Summary

The AI applications combined with blockchain technology are attracting more and more attention in the market. ChatGPT has gained hundreds of millions of users in a very short period of time, and Nvidia's stock price has grown 8 times by 2023, with a market value exceeding one trillion US dollars. AI has become the absolute mainstream of humanity, and its narrative and capital are beginning to overflow into related fields. The combination of AI applications with blockchain technology is receiving increasing attention in the market.

As an important complement to AI, Crypto has a wide range of applications and huge development potential, and is currently in its early stages. At present, many institutions and practitioners still have a trial attitude towards the combination of AI and web3, mainly starting from the most direct use case of Crypto, which is "assetization" including computing power (cloud computing, computing power market), model assetization (AI Agent), and data assetization (storage).

Currently, the unique decentralized properties of Crypto technology do not improve efficiency or reduce costs in the training process of AI, requiring a large amount of construction. However, assetization reduces the friction of market transactions and introduces more computing power that was previously unused, which is profitable in the context of scarce computing power. The assetization of models allows the community to own or use AI in a decentralized manner, with relatively simple technical implementation and low barriers, but the narrative of democratizing AI corresponds to the anxiety of AI centralization. Decentralized data can indeed reduce costs to a certain extent, but even in the context of crypto, its assetization is still difficult and requires a lot of business exploration.

Although the market has not fully reached a consensus on AI + Crypto, the distribution of its tracks has become clear. Trustless Labs has traversed more than 60 projects in the primary and secondary markets. This article will horizontally explore 7 modules including cloud computing, computing power market, model assetization and training, AI Agent, data assetization, ZKML, and AI applications, to explore the future development of AI in the cryptocurrency field and discover investment opportunities.

Cloud Computing

With the overall growth of the artificial intelligence market represented by companies like Nvidia and the trend of GPU supply shortage, cloud computing and related computing power market projects have become one of the first areas to benefit from the growth of the AI industry. Cloud computing attempts to solve the shortage of GPU computing power by integrating idle computing power from existing cloud service providers into a centralized computing power network, reducing computing power costs compared to traditional cloud services. These projects have their own focuses, most of which are concentrated on GPU computing power, but each project has different areas of focus and technical implementation, some based on container technologies such as Akash Network, and others providing virtual machine-level implementations.

For cloud computing projects, the growth of users and businesses is the basis for their value growth. These projects are usually considered as AI computing enterprises with relatively high PE ratios because they do not rely on decentralized narratives. Due to the scarcity of GPU resources, it is particularly important for primary market participants to assess the business capabilities of these projects.

Akash Network

Akash Network is a decentralized cloud computing market based on Cosmos SDK and Tendermint technology, dedicated to utilizing underutilized resources in data centers. Since its founding in 2015, Akash Network has become one of the earliest projects in this field, initially supporting only CPU computing resources. In September 2020, Akash launched its mainnet supporting CPU computing, and in September 2023, it successfully launched its mainnet supporting GPU computing, further expanding its service scope and performance. Akash was designed to tap into and occupy the huge market of underutilized resources in data centers.

Akash Network adopts a unique reverse auction mechanism, allowing users to select the lowest bidding supplier to reduce cloud computing costs, with an average price of about one-third of mainstream cloud service providers such as AWS and Azure. This pricing strategy not only saves users a lot of costs but also increases market competitiveness and attractiveness.

The underlying architecture of the project uses the Akash container platform built on k8s to orchestrate and manage containers to meet various cloud computing needs of users. This design allows users to flexibly deploy and manage containers, further improving the efficiency and flexibility of resource utilization.

Akash Network successfully raised $2 million in 2020, led by Cypher Capital, demonstrating market recognition of its technology and business model. The project's founder, Greg Osuri, has rich experience in continuous entrepreneurship and cloud architecture since 2008, and is co-founded and led by Adam Bozanich as the CTO.

Currently, the market value of $AKT has reached 130 million US dollars, with a future diluted value (FDV) of 220 million US dollars.

Ritual

Ritual is an advanced project dedicated to integrating artificial intelligence (AI) with smart contract technology, establishing an open AI infrastructure network. The project is driven by an experienced team, including Eva Zhang, who has worked at top companies such as Socket, Apple, and Google, and conducted machine learning research at Stanford University, as well as Co-founders Niraj Pant and Akilesh Potti with backgrounds in Polychain. Ritual's vision is to support developers in seamlessly integrating AI into any on-chain application or protocol, including the ability to fine-tune, monetize, and execute reasoning, aiming to promote the development of fully transparent DeFi, self-improving blockchains, autonomous agents, and content generation.

Although Ritual is still in its early stages, it has already achieved a series of milestones, including the launch of its first-phase product, Infernet. Infernet is a lightweight library that can introduce computation onto the chain, supporting any EVM-compatible chain, allowing smart contracts to locally access various on-chain use cases and tasks of AI models. Infernet not only optimizes decentralized oracle networks but also enables DApps to implement functions such as DAO proposal risk detection and NFT image generation through its SDK. Ritual also plans to launch its second-phase product, Ritual Chain, in the coming months, which will be a sovereign chain with a custom virtual machine specifically serving more advanced AI native applications.

Although Ritual has not yet launched a testnet, and lacks an economic model, token issuance, and staking mechanism, the project's open-source code, team background, technical roadmap, strategic direction, and community-shared ideas demonstrate its enormous potential and industry attention. In addition, Ritual has successfully raised $25 million, led by Archetype, with participation from Accomplice and Robot Ventures, showing investment recognition and support for its technology and vision.

Render Network

Render Network is a decentralized GPU rendering platform designed to provide on-demand rendering capabilities for artists and developers using globally distributed high-performance GPU nodes. This platform not only focuses on rendering but also supports AI computing, driving the development of next-generation rendering and AI technologies. Render Network's founder, Jules Urbach, as the strategic visionary and chief architect of the technology roadmap for OTOY, is a pioneer in the fields of computer graphics, streaming media, and 3D rendering, with over 25 years of industry experience. Since its founding in 2002, OTOY has completed four rounds of financing by 2020 and made a $50 million Series B investment in Light Field Labs in February 2023.

Render Network has developed into an early but highly promising project since its first ICO in October 2017. The project conducted a private sale period from January to May 2018. Currently, the market value of Render Network's native token $RNDR has reached 43 billion US dollars, with an FDV of 61 billion US dollars, and it has been listed on globally renowned cryptocurrency exchanges Binance and OKX.

On November 2, 2023, the Render Foundation announced that Render Network had successfully completed the core infrastructure upgrade from Ethereum to Solana. This transfer aims to leverage Solana's high performance and low-cost advantages to further drive the platform's development. During this process, Render Network introduced a new token, RENDER, minted on Solana, while the old token RNDR will still exist. In the upgrade process, 1 RNDR can be exchanged for 1 RENDER. In the future, the Render Foundation will focus on and fully support the RENDER token, marking an important milestone as Render Network moves into a new stage.

NetMind.AI

NetMind.AI is a large artificial intelligence ecosystem consisting of four core modules: computing power market, ChatBot, Agent, and life assistant. Its core, NetMind.Power, is an Ethereum-based computing power market module that provides GPU inference and training platforms. NetMind.AI's training/inference load management platform has been in the testnet phase since September 2023. NetMind.Power supports a wide range of GPU models, integrates one-click import functionality from Google Colab, and is currently in the free beta testing phase.

NetMind Chain is fully compatible with EVM, and its token $NMT has a market value of 444 million and an FDV of approximately 13 billion.

CUDOS

Similar to Akash, CUDOS is a blockchain using Delegated Proof of Stake (DPoS) on the Cosmos SDK with Tendermint Core, and has cross-chain capabilities with Ethereum and L2. Cudos Blockchain Compute aims to provide multi-chain EVM support and GPU computing capabilities.

The market value of $CUDOS is 161 million, with an FDV of 275 million.

Nuco.cloud

Nuco.cloud is a decentralized computing cloud service based on blockchain technology, aiming to provide diverse cloud computing solutions, including AI training, data analysis, scientific research, and efficient rendering use cases. The project operates on the Ethereum and Telos blockchains, leveraging the advantages of decentralization to provide users with flexible and efficient computing resources. By participating in Nuco.cloud, users can exchange their computing resources for computing power, and miners providing computing power can receive NUCO tokens as rewards. The token generation is based on Proof of Stake (POS) and Proof of Research mechanisms, and has received support from Eagle Capital GmbH. Notably, Nuco.cloud has established a partnership with CUDOS to jointly promote the development and application of blockchain technology.

To meet the needs of different users, Nuco.cloud has launched multiple product lines, including nuco.cloud SKYNET, nuco.cloud GO, nuco.cloud PRO, and CUSTOM, each targeting specific user needs and usage scenarios. These products use advanced blockchain technology and intelligent pricing mechanisms to provide users with a unique, efficient, and decentralized cloud computing service platform.

Since its inception in 2017, Nuco.cloud launched its testnet in August 2023 and is currently in the testing phase. In the 2024 roadmap, Nuco.cloud plans to rebrand and release the PRO version of its product for B2B, while seeking to list on CEX exchanges to further expand its market influence.

In terms of compliance, Nuco.cloud complies with EU GDPR standards and relevant German standards, setting it apart from many competitors, including centralized computing cloud services such as AWS, Azure, Google Cloud, and decentralized computing projects such as GLM, Akash, RNDR, and IExec RLC. According to project materials (Deck), Nuco.cloud's costs are significantly lower compared to several other decentralized computing clouds, with prices approximately only 30% of AWS for equivalent specifications, demonstrating its highly competitive pricing advantage.

Currently, the market value of Nuco.cloud's token $NCDT has reached 44 million, with an FDV of 68 million.

Dynex

Dynex is a blockchain for neural morphological supercomputing based on the DynexSolve chip algorithm, proposing the Useful Work Proof (PoUW) method to improve the speed and efficiency of decentralized networks. Dynex aims to provide computing power for artificial intelligence, machine learning, fintech, and biomedicine, primarily using GPU computing.

Dynex was launched in 2020, initially as a project designing neural morphological chips, which later evolved into a blockchain. The mainnet was launched in Q4 2022, and it has been listed on Gate.io in Q1 2024.

$DNX was fairly launched in August 2022, using a deflationary model, with a market value of approximately 86 million and an FDV of 110 million.

OctaSpace

OctaSpace is an open-source scalable distributed computing cloud node infrastructure that allows access to distributed computing, data storage, services, VPN, and more. OctaSpace includes CPU and GPU computing power, services for ML task disk space, AI tools, image processing, and rendering scenes using Blender, among others.

OctaSpace was launched in 2022 and operates on its own Layer 1 EVM-compatible blockchain. The blockchain uses a dual-chain system, combining Proof of Work (PoW) and Proof of Authority (PoA) consensus mechanisms. $OCTA has an FDV of approximately 73 million and was fairly launched.

AIOZ Network

AIOZ Network is a Layer1 decentralized computing platform for AI, storage, and streaming, interoperable with Ethereum and Cosmos. AIOZ is supported by a decentralized content delivery network (dCDN), AI computing, and thousands of globally operated individual nodes, allowing users to share computing resources for storage, transcoding, and streaming digital media content, and supporting decentralized AI computing.

The project was launched over 6 years ago and released its mainnet in December 2021. The infrastructure built includes AIOZ dCDN, AIOZ IPFS, AIOZ W3S, AIOZ W3AI, and AIOZ Web3 Streaming, providing support for web3 storage, decentralized AI computing, live streaming, and video on demand (VOD).

According to its Roadmap, the project plans to implement AIOZ Transfer dApp, AIOZ multi-chain wallet browser extension, AlOZ Node V3, AIOZ W3IPFS infrastructure in Q1; AIOZ W3AI in Q2; AIOZ W3Stream and various token standards in Q3; and AIOZ DEX in Q4.

Phoenix

- Phoenix is a blockchain infrastructure platform for decentralized AI, computing expansion, and data-driven networks. Its products include the AI platform AlphaNet for the cryptocurrency trading market and the AIGC metaverse project NYBL. Phoenix's AI computing layer is a Web3-based infrastructure designed to scale AI computing tasks and deploy AI-enabled applications easily, including deep learning, predictive analytics, LLM, federated learning, and AI edge computing. Phoenix's AI vertical solutions cover multiple domains.

Recently, Phoenix has partnered with Helium to launch the AI computing miner PhoenixNode, and its PhoenixLLM large language model service has been launched on Telegram. Additionally, Phoenix will integrate with the entire Telegram ecosystem.

Aethir

Aethir focuses on building scalable decentralized cloud infrastructure for gaming and artificial intelligence based on Arbitrum. The project, launched in 2023, is currently in the testnet phase. It aims to provide a user experience similar to web2 cloud gaming platforms, addressing AI and gaming testing, cross-platform, and distribution needs. Key AI use cases include low-latency inference, language interaction, and visual interaction. Checker node licenses were whitelisted for sale on March 18-19 at 10:00 AM (UTC), with public sale starting on March 20 at 10:00 AM (UTC) at a starting price of 0.1259 ETH per node, with incremental increases, and can also be purchased as ERC721 tokens. Checker nodes are expected to be installable and operational in Q2 2024, with coin issuance and mainnet launch anticipated in Q2. 15% of $ATH will be used to reward Checker nodes.

Iagon

Iagon is a decentralized marketplace for storage and computing power based on Cardano. It released its testnet in 2023 and is an open-source project.

OpFlow

OpFlow is a decentralized cloud computing platform focused on AI and rendering. OpFlow Hosting is a decentralized deployment cloud service compatible with TG Bot. Its rendering service specifically uses NVIDIA L40 GPU. According to its roadmap, the first phase plans to: release tokens on Uniswap; launch OpFlow Hosting (Telegram Bot); launch network nodes for ETH, Linea, Eigen Layer, and more.

$OpFlow is an ERC20 Token, with more details yet to be disclosed.

OpSec

OpSec is a decentralized cloud computing solution aiming to build the next-generation supercomputer, including Cloudverse, Cloudsec, OpSec Network, one-click node setup, DePIN hardware, and hosting services.

The project is relatively new and has not released a testnet. $OPSEC is already listed on DEX.

Computing Power Market

The computing power market, based on decentralized mechanisms, allows users to provide their GPU and CPU resources for leasing in AI training or network training projects. Although the emergence of this market theoretically does not significantly reduce the cost or improve the efficiency of AI training, its openness and low barriers allow a large amount of GPU resources to be mobilized in a short time, providing strong computing power support for the network. This approach not only leverages significant asset backing but also tokenizes GPU assets, bringing new value and significance to the computing power market.

However, these projects are often seen as "more virtual than real," relying more on their decentralized nature and related narratives (such as the process from traditional AI to decentralized inference, and then to decentralized training) than on the actual utility of their technology or services. In fact, the business model of these projects mainly revolves around this narrative.

In terms of technical support, computing power market projects that can achieve decentralized GPU operation are usually combined with the concept of DePin. The combination of computing power market projects such as io.net and nosana with DePin, combined with the high-performance chain Solana, demonstrates significant growth potential. Therefore, we recommend that investors pay long-term attention to early projects that combine Solana and AI, which not only have the potential to bring technological innovation but also may become investment hotspots.

From an investment perspective, early participation in the GPU computing power market, especially when the market shows FOMO effects, may bring high returns. This type of participation not only allows for incentives but also has the potential for high return on investment, bringing substantial economic benefits to investors.

Clore.ai

Clore.ai is a platform that provides GPU computing power rental services based on PoW. Users can rent their GPUs for AI training, rendering, and mining tasks. It uses an optional Proof of Holding (PoH) mechanism, where the more tokens the provider holds, the more CLORE they receive.

$CLORE has a market value of 90 million and an FDV of 110 million. 50% of each block goes to miners, 40% to hosts, and 10% to the team, with a token cap of 1.3 billion.

Nosana

Nosana is a cloud computing service provider focused on GPU on Solana, and the project is open source. Founded in 2021, Nosana currently has no financing information. Co-founder Sjoerd Dijkstra has extensive DevOps experience, Jesse Eisses has a good technical/ML background, and Laurens Verspeek also has a technical background and extensive development experience. In mid-October 2023, Nosana announced a shift from CI/CD use cases to AI inference, and its platform is currently in the early stages of development. There is very little data on the nosana explorer, with current statistics showing 94 GPU nodes and 160,000 completed inferences, requiring further research to validate the project.

Llama 2 and Stable Diffusion's AI inference workloads will be integrated into the network. The testnet is divided into three stages, currently in the first stage. According to official Twitter data, the second stage has already seen over 1000 devices sign up, with data and revenue models not yet disclosed. The plan is to launch the mainnet in the first half of the year, improve consumer-level node support, and in the second half of the year, implement a community connector library and official connectors for PyTorch, HuggingFace, TensorFlow, and more.

The token was launched in January 2022, and $NOS currently has a market value of 510 million and an FDV of 608 million.

io.net

io.net is an innovative decentralized AI computing power market based on Solana blockchain technology, currently in the testnet phase. This platform aims to provide access to cloud computing resources at a cost lower than traditional centralized services, with an estimated valuation of 500 million US dollars. The core appeal of io.net is its ability to support various AI computing needs such as batch inference, parallel training, hyperparameter tuning, and reinforcement learning, while its backend infrastructure consists of a series of modular layers for efficient resource management and automated pricing. Currently, the pricing for NVIDIA RTX 3090 computing resources is 0.2 USD per hour.

In terms of project background, io.net was founded by Ahmad Shadid, who built a GPU computing network for Dark Tick, a machine learning quantitative trading company, in 2020. As for funding, io.net has received a lead investment from Hack VC and support from several well-known investment institutions and individuals, including Multicoin Capital, Solana Labs, Aptos Labs, and industry figures such as Solana's founder Anatoly Yakovenko.

In terms of participation opportunities, io.net offers diverse ways for users to participate in its network, including mining income and staking income. From March 1 to April 28, 2023, the platform launched the first round of incentive programs and is expected to issue its token $IO in April. In terms of mining income, the platform calculates points based on the internet bandwidth, memory, CPU clock speed, and floating-point operation capability of the nodes to provide rewards to users. Additionally, users can earn income by staking IO Coin, with stakers receiving 1-3% of all rewards earned by participants.

It is worth mentioning that the io.net team borrowed RNDR's airdrop rules to design its own point calculation method, emphasizing the importance of bandwidth in reward calculation. Analysis shows that devices with high bandwidth have a significant advantage in the final reward distribution, indicating that users should pay special attention to improving the bandwidth performance of their devices when participating in the io.net network.

Gensyn

Gensyn is an L1 protocol focused on training deep learning models, aiming to improve the efficiency and accessibility of deep learning model training through innovative design and technical solutions. Since its inception, Gensyn has completed two rounds of funding, including a $6.5 million seed round led by EdenBlock in March 2022 and a $43 million Series A round led by a16z in June 2023.

The core of Gensyn's technology lies in its validation system, computing power supply solution, and an efficient solution. Its validation system consists of four main roles: submitter, solver, validator, and whistleblower, ensuring the trustless nature of the system through a distributed validation mechanism. Additionally, Gensyn aims to enable various devices to easily access its computing power network, including everyday gaming-level GPUs and GPUs previously used for ETH PoW mining. Its efficient machine learning training solution is based on probabilistic proof of learning, graph-based precise positioning protocols, and Truebit-style incentive games, aiming to significantly reduce training costs and improve training efficiency.

In terms of cost, Gensyn demonstrates significant competitiveness. The average cost of machine learning training is approximately $0.4 per hour, which is not only lower than the $1.5 per hour GPU call cost offered by Akash but also within the $0.1-1 cost range provided by io.net, reflecting Gensyn's cost control advantage.

Gensyn's code has not been open-sourced, and there are currently no plans for token issuance. Gensyn's development will be divided into three stages: testnet, Canary network on the Kusama relay chain, and mainnet on the Polkadot relay chain. The project is currently in the testnet phase. In the next 3-6 months, Gensyn plans to continue optimizing its technology and prepare for the next stage of development. Its vision is to become the foundational layer for machine learning computation, similar to Ethereum's smart contract execution, indicating Gensyn's long-term planning for the future integration of deep learning and blockchain applications.

Nimble

The core vision of the Nimble project is to create a decentralized AI ecosystem covering the data, computing power, and builder markets. Through this design, Nimble aims to lower the barriers to training AI models, allowing more participants to contribute to the innovation and development of AI. The project is positioned as a Composable AI Project, emphasizing the composability of various AI resources and components within a decentralized framework.

Nimble's mainnet launched on March 24, 2024, and it was selected as a Most Valuable Builder (MVB) in the seventh season of the BinanceLabs Incubation Program on March 1. A complete security audit report has not been seen yet. Nimble is valued at $30 million and has raised $6 million.

The mainnet was launched last weekend, and users can mine by contributing GPU power, with 1500 GPUs already connected to the network.

Morpheus AI

Morpheus AI is a decentralized computing power market project built on Arbitrum, aiming to help users establish proxy AIs based on large language models and call smart contracts through proxy AIs. This design not only expands the potential functionality of decentralized applications (DApps) but also creates incentives for multiple participants, including computing power providers, stETH stakers, protocol development contributors, and community API operators. In the process of participating in the Morpheus AI ecosystem, users can earn MOR tokens through staking or code submission.

Kuzco

Kuzco is a distributed GPU cluster for LLM inference on Solana. Although it is a new project, it has made rapid progress, launching a beta version for Mac and Linux users and already reaching 1400 online working nodes. Kuzco provides an efficient environment and code support, allowing users to pre-install the required models and environments on their local machines and complete tasks through network transmission. Compared to ionet, it performs better in resource utilization, with single-card utilization reaching 90%.

Currently, participants contributing computing power can receive $KZO points as a reward. Although its expected returns, development roadmap, and token economic model have not been clearly disclosed, it has already gained attention from the Solana official team. There has been no financing yet, but token issuance may occur in the near future.

Golem

Golem is a decentralized computing power market based on Ethereum, focusing on providing CPU power sharing services based on Ethereum since its launch in 2015. Golem is one of the earliest peer-to-peer computing power network protocols and has established a network node system including providers and requesters. Starting in 2022, Golem has entered the GPU market, launching the first phase of the GPU Beta testing program and starting the second phase in March 2024.

The total supply of $GLM is 1 billion, all of which are currently in circulation, with a market value of $561 million, and the code is open source.

Node AI

Node AI is a decentralized GPU computing power market, with its parent company being EyePerformance. Rental costs are as follows: A100 is approximately $0.85/hour, and A10 is approximately $0.22/hour. $GPU currently has a market value of 121 million.

GPU.Net

GPU.Net is a decentralized GPU resource network aimed at meeting the computing power needs of new technologies such as generative AI, Web3 metaverse, cryptocurrency mining, and high-end graphics rendering by providing decentralized GPU infrastructure. In August 2023, GPU.Net completed a $500,000 financing round, with participation from Momentum 6 and Alphablockz, as well as support from Nvidia and Taanga Studios. It has already launched early network pre-registration.

GamerHash

GamerHash utilizes the remaining computing power of players' computers while playing high-end games for cryptocurrency mining. For example, if a player is only using 15% of their computer's computing power while gaming, GamerHash automatically utilizes the unused capacity for cryptocurrency mining without requiring additional user intervention or monitoring. To cater to users with lower-end hardware, GamerHash has introduced the Play&Earn feature. Users can choose to complete specific tasks, such as playing certain games or downloading apps, to earn GUSD, an internal currency pegged to the US dollar, providing a new income channel for users with limited hardware capabilities.

NodeSynapse

NodeSynapse is a GPU computing power market that provides server hosting, Web3 infrastructure, GPU computing, and a unique revenue-sharing model for token holders.

Model Assetization and Model Training

In the trend of combining blockchain technology and AI, an important development direction is the assetization of AI models or running business models through tokenization. This approach has gradually demonstrated its value in multiple specific application scenarios, such as security audits, chatbots, AI advisors, and more. Due to the relatively low technical barriers of such projects and the ease of implementation, distinguishing the quality and investment value of projects becomes particularly important in blockchain and AI integration projects.

The key is to identify whether the project truly possesses innovation and technological barriers. Simply trading ownership or usage rights of AI models does not constitute genuine technological innovation. True technological breakthroughs should focus on effectively validating the outputs of models and ensuring the operation of models in a decentralized environment.

Saharalabs

SaharaLabs aims to address data sharing and privacy issues in AI model training through its two core products: Knowledge Agent and Data. The project facilitates data sharing and decision-making for individuals and enterprises by providing semi-automated autonomous agents and data operation tools while ensuring privacy and security. Currently, SaharaLabs has successfully attracted 30 enterprise clients and achieved positive cash flow, demonstrating the market feasibility and practical value of its solutions. SaharaLabs is led by Professor Sean and Tyler, with a team of over 30 members. Professor Sean is a professor at the University of Southern California and has received numerous honors, including being named Samsung's AI Researcher of the Year. Tyler has extensive experience in the blockchain industry and previously served as the investment director at Binance Labs.

Its product, Knowledge Agent, provides users with customized semi-automated agents for sharing and processing external or internal data for decision-making. These agents can be fine-tuned for private data while providing privacy protection, data source verification tools, and a development toolkit for multi-agent collaboration. The Sahara Data Marketplace offers comprehensive data operation tools, including data collection, labeling, quality control (QA), and project management, addressing data privacy issues and already adopted by renowned institutions such as MIT and Microsoft.

SaharaLabs has raised $600 million in funding and received $6 million in support through a seed round, led by Polychain Capital, with participation from Sequoia Capital, Samsung Next, Matrix Partners, and others. The project's roadmap includes launching the Sahara Data Marketplace in Q2 2024, testing the Sahara ID in Q3, and the mainnet and formal launch of Sahara Agent in Q4.

Bittensor

Bittensor is a decentralized open-source project aimed at creating a neural network protocol on the blockchain. This protocol allows for the creation of AI-driven decentralized applications (dApps) and facilitates peer-to-peer value exchange between AI models. Bittensor was co-founded by former Google software engineer Jacob Robert Steeves and former assistant professor at the University of Toronto and postdoctoral fellow at the University of Waterloo, Ala Shaabana, with James Woodman serving as the Chief Operating Officer. The project conducted a "fair launch" in 2021, without any pre-mined tokens, VC rounds, or private sales. The token TAO is generated through mining. Known investors and market makers include DCG, GSR, Polychain Capital, and Firstmask, among others.

The Bittensor network core consists of miners and validators. Miners are responsible for submitting pre-trained models to receive rewards, while validators ensure the validity and accuracy of these models' outputs and select the best outputs to return to users. For example, when a user requests an AI chatbot to answer a question, the question can be answered regardless of how many nodes the Bittensor network is running. The query is sent to the validator by the user, and the validator then passes the query to the miner, ranks the miner's output, and ultimately returns the highest-ranked output to the user.

The key developments of the Bittensor project include:

- Subnets: All AI applications on Bittensor actually run on its subnets, with a total of 32 subnets, each with a specific use case. The entry threshold for participating in subnets is 6000 TAO, costing over $4 million. Miners and validators can earn 7200 TAO in rewards daily, and if the subnet operates well, daily income can reach hundreds of thousands of dollars; otherwise, the subnet may be eliminated.

- Miners/Validators: The entry barriers to becoming a miner or validator are high. Miners need to undergo machine performance testing, while becoming a validation node requires staking a large amount of TAO and ensuring continuous device uptime. For miners, if they cannot provide optimized models or unique large LLM models, they will quickly be removed from the network.

The total supply of TAO tokens is 21,000,000, all of which are in circulation, with a market value of $4,474,463,212. It is listed on exchanges such as MEXC, Gate.io, KuCoin, and Bitget. Retail investors can choose to stake TAO to existing validation nodes and enjoy an annualized yield of approximately 15.85%.

iExec RLC

iExec RLC is a decentralized cloud resource platform based on Ethereum, aiming to change the current cloud computing model through integrated DApps, computing power markets, and data markets. The platform utilizes the innovative iExec Proof-of-Contribution (PoCo) consensus mechanism to ensure the validity and security of off-chain computing while protecting the platform from interference by dishonest participants. iExec was co-founded by Dr. Gilles Fedak and Dr. Haiwu He, with Dr. Fedak serving as the CEO. Prior to his involvement in blockchain entrepreneurship, Dr. Fedak had made pioneering achievements in software and algorithm development for cloud computing and large-scale parallel systems, winning several best paper awards. Dr. Haiwu He, as the head of the APAC region, was a "Hundred Talents Professor" at the Computer Network Information Center of the Chinese Academy of Sciences, leading research in high-performance computing (HPC) and cloud computing. In 2017, iExec completed a $12 million fundraising through an ICO.

The core functionality of the iExec platform allows users to run containerized applications, primarily targeting short-term and one-time tasks. Although it currently does not support a wide range of use cases such as web-based or API-based applications, iExec has successfully powered DApps on its sidechain and established a task pool for sorting by task size. The platform's computing resource bidding system enables users and applications to publish job orders based on preset criteria, and cloud providers (workers) provide computing power based on the prices they are willing to accept. Additionally, iExec has introduced the concept of pools, organizing workers (job nodes) that can be either public or private, similar to traditional cloud service providers.

The PoCo consensus algorithm serves as a defense mechanism for the iExec marketplace, ensuring trust execution on a decentralized network and preventing potential adverse outcomes and unreasonable objections. As of now, the market cap of $RLC is $322 million, and its fully diluted valuation (FDV) is $387 million. Since its launch in 2016, iExec has achieved significant milestones in the decentralized cloud computing field and became an important member of the Intel AI ecosystem in 2020.

iExec is continuously expanding its technological and service scope, with future plans including research and development (R&D) of AI and Large Language Models (LLMs), research and development of Privacy-Enhancing Technologies (PET), development of iExec Oracle IDE, Privacy Pass activities, Worker Pass second issuance, release of Dapp Store web interface, Questbook bounty tasks third season, Exec Web3 Incubator third and fourth seasons, and an upgrade of the PoCo consensus algorithm.

Allora

Allora is a self-improving, decentralized artificial intelligence network that obtains more accurate inferences through building a probability market. AI/ML agents in the Allora network broadcast their predictions on a peer-to-peer network using their data and algorithms, and each agent references these predictions to evaluate all other agents' predictions. The network consensus mechanism combines these predictions and evaluations and allocates rewards to agents based on the quality of their predictions and evaluations. This carefully designed incentive mechanism enables Allora to continuously learn and improve, adjusting as the market evolves.

Allora has built its independent chain based on Cosmos and implemented PoS, rewarding validators and AI job nodes. The nodes verify each other's inferences while performing reasoning, predicting the quality of each agent's reasoning directly through mutual evaluation, and distributing rewards based on the evaluation results.

Allora's internal testnet, Edgenet, was launched on March 5th and is currently collaborating with multiple projects and institutions to operate test nodes, with plans to launch the mainnet in Q2. Its investment institutions are also quite prestigious, with participation from Polychain, Framework, Blockchain Capital, CoinFund, Delphi Ventures, dao5, and Distributed Global.

lPAAL AI

lPAAL AI is an AI ecosystem built using custom data sources and Large Language Models (LLMs), allowing users to create personalized AI for professional strategy trading, market intelligence, and more, and deploy them to multiple platforms such as Telegram and Discord. PAAL AI tools include MyPaal, AutoPaal, and AutoPaal X. It has received investments from Google Cloud, Coingecko, OKX, and others. The total supply of PAAL is 1 billion, with a circulating supply of approximately 650 million, and a market cap of around $100 million.

MyShell

MyShell is an AI platform based on opBNB that allows users to create chatbots, enables creators to call different models and external APIs in the same way, and allows third-party model providers and API providers to integrate their services into the platform for developers to use. It incentivizes creators and users' activity through Shell points and Shell Coin (Shell Coin is an airdrop voucher, and points can be exchanged for Coin). It raised $5.6 million in seed funding in October 2023, led by INCE Capital, with participation from Folius Ventures, Hashkey Capital, SevenX Ventures, TSVC, and OP Crypto. Binance Labs has also announced the entry of MyShell into its sixth incubation program. Its valuation is approximately $57 million. It is currently in the development testing phase.

Qubic

Qubic is an L1 PoW platform that utilizes PoW computing power for AI training. The mainnet was launched in April 2022. It was founded by Sergey Ivano (also known as Come From Beyond or CFB). CFB was the third person in history to mine Bitcoin and his creation, NXT, was one of the most successful ICOs. He is also a co-founder of Iota.

- Quorum Protocol: This protocol processes transactions and executes smart contracts through 676 computers (validators), ensuring the finality and reliability of results.

- AI Aigarth: This is an AI software running on Qubic that gathers information from tens of thousands of Qubic-AI miners who use their computing power to create billions of artificial neural networks.

AI Agent

An AI agent can be understood as an intelligent entity with the ability for autonomous understanding, memory, decision planning, tool usage, and execution of complex tasks. This type of intelligent agent not only guides users on "how to do" but also actively assists users in completing tasks. Here, the specific AI agents referred to are projects that interact with AI models and blockchain technology, such as trading, providing investment advice, operating bots, enhancing decentralized finance (DeFi) functionalities, and conducting on-chain data analysis.

These AI agents have specific and direct application scenarios, namely trading. Their close integration with blockchain technology enables them to directly generate income, introduce new trading scenarios, and optimize the user experience of blockchain. This integration is actually an advanced narrative of decentralized finance (DeFi), creating profits through trading activities, attracting capital investment, creating speculative opportunities, and driving the operation of the Pareto flywheel effect.

AI trading agents typically start with a relatively low market value within the community, with low entry costs, thus offering good potential for investment returns.

Morpheus

Morpheus is a decentralized AI computing power market built on Arbitrum, helping users build AI agents based on large language models and enabling these agents to call smart contracts. Incentives are aimed at miners providing computing power, staking stETH, protocol development contributors, and community API operators. The project team uses character names from "The Matrix" movie (Morpheus, Neo, Trinity) as aliases on their website.

The core developer is David Johnston, who has years of experience in investing and serving as a CEO. Since 2013, he has been involved with the Bitcoin Foundation, and later joined Multicoin Capital and Space Fund. From 2021 to the present, he has been working at DLTx. In 2023, he created the "Intelligent Agent" framework and began investing in Morpheus.

Morpheus has a high community following and is distributed in a fair launch manner. The first phase of staking code is well completed and has undergone security audits. The community also has bug bounties, and the code security is strong. However, the code updates for AI Agent are slow, and the progress of the core modules is unclear. The main participation methods include staking stETH to participate in the distribution of capital, providing code support for Morpheus, participating in mining after the launch of the computing network on May 8, creating some network dashboards and tools, and becoming a community contributor.

#### **QnA3.AI**

[QnA3.AI](https://qna3.ai/) provides full-lifecycle, full-scenario services for information management, asset management, and rights management. Technically, QnA3 utilizes Retrieval-Augmented Generation (RAG) technology, combined with LLM understanding, pre-training, scalability, and reasoning capabilities to optimize information retrieval and generation, improving timeliness and accuracy. At the same time, the team emphasizes the AI+Trading and AI+DePIN concepts in asset management and rights management, advancing the practice of decentralized machine learning. QnA3.AI is incubated by Binance Labs and received investment from the Solana Foundation on February 25, 2024.

QnA3.AI started in January 2023 and experienced rapid development within just one year. The project launched a Q&A feature in June, rapidly increasing its user base. In September, it introduced an intent-centric Telegram bot, increasing its user base to 300,000. By December, the daily active user count reached the top on the BNB Chain, with a total user base exceeding 2 million. To date, the user count has exceeded tens of millions.

#### **Autonolas**

[Autonolas](https://olas.network/) is an open market for creating and using decentralized artificial intelligence agents. Autonolas also provides a set of tools for developers to build off-chain hosted artificial intelligence agents and connect to multiple chains, including Polygon, Ethereum, Gnosis Chain, and Solana. They currently have some active agent concept verification products, including products for market prediction and DAO governance.

David Minarsch is the CEO and co-founder of Autonolas' parent company Valory, holding a Ph.D. in Economics from the University of Cambridge, specializing in multi-agent services. Previously, he served as the Head of Multi-Agent Services at Fetch.ai. Investors include Signature Ventures, Semantic Ventures, True Ventures, Proof Group, and others.

#### **SingularityNet**

[SingularityNET](https://singularitynet.io/) is an open, decentralized AI service network with a mission to create a decentralized, democratic, inclusive, and beneficial general artificial intelligence. Developers can publish their services to the SingularityNET network, and anyone with internet access can use these services. Developers can charge for the use of their services using the native AGIX token.

The creators are Dr. Ben Goertzel and Dr. David Hanson, both core developers of the famous humanoid robot Sophia. SingularityNET's investors include Fundamental Labs. In May 2022, SingularityNET and Singularity DAO received a $25 million investment commitment from the investment group LDA Capital.

SingularityNET's services can provide reasoning or model training across multiple domains, such as images, videos, speech, text, time series, bio-inspired AI, and network analysis. These services can be as simple as packaging well-known algorithms or as complete end-to-end solutions for industry problems, or as standalone AI applications. Developers can also deploy autonomous AI agents that interoperate with other services on the network. For example, facilitating trust and automated transactions through multi-party hosting, releasing new AI services and organizations on the blockchain, tracking successful API calls, and defining pricing strategies.

#### **Fetch.AI**

[Fetch.AI](https://fetch.ai/) is one of the earliest deployed AI agent protocols and has developed an ecosystem for building, deploying, and using agents using its FET token and Fetch.AI wallet on-chain. The protocol provides a comprehensive set of tools and applications for using agents, including wallet functions for interacting with and issuing commands to agents.

The Fetch development team mostly consists of graduates from prestigious universities or individuals from Fortune 500 companies, all of whom are AI or algorithm experts. It is worth mentioning that the CEO and CTO have connections to Deepmind, a Google-owned AI company. Deepmind's flagship product, Alphago, defeated the Korean Go champion Lee Sedol and also defeated professional players in StarCraft 2. The advisory team mostly consists of professors from prestigious universities, with a strong academic background overall. In terms of funding, in March 2021, the Toronto digital asset company GDA Group invested $5 million; in March 2022, Fetch launched a $150 million development fund to encourage developers to develop projects in its ecosystem, with MEXC Global leading the fund and Huobi and Bybit participating.

#### **Humans.ai**

[Humans.ai](https://humans.ai/) is an AI blockchain platform that brings together stakeholders in the ecosystem of using AI for large-scale creation, integrating an AI tool library into a creative studio suite where users can select and implement their own creativity. Individuals have the right to create and own their digital portraits, which can be used by themselves and others to create any number of digital assets. Synthetic media, AI applications, and other digital assets can generate NFTs using blockchain technology. The total supply of the Humans.ai token HEART is 7.8 billion, with a circulating supply of approximately 5.12 billion and a market cap of approximately $85.96 million.

#### **Metatrust**

[Metatrust](https://www.metatrust.io/) is a Crypto-empowered AI Agent network. MetaTrust has built the world's first comprehensive Web3 security solution, covering the entire software development lifecycle (SDLC), founded by a globally renowned research team from Nanyang Technological University. It raised $10 million in seed funding, led by M23 Fund, with participation from Redpoint, ABCDE, LongHash Ventures, and Hash Capital.

#### **AgentLayer**

[AgentLayer](https://agentlayer.xyz/home) is a decentralized agent network built by the Metatrust team based on OP Stack+EigenDA's core chain structure. EigenDA can balance the high availability of data and significantly improve the overall performance and security of the AgentNetwork. OP Stack, as a complete toolbox for layer2, supports Optimism and other Rollup implementations, providing key components such as sequencers, nodes, and contracts, which can be independently applied to different scaling implementation schemes.

#### **DAIN**

DAIN is building an agent2agent economy on Solana. DAIN aims to enable agent proxies from different enterprises to seamlessly interact with each other through a universal API, greatly opening up the design space for AI agents, with a focus on agents that can interact with web2 and web3 products. In January 2024, DAIN announced its first collaboration with Asset Shield, allowing users to add "proxy signers" to their multi-signature, who can interpret transactions based on user-set rules and approve/reject them. DAIN is developing an Agent that can retrieve on-chain information and conduct transactions, analyze and process on-chain data, and provide purchasing advice in chat form.

ChainGPT

ChainGPT is an AI model designed for blockchain and crypto, with products including AI NFT generator, AI news generation, AI trading assistant, smart contract generator, and smart contract auditor. ChainGPT won the BNB Ecosystem Catalyst Award in September 2023. The CGPT token has a market cap of approximately $40.63 million.

Data Assetization

The combination of AI and encryption technologies in the data track is seen as a field with enormous potential, with the core value lying in data and computing power as the basic means of production for AI. Unlike the decentralization of computing power, which may reduce efficiency, there is a rationale for a certain degree of decentralization in handling data, as data production itself is decentralized. Therefore, theoretically, the data track has great potential for development in the field of AI and encryption technologies.

However, the core challenge in this field is the lack of a mature data trading market in traditional markets, making it extremely difficult to effectively value and standardize data. Project parties find it difficult to attract large amounts of capital through token incentives because, in the absence of an effective evaluation mechanism, the value of data is difficult to reflect in token prices. This situation leads to a potential "flywheel effect" fracture, making it difficult for even highly potential projects within the data track to leverage large-scale capital through low-cost token incentives.

Despite the challenges, some projects are attempting to explore new models and solutions in the data track from different perspectives. For example, projects like Sapien focus on providing a market for AI-required labeled data, attempting to solve the problem of acquiring AI training data. Additionally, considering the high demand for bandwidth in decentralized AI training, bandwidth providers have become a new entry point in the data track. Projects like grass.io are attempting to build a decentralized bandwidth ecosystem to indirectly provide data for AI training, demonstrating attempts to find new opportunities and solutions within the data track.

Synesis One

Synesis One is a data crowdsourcing platform on Solana, where anyone can earn $SNS by completing micro-tasks to train AI. Off-chain annotation is sent to on-chain validators for verification and rewards are issued upon verification.

The South Korean development team underwent a reorganization on October 11, 2023. Isaac Bang serves as the CEO, having previously been the Growth Director at Synesis One. Currently, Synesis One is collaborating with Mind AI, which will use the data collected by Synesis One to train AI and is expected to support audio, video, and image data, as well as RPA (robotic process automation) in the future. Mind AI has signed cooperation agreements with General Motors and the Indian government. It has raised $9.5 million in funding.

Grass.io

Grass.io is a decentralized bandwidth marketplace. Users can sell their surplus bandwidth to AI companies that use it to fetch data from the internet. There are currently over 2 million individual IP network addresses, and only users who are online in real-time can earn Grass points.

It has raised $3.5 million in seed funding, led by Polychain Capital and Tribe Capital, with participation from Bitscale Capital, Typhonv, and others. Tokenomics have not been disclosed, and the team members expect to launch the token by the end of the year.

GagaNode

GagaNode is the next-generation decentralized residential bandwidth marketplace, aiming to alleviate the global shortage of IPv4 addresses through Web3.0 technology. It has good support for major systems (including mobile). The code has been open-sourced.

Ocean

Ocean Protocol allows anyone with valuable datasets to tokenize their data and offer it on the Ocean Market. Users can create data NFTs representing their data and purchase them using data tokens. It is possible to participate in data challenges by building AI trading bots and staking tokens.

Founder Bruce Pon has worked at Mercedes-Benz for over 5 years, lectured at MIT, Oxford University, New York University, and the European School of Management and Technology (ESMT) over 200 times on blockchain, cryptocurrency, and decentralized technologies. The project has over 35 advisors globally.

ZKML

By introducing ZK into the field of machine learning, it allows for rapid verification of model computation correctness without revealing information. The trustless verification of models enables ZKML to be used as a trustless agent or in some privacy scenarios, such as applications represented by Worldcoin.

At the same time, machine learning can potentially be run in smart contracts through ZK, allowing smart contracts to achieve greater automation and flexibility. Additionally, the trust issue of ML models as a "black box" can also be addressed through ZK verification.

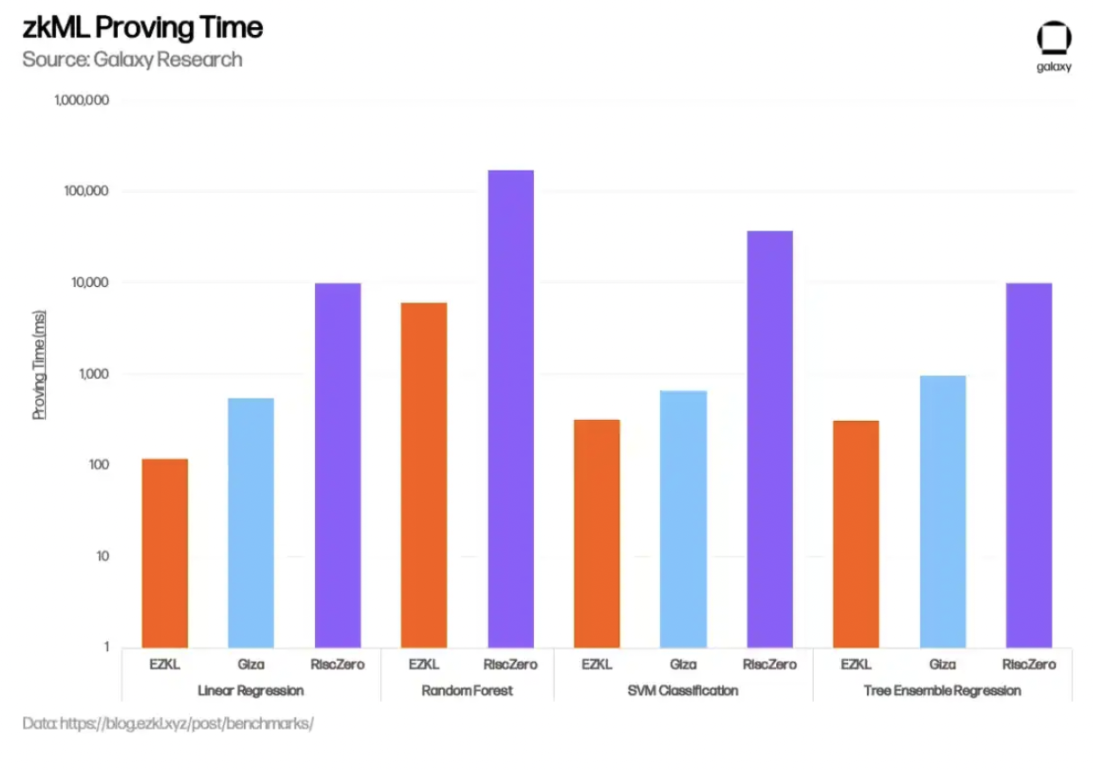

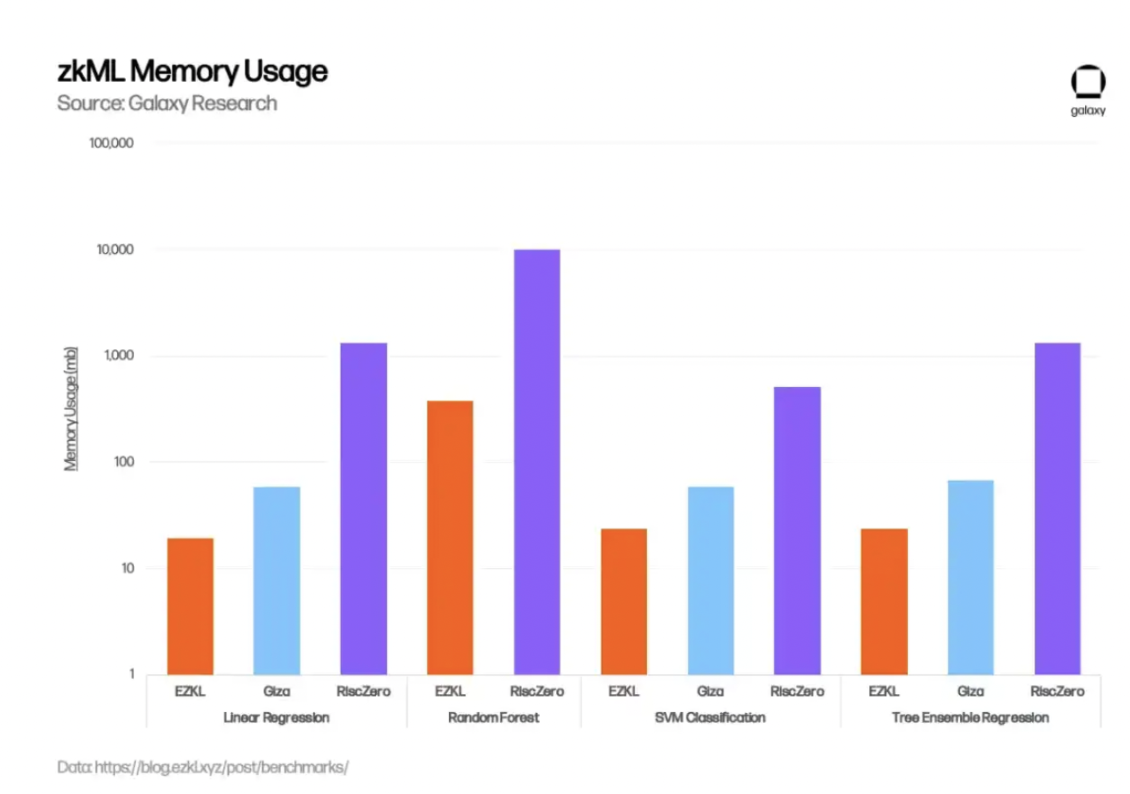

The infrastructure of ZkML is represented by on-chain ML, such as Modulus Labs, and trusted inference proof services represented by Giza and EZKL, as well as coprocessors represented by Risc Zero and Axiom. This track is still relatively early and requires consideration of its technical capabilities and team background.

WorldCoin

WorldCoin was launched by OpenAI and requires users to scan their irises to generate a unique ID. In the future, biometric IDs can be self-stored using encryption on personal devices, and the required models are used for local verification of this biometric information. Users can provide proof of their biometric information without revealing their identity, thereby resisting witch attacks and ensuring privacy. It is currently a leader in the AI field. Worldcoin has raised over $250 million from multiple rounds of funding from investors such as a16z, Khosla Ventures, Bain Capital Crypto, Blockchain Capital, and Tiger Global.

The platform has over 1 million active users. World ID verified using device verification or Orb-verified World ID can be used for identity verification on DRiP and immediately unlock Droplet rewards.

EZKL

DAIN is an open-source platform that generates zero-knowledge proofs to prove certain results without revealing the model itself. In recent months, EZKL has made significant progress in enhancing zkML solutions, focusing on cost reduction, improved security, and faster proof generation. For example, in November 2023, EZKL integrated a new open-source GPU library that reduced aggregation proof time by 35%. In January of this year, EZKL released Lilith, a software solution for integrating high-performance computing clusters and concurrent job orchestration systems when using EZKL proofs. It has announced a collaboration with OP.

Jason Morton is the CEO of EZKL and holds a Ph.D. in Mathematics from the University of California, Berkeley, and a Bachelor's degree in Economics from the University of Michigan.

Giza

Giza is a machine learning platform built on StarkNet. In addition to providing tools for creating verifiable machine learning models, Giza plans to implement a web3 equivalent to Hugging Face, opening a user market for zkML collaboration and model sharing, and ultimately integrating decentralized computing products. Recently, Giza Datasets optimized Web3 dataset frameworks for ML workflows and structured them for model training purposes.

Giza was founded in October 2022 by Cem Dagdelen, Fran Algaba, and Renç Korzay. It completed a $3 million pre-seed round led by CoinFund, with participation from StarkWare, TA Ventures, and Arrington Capital. Giza has not yet issued tokens.

RiscZero

RiscZero offers a new type of ZK virtual machine (ZKVM) that allows developers to execute arbitrary computations while preserving privacy. Brian Retford is the co-founder and CEO of RISC Zero. Previously, he co-founded Vertex.AI and served as CTO. He also worked as a software engineering manager at Google. RISC Zero has completed a $40 million Series A funding round, with participation from Blockchain Capital, Bain Capital Crypto, Geometry, Alchemy Ventures, and IOSG Ventures.

RISC Zero's main products are zkVM and Bonsai. zkVM is a zero-knowledge virtual machine that allows users to prove the correct execution of any Rust code. It is based on zk-STARK. Bonsai Network is RISC Zero's L2. Applications send collaborative requests to the Bonsai Relay, which then forwards proof requests to the Bonsai Proof Service. RISC Zero zkVM executes and generates proofs to verify the correct execution of the code, which can be verified by anyone. Subsequently, the Bonsai Relay publishes the proof on-chain, and the application receives the results through a callback function.

Modulus

Modulus is developing a new zk-proof technology tailored for AI models. In November, Modulus launched Remainder, a specialized zero-knowledge prover designed to economically integrate models into smart contracts by reducing AI model costs and proof generation time.

The leadership team of Modulus Labs includes Daniel Shorr, Nicholas Cosby, and Ryan Cao. Daniel Shorr is the co-founder and CEO of the company. He studied at Stanford University and is known for his leadership and public speaking skills.

Funding: Raised $12 million in seed funding led by Bain Capital Crypto; with participation from Blockchain Capital, Galaxy, DELPHI VENTURES, Figment Capital, and IOSG CENTURES, completed a $40 million Series A funding round.

In 2024, Modulus Labs will release the Modulus API, and its codebase will be open-source. Modulus Labs plans to integrate this product into various dApps in Q1 and Q2 of 2024.

Pi Squared

Pi Squared uses zero-knowledge proofs (ZK) to verify the correctness of the execution of any program without relying on a specific programming language (PL) or virtual machine (VM). Based on the K framework and matching logic, it provides a universal and efficient verification method, aiming to achieve seamless interoperability of blockchain, languages, and applications.

The K framework is a formal verification-like framework, where the process is to write the source code execution spec according to the requirements of the K framework. The K framework can prove whether the source code complies with the spec. It is compatible with multiple languages, which is the underlying support for Pi Squared's general verification. The proof logic implementation of K framework formal verification will output "mathematics proofs". Pi Squared implements the process of verifying these mathematics proofs using zk circuits and can generate proofs, which can be verified on-chain. Therefore, Pi Squared can be used to provide on-chain trustworthy proofs for smart contracts: by generating proofs using K framework off-chain and zkifying the verification process, proof of proof can be verified on-chain, equivalent to formal verification of smart contracts, i.e., on-chain verifiable code audit. This is also the Near term expected functionality of the Pi Squared project, providing contract auditing and developer verification tools. The benchmark displayed in its official GitHub also proves that this logic is mostly feasible, but overly complex logic will consume more time or computational resources.

This verification logic can be used to verify transactions, i.e., putting the process of transactions, contracts, execution, and proof generation off-chain, generating zk proofs using K framework and proof of proof services. All validators no longer maintain a single chain but verify zk proofs to perform state transitions, completing the business logic of off-chain execution and on-chain verification.

Currently raising $5.3 million with a valuation of $50 million. The Fully Diluted Valuation (FDV) is $200,000,000, with the team holding a 12% stake, and the FDV growth factor for 1-4 years is 1.5.

AI Application

Here is the translation of the provided markdown:

Here refers to the introduction of AI capabilities into existing crypto businesses, such as implementing AI for automatic investments in DeFi to achieve more efficient returns, introducing cloud gaming in Gamefi, or using AI production capabilities to create game resources and AI role-playing, and so on. There are numerous projects of this kind, which require analysis based on their specific business models.

DeFi

- inSure DeFi is a decentralized insurance protocol where users can purchase SURE to insure their crypto asset portfolios. inSure aims to allocate cryptocurrency ownership risks in liquidity pools, and insurance premiums are determined using a dynamic pricing model leveraging Chainlink.

- The market value of SURE is approximately $130 million.

- Hera Finance is an AI-driven multi-chain DEX aggregator integrated with Arbitrum, Metis, Avalanche, Base, BNB Chain, Ethereum, Fantom, Mantle, and Optimism. The HERA token has a total supply of 10 million, with a circulating supply of 3.766 million and a market value of approximately $18.1 million.

- SingularityDAO is an AI-driven DeFi protocol and decentralized investment portfolio management protocol that has launched the AI Launchpad. In May 2022, decentralized artificial intelligence network SingularityNET and Singularity DAO secured a $25 million investment commitment from investment group LDA Capital, to accelerate the adoption of AI tools, expand the ecosystem, and drive the development of AI-supported DeFi applications. The total supply of SingularityDAO token SDAO is 100 million, with a circulating supply of 86,303,603 and a market value of approximately $47.08 million.

- Arc is an innovative technology company dedicated to transforming Web3 through its AI-driven Reactor, DeFi ecosystem, and DApp. In the spring of 2023, ARC acquired Lychee AI; in July, Arc launched ARC Swaps AI; in August, Arc joined Google Cloud's AI Startup Program. The market value of the ARC token is approximately $37.76 million.

- AQTIS is an intelligent liquidity protocol supported by Quant-Tech and AI, aiming to establish a sustainable and robust real-yield ecosystem. $AQTIS is used somewhat like Gas on ETH, with an FDV of $69,927,812.

- Jarvis Network is a DeFi platform that utilizes AI algorithms to provide optimized trading and investment strategies for cryptocurrencies and other assets. Its native token is JRT, with a total supply of 565 million and a circulating supply of approximately 397 million, with a market value of $3 million.

- LeverFi is an on-chain leverage trading protocol. In August of this year, LeverFi announced a collaboration with Microsoft to develop the AI DeFi solution Morpheus, based on Microsoft Azure OpenAI services. It is an AI investment portfolio management assistant that provides valuable portfolio management insights and helps users make investment decisions through intuitive machine learning for real-time on-chain monitoring. In September 2023, LeverFi announced a $2 million investment from DWF Labs, with a two-year lock-up and release period. LeverFi also secured an additional $2 million over-the-counter trading commitment, which can be executed at any time within two years if needed. The total supply of LeverFi token LEVER is 35 billion, with a circulating supply of approximately 28.8 billion and a market value of approximately $37.81 million.

- Mozaic is an automatic yield farming protocol based on LayerZero, combined with AI concepts. FDV $126,648,136

Gaming

- Sleepless AI is a virtual companion game based on AI blockchain, using AIGC and LLM to create rich story-based gameplay and organic interaction with characters. The project is currently developing three games, with the first game being "HIM," a virtual boyfriend otome game (Note: Otome games are a type of romance simulation game targeted at female audiences), featuring unique SBT characters that are immutable and based on the blockchain. Binance launched the Sleepless AI token AI on Launchpool. FDV $1,541,188,206

- Phantasma is a Layer1 public chain aimed at gaming, entertainment, and content creation, offering Unity SDK, smartNFT technology, and an AI smart contract encoder, allowing users to build DApps without code using Phantasma AI. The SOUL token of Phantasma is fully circulated, with a market value of approximately $27.75 million.

- Delysium is an AI-driven open-world framework and Web3 game publisher, aiming to build an AI-driven virtual society using AGI. They have launched the AI-driven Web3 operating system Lucy, which allows users to interact with various DApps using natural language. Everyone can create their own AI-Twins virtual characters through Delysium AI, and players can interact with these AI virtual characters to learn about cryptocurrencies, check and trade crypto assets, discover cryptocurrency opportunities, and receive risk warnings through natural language conversations. Delysium also became the first AAA playable game Delysium: Center City to be listed on the Epic Games Store. FDV $723,377,08424

- Mars4.me is an interactive 3D metaverse project that will drive AI-driven metaverse game development. Mars4 has multiple plots in the metaverse, each represented by an NFT token. The Mars4 development team has used detailed Mars terrain maps based on NASA Mars data. In May 2023, Mars4.me received long-term financial support from DWF Labs, with the specific investment amount not disclosed. The token MARS has a market value of approximately $9.04 million.

- GamerHash utilizes the remaining computing power of players' computers during high-performance gaming for cryptocurrency mining. For example, if a player is only using 15% of their computer's computing power while gaming, GamerHash automatically utilizes the unused capacity for cryptocurrency mining without requiring additional user actions or monitoring. To serve users with lower-end hardware, GamerHash has introduced the Play&Earn feature, allowing users to earn the internal currency GUSD, pegged to the US dollar, by completing specific tasks such as playing certain games or downloading apps, providing a new income channel for users with limited hardware capabilities.

- Gaimin, founded by the esports team Gaimin Gladiators, differs from the io.net general-purpose GPU decentralized network. Gaimin aims to build a dApp that combines cloud computing power and gaming platforms, allowing players to rent out their GPU computing power during idle times to earn additional rewards. Leveraging the high-performance GPU computing power of most players, Gaimin aims to build a decentralized distributed supercomputing platform, gaimin.cloud, which can provide customers with data processing services such as video rendering, AI deep learning, and blockchain computing. Gaimin recently announced its plan for an L2 game public chain, which will build an L2 public chain on BNB using opBNB Stack technology and collaborate with MovementLab to use Move technology, achieving a throughput of over 150k TPS, reduced latency, minimal gas fees, and enhanced Web3 gaming user experience.

- Cerebrum Tech is a generative AI, gaming, and Web3 solution. In October 2023, Cerebrum Tech announced the completion of a $1.8 million funding at a valuation of $15 million, led by Boğaziçi Ventures, with co-investment from the venture capital fund Inveo Ventures Coinvestment. No token has been issued yet.

- Ultiverse is a metaverse gaming platform that has launched the AI-driven open metaverse protocol Bodhi. In March 2022, Ultiverse completed its seed round of financing, led by Binance Labs and Defiance Capital, with participation from Three Arrows Capital and SkyVision Capital, among others. The amount of funding raised was not disclosed. In the same month, Binance Labs made an additional $5 million equity investment in Ultiverse. No token has been issued yet.

NFT

- NFPrompt is an AI-driven Prompt artist platform where users can generate NFTs using AI. On December 19, 2023, Binance launched the Launchpool project NFPrompt (NFP), supporting users to stake BNB, FDUSD, and TUSD. In September 2023, NFPrompt was selected for the sixth season incubation program by Binance Labs. The total supply of NFPrompt token NFP is 10 billion, with an FDV of $513,189,180, and 21% of the total supply is immediately unlocked from the genesis for the initial airdrop and Binance Launchpool.

- Vertex Labs is a provider of metaverse, Web3, and AI infrastructure. It previously completed the acquisition of the NFT series HAPE PRIME development studio Digimental Studio for $12 million. Vertex Labs has launched the Caduceus Layer1 blockchain (providing Caduceus TrustedAI), Layer3 network, distributed real-time rendering, and AI computing platform Vertex Network, 3D virtual world platform LightCycle, and the Web3 brand Hape Prime, which integrates fashion, music, and culture. The Caduceus token CMP is part of the DWF Labs investment portfolio, with an FDV of $7,393,545.

Education

Hooked Protocol is a Web3 gamified social education platform that began building Hooked AI at the end of 2022. This product includes the Hooked Avatar NFT supported by AIGC and the perceptive AI mentor Hooked Academy supported by ChatGPT. The total supply of Hooked Protocol token HOOK is 5 billion, with a circulating supply of approximately 1.1 billion and a market value of approximately $130 million.

System

Terminus OS is a Web3 operating system based on an open and proprietary blockchain-edge node-client (BEC) architecture developed by ByteTrade. In this architecture, the client is the user's lightweight software, deployable on browsers, mobile devices, or any device, enabling AI POI (Proof of Intelligence) for the AI era. Terminus OS has not issued a token yet. In June 2022, ByteTrade Lab completed a $50 million Series A financing, with lead investment from SIG Haina Asia Venture Fund, INCE Capital, BAI Capital, Cloud Nine Capital, BlueChi Ventures, and PCG, among others.

Summary

The integration of AI and cryptocurrency technology has brought innovative opportunities to various industries, from computational power clouds to AI applications, from data assetization to zero-knowledge machine learning, all demonstrating the profound impact of technology integration. With the emergence of more innovative projects, we have reason to believe that the future of AI and cryptocurrency fields will be more diverse, intelligent, and secure. In the future, we look forward to witnessing more cross-industry collaborations and the birth of innovative technologies, collectively driving AI and blockchain technology towards broader application prospects.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。