Original Author: The DeFi Investor

Original Translation: TechFlow

The real-world assets (RWA) sector is one of the areas with the highest long-term potential. This is clearly not just a short-term narrative.

Tokenizing real-world assets brings many benefits:

More convenient access

Transparency and auditability

Near-instant settlement

Composability (imagine opening a tokenized car loan on decentralized money markets like AAVE)

I believe that cryptocurrencies will play an important role in the RWA/tokenization industry.

In this article, I will discuss the reasons for my bullish view on RWA, some RWA projects on my watchlist, and strategies for choosing the right coins in this field.

Reasons for my bullish view on RWA

Real-world assets in the cryptocurrency space refer to the tokenization and on-chain representation of tangible assets.

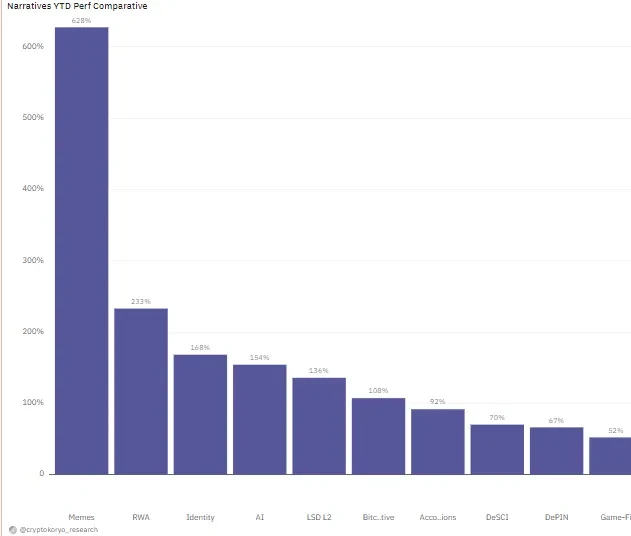

According to Crypto Koryo's dashboard, the narrative around real-world assets has been the second best-performing narrative this year, surpassing artificial intelligence.

However, the total market value of real-world assets in the cryptocurrency industry is still relatively small: slightly over $9 billion according to Coingecko's data.

In context, Boston Consulting Group predicts that by 2030, the tokenization of illiquid assets will reach $16 trillion. While this forecast may be overly optimistic, it is clear that tokenization has enormous growth potential.

Stablecoins are a prime example of real-world assets that have been tokenized and found products suitable for the market, with a current market value exceeding $150 billion.

Recent news from BlackRock has further fueled this trend.

You may have heard that BlackRock, the world's largest asset management company, announced a tokenized fund worth over $100 million on Ethereum a few days ago.

Although this news is not directly related to any cryptocurrency RWA projects, speculation about it has led to a significant increase in RWA token prices.

Furthermore, the significance of this news lies in one major reason:

BlackRock's launch of an on-chain tokenized fund legitimizes the on-chain real-world assets industry and paves the way for other institutions to take similar actions.

Following BlackRock's application for a Bitcoin spot ETF last year, several financial giants including Fidelity subsequently applied. I believe this time is no different.

Additionally, RWA/tokenization is a narrative that is easy for retail investors to understand. To outperform the market, you must invest in tokens that retail investors are willing to buy after they start paying attention to cryptocurrencies.

Considering all the above, I expect real-world assets to be one of the best-performing narratives in this bull market.

RWA market landscape

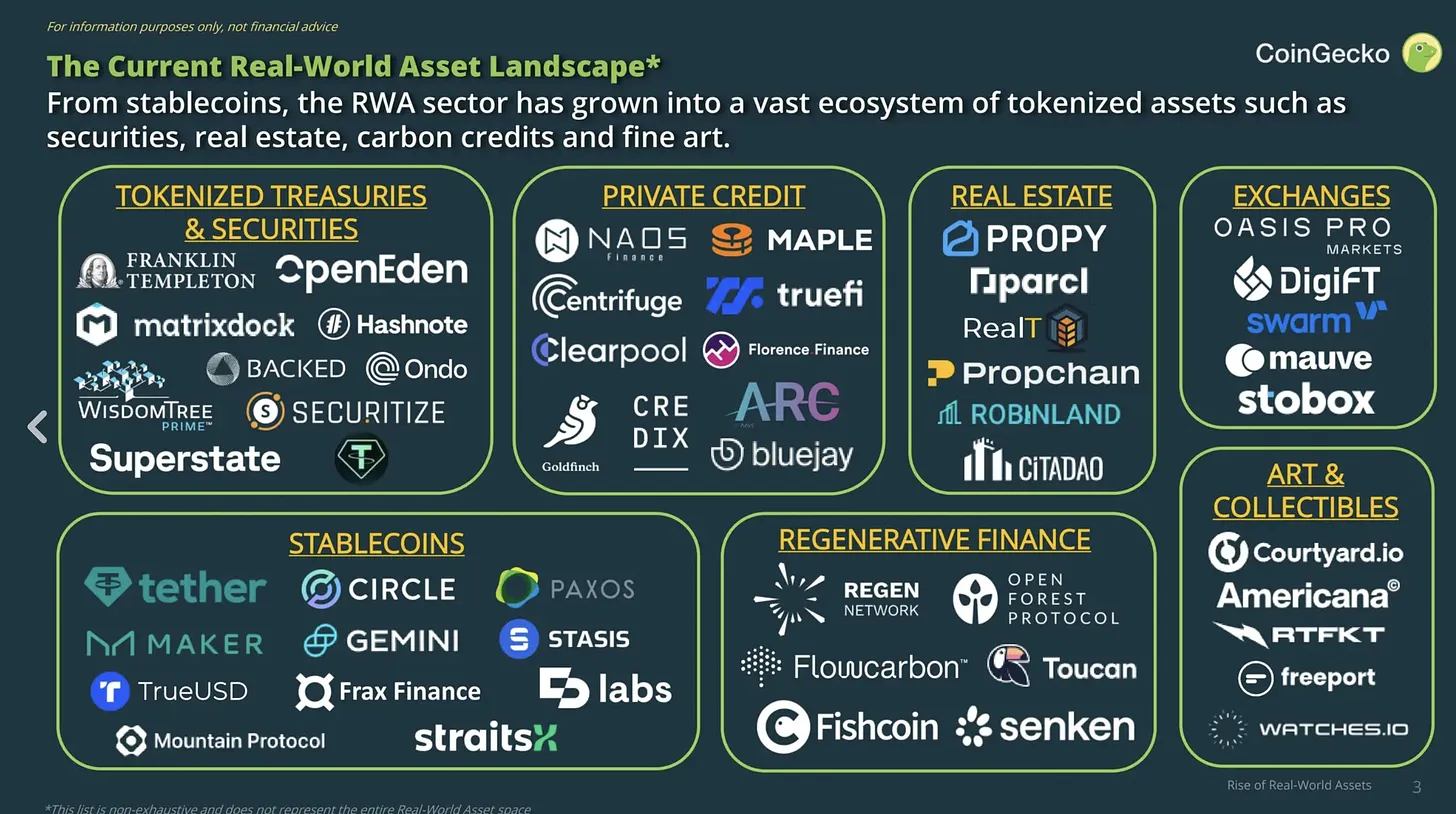

As shown in the above figure, this industry has many subcategories, some of the most important of which include:

Tokenized government bonds and securities

On-chain private credit

Infrastructure projects (e.g., RWA blockchains)

Real estate

Renewable finance

There are dozens of interesting RWA projects, and it's impossible to cover all of them. However, I will focus on some market leaders and prominent projects:

Mantra

Mantra is the first blockchain designed specifically for real-world assets.

Just a few days ago, the team announced securing $11 million in funding.

Some core features of this blockchain include:

MANTRA Compliance Module: a set of tools to help Web3 platforms comply with regulatory requirements, including KYC protocols and sanction screening

MANTRA Token Service Module: an SDK that enables enterprises to easily create, issue, distribute, and manage digital assets that comply with various regulatory frameworks

Mantra DEX: leveraging the Cosmos ecosystem to make trading real-world assets in DeFi more straightforward and efficient

In summary, the project aims to make it easier for businesses and investors to launch and trade tokenized assets on-chain.

Compliance with regulatory requirements has always been a major issue for Web3 enterprises, and Mantra provides several tools to simplify this process.

Ondo Finance

Ondo provides liquidity exposure to institutional-grade financial products such as short-term US government bonds and ETFs.

The protocol has a TVL of $220 million and has received support from Pantera Capital and Coinbase.

As mentioned earlier, through Ondo, you can invest in tokenized US government bonds. Interestingly, after doing so, you can use protocols like Flux Finance to lend these tokenized government bonds in DeFi.

Composability is a key feature of DeFi, as it enables developers to combine multiple DeFi products into entirely new products, as Flux has done.

It will be interesting to see more RWA projects leveraging the composability of DeFi to achieve new use cases.

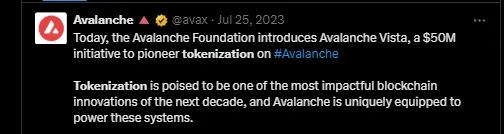

Avalanche

While Avalanche is primarily known for being an L1 platform for various dApps, its team has also put a lot of effort into tokenization and institutional adoption.

For example, last year Avalanche:

Introduced a $50 million ecosystem fund to expand tokenization

Announced partnerships with financial giants like WisdomTree and J.P. Morgan

Launched the Evergreen subnetwork tailored for institutions

Recently, Citibank also announced successful exploration of tokenizing private funds using Avalanche subnets.

Another interesting development is that a well-known asset tokenization company, Securitize, chose Avalanche to issue its first tokenized asset last year.

Parcl

Parcl is the first derivative DEX in the real estate market.

The project has received support from Coinbase Ventures, Solana Ventures, and Dragonfly. The launch of its token has been confirmed to take place in the coming weeks.

Parcl is one of the largest dApps on Solana, with a TVL of almost $200 million.

Using Parcl, you can easily speculate on price fluctuations in the real estate market as the platform provides city indices.

Clearpool

Clearpool is a decentralized credit market.

Through it, you can lend USDC to institutional borrowers in exchange for up to 23% annualized yield.

All borrowers sign a legal agreement before funds are disbursed to ensure the right to recourse in case of default.

Interestingly, Clearpool's TVL has grown by nearly 50% in the past few weeks.

LandX

LandX has a unique product as it is the first decentralized RWA platform for investing and trading farmland and agricultural products.

The protocol provides funding to real-world farmers in exchange for legal shares of their crops. With the crops of LandX farmers tokenized, you can easily invest and gain inflation-resistant returns through the platform.

Commodity inventory can be provided as liquid digital assets through LandX.

Other notable projects:

Florence Finance: Leading Euro-denominated RWA project connecting DeFi with physical loans

MakerDAO: While MakerDAO is not strictly an RWA project, its stablecoin $DAI is mostly backed by real-world assets. DAI holders can also collateralize their stablecoins to earn yield generated by sDAI

Centrifuge: Centrifuge allows anyone to lend assets to institutions in exchange for stable returns

Choosing the winner in the RWA narrative

Now I will introduce the elements I look for in RWA projects to determine which RWA tokens might be good investments.

In general, here's what I look for:

Strong community: No community = no one will buy your bag (investment)

Increasing adoption: You can use tools like DeFiLlama to view statistics for almost any protocol (I typically look at Total Value Locked TVL and revenue)

Team very active on social media: We live in an attention economy. Ideally, you'd want to bet on teams that understand the importance of marketing

Publicly identifiable team: This is not necessary for most projects, but I would say it's crucial for real-world asset protocols

Strong backers: Projects with investors like Binance Labs, Coinbase Ventures, a16z, or other well-known investors usually have a good understanding of how to adapt to new narratives

Partnerships with financial giants: This is not necessary, but for example, in the case of Avalanche, $AVAX always sees a significant increase after each announcement of a new major partnership

Token utility: Token utility is not very important in a bull market, but ideally, I want to invest in tokens that directly benefit from the success of the project

You are unlikely to find a project that meets all of these criteria. But the more criteria are met, the better.

As I mentioned earlier, the total market value of the entire physical asset cryptocurrency industry is currently around $9 billion. In my view, this is very low, and I believe it has enormous growth potential in this bull market cycle.

Almost all tokens will rise at the start of altcoin season.

Hopefully, through the investment framework I have presented above, you will be able to find and invest in future top performers.

One final piece of advice:

If you want to invest in RWA tokens for the long term, do not buy RWA tokens at market prices that have doubled or tripled in recent news about BlackRock. Wait for a -25-35% price correction, then place your order to buy.

If you are patient, the market will give you the opportunity to buy them at a slight discount.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。