Author: Infinity Labs Research

Blast is undoubtedly the hottest unreleased L2 at the moment, with over 3,000 projects signing up for the Big Bang event, unprecedented in popularity.

On March 22, Blast allocated the first batch of gold points to dApps on the mainnet, totaling 10 million. Of these, the winning projects from Big Bang received an additional 4 million, while the mainnet dApps received a total of 6 million. This is the first phase of allocation, and based on a bi-weekly schedule, it is estimated that there will be a total of 5 allocations, with an estimated total of 40 million gold points.

How much is one gold point worth?

Based on Blast's current off-chain valuation of $5 billion, assuming that the total airdrop of Blast is 20%, or $1 billion, according to Blast's rules, 10% will go to Blast Points and 10% to Blast Gold:

So we can roughly estimate: 1 Blast Gold is approximately 12U.

Strategies for earning Blast gold points

To obtain gold points, one must participate in dApps. Currently, a large portion of funds on the chain are actually idle, so players who participate in dApps may receive significant excess returns.

However, at the same time, it is noted that the allocation of gold points to projects is not entirely linear with TVL. The project with the highest TVL received 200,000 points, while some projects with lower TVL but performing well also received tens of thousands or even hundreds of thousands of points.

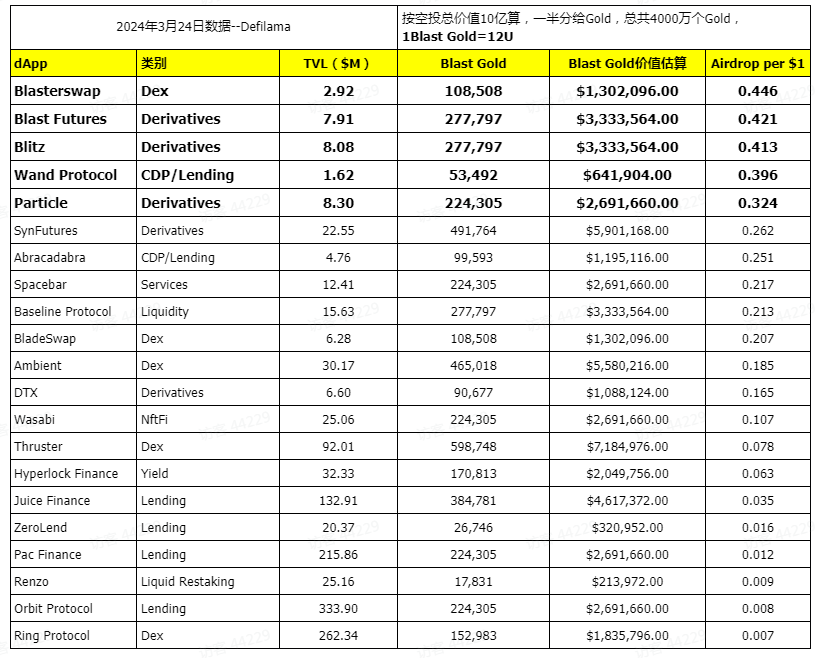

Therefore, for projects that test funds, the best strategy for capturing gold points is to participate in projects with a high allocation of Gold, but where TVL has not yet seen a large influx of funds.

By comparing the TVL and the amount of Blast Gold obtained from these projects on Defilama, we can estimate a cost-effectiveness ranking.

This table mainly targets Defi projects, using TVL as a rough judgment basis. The project ranked first in the table can receive 0.4U for every 1U deposited, with extremely high cost-effectiveness.

Of the top five projects, three are derivative trading platforms, one is a Dex, and one is a CDP lending protocol. This article will provide a brief introduction to these five projects to help everyone choose a high-yield project for their gold points participation.

Introduction to high-yield gold point projects

First, let's introduce three derivative trading platforms: Blast Futures, Blitz, and Particle. In this bull market, derivative trading platforms have become the most competitive track outside of Dex. The trading frequency of derivative trading platforms is higher than that of Dex, and an excellent project can contribute a large number of users and trading volumes to the public chain platform, so public chain platforms often pay more attention to such projects.

Currently, the TVL of these three derivative trading platforms is quite close, all around $8 million, fiercely competing for the second place.

Particle

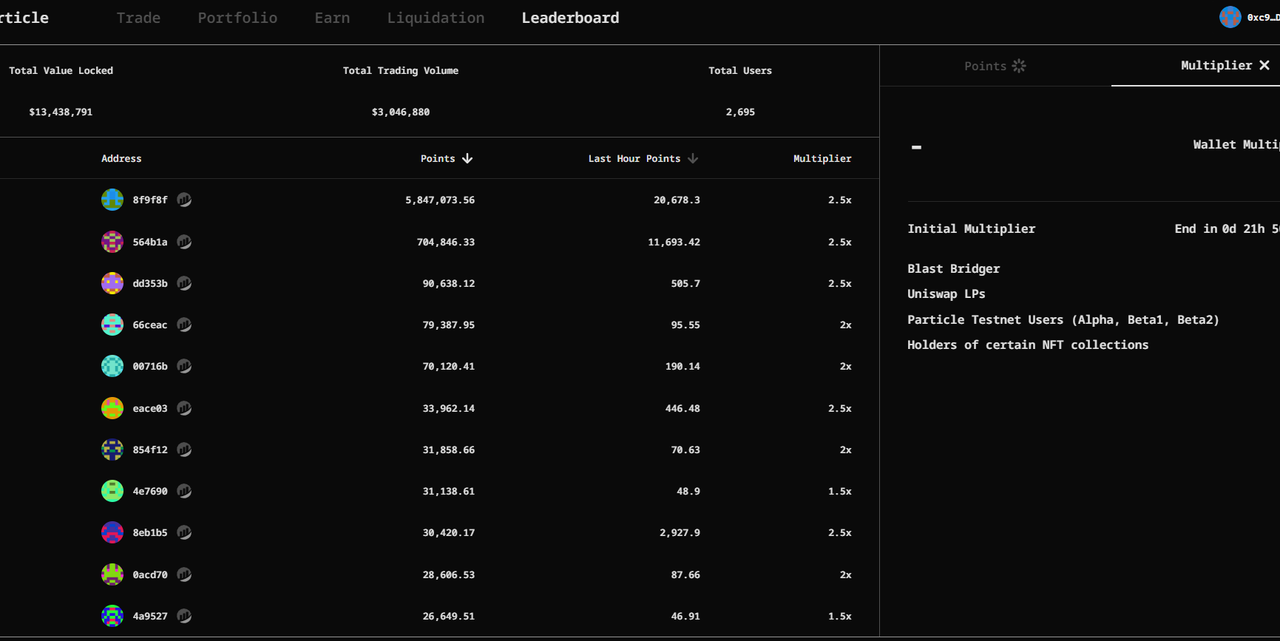

The TVL queried on Defilama is $8.3 million, while Particle's official TVL data is $13 million, with a trading volume of $3 million, resulting in a ratio of 0.23 between trading volume and TVL.

Particle currently has 8 trading pairs for spot trading and leveraged trading, and the depth of each trading pair and the size of long and short positions determine the maximum leverage.

Particle received 224,305 gold points in the first phase. According to the official announcement, these gold points will be distributed to users based on Particle Points, and the specific distribution rules have not yet been announced. In general, the higher the Particle Points obtained, the more gold points can be distributed.

Particle's Leaderboard page allows users to check their points, which can be obtained through TVL contributions and trading volume contributions, with a bonus coefficient of up to 2.5x. Blast cross-chain users, Particle's testnet users, Uniswap users, and some NFT holders can receive bonus coefficients.

In terms of contract security, Particle has provided an audit report: https://code4rena.com/reports/2023-12-particle, and has been running smoothly since its launch.

When participating in the project, it is important to note that there may be some wear and tear, whether contributing to liquidity or trading volume. It is recommended to participate in trading pairs with high depth, such as the USDB-WETH trading pair, to minimize wear and tear.

Blitz

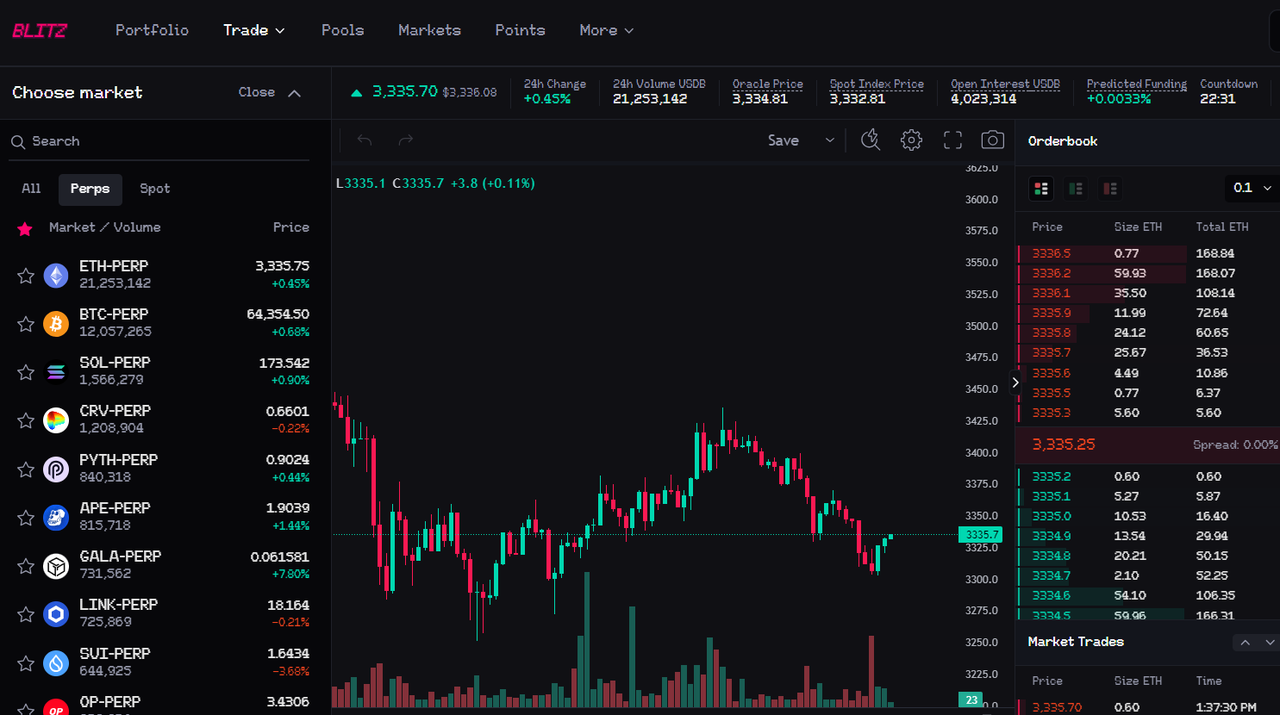

Blitz offers a wide range of derivative trading options, with over 40 token derivatives covering mainstream blue-chip projects, meeting a variety of user needs. Defilama's queried TVL for Blitz is $8.08 million, with a 24-hour trading volume of $48 million, resulting in a ratio of 5.94 between trading volume and TVL. Data shows that Blitz has a relatively high capital utilization rate and active trading.

Blitz uses a centralized exchange order book form, and users need to deposit funds into the Blitz platform before trading. Each derivative has different leverage ratios, with a maximum of 20x.

Blitz received 277,792 gold points in the first phase. To enter the points system and obtain their own invitation link, users need to deposit at least 5 USDB or 0.003 WETH into Blitz.

According to the website, the points display is not yet online, and the specific rules have not been announced. However, it can be speculated that to obtain Blitz points, contributions to liquidity and trading volume are also required. In addition, Blitz's activities on Galxe are still ongoing, and Blitz Community Points can be obtained through these activities. For specific rules, refer to the official documentation: https://docs.blitz.exchange/points-and-protocol-rewards/blitz-community-points

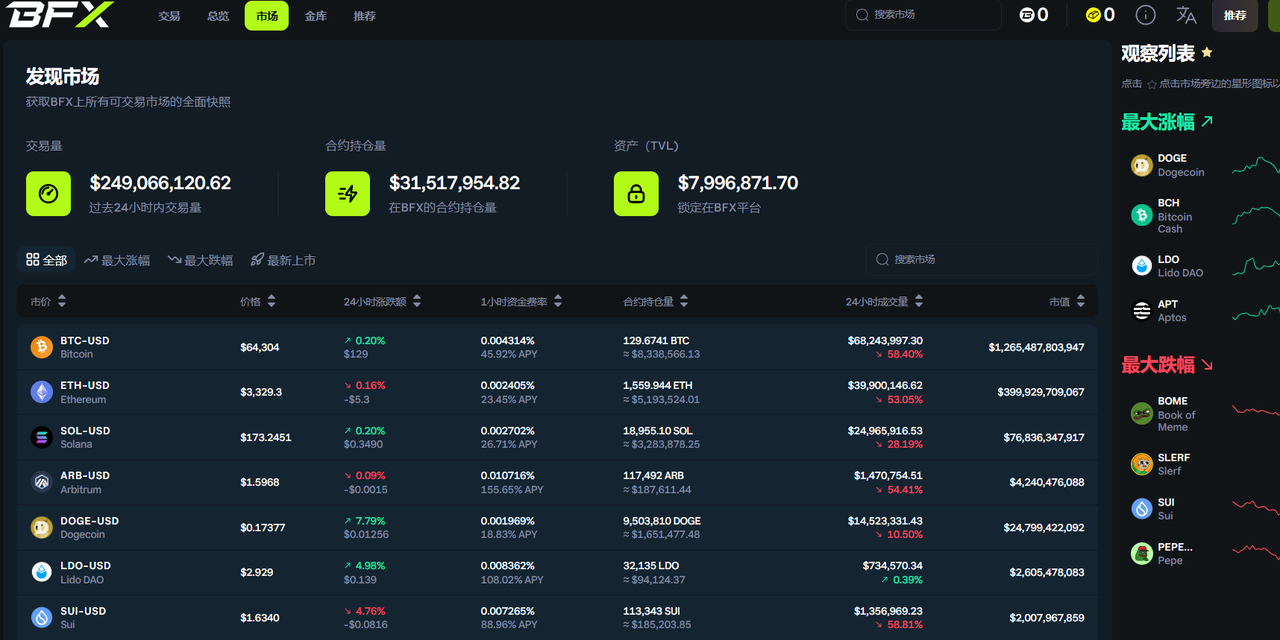

Blast Futures

Blast Futures has a TVL of $7.91 million, with a 24-hour trading volume of approximately $246 million, resulting in a ratio of 31.09 between trading volume and TVL, the highest among the three derivative trading platforms. This data even exceeds that of the leader, Synfutures (Synfutures' TVL is $22 million, with a 24-hour trading volume of $333 million).

Blast Futures currently offers trading for 37 varieties, covering mainstream and currently popular assets, with good trading depth and a smooth user experience.

In the first phase, Blast Futures received 277,797 gold points. The official announcement stated that 100% of Blast Gold will be distributed to users, and it will be distributed daily. Based on our research, because Blast Gold is distributed every 2-3 weeks, it should be recorded in users' accounts and distributed once received.

How can one receive Blast Gold? According to the official documentation, users can do so through trading volume, asset deposits, and Staking.

75% of Blast Gold will be distributed to users who deposit assets and participate in the gold vault Staking. Blast Gold will be allocated based on the user's deposit amount and duration, meaning the more money deposited and the longer the duration, the more Blast Gold received.

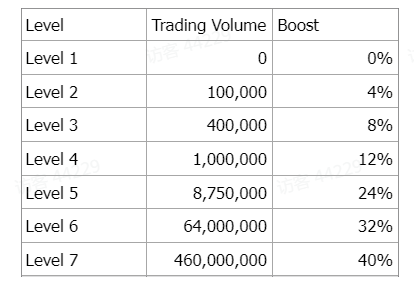

25% of Blast Gold will be distributed based on trading volume, with more trading volume resulting in more Blast Gold, and an upgrade can provide a 40% bonus.

The levels and bonus coefficients are as follows:

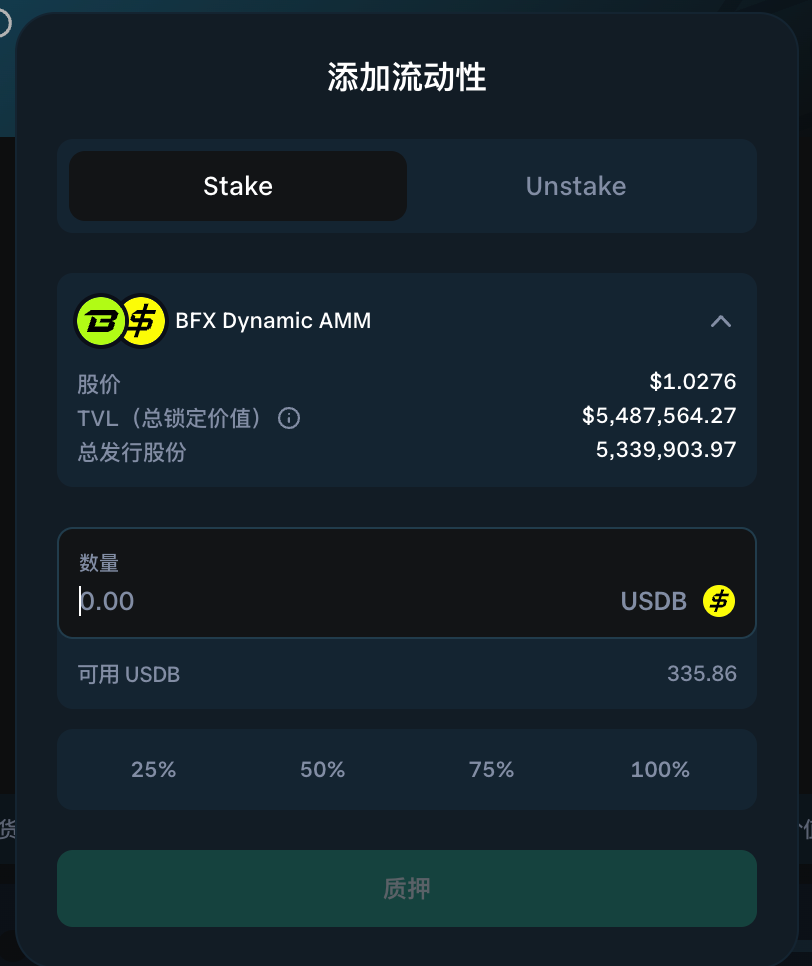

After understanding this mechanism, we can participate in the activity by depositing USDB:

The USDB deposited in the gold vault serves as dynamic AMM funds for the protocol, with a current annualized return of 41.46%. However, this dynamic mechanism of BFX may also pose risks in a unilateral market situation, which users should be aware of.

Another way is to increase trading volume. The current contract trades are all trading pairs of a certain asset and stablecoin. This depends on which asset users are more familiar with, and choosing a relatively stable asset for trading can be a strategy, but it's important to minimize trading friction costs.

Blast Futures' contracts have also been audited (https://github.com/BlastFutures/Blast-Futures-Exchange/blob/main/audits/bfx_audit_report_hats.pdf), showing that the project team places a strong emphasis on security.

Additionally, the project's token has not been publicly released yet, and may also provide benefits to users in the future.

Blasterswap

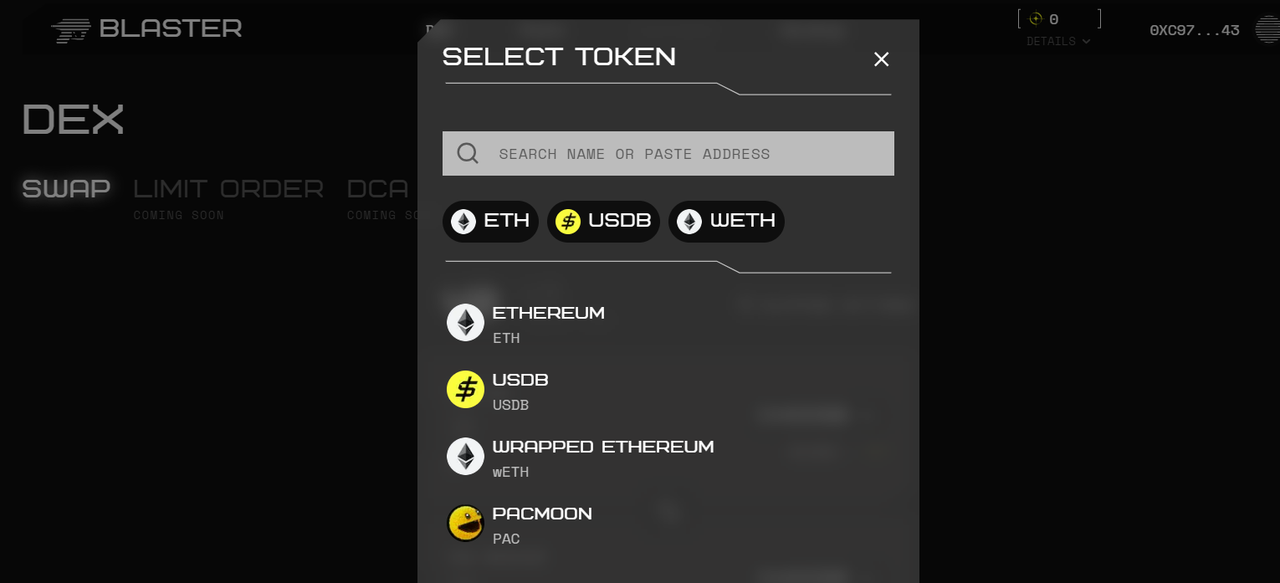

Blasterswap is a Dex protocol, a fork based on Uniswap V2 and V3. Its innovative features include the addition of a Launchpad to allow users to easily launch tokens, the addition of limit order functionality, and zero-error execution deployment investment strategy (DCA). However, in order to pursue protocol stability, Blasterswap has chosen to only launch the most conservative basic functions of Uniswap V2 at this stage, with other innovative features not yet launched. According to the website's priority display, the next focus will be on the Launchpad. Blasterswap's current TVL is $2.91 million, ranking sixth in the Dex track on Blast, mainly because its product has only recently been launched, and it currently offers few trading pairs.

This type of project is relatively easy for everyone to understand, with no additional learning costs, so this article will not provide an extensive introduction to the project. It is also user-friendly for users looking to earn points, as the Uniswap V2 protocol has already been market-tested and is considered relatively safe. However, it's important to note the risks: if the AMM trading pair is not a stablecoin trading pair, there may be impermanent loss. Additionally, a purely forked protocol may indicate a lack of technical sophistication, so we will only observe its operational capabilities.

Blasterswap received 108,508 gold points in the first phase. According to the project's documentation and the introduction from the administrators on Discord, Blasterswap promises to distribute 100% of Blast Gold to users and partners. As of the time of writing, the project team has not disclosed the specific distribution ratio, which will be made public later. The yield rates in the table above are calculated assuming that 100% of the Gold will be distributed to users, so the deviation will not be significant if the proportion distributed to partners is not large.

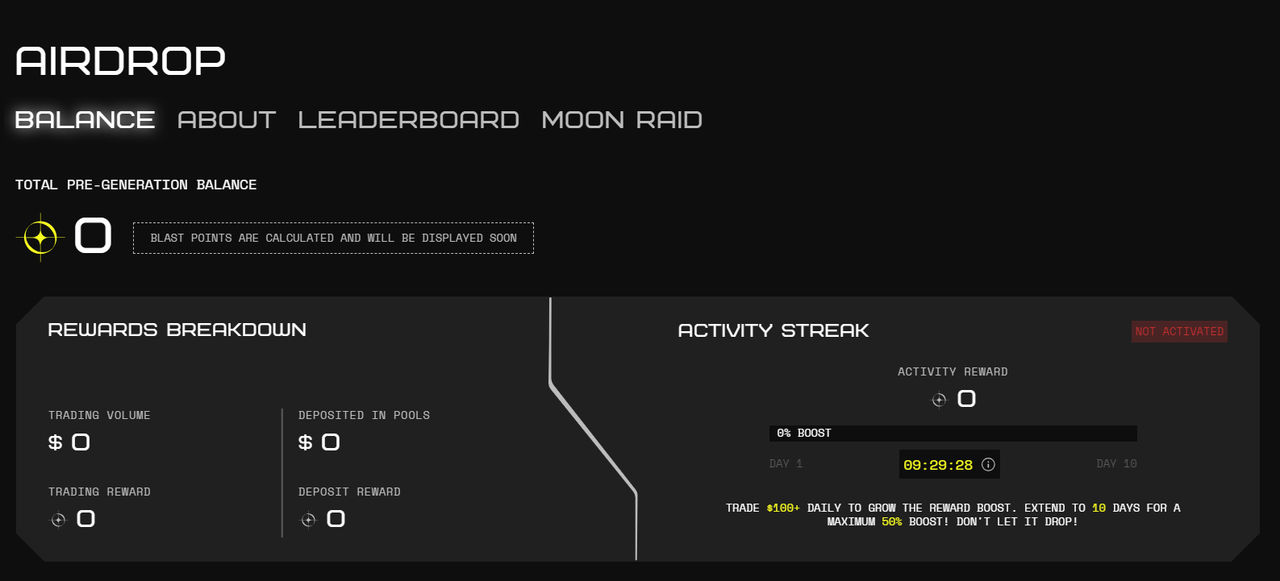

The specific way for users to participate is to join Blasterswap's Pre-Generation activity to earn its Pre-token and participate in the activity. Since the early bird activity has ended, we can only participate in Pre-Generation.

The activity's mechanism is relatively simple, mainly divided into four categories: trading rewards, task rewards, liquidity provision rewards, and referral rewards.

Trading rewards: User trading volume on the platform will be recorded, with $100 equivalent trading volume earning 15 points, $1000 earning 200 points, and $10,000 earning 3000 points.

Task rewards: Accelerated points can be earned by trading $100 worth of volume daily, with a maximum 50% bonus for 10 consecutive days.

Liquidity provision rewards: Users depositing $100 worth of assets on the platform can earn 10 points daily, with over $1000 earning 150 points, and over $10,000 earning 2000 points.

Referral rewards: Inviting users can earn a 10% points commission from the invitee.

Trading and providing liquidity are the main ways to earn points. To avoid impermanent loss, consider trading stablecoin pairs to earn points.

In terms of contract security, Blasterswap has submitted a contract audit report: https://github.com/blasterswap/blasterswap-core-v2/blob/main/AstraSec-AuditReport-BlasterSwap.pdf

Combined with its mechanism based on the mature Uniswap V2, I believe it should be relatively safe.

Blasterswap requires daily trading to earn more points, which can be quite demanding, but the expected yield of Gold points is worth participating in. Additionally, the platform's own token is likely to be distributed to users, providing even greater earning potential.

Wand Protocol

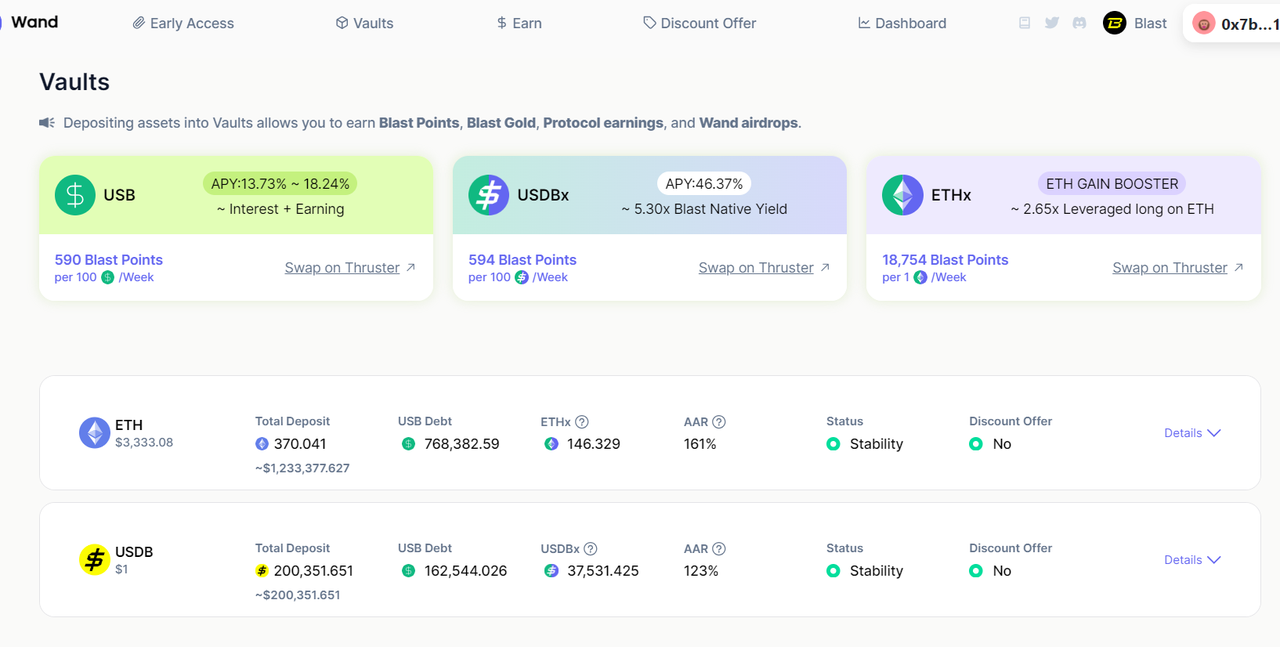

Wand Protocol is a CDP protocol. On Defilama, it can be seen that there are relatively few CDP protocols on Blast, and the native CDP protocol currently is only Wand Protocol. The so-called CDP is a short form for over-collateralized debt position, with the pioneer being MakerDao. The logic of the CDP model is simple: assuming the current price of $ETH is $3000, if you pledge 1 $ETH into MakerDao, you can roughly exchange it for 2500 $DAI, thus achieving on-chain collateralized loans, with the extra $500 being your over-collateralized portion.

The Wand Protocol has made some innovations and proposed the Pooled-CDP model. In the Wand Protocol, each asset corresponds to a shared CDP Vault, achieving global liability and making the over-collateralized portion globally shared. Wand has also tokenized the over-collateralized portion, creating Margin Tokens, allowing the over-collateralized portion to be traded, thereby increasing capital utilization and creating more gameplay opportunities.

This innovation has raised the learning threshold for users, so there has not been a large influx of funds. Currently, the TVL of the Wand Protocol is $1.6 million. The protocol has opened two pools for ETH and USDB, both of which are Blast's native interest-bearing tokens. Users can deposit ETH or USDB into the Vault, borrow the protocol's stablecoin $USB, and also receive $ETHx and $USDBx. $ETHx is equivalent to a leveraged token for ETH, while $USDBx amplifies the returns of USDB by multiple times.

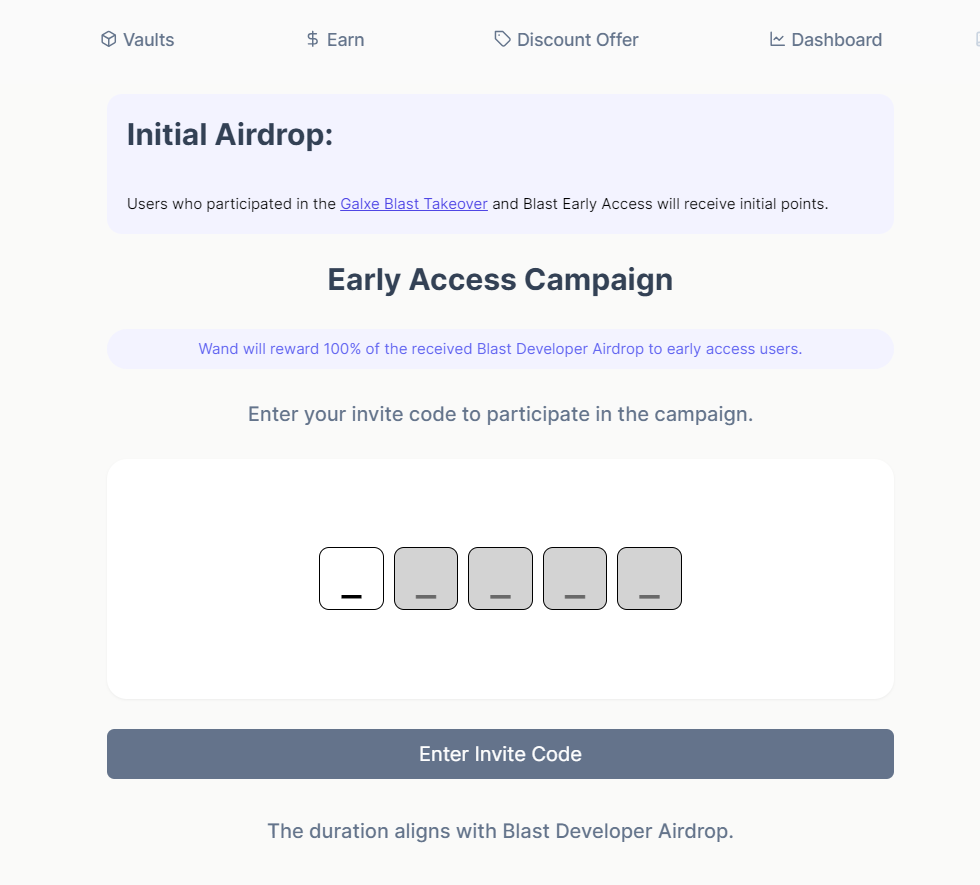

In the first phase, Wand received 53,492 gold points, and according to the official documentation, these gold points will all be distributed to Wand users. Wand has designed its own points system, which can be accessed through Early Access. Those in need of an invitation code can find it on the Wand Discord.

Specific rules for earning points can be found in the official documentation: https://docs.wand.fi/early-access-campaign/blast-gold-developer-points

Addresses that have participated in the Wand Galxe activity and have previously deposited money in Blast will receive initial points (a benefit for freeloaders), and the rest will be allocated based on TVL contributions. It is recommended to choose to deposit either ETH or USDB based on your own assets, or directly swap Wand's protocol tokens from Thruster. Users interested in stablecoin financial management can choose to buy $USB (APY approximately 20%) or $USDBx (APY approximately 50%), both of which offer attractive APY for stablecoin financial management. Those bullish on ETH can directly buy $ETHx, which is equivalent to spot leverage for long ETH.

In terms of contract security, Wand has provided a third-party audit report: https://github.com/wandfi/wand-contract-blast/blob/main/audits/Beosin_202403081621.pdf, and the oracle used is Redstone.

CDP protocols are relatively mature, and the project has been running smoothly since its launch, making it relatively reliable in terms of security. While earning points with peace of mind, users can also look forward to the airdrop of Wand's platform token.

In addition to these promising DeFi projects, it is recommended that everyone actively explore gaming and NFT projects. The Blast official announcement mentioned that future gold points will also be distributed to holders of ERC721 and ERC20 tokens. We will continue to monitor the distribution of gold points and provide timely updates for better point-earning strategies.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。