Do you understand the new paradigm?

BlackRock’s CEO in 2017 - "Bitcoin is an index of money laundering"

BlackRock’s CEO in 2023 - "Bitcoin is an asset that protects you"

Looking back at gold's history - the most similar asset to BTC - the ETF legitimized gold as an investment, and demand for physical gold soared.

They brought new investors and new demand into a market with a relatively fixed supply, and the same will happen for Bitcoin.

“But Bitcoin is not backed by anything!!”

Bitcoin is backed by energy.

It uses energy to secure the network, and it's the most powerful and secure computer network on the planet. If you took over all the data centers from Google, Facebook, and Amazon, you would still be nowhere near its power.

Since we started comparing the two assets, let's analyze the gold ETF performance since its launch to understand what could happen with Bitcoin.

The first true gold ETF launched in Australia in 2003, but the big one was SPDR Gold Shares, which launched in the US in 2004. Demand was unprecedented, with 50 million shares trading on its first day.

The first 30 days went like this:

• 8 days of positive flows

• 1 day of negative flows

• 11 days with zero flows

In comparison, BTC ETFs performed like this:

• 17 days of positive flows

• 6 days of negative flows

• 1 day with zero flows

BlackRock alone has accumulated more AUM than the gold ETF after the first month.

$IBIT - $3.55 billion

$GLD - $1.26 billion

Impressive no?

However, considering only the first month doesn't give a proper view, so let's zoom out.

2004 $GLD inflows - $1.5b billion

2005 $GLD inflows - $3.3 billion

2006 $GLD inflows - $4.8 billion

$9.6 billion in its first three years.

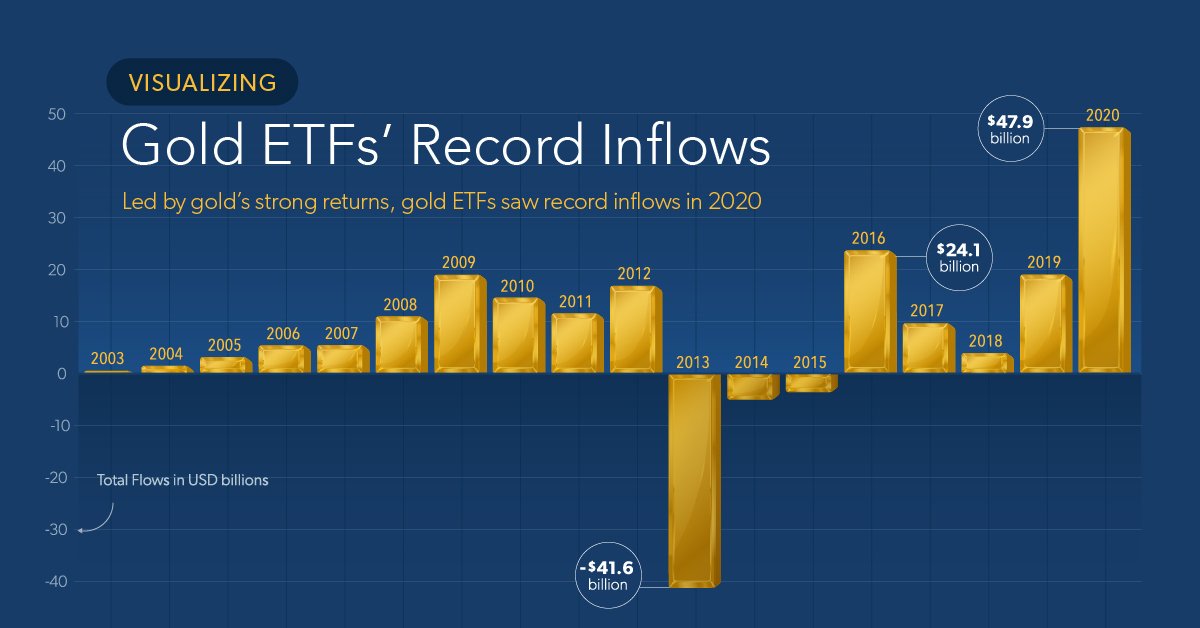

Below, you can see a more detailed view of gold ETF inflows/outflows from 2003 to 2020.

Now, how did these inflows/outflows affect the price over the years?

Since the ETF launch in 2004, gold went up by 360% ($450 → $2,090). Its market cap passed from being worth $2.99 trillion to $14.05 trillion today.

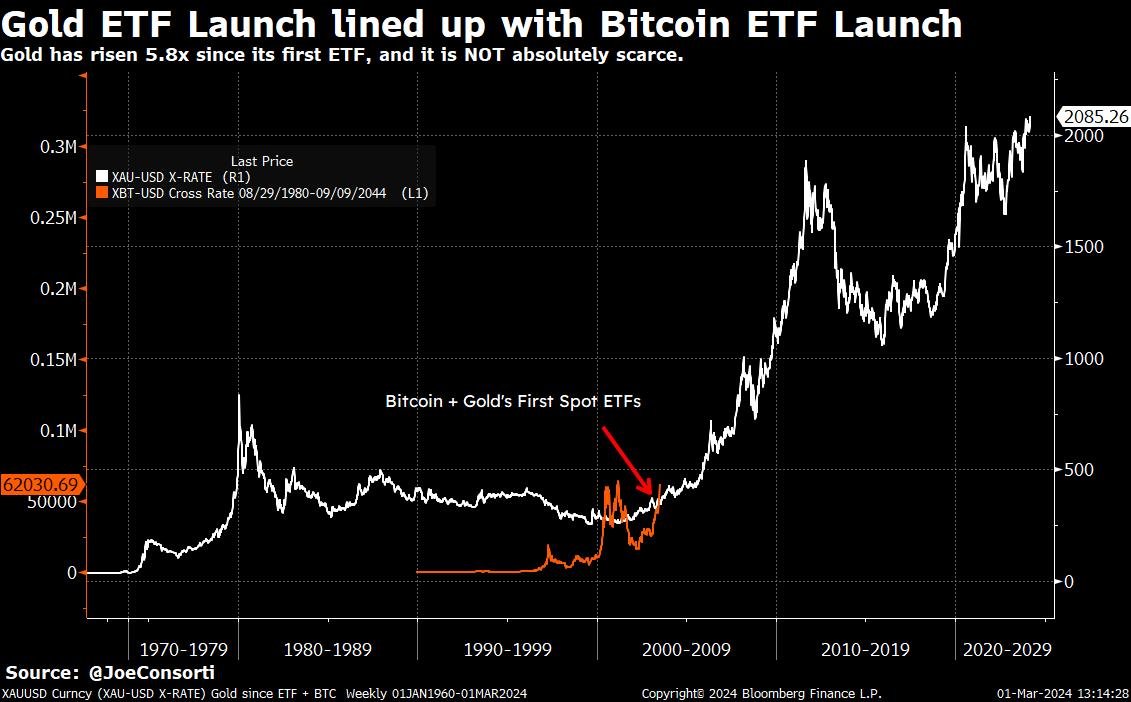

For comparison, here is what $BTC looks like if we line up its chart with the that of gold.

Take into account that gold's annual inflation rate, historically, has been about 1-2%. On the other hand, Bitcoin's inflation rate will be ~0.895% after the halving.

Put on top of this the higher demand for Bitcoin, and you will have a much faster increase in price.

Proof of higher demand and attention for BTC can be also noticed by the higher volumes of BlackRock's BTC ETF than the gold ETF against the $SPY (ETF of the S&P500).

• Volumes in the first 7 trading sessions - $GLD / $SPY = 16.8%

• Volumes in the first 7 trading sessions - $IBIT / $SPY = 25.2%

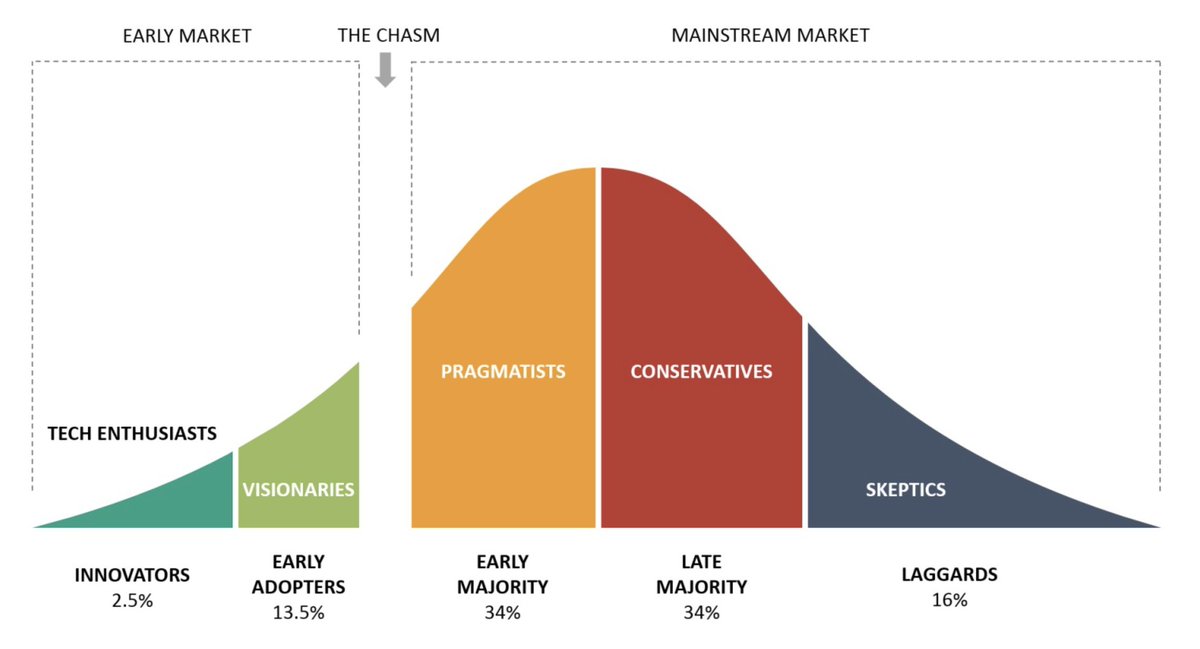

The thing people forget is that the vast majority of the market -- 85% typically -- is to the right of the chasm.

Bitcoin still trades at a 91% discount to gold. We tend to forget we're still so early.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。