Tracking real-time hotspots in the currency circle, seizing the best trading opportunities. Today is Monday, March 25, 2024, and I am Yibo! We are not predicting trades, but actually observing market fluctuations (narrowing, spreading), structure (market batch structure), and sentiment (external market stocks, US dollars, etc.). As a trader, you (through trading) not only influence prices but are also influenced by prices as a factor affecting your emotions and behavior.

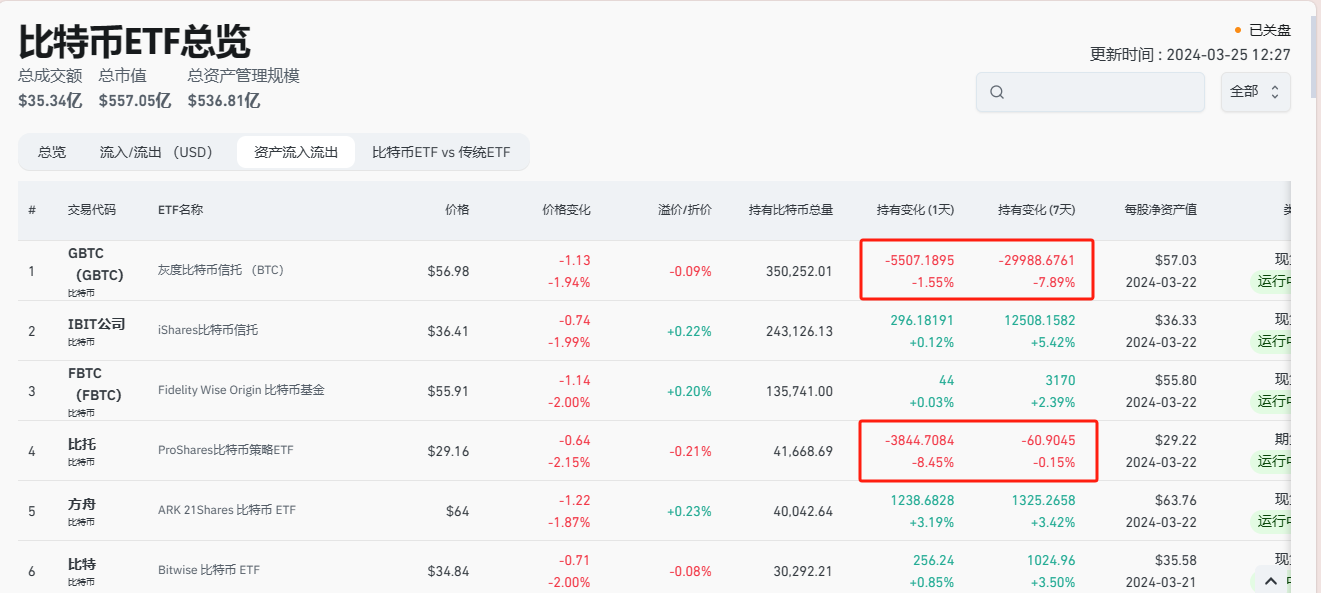

Grayscale outflowed 2592 BTC yesterday, and the total buying volume of all ETFs such as FBTC from Fidelity and IBIT from BlackRock was 1805 BTC. The net inflow into the market was -787 BTC. This marks the fifth consecutive day of negative net inflows for BTC. Currently, there are few retail investors buying BTC above 60,000 points, and the cost-effectiveness ratio of fund utilization and returns is not high. The Fed's interest rate cut is an uncertain factor, and there are 28 days left until the Bitcoin halving. Grayscale continues to sell BTC, and institutions like BlackRock seem to be struggling to keep up, which is bearish. However, the upcoming Bitcoin halving is bullish. In terms of trend, the buying pressure at the 60,000-point level is relatively strong, while the selling pressure above 70,000 points is also strong. There is a high possibility that the market will see a halving trend. The overall market sentiment for BTC is positive, especially for long-term holders. Therefore, stability is crucial in the upcoming period.

From the current market perspective, after hitting a low of 64635 last night, the market rebounded to around 67700. Although it has been in a oscillating downtrend, the overall bullish trend is still relatively strong. The upward movement has been taking one step forward and one step back, but we can consider all current pullbacks as corrections. The current minor retracement is also paving the way for the subsequent bullish trend. Therefore, we can understand the current situation as a correction in exchange for time and space, and we can continue to focus on buying opportunities during the retracement.

Ethereum started to rebound after hitting a low around midnight and reached a high of around 3470 in the early morning before falling back under pressure. Looking at the indicators, the MACD bullish volume is shrinking. The main resistance above is concentrated around 3550. During the adjustment at the end of last week, the price of the coin showed relatively weak retracement, so the rebound is naturally weak as well. However, the short-term trend is oscillating upward, with levels of 3250-3300-3350 on the hourly chart, indicating a bias towards an upward trend. It is advisable to go long in the morning in line with the trend.

In this market, it ultimately comes down to ability. If your ability is insufficient, the market will eventually take back what it has given you. Therefore, when your wealth exceeds your ability, you need to control the retracement, even though this control is futile. The arrogance and conceit that come with profits will ultimately destroy a person's rationality. However, in the capital market, there is no need to worry about the situation where your wealth is lower than your ability, because this imbalance will eventually be corrected by time. If it is not corrected, there is only one reason, which is your own lack of ability. If you are still in a state of confusion, not understanding the technology, unable to read the market, not knowing when to enter, unable to set stop-loss orders, not knowing when to take profits, blindly adding positions, getting trapped at the bottom, unable to hold onto profits, and unable to seize opportunities when the market comes, these are all common problems for retail investors. However, it's okay. Come to me, and I will guide you in the right direction for trading. A thousand words are not as good as one profitable trade. Instead of frequent operations, it's better to be precise with each trade, making each one valuable. What you need to do is find me, and what we need to do is prove that our words are not empty. 24-hour real-time trading guidance. The market fluctuates quickly, and due to the impact of review timeliness, real-time layout for the subsequent market trends is the main focus. Coin friends who need contract guidance can scan the QR code at the bottom of the article to add my public account.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。