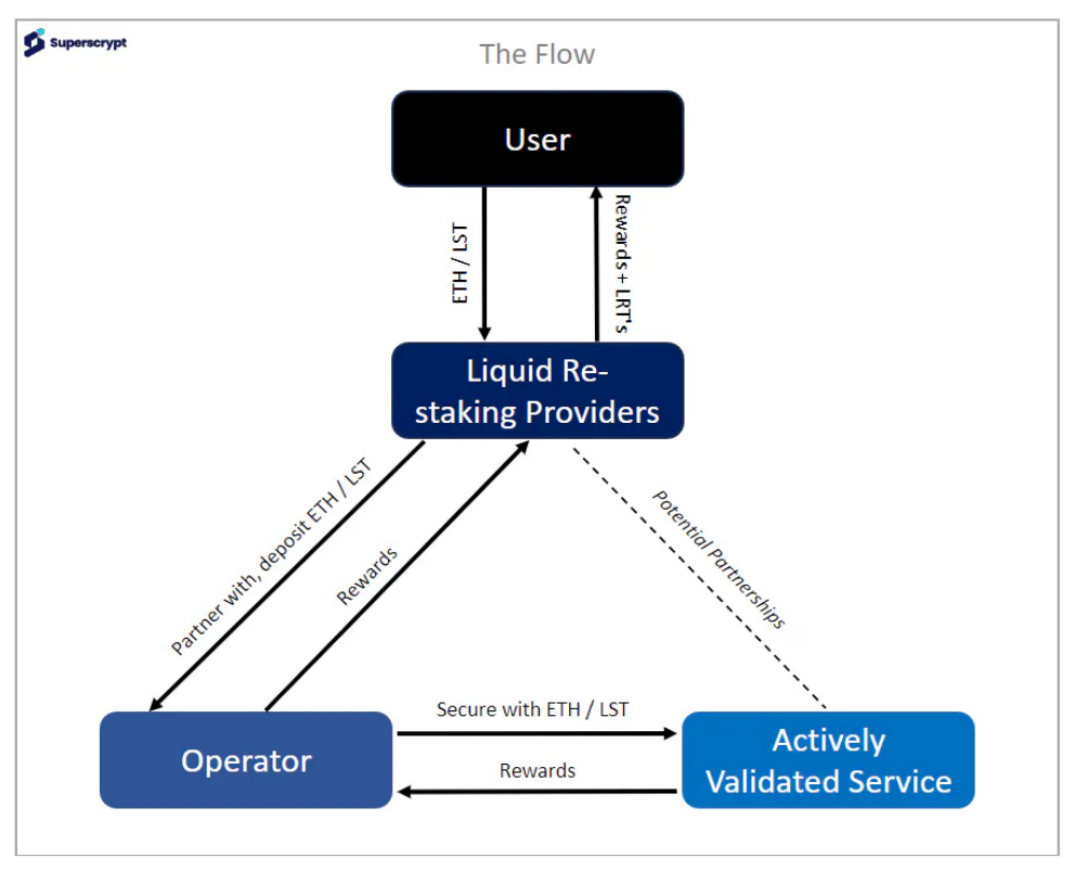

There are four key participants in the Restaking ecosystem:

1) Restaking stakers/users—those who wish to stake their ETH or LST to earn additional income.

2) Liquid Restaking providers—a user interface that abstracts the complexity of managing nodes and selecting different protocols to secure security. Users deposit ETH into it, allowing the provider to manage who to allocate to and what to allocate.

3) Operators—validators ensuring the security of new protocols.

4) Active validation services—protocols secured through restaking.

The entire process is roughly as follows:

3. Current Restaking Ecosystem

EigenLayer is relatively new, so what is the current state of the Restaking setup?

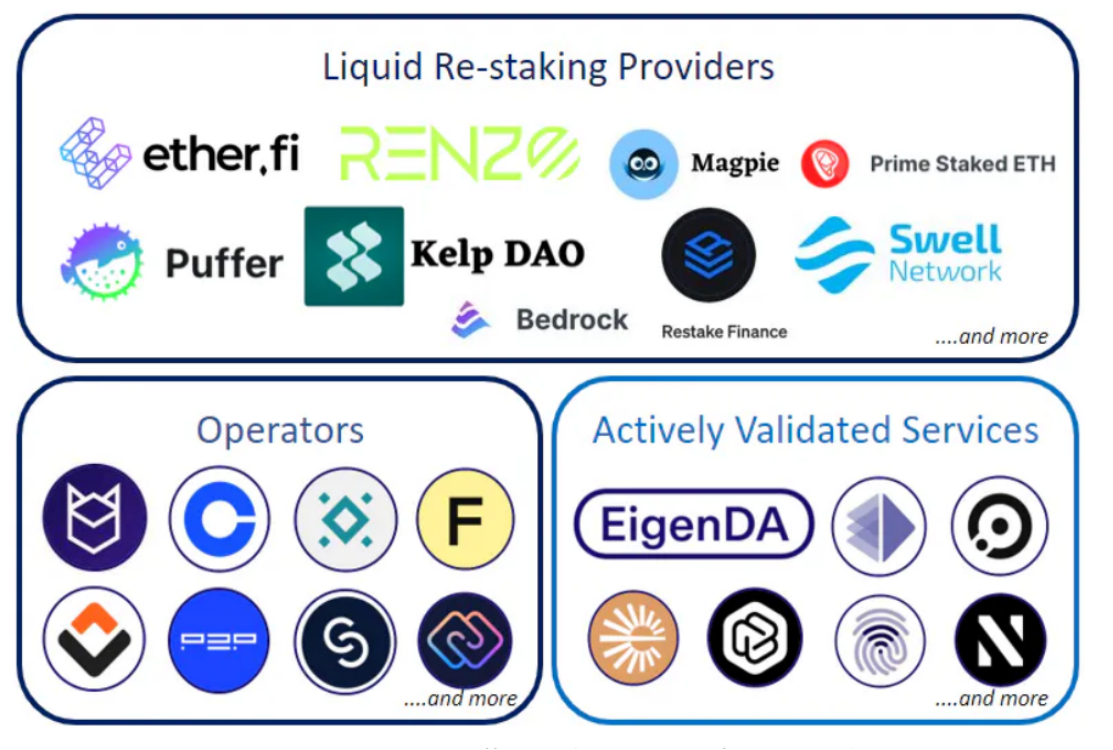

Active Validation Services (AVS): AVS is any system that wishes to use Restaked ETH to bootstrap its network, whether it's a rollup upgrade, data availability layer, oracle, coprocessor, or even a simple cryptographic memory pool. Relying on Restaked ETH for network validation and security allows them to avoid having to issue their own tokens to accomplish this task.

As of now, in EigenLayer's Holesky test network, unlicensed AVS has not yet been launched. Currently, as the mainnet phase 2 approaches in the second quarter of 2024, only internal and the first AVS—EigenDA (data availability layer)—are running on the test network. Phase 3 will introduce AVS beyond EigenDA, entering the test network and mainnet in the second half of 2024.

Currently, there are approximately 10 AVS plans set to launch in the coming months before becoming unlicensed. These AVS are spread across upgrade infrastructure (AltLayer, Lagrange), serializers (Espresso), other chains (Ethos for Cosmos, Near), L2/Rollup aggregators (Omni, Hyperlane), and other areas (Silence for privacy, Aethos for compliance), among others. The complete list can be found here.

Operators: Operators provide security for AVS (a unit of work that an AVS needs to complete, which may include validating transactions and finalizing blocks, providing data availability guarantees, ensuring coprocessor outputs, or validating rollup upgrade states) by Restaking their ETH on EigenLayer. They register on EigenLayer, allowing ETH holders to delegate their staked assets to them and then choose to provide a range of services to AVS to enhance the overall security and functionality of their network. The most active operators include Figment, P2P, Chorus One, and Kiln.

Liquid Restaking Providers: Cryptocurrencies would not have their uniqueness without another innovation to unleash liquidity—introducing "Liquid Restaking Tokens" or LRT. These tokens are an improvement on Liquid Staking Tokens (LSTs). Just as users stake ETH into LST protocols (such as Lido) and use the derivatives they receive (stETH) to participate in more DeFi activities, LRT users can now stake their ETH or LST in a Liquid Restaking protocol and use the derivatives they receive to participate in more DeFi activities. LRTs abstract away all the complexity from end users and act as an interface layer between users and EigenLayer operators. Their sole purpose is to maximize returns for users while minimizing risk exposure.

Complete ecosystem: https://www.eigenlayer.xyz/ecosystem?category=AVS%2CRollup%2COperator

4. Why is the emergence of Restaking groundbreaking, and what are the main concerns?

1) Key Positives:

Inheriting Ethereum's security

It takes years to achieve Ethereum's critical mass. Simply put, the estimated cost of a 34% attack on the Ethereum network in early 2024 (when the price of Ethereum was around $2,300) is approximately $343.9 billion, and the attacker would need until June 14, 2024, to gain control of the network. Even with marginal costs and efforts to inherit this decentralization and thorough security, it is an obvious choice. This makes Ethereum the foundational asset of programmable trust.

Driving innovation using existing infrastructure

A major focus and cost of any middleware or infrastructure solution is ensuring a decentralized validator set. This is undoubtedly a significant task. Through EigenLayer, these issues can be abstracted, focusing on building the best technology.

LRTs significantly promote retail adoption—LRTs provide seamless integration between Restaking and DeFi, allowing users to stake ETH or LSTs without worrying about which operators to work with and which AVSs to support. This has been proven by their success in attracting billions of total value locked (TVL).

2) Concerns:

Huge leverage or "Restaking"

Operators/Restakers will stake on multiple AVSs without any mechanism to prevent them from doing so. In fact, it is also in their financial interest to do so. We must understand the potential chain reaction this could cause. In short, if they are penalized in one place, then Ethereum will be lost, and security will also decrease elsewhere, potentially causing a chain reaction and potential issues. One solution here is to attribute security, but this means every dollar staked only protects one AVS, providing better security but lower returns.

Assuming this small subset is as honest as most, Ethereum as a whole is decentralized and secure, but does this very small subset protecting your AVS have the same characteristics? This is hard to guarantee and ultimately depends on the AVS to ensure. While EigenLayer conveys the importance of decentralization within each AVS, any project leveraging the security of a small number of validators may encounter issues.

Risk of using native ETH vs. Restaking with LRT—If you Restake LST with LRT (now with more options), and then stake it with AVS, you have three layers of smart contract risk for each AVS you Restake with. Ultimately, EigenLayer itself is just a smart contract system on Ethereum.

LRTs are essentially "risk managers," as they decide which AVSs to protect with their ETH, but do they have the skills to manage risk? While LRTs abstract away everything from retail users and allow them to access Restaking, they not only have to trust the LRT smart contracts but also trust that they can work with the right operators, choose the best AVSs, and manage risk accordingly. There is currently almost no evidence of any LRT's risk management capabilities, and it is hoped that no single LRT pursues maximum returns without considering risk.

A recent development is the collaboration between LRT providers and AVS to guarantee a specific level of security. For example, EtherFi has committed $500 million of Ethereum security to Lagrange and Aethos each, and $600 million to the Omni Network. With increased competition in this space, more such transactions are expected to occur, but it is important to understand that absolute security is more difficult to guarantee, as TVL depends entirely on the dollar price of Ethereum, and users have no lock-in period and can unstake at any time, making absolute numbers more unreliable.

Although technically in the "test network" stage, EigenLayer and the Restaking ecosystem are growing rapidly. We expect many missing pieces and simplified products to be added, as well as more innovations that can be unleashed through EigenLayer when it enters the mainnet and becomes unlicensed.

Here, we want to mention a list of some (certainly not comprehensive) innovations and missing pieces that we think will be very interesting when EigenLayer enters the mainnet and becomes unlicensed.

In Restaking, we are excited about innovation and some unfinished aspects… Restaking is in its early stages, and there are several undeveloped aspects that will help realize its full potential by simplifying stakeholders and reducing user and liquidity friction.

3) Key Innovations:

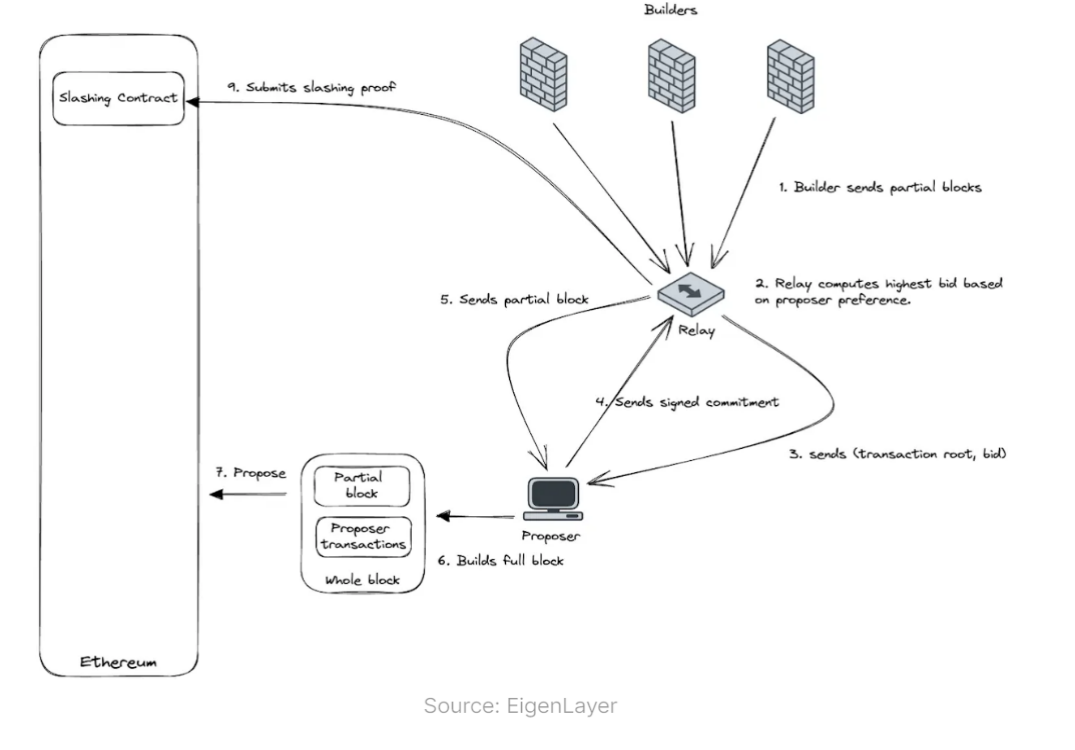

A. MEV

In addition to inheriting trust in decentralized security and economic security from Ethereum, you also inherit Ethereum's inclusive trust, meaning that these operators (validators) are Ethereum's validators (also proposers), which opens up many possibilities for innovation (and some necessary risk controls).

This allows for changes to the inclusion, ordering, and structure of blocks, ensuring the integrity of MEV management through EigenLayer. An example could be proposers adding new transactions to blocks (as with EIP-1559), which may enhance resistance to censorship, or block proposers committing to return front-running or liquidation profits to, for example, Uniswap pools. Furthermore, for rollup upgrades, managing MEV includes having decentralized serializers or even threshold encryption, all of which can become AVSs! Here is an example of MEV Boost+.

It is important to note that some risks may arise here, especially as EigenLayer develops, such as EigenLayer operators potentially having exclusive order flow or extracting more cross-domain MEV, as the operators here are also builders and validators. A good example is if an EigenLayer node responsible for updating oracles is also a current Ethereum proposer, they can locally construct blocks and gain MEV related to oracle updates.

B. Decentralized AI

Although decentralized AI is still in its early stages, the potential opportunities that using EigenLayer could bring are fascinating. This is not surprising, as the founders of EigenLayer have a deep background in AI research. Recently, Ritual announced a partnership with EigenLayer, where EigenLayer will provide a higher degree of decentralization and security for Ritual's AI operations than they could achieve by bootstrapping their own network. But what else can AI and EigenLayer achieve?

Let's start with an example from a recent Unchained podcast featuring EigenLayer's founder. We all know that Web3 wallets are in desperate need of an upgrade. Now imagine running an AI model that can execute transactions or bridge assets for you based on natural language. It's like calling your broker and asking them to buy stocks for you, and they say it's done. The end user doesn't need to worry about which trading platform was used or where the assets are custodied. All of this is protected by the operators signing intentions and transactions. A natural language-driven transaction protected by Ethereum.

Another example could be using this security to ensure the use of coprocessors in AI inference. The inference protocol runs off-chain, and then the answer is returned, but how do you trust it? One way is to use ZKML, which is a good approach but still under heavy development. A simpler approach is just a security pool supporting the answer. This cryptographic economic security adds trust to the AI inference protocol and, in the event of incorrect claims, there is a pool that can allocate capital accordingly.

This is just the beginning, and we can expect to see many other innovations emerge. In fact, as we move forward, we expect many AI projects that did not include EigenLayer in their roadmap to realize that this shared trust model is a great starting point for incorporating cryptographic economic security into their protocols.

C. Zero-Knowledge Proof Verification

Ethereum is a very good general-purpose virtual machine. You can build zero-knowledge verifiers on it, but every operation has a cost, otherwise you may potentially be sending junk to the system. The cost of each zero-knowledge verification depends on SNARK, which is usually cheaper than STARK, and Mina's IPA commitment scheme.

Given that this cost is quite high, it may be more effective for operators on EigenLayer to participate in off-chain zero-knowledge proof verification and prove the correctness of the proof on-chain, which is also emphasized in the EigenLayer whitepaper.

The Aligned Layer team (which will become an AVS) is addressing this challenge by building a layer for verification and aggregation, which sits on top of EigenLayer and can be used with any proof system. In fact, this can also work very well with optimistic proofs, and they are actively exploring fraud proofs to reduce proof time windows and achieve better finality.

D. Optimized Payments between AVS and Operators

As AVS becomes more unlicensed and numerous, understanding how much they pay to operators to ensure the security of their networks is crucial. Are they paying too little, too much, or just right? This requires serious risk and security modeling, understanding the cost of corrupting protocols, the amount attackers could profit, and ensuring the former always exceeds the latter. Anzen from Hydrogen Labs is attempting to address this issue by building an economically secure oracle that brings the required data on-chain and dynamically adjusts the fees paid to operators to ensure they are within a security margin.

E. Seamless Integration between Operators and AVS

Node operators want to integrate quickly with the best AVS to ensure optimized returns. However, integrating each AVS will have different CLIs for management and different integration paths. What if there could be a single interface allowing for seamless integration between operators and AVS? Although still in the early stages, the team at Nethermind is working hard to achieve this, and we can clearly see how this will further create a frictionless experience.

F. EigenCerts

Although still in development and associated with the aforementioned security attribution model, EigenCerts is built for AVS, allowing for the aggregation of signatures and their publication to the mainnet, detailing the attribution of every dollar Restaked on AVS to an operator. Once this feature is enabled, we will see how Restakers want to view this certificate and ensure that their staking is not allocated to too many AVSs, even if that may reduce returns. We can see some early-stage code here.

5. Conclusion

EigenLayer brings a transformative future to Web3, providing a scalable and secure foundation for Ethereum innovation and beyond. While there are some risks, the high returns make taking on these risks more tempting, but we hope that key stakeholders here take risk management seriously and address these concerns in a proactive manner. EigenLayer has the potential to disrupt the Web3 ecosystem and drive innovation at an unprecedented pace, and we look forward to the future developments.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。