Not everyone will make it this cycle.

You need to shift your mindset and detach from the crowd.

Coinbase app ranking will not tell you when the top is in.

Start thinking differently.

“When a measure becomes a target, it ceases to be a good measure.”

In other words, when we set one specific goal, people will tend to optimize for that objective regardless of the consequences. This leads to ignoring other equally important factors of a situation.

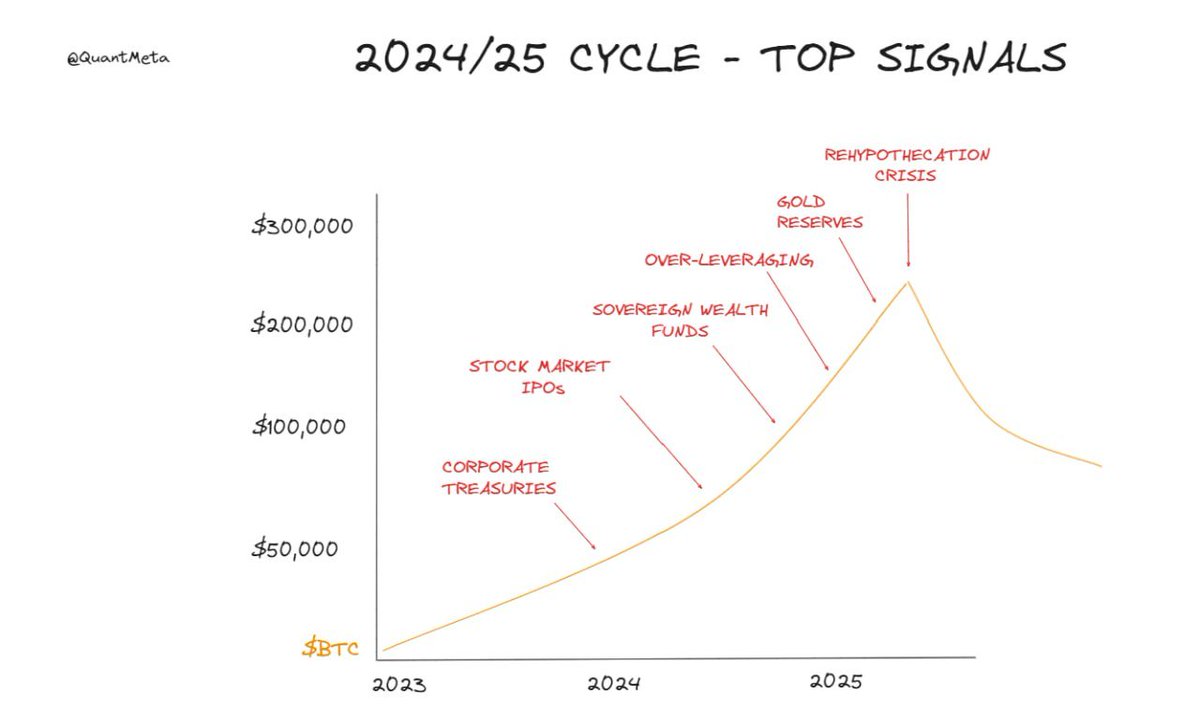

Furthermore, let me tell you that most of the top signals mentioned on CT won't work this time.

What was an obvious top signal in 2017 wasn't in 2021, and the same goes for 2024-25.

We’re moving towards the right curve of the adoption rate, and now all retail knows about crypto - some heard about it in 2017, and then almost everyone heard about it in 2021.

Don't mix the signs of adoption with top signals. Don’t let the PTSD ruin your fun.

Another point to address is the shift of influence - BlackRock & Co. controls Bitcoin now.

They are the major ETF providers and own shares of each other. So, they control the sentiment around BTC now.

And they also own all the media platforms. They can literally shape the narrative as they want.

Let me re-phrase it like this:

If most of this run-up is driven by institutional bids, why would retail indicators be relevant?

The indicator for this cycle will come from the people who haven’t been onboarded yet.

Yes, It can be retail who still haven't touched crypto - "late majority" and "laggards" - but you gotta think on a bigger scale.

Sovereign Wealth Funds

Think of those countries with a sovereign wealth fund starting to diversify in $BTC. Some already invest in stocks, so it might be possible to see this scenario.

• Saudi Arabia - $400 billion

• Abu Dhabi - $800 billion

• China - $1 trillion

• Norway - $1 trillion

• Australia - $150 billion

• Qatar - $300 billion

• Singapore - $500 billion

Corporate Treasuries

We have already seen this in 2021 with Tesla purchasing $BTC and, more recently, with Reddit disclosing some of its crypto holdings.

The trend is just starting. Once you see daily headlines of companies diversifying their assets into

,it might be rational to start derisking.

Stock Market IPOs

Coinbase IPO in 2021 was the first major crypto company to be listed in the stock market. We might see this time tens of crypto companies doing their IPOs, and at some point, one listing will mark the top.

Over-Leveraging

Big hedge funds, companies, and maybe even small countries over-leveraging in the final stages of the bull run and getting rekt could be another scenario we might see this cycle.

Rehypothecation Crisis

The next Luna-type of collapse might come from the restaking sector and kickstart the bear market. It seems like everyone is overlooking the huge consequences of a depeg or slashing event in this sector.

Gold Reserves

The ultimate ultra top signal could be governments diversifying a small % of their gold reserves into Bitcoin - the "digital gold".

Some additional minor signals

Low-Income Countries Workers Shortage

Another big signal is when low-income countries will have a shortage of workers because these are making $300 to $600 a month mapping the roads with hivemapper or other DePIN projects and earning a higher salary than what they'd normally get.

Happened at a small scale last cycle with Axie and StepN. Will happen at a larger scale this cycle.

Las Vegas Sphere

Time Square was full of shit memecoins in 2021. The Las Vegas Sphere with crypto ads running on it for weeks straight will be the version of this cycle.

Funding Rounds

A pretty secure signal again will be checking the volumes of VC investments. Funding rounds skyrocketing and, maybe overpassing tradFi ones might be the indicator again to start exiting.

“The financial markets generally are unpredictable. So that one has to have different scenarios... The idea that you can actually predict what's going to happen contradicts my way of looking at the market.

- George Soros.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。