Based on the information you provided, despite inflation data being stronger than expected in recent months, the majority of Federal Reserve officials still insist on their plan to cut interest rates three times this year. Although the latest data did not give them confidence to start cutting interest rates, the Fed chairman stated that the forecasts released on Wednesday showed almost no change compared to December last year, and indicated that most of his colleagues expect two to three interest rate cuts this year. This indicates that the Fed holds a cautiously optimistic view of the economic outlook and believes that cutting interest rates will help stabilize the economy and achieve inflation targets.

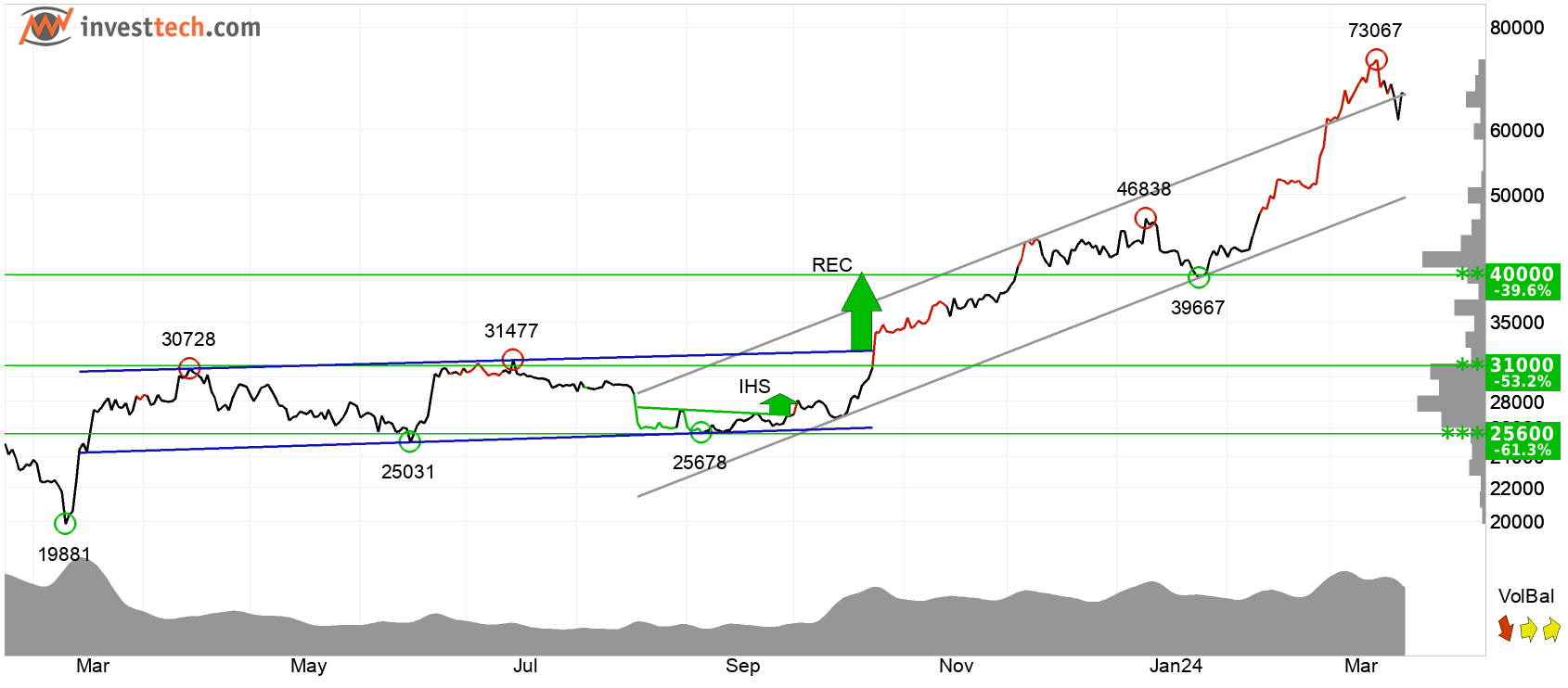

In addition, you mentioned that Bitcoin experienced a drop after reaching a high, but the current price has stabilized around $65,000, and there is a possibility of further upward movement in the future. This indicates that after a period of price fluctuations, the market may be starting to view Bitcoin favorably again, believing it has the potential for upward movement.

1. Review: Bitcoin falls below 70,000, market enthusiasm subsides

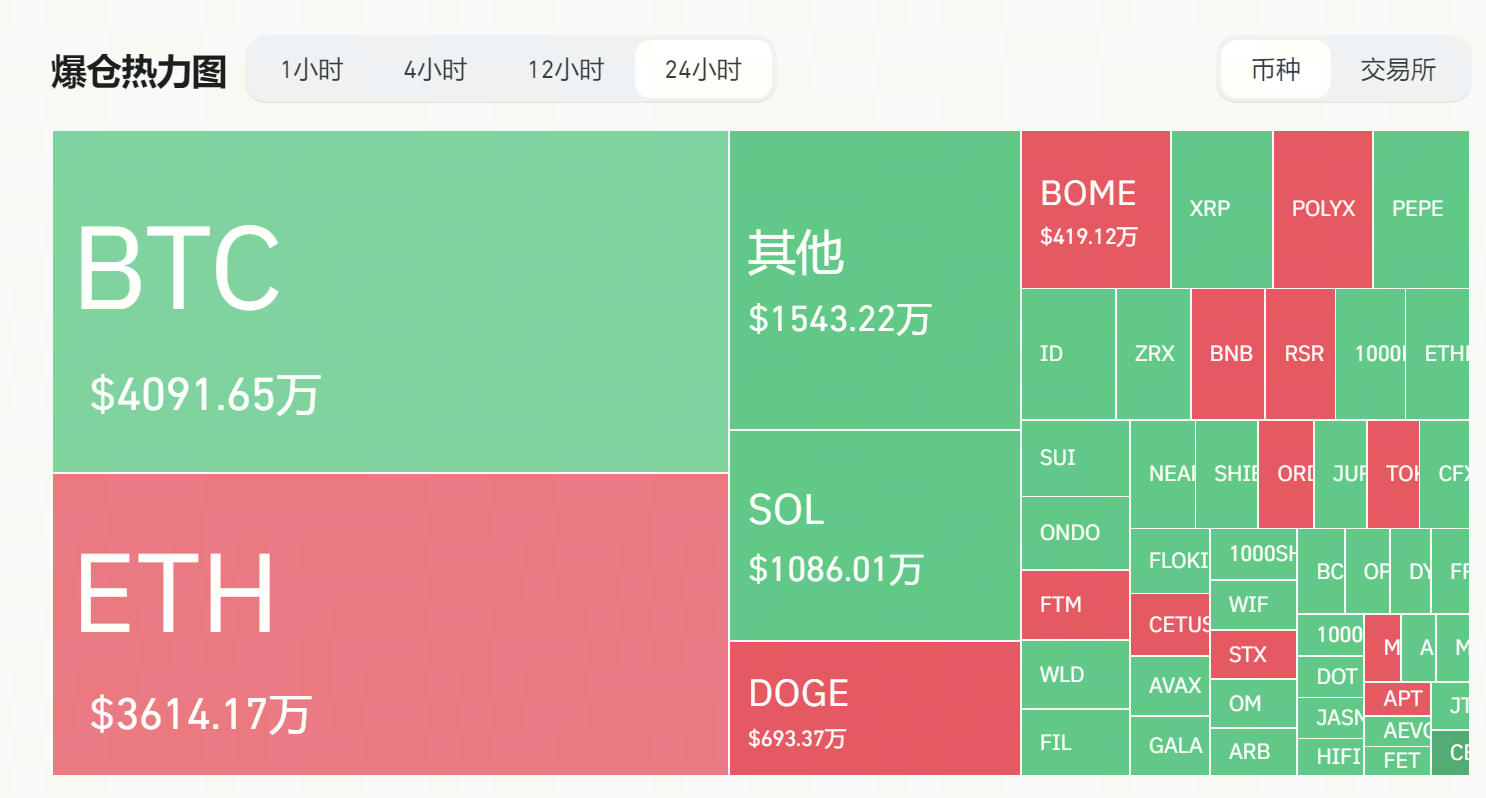

This week, Bitcoin was impacted by Grayscale's sell-off, breaking through psychological support levels multiple times, and even dropping to $61,000 in a short period, putting continuous pressure on mainstream cryptocurrencies.

Figure 1. Liquidation heat map (Source: coinglass.com)

This week, against the backdrop of increasing expectations for Bitcoin halving, stablecoins are flowing in at an accelerated pace, and savvy investors generally believe that the rise is not over yet, with the Fed's continued interest rate cuts.

Figure 2. USDT market value continues to rise (Source: CoinMarketCap)

Currently, Bitcoin has returned to within its track, and the price may have further support.

Figure 3. This decline returns to the track, but $60,000 support is evident (Source: investtech)

2. Halving narrative still driving price increases

1) Token economics of halving

The halving event, by reducing the rate of new Bitcoin production, helps solidify the scarcity of Bitcoin, similar to precious metals such as gold and silver. This scarcity concept is based on the principles of supply and demand economics, where when the supply of a particular entity or commodity is scarce and demand increases, its price will rise. The Bitcoin network has also experienced a similar phenomenon, with the halving event significantly reducing Bitcoin's inflation rate.

Figure 4. Bitcoin halving price change range regularity (Source: Huobi)

Historical data shows that halving events typically lead to a rise in Bitcoin prices, as the reduction in supply and increase in demand drive up the price of Bitcoin in the cryptocurrency market. However, price trends are influenced by multiple factors and are often subject to market sentiment fluctuations.

2) Halving and bull markets

The halving event is a key mechanism in the Bitcoin network, occurring approximately every four years with every 210,000 blocks mined. In the course of Bitcoin's development, three halving events have occurred:

November 28, 2012 - The first halving reduced the mining reward to 25 BTC per block, leading to a price increase from $12 to $1,217.

July 9, 2016 - The second halving reduced the mining reward to 12.5 BTC per block. At that time, the market value of Bitcoin was $647, which surged to $19,800 by December 17, 2017.

May 11, 2020 - The third and most recent halving reduced the mining reward to 6.25 BTC. The price of Bitcoin surged from $8,787 to $64,507, a staggering increase of 634%.

After each halving event, there has been a significant bull market, ultimately reaching historic highs. Based on past experience, we can almost certainly say that the bull market in 2024 has not yet reached its peak.

3. Three interest rate cuts become consensus

Consumer spending has cooled, and employment surveys have been mixed. The most closely watched employment growth indicator has been steady, but previous reports have been significantly revised downward, reaching historically high levels. Wage growth continues to slow, and the unemployment rate has steadily risen from 3.4% in April of last year to 3.9% in February.

These data may provide material for Federal Reserve officials concerned about keeping interest rates at current levels for an extended period. Although the market expects the Fed not to cut interest rates at the next meeting on April 30 to May 1, Powell avoided the question of whether a rate cut might be possible.

According to data from the CME Group, late Wednesday, the futures market's expectation of a Fed rate cut in June rose to around 75%, compared to nearly 50% earlier this week.

Diane Swonk, chief economist at KPMG, stated that these forecasts and Powell's remarks leave a clear impression that the central bank "no longer sees an economic recession as necessary to lower inflation."

4. Conclusion

With Bitcoin's halving set to directly reduce supply in 30 days, combined with the high probability of a Fed interest rate cut before June, funds from retail investors and ETFs are likely to continue to drive up the price of Bitcoin.

Disclaimer: The above content is for reference only and does not constitute any investment advice. The gains and losses resulting from investor operations based on this content are unrelated to this article.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。