Tracking real-time hotspots in the currency circle, seizing the best trading opportunities. Today is Wednesday, April 3, 2024, and I am Yibo! We do not predict trades, but actually observe market fluctuations (narrowing, diffusion), structure (market batch structure), and sentiment (external market such as US stocks, the US dollar, etc.). As a trader, your trades affect prices, and prices also affect your emotions and behavior.

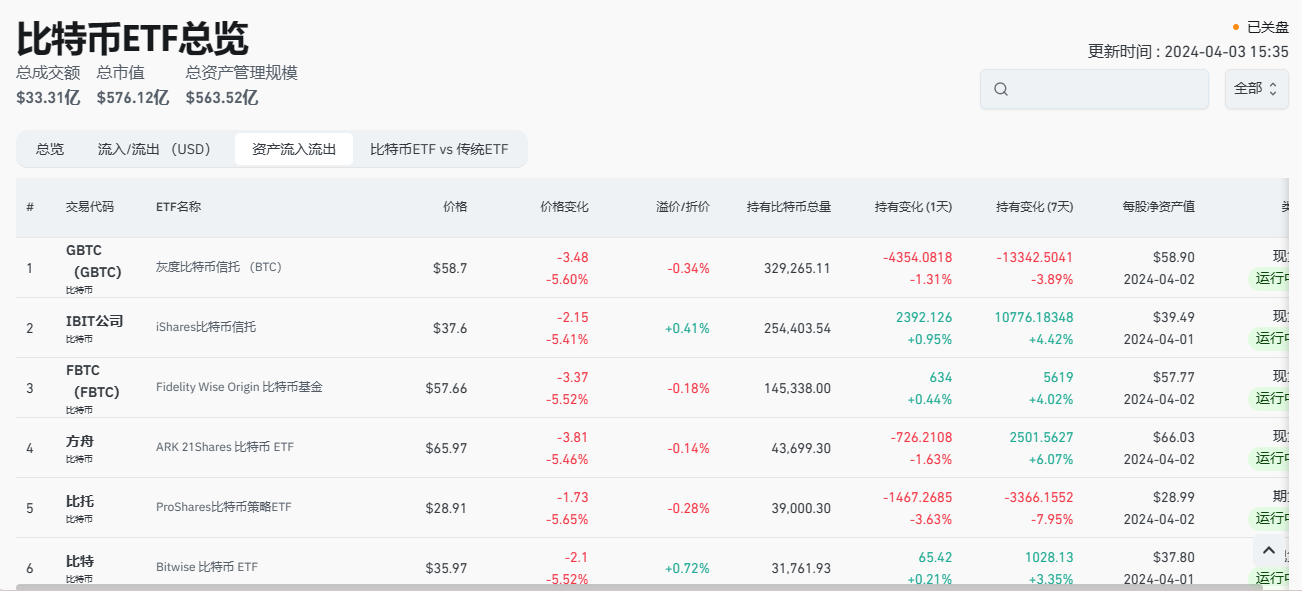

With Powell's hawkish speech on March 31, the expectation of interest rate cuts has been diminishing. Bitcoin plummeted for two consecutive days on April 1st and 2nd, breaking through the 30-day moving average support, dropping from a high of 71k to 65k, a drop of over 8%. Some say that this is due to the diminishing expectation of interest rate cuts, the rise in US bond yields, the rise in the US dollar index, and the decline in US stocks, which led to the linkage of Bitcoin. However, gold, like a runaway horse, continued to climb despite the diminishing expectation of interest rate cuts, already breaking through $2280. How do we explain this? The only explanation is that the macro aspect is a smokescreen. Let's take a look at the changes in the data of Bitcoin spot ETFs. ARKB had a net outflow of approximately $87.5 million yesterday, GBTC had a net outflow of $81.9 million, according to on-chain monitoring data. The Bitcoin ETF ARKB, launched by Ark Invest and 21Shares, had a net outflow of approximately $87.5 million yesterday, marking the second consecutive day of net outflows. Grayscale's GBTC had a net outflow of $81.9 million, while BITB had a net inflow of $4.3 million. IBIT from BlackRock had a net inflow of $150 million, HODL had a net inflow of $6 million, Fidelity's FBTC had a net inflow of $45 million. DEFI had a net inflow of $1 million, Invesco's BTCO had no fund inflow/outflow, BRRR had a net inflow of $4 million, and Valkyrie's BRRR had a net inflow of $3.7 million. From April 2nd to the present, there has been a net inflow of $36 million. In fact, except for Grayscale, ARKB, and the rest, all other ETFs had a net inflow, and the rest of the ETFs were in an inflow state. In terms of news, the US non-farm payroll data for March will be released this Friday, which will determine whether there will be an interest rate cut. In fact, all of these are the purposes of institutions to use to suppress the market and absorb funds.

Bitcoin touched the support level near 64,000 yesterday, and the daily closing was also a solid bearish candlestick. It also represents strong selling pressure yesterday, and there was a small rebound at the opening today. Therefore, it is necessary to pay attention to the resistance level near 66,700 within the day. If it breaks through, it can continue to look at the range of 68,500-70,000. However, if there is no good breakthrough in the short term, there will still be a test of the support level. It is difficult for the daily level to effectively break through the previous low of 60,000. If the non-farm payroll and unemployment data released on Friday are positive, it will usher in a major rebound for BTC. The 4-hour level has effectively supported the 200-day moving average. Referring to the previous two times, it bottomed out at the 200-day moving average and then started a major rebound.

The market for Ethereum reached the support level near 3200 again yesterday. Currently, the resistance level within the day can be focused on at 3420-3480. After breaking through, continue to look at the weekly resistance level of 3720, which has not been reached. The current price is running near 3303. After breaking through the previous low on the hourly level, it quickly rebounded, forming a bullish divergence structure and a rebound. The short-term pressure is near 3350, and the probability of a breakthrough is not high. The short-term trend is in a bottom oscillation. The 4-hour level is gradually decreasing in volume, showing a consecutive upward trend. The short-term market trend is clearly resistant to stopping the decline, and it is expected to undergo an oscillating adjustment. After stabilizing, there will be a consecutive upward rebound.

YGG is a relatively active currency in the chain game ecosystem. On April 1st, it surged to 1.777 but fell back after encountering resistance, and today it broke down to 1.19. Recently, YGG has had a lot of narratives. YGG has established a strategic partnership with the blockchain game center Iskra. The chain game guild, Yield Guild Games (YGG), has begun to explore the next major evolution, transforming from a chain game guild to a chain game guild protocol. Although YGG fell below the support level today, the trading volume is actively shrinking, and the order book volume ratio shows no significant selling pressure. A major rebound will occur at any time. Patiently hold and wait for opportunities. Similarly, for spot trading, it is advisable to build positions near 1.1!

In this market, it ultimately comes down to ability. If your ability is insufficient, what the market gives you will eventually be taken back. Therefore, when your wealth exceeds your ability, you need to control the drawdown, even though this control is futile because that kind of profitable arrogance and arrogance will ultimately destroy a person's rationality. However, in the capital market, we do not need to worry about the situation where our wealth is lower than our ability because this kind of imbalance will ultimately be corrected by time. If it is not corrected, there is only one reason, which is that your ability is insufficient. If you are still in a state of confusion, do not understand the technology, do not know how to read the market, do not know when to enter the market, do not know how to set a stop-loss, do not know when to take profit, randomly add positions, get trapped in bottom fishing, cannot hold onto profits during market volatility, and cannot seize the market opportunities. These are common problems among retail investors, but it's okay. Come to me, and I will guide you in making the right trades. A thousand words are not as good as one profitable trade. Instead of frequent trading, it's better to be precise, making each trade valuable. What you need to do is find me, and what we need to do is prove that what we say is not empty. 24-hour real-time guidance for trading. Market trends change quickly, and due to the impact of review timeliness, real-time layout based on actual trading is the main focus for the subsequent market trends. Coin friends who need contract guidance can scan the QR code at the bottom of the article to add my public account.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。