Innovation and Vision of Orion+Lumia: From Decentralized Universal Aggregated Trading to Defi Infrastructure Layer

Orion is an innovative universal aggregated trading platform that aggregates liquidity from both DEX and CEX. Its core products include two trading products, a cross-chain bridge, and an embeddable widget.

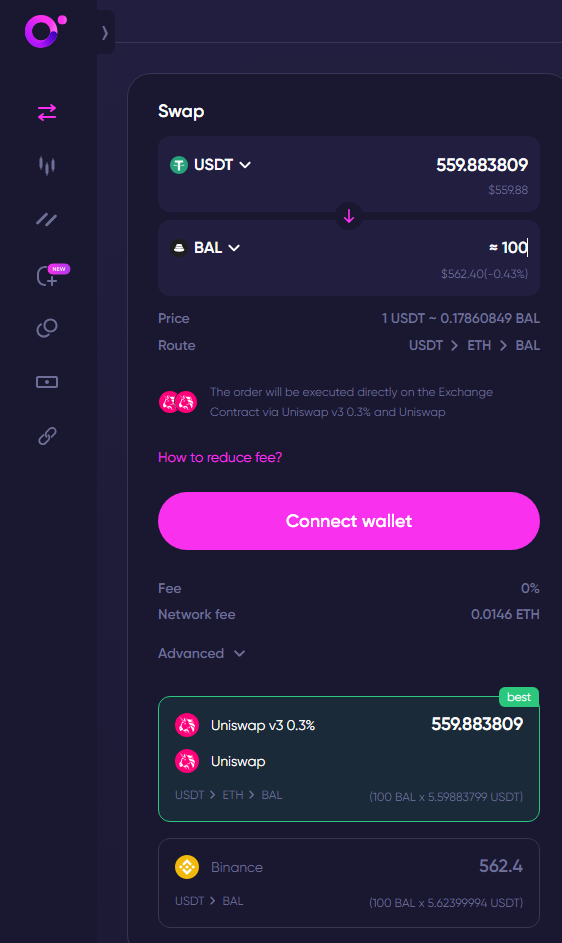

Among them, the two trading products are aimed at a wide range of investors. Swap is a product that caters to the habits of SWAP users; Trade is a product that caters to the habits of CEX users. However, both of these trading products are decentralized.

➤DeCEX+DEX= Orion SWAP

❚CEX+DEX Comprehensive Aggregation

As a comprehensive aggregation trading platform for CEX+DEX, the markets faced by traders on Orion SWAP include DEX such as Uniswap, Curve, and CEX such as Binance, Kucoin, etc. Therefore, Orion SWAP can achieve top-level CEX+DEX trading depth.

Orion SWAP can achieve the most optimal solutions and prices for transactions. This includes selecting CEX or DEX, transaction routing paths, and suitable trading pools for Uniswap.

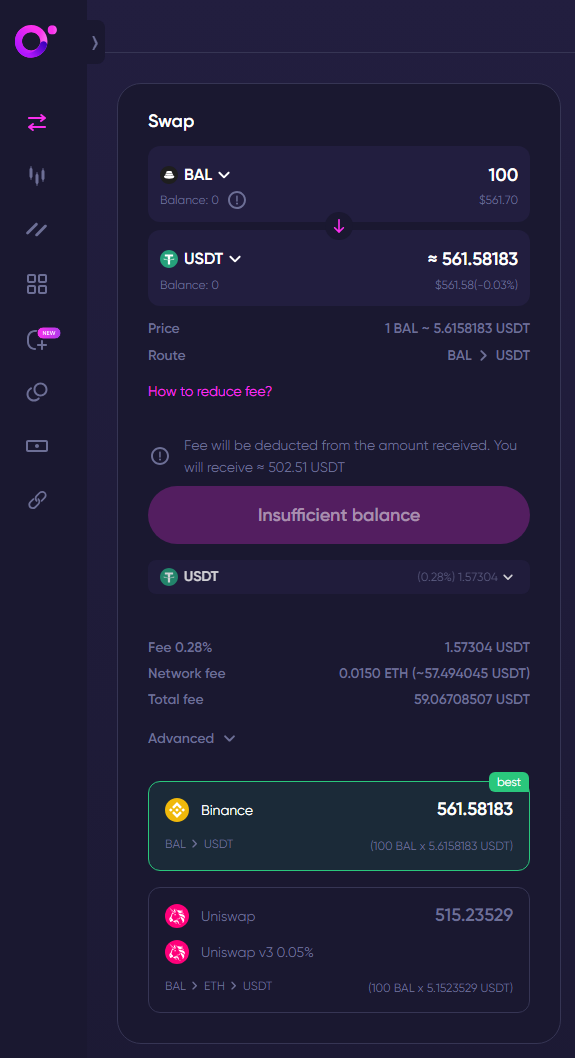

For example, when the user "小蜜蜂" (Little Bee) tries to sell BAL, Orion calculates that the optimal solution is to sell on Binance, which can result in nearly 9% more sales than Uniswap.

However, the situation is reversed when buying BAL. Buying on Uniswap can save users money.

Aggregating DEX is common, and aggregating CEX is not new. However, it is extremely rare to simultaneously aggregate CEX and DEX exchanges. Before Orion SWAP, "小蜜蜂" had never heard of such comprehensive aggregation of DEX.

❚DeCEX

Traders can participate in CEX trading such as Binance through Orion SWAP, but:

First, traders do not need KYC on Orion SWAP, bypassing regulation. For example, U.S. users cannot directly use Binance, and domestic users cannot KYC on Kucoin. By simply using a wallet to connect to Orion SWAP, users can trade tokens on platforms such as Binance, Kucoin, etc., and can trade at the most advantageous prices from both CEX and DEX.

Second, compared to trading directly on DEX, when users choose to participate in DEX trading on Orion SWAP, the transaction fee is zero, saving users transaction costs.

Third, traders can participate in trading by connecting their wallets to Orion. Funds remain in their own wallets, rather than being deposited into the wallets of CEX, allowing traders to benefit from the protection of blockchain technology without facing the centralization risks of CEX.

Orion SWAP provides users with decentralized CEX services, known as DeCEX.

❚Orion Terminal

Orion Terminal is the core technology of Orion Swap, serving as an aggregator for decentralized CEX and DEX. With ultra-fast order execution and price feedback, Orion Terminal provides users with high efficiency and quality.

➤Transformed AMM Price Curve+Virtual Order Book=Orion Trade

Orion transforms the AMM price curve into an order book. Virtual order books are continuously calculated to create better prices.

Orion Trade provides a similar experience to CEX, with candlestick charts and order book information. Of course, this order book information is virtual. It supports market and limit orders.

➤Orion Bridge

Using Atomic swaps, a series of cryptographic technologies and smart contracts are used to ensure that both parties adhere to the trading agreement. In Orion Bridge, the user's counterparty is a broker. Atomic trading technology can protect the interests of both parties. If any part of the transaction fails, the transaction will be automatically canceled, and the funds will be returned to the user.

➤Orion Widget

Orion Widget is a widget product that can be embedded in other web pages or applications. Once embedded, users can participate in aggregated trading on Orion by connecting their wallets. The simple UI integration allows developers to integrate Orion Widget with minimal programming.

➤Fiat Trading

Orion provides users with a decentralized way to participate in CEX trading while bypassing regulation. It also provides users with a channel for fiat trading.

In contrast to Orion Widget, which is a widget developed by Orion for use in other applications, Orion's fiat trading is implemented through embedding the MoonPay widget, supporting users to purchase cryptocurrencies using credit cards. Currently, it supports USDT, ETH, ORN, and BNB.

The above are the core products and main functions of Orion. Underneath these products and functions is the financial infrastructure of the Orion ecosystem—Orion Pool and liquidity nodes.

➤Fee Distribution

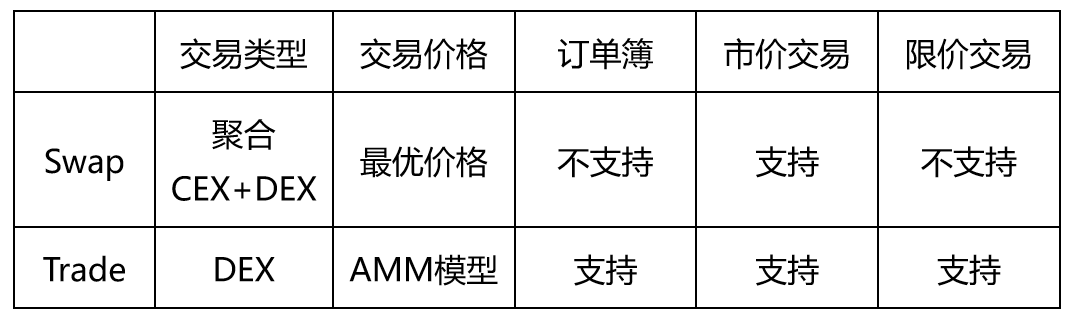

The fee rate for DEX transactions is 0.

For stablecoin transactions on CEX, the fee rate is 0.03%, with 0.015% allocated to the platform and liquidity nodes.

For non-stablecoin transactions on CEX without a referrer, the fee rate is 0.28% (starting price), with 0.08% allocated to the platform and 0.2% to liquidity nodes. With a referrer, the fee rate is 0.25% (starting price), with 0.05% going to the platform, 0.1% to liquidity nodes, and 0.1% to the referrer network, up to five levels.

Orion Bridge has no fees.

➤Orion Financial Infrastructure

❚Orion Pool

In addition to aggregating major CEX and DEX, Orion has also established its own liquidity pool—Orion Pool.

Among them, the trading pairs for Orion platform token $ORN and BNB, among 5 other coins, can be used for LP staking. The highest annualized yield is for USDT-ORN, with a basic annualized yield of 8.76% and a maximum annualized yield of 43.83%.

❚Liquidity Nodes

Liquidity nodes, formerly known as brokers, act as the user's trading counterpart and conduct trades on the corresponding DEX or CEX.

For example, when a user purchases ETH through Orion Swap, the Orion Terminal program calculates that the trading price on Binance is more advantageous. The broker sells ETH to the user, while simultaneously conducting a reverse trade on Binance to purchase ETH, thereby indirectly completing the transaction for the user on Binance.

According to Defillma data, the TVL of Orion Pool is $6.82 million, and the TVL of Orion's liquidity nodes is $1.53 million, including staked funds, for a total TVL of $19.29 million.

➤Defi Ecosystem Infrastructure Layer—Lumia

❚From Liquidity Nodes to Lumia

Liquidity nodes connect to major CEX via API to aggregate the liquidity of CEX and DEX.

Lumia is an extension of the existing liquidity nodes. With more liquidity nodes, decentralized aggregation can be enhanced, providing users with more stable and better user experience in aggregated trading services.

❚Vision of Lumia

In addition to the liquidity of CEX and DEX, Lumia's Medium mentions lending applications, addressing sandwich attacks, and capturing MEV. This means that Lumia is no longer limited to trading products but is committed to becoming the financial infrastructure layer of the entire Defi ecosystem.

In the era of Orion, traders can benefit from advantageous prices and decentralized experiences through aggregated trading.

In the era of Lumia:

First, due to the expanded aggregation breadth of Lumia, traders can have a better experience.

Second, due to the multidimensional aggregation of Lumia, lending users can also benefit from more stable interest rates.

Third, people can participate in Lumia nodes to earn income from trading systems, lending products, and on-chain fees, lending liquidation, arbitrage, and more.

➤Funding

Projects listed on Binance probably do not need background research on the team. Let's summarize the funding information.

In mid-2020, Orion raised $3.45 million through a Dynamic Coin Offering (DYCO).

According to Coincarp, from March to April 2021, Orion raised over $2.9 million.

Recently, Orion has received a new round of strategic investment from DWF.

➤Conclusion

As an aggregated trading platform, Orion may be at a disadvantage because its actual value in the market goes beyond these TVL figures.

In fact, as an innovative pioneer in aggregating CEX+DEX, Orion is a project that cannot be ignored.

The upcoming Lumia is somewhat similar to an oracle. An oracle bridges data between DEX and CEX, while Lumia bridges value between DEX and CEX. The Orion+Lumia technology and architecture have the potential to improve the Defi and trading ecosystem, making the entire centralized and decentralized financial market smoother and promoting seamless integration between DAPPs and between DAPPs and CEX applications. Users can have a better experience, and participating in Lumia nodes may also provide more profit opportunities.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。