Author: Paradigm

Translation: Plain Blockchain

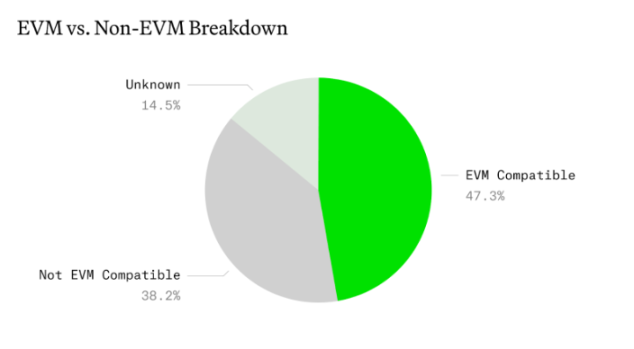

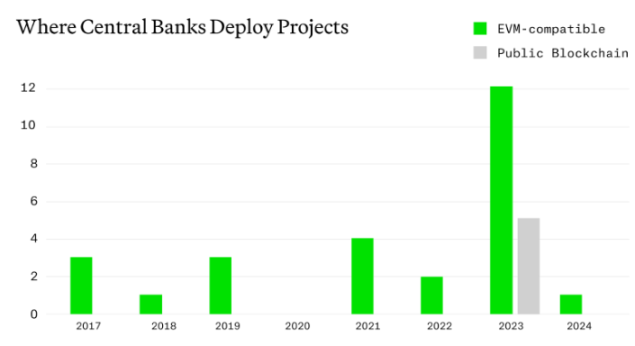

We collected data on 63 blockchain-related experiments led by central banks of G20 member countries. We found that in different application scenarios such as central bank digital currency (CBDC), tokenization, DeFi, etc., a considerable number of projects (47% in the sample) are compatible with the Ethereum Virtual Machine (EVM), which means they are based on Ethereum's technology stack. Furthermore, an increasing number of projects are being launched on public blockchains, proving that public, permissionless infrastructure does not conflict with the needs of regulatory agencies.

Our research results highlight several important facts:

Innovation always occurs at the edge and is eventually adopted by existing institutions. Therefore, hindering innovation will inevitably reduce the ultimate scope of mature technology. Even though central banks are skeptical of cryptocurrencies (indeed they are), they are still leveraging battle-tested permissionless world technology with their unique background. If the U.S. government stifled innovation in information and communication technology (ICT), Fedwire communications might still be using telegraph machines and Morse code. As a result, central banks are beginning to move beyond basic CBDC and payment projects and are now exploring tokenization and DeFi. These projects are becoming increasingly complex and are being deployed more frequently on public, permissionless blockchains.

In our view, the following are some of the most interesting projects:

Mariana Project: A cross-border foreign exchange project using tokenized central bank currency and an Automated Market Maker (AMM) on the Ethereum Sepolia test network.

Guardian Project: Three sub-projects aimed at building liquidity pools, structured notes, and asset-backed securities using Ethereum's second-layer solutions for trade finance.

It is still too early to predict how many projects will be deployed on public networks by 2024, but we believe that more projects will emerge from now on. As mentioned earlier, the Monetary Authority of Singapore (MAS) has launched some of the most innovative projects in this field. MAS is unquestionably a leader in this area, and its actions indicate that deploying projects on blockchains with permissionless validator sets does not fundamentally violate sanction laws.

Network effects are very important, and we believe this once again demonstrates that Ethereum has the strongest developer ecosystem among today's major tier-one chains. According to some rumors, we have heard that some traditional financial institutions have abandoned proprietary enterprise blockchains in favor of EVM-based blockchains due to the strength of the developer community (e.g., development tools, human resources, etc.).

Open-source software has been battle-tested. Currently, most of the internet runs on Linux-based servers, and the future of the financial industry is no exception. Cryptocurrencies often have adversarial aspects, but one often underestimated benefit is that projects deployed on public blockchains (as well as the blockchains themselves) have undergone significant stress testing in the wild, both in terms of security and economic design.

The United States is falling behind, but it has the opportunity to create a positive feedback loop. In our sample, the United States has completed 5 public projects, while Singapore, with a significantly smaller capital market size, has completed 8 projects (some of which have additional stages that we did not separately record).

At first glance, this may not seem very optimistic. However, as long as other countries continue to leverage EVM-based open-source software projects, we believe the United States has the opportunity to lead by being the home to many of the most ambitious builders. As U.S. technology is exported to other parts of the world, American values will also be disseminated. We are particularly excited to see the New York Federal Reserve Bank has started adopting Rust technology.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。