It is expected that at 21:55 Beijing time on March 13th, the Ethereum Cancun upgrade will be officially deployed on the mainnet. This is a major upgrade for Ethereum following the completion of the Shanghai upgrade in April 2023.

The Shanghai upgrade aimed to unlock staking and rewards for ETH validators, while the core of the Cancun upgrade is the introduction of the data unit "Blob" for Ethereum's scalability solution (protodanksharding), which aims to reduce transaction fees for Rollup Layer2 networks.

This means that after the Cancun upgrade, Gas fees for Layer2 networks such as Optimism and Arbitrum will significantly decrease. Some developers estimate that fees could drop by 75%. The reduction in fees will directly benefit regular users and DApp applications using these networks.

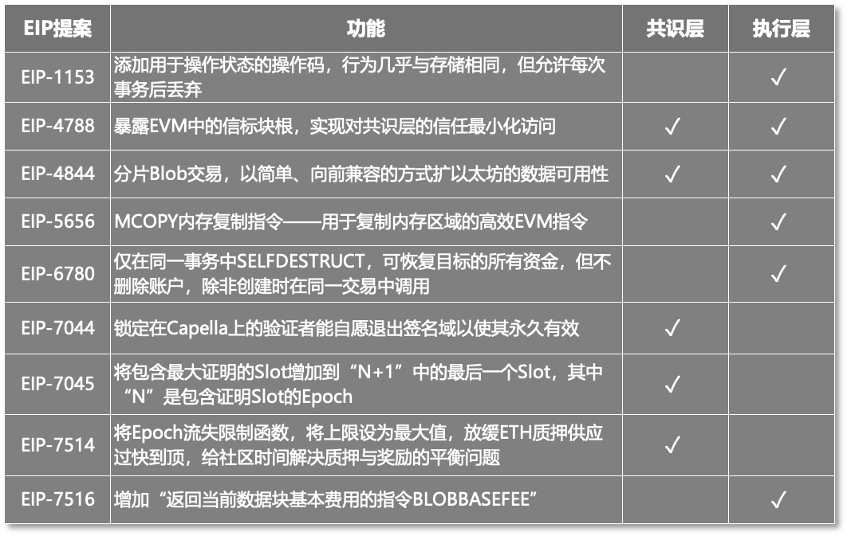

Nine major improvement technologies deployed to the mainnet

After the Ethereum mainnet completes the Cancun upgrade, the network's scalability, security, and user experience will be improved through nine improvement proposals (EIP). According to official Ethereum information, these nine proposals will be integrated into Ethereum's consensus layer and execution layer based on their different functions.

Nine proposals and functions of the Cancun upgrade

Nine proposals and functions of the Cancun upgrade

Many of these EIPs have direct relevance to the user experience of the Ethereum ecosystem. For example, EIP-7044 aims to allow validators locked on Capella to voluntarily sign off.

Currently, validators need to stake 32 ETH to ensure that they will handle transactions properly and maintain the network's security. They receive rewards for fulfilling their duties, but if they fail to do so, they may lose a portion of their staked ETH due to penalties.

Users without 32 ETH can currently choose third-party staking platforms like Lido to participate in staking with a small amount of ETH, but they cannot guarantee that these third-party validators will not default. If they do, regular users may suffer losses.

Now, EIP-7044 will allow validators and ETH stakers to sign off positions in smart contracts and specify when to execute them.

In addition to EIP-7044, one of the most notable proposals is EIP-4844, which is also a core feature of the Cancun upgrade. It will increase the data storage space for Rullup Layer2 and significantly reduce transaction fees, laying the foundation for future shard data structure upgrades for Ethereum.

EIP-4844 proposes the "protodanksharding" sharding solution, which is an initial Layer2 scaling solution and an intermediate step in the future Danksharding sharding technology roadmap. The Danksharding roadmap aims to enable Ethereum Layer2, especially Rollups, to provide economically efficient transaction capabilities on the mainnet even when congested. It is an important means of Ethereum's scalability and will be realized through long-term upgrades.

The core of protodanksharding implementation is the introduction of "Blob" as a sharding data unit, designed to be more flexible and efficient than the current calldata used to store transaction data on the consensus layer. It carries transactions stored on the consensus layer and will be automatically deleted within 1-3 months. This method helps reduce storage costs and enables the transmission of Rollup transaction data at lower fees, ultimately reducing Gas fees for users.

Significant decrease in Layer2 network fees

In the short and medium term development of Ethereum, Rollup may be the only trustless and permissionless scaling solution for Ethereum. Due to the high transaction fees on the Ethereum mainnet, the ecosystem urgently needs to transition to Rollup.

Indeed, Rollup Layer2 networks significantly reduce user transaction costs: the transaction fees on Optimism and Arbitrum are often about 3-8 times lower than those on the Ethereum mainnet, and ZK Rollups have even better data compression capabilities, reducing fees by 100 times compared to the Ethereum mainnet.

On March 12th, the Gas Fee for Ethereum was 57 Gwei, equivalent to $4.8. During the same period, the Gas Fee for Arbitrum was 0.2 Gwei, approximately $0.017, and the Gas Fee for Optimism was close to 0 Gwei, approximately $0.000089.

According to calculations by user @msilb7 from the Web3 data platform Dune, considering the total daily Gas fees consumed by Ethereum and various Layer2 networks, the Gas fee price per second on the Ethereum mainnet is as high as $198.82, while it is $3.23 for Optimism and $6.32 for Arbitrum.

On March 5th, the Gas fees for the Ethereum mainnet surged again, reaching an average of 98 Gwei, the highest level since early May 2023. According to Ethereum browser data, the average Gas fee for a single transaction was $87.45, and the average Gas fee for NFT transactions on that day reached $147. Meanwhile, the transaction fees for Optimism and Arbitrum remained consistently low, in the single digits.

Nevertheless, these fees are still expensive for many users. EIP-4844, introduced in the Ethereum Cancun upgrade, will address this issue. The largest expenditure in Layer 2 transaction fees is currently the "call data" fee, which accounts for over 80% of the total Layer 2 transaction fees. The mechanism of the Blob unit "temporarily storing data" is very beneficial for short-term transactions.

According to calculations, the cost of Blob will be less than 0.001 ETH, and the transaction fees for Rollups will be less than $0.05. Developers at Offchain Labs predict that based on previous network traffic levels, the Gas fees for Layer2 networks will immediately decrease by 75% due to the Cancun upgrade.

Undoubtedly, this will benefit the widespread adoption of the Ethereum ecosystem by users and DApps, further driving the prosperity of Rollup ecosystems like Optimism and Arbitrum.

According to Binance data as of 11:00 on March 13th, ETH is priced at approximately $4020. Earlier, around 1:00 in the morning, influenced by a short-term sell-off of BTC, the lowest price of ETH in 24 hours was $3828. The governance token for Optimism, OP, is priced at $4.42, following a similar trend to ETH, with a 24-hour low of $4.11. The governance token for Arbitrum, ARB, is priced at $2.06, with a 24-hour low of $1.90.

It is worth noting that a large amount of ARB will be unlocked during the Cancun upgrade. Data from the digital asset tracker Token Unlocks shows that on March 16th, Arbitrum will release approximately 1.111 billion ARB, accounting for about 76% of the circulating supply, with a value of approximately $2.266 billion at the time of writing.

Of this, Arbitrum will unlock 673.5 million ARB for its team and advisors, worth approximately $1.38 billion at the current price. An additional 438.2 million ARB will be unlocked for Arbitrum's early investors, currently valued at about $902 million.

Cryptocurrency analysts caution that the amount of unlocked ARB accounts for a large portion of the circulating supply. According to Arbitrum's rules, no ARB will be released before the unlock date, and they will be released to the market in one go on the specified issuance date. Holders should be mindful of the price fluctuations of ARB.

(Disclaimer: Readers are advised to strictly comply with local laws and regulations. This article does not represent any investment advice.)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。