March 27, 2024 marks a milestone as BadgerDAO, in collaboration with the liquidity staking platform Lido, launched eBTC, a new type of synthetic Bitcoin token. This move aims to allow users to borrow Bitcoin without paying any upfront fees or interest through an innovative lending model, while introducing an incentive program of "earning to borrow Bitcoin," increasing the attractiveness of borrowing. To encourage user participation, eBTC and Lido have committed to distributing incentives through airdrops, eliminating the complexity and high cost of claiming incentives.

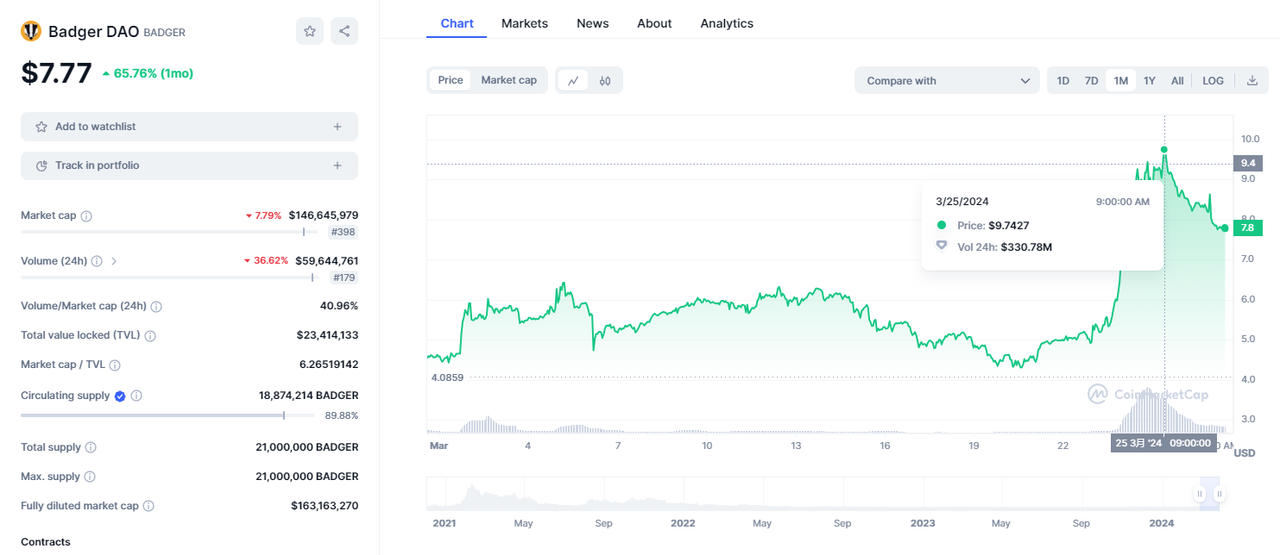

At the same time, BadgerDAO's token BADGER has garnered attention in the market. Since BadgerDAO released the eBTC protocol whitepaper in July 2023, the price of BADGER has experienced significant growth. Especially in the past month, the price has risen from 4.0859 USDT to 7.77 USDT, reaching a high of 9.7427 USDT at one point, showing an astonishing increase of 138.94%. This price trend is closely related to the heat of the Bitcoin ecosystem and BadgerDAO's launch of the 2.0 plan—a synthetic Bitcoin eBTC designed to resist scrutiny.

The launch of eBTC has not only brought positive market feedback to Badger DAO itself but also added new momentum to the development of the entire Bitcoin ecosystem. The market is closely watching whether this new narrative can help Badger DAO establish a presence in the Bitcoin ecosystem.

eBTC Emergence: Addressing DeFi Limitations, Innovating Bitcoin's Path

Analyzing Bitcoin's Core Value and Market Return

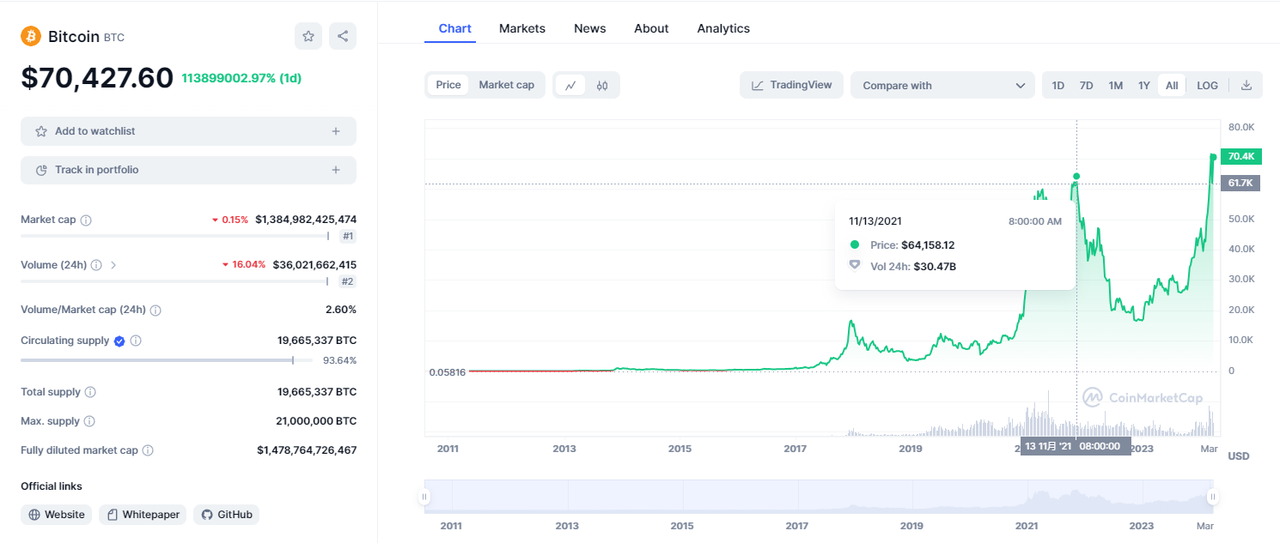

As a pioneer in digital currency, Bitcoin has not only led the wave of cryptocurrencies but also proposed a new mechanism for value storage and exchange. The design's maximum supply of 21 million aims to provide a reliable option against inflation. Despite its market value of $540 billion, Bitcoin's participation in decentralized finance (DeFi) has been limited due to its native design. Furthermore, since February 2024, the continuous rise in Bitcoin prices has set new historical highs, reigniting market recognition of its core value and strengthening its position as digital gold.

Market Trends: Importance of Bitcoin and Increased Investor Confidence

With the launch of Bitcoin Ordinals and the historical high in Bitcoin prices, the community has shown new interest in Bitcoin's future potential. Against the backdrop of global economic fluctuations and financial market uncertainty, Bitcoin has once again become a safe haven for investors. The growth in its market value and its share in the cryptocurrency market highlights Bitcoin's attractiveness to investors, especially in the macroeconomic pressure and policy change environment.

Role of eBTC: Opening a New Chapter in Bridging Bitcoin and DeFi

To break the limitations of Bitcoin's application in the DeFi field, eBTC has emerged. It appears in the form of synthetic assets, not only introducing Bitcoin's value into the DeFi ecosystem but also expanding its application scope. Unlike traditional tokenization methods such as wBTC and hBTC, eBTC effectively avoids the risks of centralized custody and cross-chain bridges in a decentralized manner, providing Bitcoin holders with a safer and more flexible way to participate in the DeFi ecosystem. This innovation not only strengthens Bitcoin's "digital gold" attributes but also provides new momentum for its active participation in DeFi projects due to its historical price highs, promoting further development and maturity of the entire cryptocurrency market.

With the launch of eBTC and the innovation in Bitcoin prices, the close integration of Bitcoin with the DeFi field signifies a significant advancement in the cryptocurrency ecosystem. It not only brings new growth opportunities for Bitcoin itself but also opens up new paths for the expansion of the DeFi ecosystem. With such ongoing innovations, Bitcoin's role in the DeFi field is expected to become more prominent, providing users with more value and choices.

Technical Analysis: How Does eBTC Optimize DeFi Lending and Efficiently Utilize Bitcoin Assets?

The eBTC protocol introduces a revolutionary mechanism that allows the use of stETH provided by Lido as collateral, enabling users to borrow eBTC without paying any initial fees or interest. The core of this approach lies in generating income from the collateral yield extracted from the collateral, initially set at 50% of the accumulated yield, and allowing adjustments through a simplified governance process.

1. Governance Structure and Security

eBTC aims to provide a decentralized, trustless synthetic version of Bitcoin in DeFi, using a minimal governance mechanism to maintain its non-custodial and anti-censorship characteristics. In addition, eBTC utilizes Chainlink's decentralized oracle network to ensure the accuracy and reliability of price information. This mechanism, through a combination of primary and backup oracles, ensures the protocol's sensitivity and responsiveness to market changes.

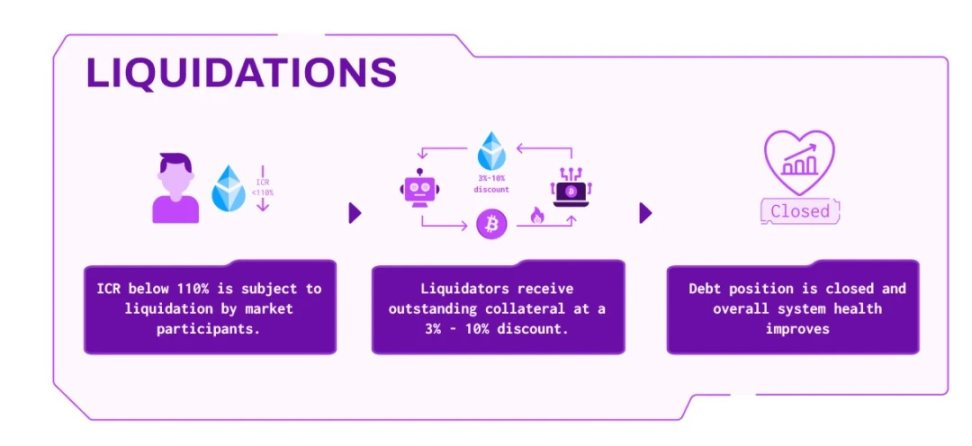

2. Debt and Liquidation Management

eBTC establishes a liquidation mechanism to ensure the system's robustness, triggering the liquidation process when the debt ratio of the collateral falls to a specific level. This provides market participants with reward opportunities and ensures the protocol's solvency through a debt redistribution mechanism.

3. Secure Collateralized Borrowing Model for Decentralized Lending

Compared to existing Bitcoin products that rely on centralized custody and cross-chain bridges, eBTC adopts a Collateralized Debt Position (CDP) model, providing a safer, decentralized lending method. Users can borrow eBTC, pegged to the value of Bitcoin, by collateralizing ETH without involving cross-chain risks, increasing capital efficiency while reducing centralized risks.

4. Advantages and Innovations

The emergence of eBTC not only provides users with a new way to gain exposure to Bitcoin but also allows users to earn from their collateralized assets by collateralizing ETH. Unlike other synthetic assets, eBTC, through its unique collateral model and revenue-sharing mechanism, provides users with a way to borrow without paying lending fees while increasing their earnings. This model attracts users who are bullish on ETH and wish to hedge against BTC prices through lending, bringing new vitality and opportunities to the DeFi market.

In summary, eBTC is not only a major breakthrough in Bitcoin's application in the DeFi field but also provides users with an efficient platform for cryptocurrency collateral and lending without high risks, marking a significant advancement in cryptocurrency synthetic assets and lending models.

eBTC Debut: Can It Become the Value Link Between Bitcoin and Ethereum?

The launch of eBTC not only represents a significant innovation in existing lending models but also heralds a new era of interconnectedness between the Bitcoin and Ethereum ecosystems. Although Bitcoin and Ethereum play leading roles in the cryptocurrency field, their interaction and integration have been limited, constrained by their respective technical frameworks and differences in community beliefs. The emergence of eBTC encourages users of these two ecosystems to explore each other's value and potential, fostering deeper cooperation and development within the cryptocurrency community.

For the Bitcoin community, eBTC provides a unique opportunity to access the Ethereum ecosystem while maintaining their investment and belief in Bitcoin. This mechanism not only expands the revenue channels for Bitcoin holders but may also introduce them to a wider range of DeFi applications and derivative trading, increasing the use cases and liquidity of Bitcoin. For Ethereum users, eBTC offers a simple way to gain exposure to Bitcoin, especially as an attractive hedging tool in the face of market fluctuations. Through eBTC, Ethereum users can enjoy the potential gains from the rise in Bitcoin prices while maintaining their investments in ETH.

Looking more broadly, the integration of eBTC could lead the entire cryptocurrency field into a new era of collaboration. It not only brings unprecedented opportunities for individual investors but also has the potential to attract attention from the traditional financial world, using DeFi mechanisms to manage Bitcoin assets and injecting unprecedented liquidity and vitality into the Ethereum ecosystem. This cross-ecosystem liquidity and collaboration not only strengthens the Ethereum platform itself but also opens up new pathways for the widespread acceptance and application of Bitcoin.

In summary, the launch of eBTC is not just a technological breakthrough; its far-reaching impact could promote the overall growth and maturity of the cryptocurrency world. By promoting interoperability and collaboration between Bitcoin and Ethereum, eBTC presents a possible path for widespread integration, coexistence, and mutually beneficial development in the cryptocurrency space. As the boundaries between cryptocurrency and the traditional financial world become increasingly blurred, the role of eBTC may become even more important. Does this mean that we are at a crucial turning point in cryptocurrency history, moving towards a more open and interconnected future?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。