Solana's 6 listed MEME coins on-chain have seen an average increase of 906.72%, with the highest increase being CHAT, which has surged by 1843.74% in the past week.

By Frank, PANews

On the evening of March 5th, Bitcoin once again broke through the $69,000 mark, reaching a new all-time high, but the market quickly turned downward, causing a sharp drop in meme coins. Looking back at the recent crypto surge, meme coins, apart from Bitcoin, have been one of the hottest tracks, with an overall market value increase of 159.3% as of March 5th. PANews has conducted an analysis of the popular 20 coins, attempting to reconstruct the reasons and details behind this meme coin surge. Who is driving this brief meme frenzy?

Elon Musk Ignites the Fuse, Retail FOMO Ignites the Market

The meme coin surge seems to have collectively skyrocketed overnight. However, analysis reveals that the surge in meme coins began as early as February 23rd, with TROLL being one of the first coins to show significant gains that day, one of the many meme coins ignited by Elon Musk.

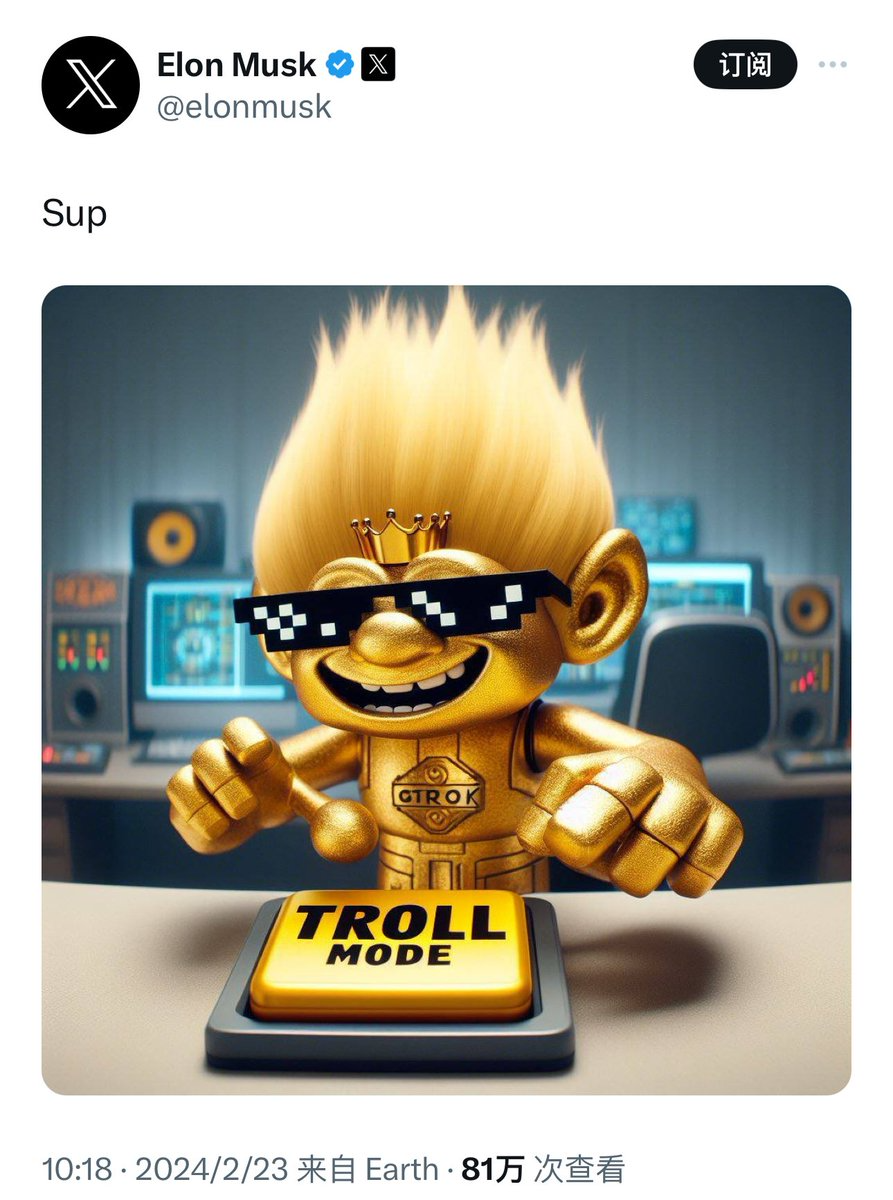

At 10:18 am on February 23rd, Musk tweeted about SUP, accompanied by an image of a doll wearing a Grok shirt, pressing the TROLL MODE button. Following this tweet, the price of TROLL quickly surged, reaching an increase of 38.11% within 15 minutes.

Another coin, TRUMP, was also one of the early surging coins. This meme coin, used to predict Trump's re-election, began surging in early February, and its project director, YouTube talk show host Steven - Stiel, recently interviewed with Coindesk. Similarly, TRUMP tokens also started to surge on February 23rd, possibly due to Trump's popularity during the campaign.

However, neither of these two tokens are considered mainstream meme coins. The truly mainstream meme coins such as PEPE, MEME, DOGE, and SHIB surged almost between February 24th and February 26th. Among them, PEPE was one of the earliest coins to surge. On February 23rd, both Binance and OKX exchanges almost simultaneously interacted with the official PEPE. On that day, PEPE saw a nearly 20% increase.

Subsequently, from February 26th, abnormal movements in the meme coin market became frequent, and the FOMO sentiment in the community spread throughout the market.

QCP Capital analysts pointed out that a "speculative buying frenzy" appeared during the Monday Asian trading session, possibly driving the price surge. The report stated that as retail FOMO effect truly emerged, meme coins, especially, were rebounding significantly.

From on-chain data, this claim is also confirmed. Taking PEPE as an example, according to Coinmarketcap data, from February 26th to March 4th, the number of short-term traders (holding period less than 1 month) addresses for PEPE increased from 9,398 to 31,038, nearly tripling. SHIB's data is almost identical. From February 26th to March 4th, the proportion of whale holdings for SHIB decreased from 62.36% to 57.9%, while the proportion of retail investors increased from 23.74% to 27.34%.

Solana Emerges as a Hotbed for Meme Coins, Ethereum HODLs, Not FOMOs

Unlike previous meme frenzies, this year's meme frenzy is no longer exclusive to Ethereum. Meme coins on Solana's chain have shown enormous potential to compete with Ethereum. From our analysis of 20 popular meme coins, 6 are listed on Solana's chain, 12 on Ethereum, and 2 on BNB. (Related reading: Is the Shiba Inu on Solana more cost-effective? Calculate the true situation of playing Shiba Inu with the Kelly formula)

In terms of price surges, meme coins on Solana's chain may have more room for growth. The average surge of the 6 listed meme coins on Solana's chain reached 906.72%, with the highest surge being CHAT, which surged by 1843.74% in the past week. The 12 listed coins on Ethereum's chain had an average surge of 479.87%. This difference may be due to market value, with the average market value of meme coins on Ethereum's chain reaching 1.764 billion, while SOL's average market value is 705 million. Clearly, smaller market values are more likely to trigger greater FOMO.

Although this is a typical meme season, not all meme coins have benefited from this frenzy. Looking at the composition of popular meme coins, all meme coins on Ethereum's chain have been issued for more than 3 months, with most being issued for over six months. In contrast, meme coins on Solana's chain have been issued for almost 4 months, with only BONK being issued in February 2023. It seems that meme coins on Ethereum's chain value time accumulation, and meme coins with a certain community size and recognition are more likely to be recognized by Ethereum meme players.

Some Make Thousandfold Profits, Some Lose Millions in Half a Day

In fact, the extreme volatility of meme coins has always been a subject of great controversy within the community. Investors focused on value investing theory believe that meme coins are merely emotional signals, with enormous risks and no benefit to the development of the crypto market. However, new crypto investors are more optimistic about this straightforward investment target.

In this round of meme coin frenzy, there are still tales of sudden wealth and retail investors being wiped out.

According to Lookonchain monitoring, a user who invested less than $3,000 in 4.9 trillion PEPE coins now holds tokens worth about $35 million. During this surge, the user sold tokens worth $2 million, resulting in a return rate of approximately 11,077 times!

Spot On Chain monitoring shows that five wallets (likely owned by the same person) made a profit of $5.66 million (a 475% increase) when PEPE hit a new all-time high. These wallets withdrew a total of 96.996 billion PEPE from Binance on January 16, 2024, when these PEPE were only worth $1.19 million.

In the market game, where some profit, others lose. Another Twitter user @yonghaochen168 shared that they bought 100 billion PEPE coins on the morning of March 5th, only to panic and exit at noon due to the sharp market downturn, resulting in a loss of $140,000 (approximately 1 million RMB) in half a day. They stated, "I don't know if the PEPE party is over, but I'm done. Even in a bull market, you can lose money, not buying at the bottom, and messing around at the top can easily lead to losses."

The volatile market of meme tokens has also led to significant losses for many aggressive investors who opened contracts. On March 5th, in aicoin's liquidation list, the liquidation amount for meme coins was approximately 836 million, second only to Bitcoin's liquidation amount of 1.055 billion. The token with the largest recent surge, CHAT, has now dropped from its peak of $7.61 to $3.66, halving in price.

At the same time, whales are retreating. According to Arkham data analysis, in the past week, the top ten addresses for PEPE reduced their holdings by $22.23 million. In recent days, news of many meme coin whale addresses, including Sun Yuchen, reducing their holdings has been frequent.

We cannot accurately determine whose funds drove this round of meme coin surge, but from the current results, the biggest profits have always been made by those whales who had already positioned themselves. For retail investors outside the loop, all that remains is more FOMO sentiment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。