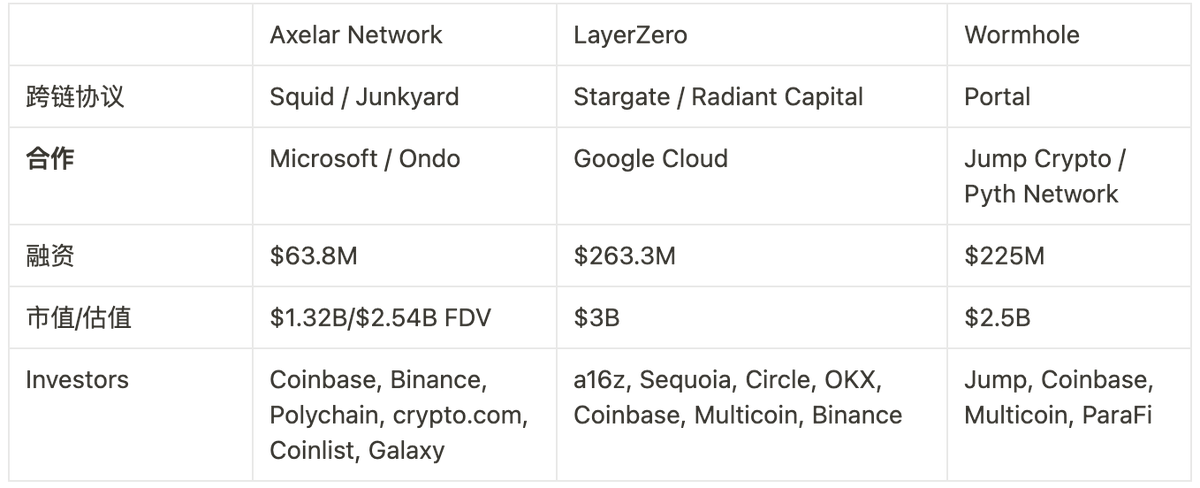

While taking advantage of the wormhole to prepare for the coin issuance, recently $AXL has been listed on Binance at around $2, and it may continue to become a stable beta investment portfolio in the subsequent bull market. Below is a comparison of some similar products. Traditional cross-chain protocols face security issues. Cross-chain communication protocols are crucial for the continued growth and mainstream adoption of blockchain, allowing users and applications to seamlessly interact in a decentralized ecosystem. Below is a comparison of Axelar, Chainlink CCIP, LayerZero, and Wormhole:

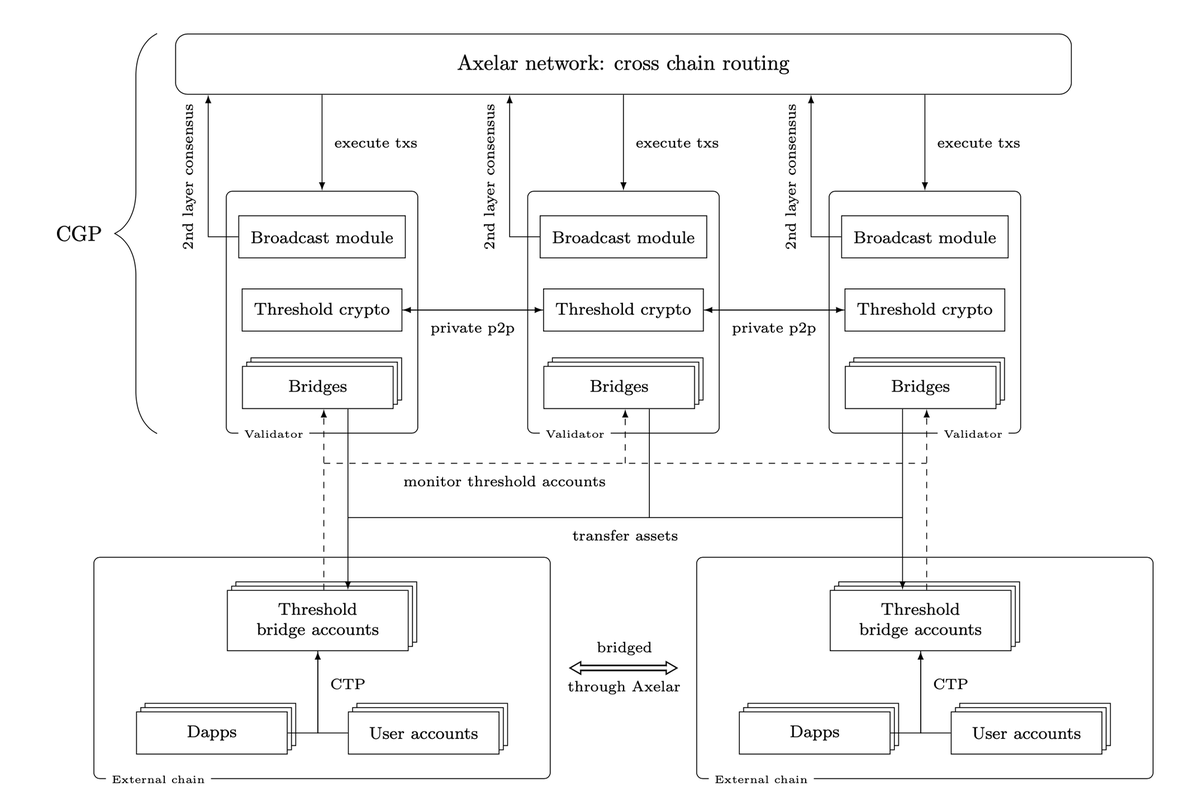

- Axelar Network:

- Connects to 60 chains and facilitates complex transactions through Generalized Message Passing (GMP). In addition to simple token transfers, it also supports complex applications such as smart contract calls and state synchronization.

- Axelar focuses on the Cosmos ecosystem, bridging Cosmos and EVM, and enhances decentralization and security through features such as secondary voting and key rotation.

- Its continuously growing network effect positions it favorably in the expanding Cosmos ecosystem, and it has a close relationship with Ondo Finance, which may imply something significant.

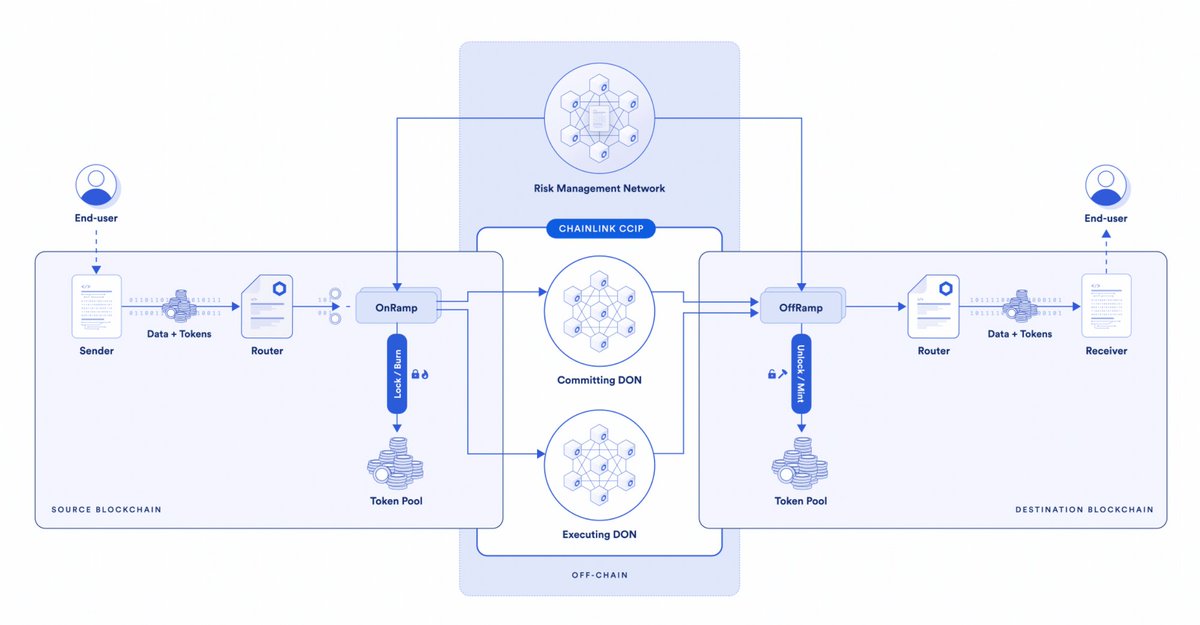

- Chainlink CCIP:

- Triple network architecture enhances security and prepares for TradFi adoption through partnerships with entities like SWIFT.

- However, it only supports cross-chain communication for 9 chains and has fewer protocol projects.

- LayerZero:

- Connects to 60 chains and leads in terms of transaction volume. Its scalable endpoint design improves efficiency and supports various tokens compliant with the OFT standard. The expected airdrop may overstate some transaction volume metrics.

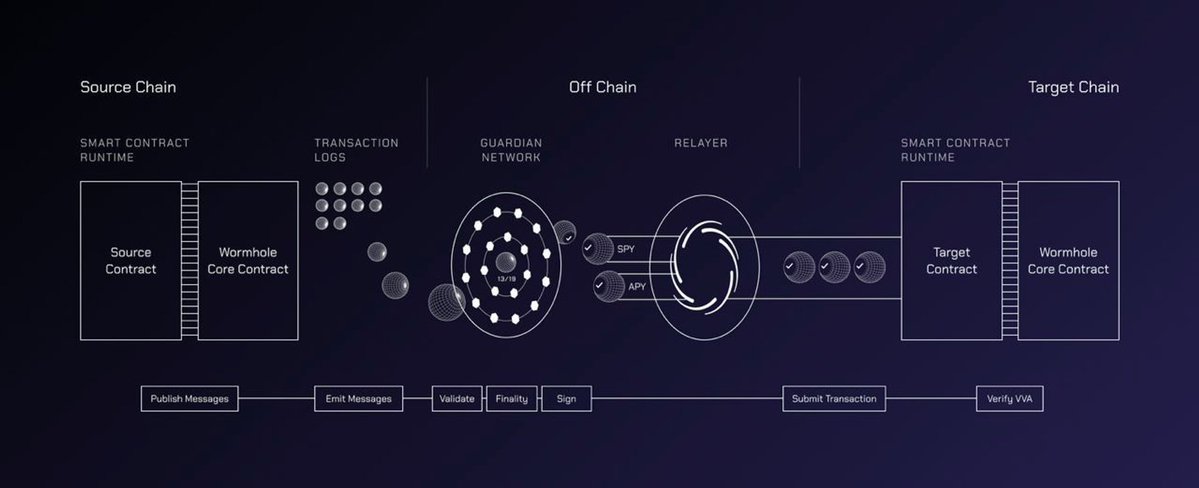

- Wormhole:

- Connects to a total of 29 chains, fewer than Axelar and LayerZero. It supports non-EVM chains such as Solana and Sui and collaborates with the world's largest staking service node provider, Everstake, and the developer Certus One (Jump).

- Similar to LayerZero, the expected airdrop may overstate some transaction volume metrics.

In summary, $AXL connects to the most chains among its competitors, and its data is strong in all aspects. Since its initial release, its valuation has more than doubled, and its valuation model is relatively inexpensive compared to similar projects. As an early coin issuance project that has reaped dividends, it might ride the wave of the subsequent market surge all the way to the moon.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。