Today's Headlines

- The Federal Reserve's Bostic reiterated that it is expected to only have one interest rate cut this year.

- The net outflow of spot Bitcoin ETF on March 25 was approximately $250 million.

- The US SEC plans to require judges to impose a $20 billion fine on Ripple Labs.

- XRP defense lawyer: The SEC's court remedial measures related brief will be disclosed no later than March 26.

- Bakkt's total revenue for the full year of 2023 was $780.1 million.

- FTX will sell 2/3 of Anthropic's shares for $884 million.

- Ark Invest released an innovative platform white paper: public chains will drive the reconfiguration of the financial ecosystem.

- Orderly Network will launch a points program starting next week.

- Thailand will finalize the details of the digital wallet plan on April 10.

- Cyvers Alerts: Curio Ecosystem encountered a $16 million vulnerability exploit.

Hot Projects (DeFi Track on SOLANA)

Marinade Finance:

Project Introduction: Marinade Finance is a liquidity staking protocol that allows users to stake SOL tokens to earn compound interest and help maintain the decentralization of the Solana ecosystem. Users can monitor all Solana validators through Marinade and delegate to the best-performing validators.

Investment Reason: As the largest liquidity staking protocol on Solana, Marinade provides a way to earn returns by staking SOL while supporting the security and decentralization of the Solana network. For investors seeking passive income and supporting the development of the Solana ecosystem, Marinade is an attractive choice.

Raydium:

Project Introduction: Raydium is the first AMM (Automated Market Maker) and liquidity provider built on the Solana blockchain, offering trading, swapping, and liquidity mining functions. The Raydium DEX platform allows users to access Serum's order book, combining on-chain protocols and the CFAMM algorithm to provide users with more trading options.

Investment Reason: Raydium's AMM mechanism and liquidity mining provide investors with opportunities to participate in the Solana DeFi ecosystem and earn returns. For investors looking to trade and provide liquidity in the Solana ecosystem, Raydium offers a mature platform.

Solend:

Project Introduction: Solend is a decentralized lending protocol on Solana that supports borrowing and lending of various crypto assets. Solend offers margin trading and a rewards program, expanding its business beyond just loans.

Investment Reason: Solend's support for diverse assets and innovative lending features provides investors with more financial operation choices. For investors seeking to engage in more complex financial activities within the Solana ecosystem, Solend offers a versatile lending platform.

Orca:

Project Introduction: Orca is a DEX built on the Solana blockchain, providing a user-friendly interface for asset swapping and liquidity provision.

Investment Reason: Orca's ease of use and beginner-friendly design make it an ideal choice for entering the Solana DeFi ecosystem. For investors looking to participate in trading and liquidity mining easily, Orca provides a convenient entry point.

Pyth Network:

Project Introduction: Pyth Network is a decentralized oracle network that provides price data for smart contract applications. Pyth aggregates data from top exchanges and market makers and distributes this data across multiple blockchains.

Investment Reason: As a key infrastructure in the Solana ecosystem, Pyth Network provides accurate price data for DeFi projects and serves as the foundation for building complex financial products. For investors bullish on the development of the Solana DeFi ecosystem, Pyth Network offers a crucial service supporting the entire ecosystem's operation.

Market Overview

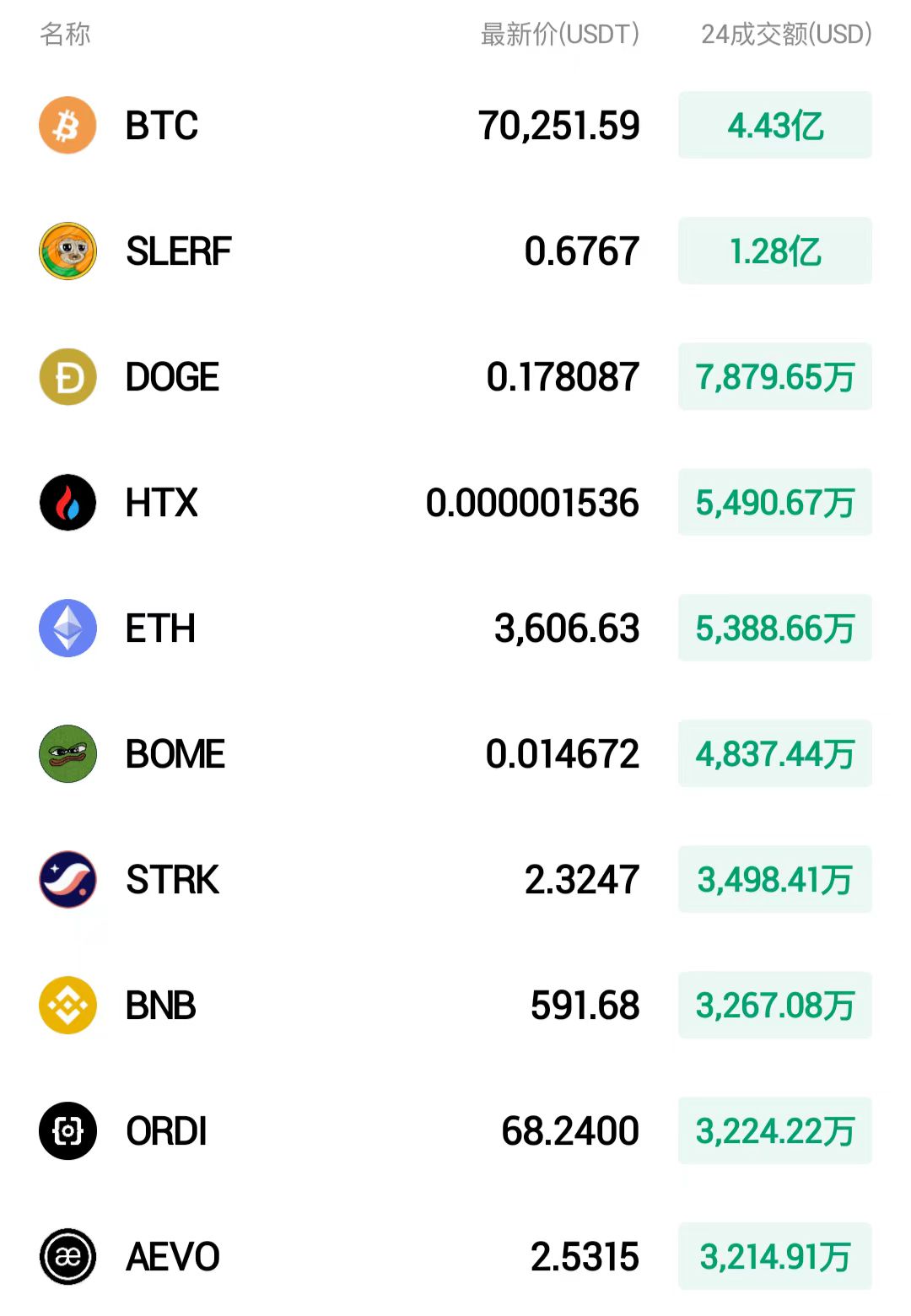

Bitcoin (BTC) continued to rebound in the past 24 hours, rising by 5.43%, reaching a high of $71,129 and a low of $63,785, with a volatility of 6.92%. Ethereum (ETH) rose by 5.08% in the past 24 hours, reaching a high of $3,659 and a low of $3,300, with a volatility of 7.23%. HTX rose by 0.32% in the past 24 hours, reaching a high of $0.000001570 and a low of $0.000001479, with a volatility of 3.71%.

Major cryptocurrencies are all on the rise, with AVAX showing a significant increase of 4.55%. The total market value of cryptocurrencies is $2.78 trillion, up 5.1% from yesterday; the total 24-hour trading volume across the network is $134.1 billion, continuing to rise from yesterday.

Today's fear and greed index is 75, unchanged from yesterday, indicating a greedy market sentiment.

Today's Huobi fixed investment index is 23, an increase of 26 points from yesterday, indicating a holding and wait-and-see attitude.

Market Opportunities

Analyst MAX: Yesterday, the cryptocurrency market warmed up again, with BTC surging to $70,000. The main reason for the rise in the market yesterday was the substantial rise in the concept of digital currency in the US stock market. The bullish factors in the market itself are limited. In terms of price, it has once again entered a bullish structure, with a focus on the upper pressure around 70,500 for BTC in the short term, and a bullish view if it breaks through. For ETH, attention is on the pressure around 3,680. The recent market volatility is large, so strict risk control and position management are essential. The above is personal advice, for reference only.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。