Original | Odaily Planet Daily

Author | Fu Ruhe

With BlackRock launching the tokenized fund BUIDL, which attracted $160 million in funds within a week, and Ondo as the leading project in the RWA sector, allocating the underlying assets of the OUSG product (US short-term Treasury bond ETF) to BUIDL, RWA has once again become a hot topic of discussion in the community.

RWA, as one of the important bridges connecting the crypto industry with real assets, has been highly anticipated since its inception, but only a few well-known projects such as Ondo and MakerDAO have been truly recognized and adopted.

However, the recent RWA project Midas completed a $8.75 million seed round financing and received investment from institutions such as Coinbase Ventures and GSR. With the support of well-known institutions, Midas has entered the public eye.

Next, Odaily Planet Daily will explain the overview and future development prospects of the Midas project.

On the Surface RWA, Actually a Stablecoin Yield

Midas is a protocol for asset tokenization, converting tokenized real assets into permissionless ERC20 tokens and allowing tokens to circulate in DeFi projects. Currently, the first asset tokenization product launched by Midas is mTBILL, with an annualized yield of 5.23% and a TVL of $3.03 million.

The underlying asset of mTBILL is the iShares $ Treasury Bond 0-1yr UCITS ETF (IB01.L), with assets under management of $14.6 billion, a daily trading volume totaling $25.18 million, and an annual return rate of 5.26%, with a Standard & Poor's rating of AA. Each mTBILL token is pegged to each share of IB01.L at a 1:1 ratio.

When IB01.L matures, the assets are reinvested, increasing the net asset value (NAV) of the fund. As the overall fund's net asset value accumulates, the value of each corresponding token increases in turn. Therefore, the redemption of mTBILL products will be based on the calculation of the net asset value at that time.

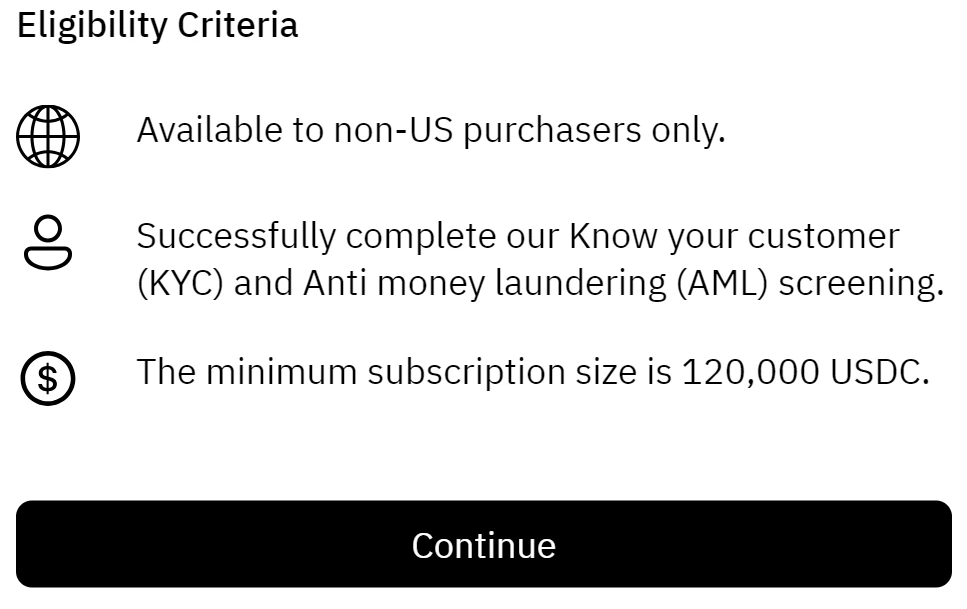

Like other RWA projects, purchasing and redeeming mTBILL products requires KYC and AML verification. Individuals and institutions in the United States cannot participate, but there are no restrictions for other countries. Additionally, the initial purchase threshold is 12,000 USDC, which is not low, but it is not specified which type of investors are allowed to purchase, as long as the funds meet the requirements. It is worth noting that the project has not clearly indicated the threshold requirement for redeeming assets, only the purchase threshold. Whether partial shares of mTBILL can be redeemed immediately in the secondary market still needs further confirmation, and although the project claims to have immediate response, the process of purchasing and redeeming requires some time.

The flow chart of the mTBILL product is as follows: after users complete KYC and AML verification, they can deposit tokens into the contract using USDC or deposit funds via bank wire transfer, and the project will provide tokenized bills, mTBILL. However, there is a doubt that after mTBILL is deposited into the contract address at a 1:1 ratio with IB01.L, the subsequent movements of the tokens are not explained by the project. For example, it is not clarified whether the tokens will be purchased through a company or default to be purchased by the Midas project itself, without third-party supervision, and there is no SPV provided as a risk isolation place as Ondo does.

In addition, Midas focuses on DeFi for RWA in the RWA sector. After purchasers buy mTBILL, they can participate in related DeFi projects on-chain, mainly for lending, without the need to verify the counterparty's KYC qualifications, and can trade in the market. However, if asset redemption is required, the redeemer must meet KYC and other related verifications. Midas's approach is to review the entry and exit points of mTBILL, and the behavior during the process is not restricted.

In terms of fees, Midas does not charge issuance fees at the beginning of the project, only an ETF management fee of 0.07%, and it is not yet known whether fees will be charged in the future.

Overall, in most RWA projects that mainly target institutions and high-net-worth investors, the Midas protocol emphasizes the on-chain DeFi use of RWA products, integrating RWA products into the existing DeFi ecosystem to provide additional yield and utilization of the products. Although support for related lending protocols has not been seen at this stage, Midas is still in the early stages, and with the support of institutions such as Coinbase and GSR, the DeFi use cases may continue to expand. Interested investors should also pay attention to the risk points mentioned earlier in the article—the product-related explanations are still incomplete.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。