You get some really wonky stuff that happens in market trend transitions. Like large delta-neutral funds/institutions getting blown out on "risk free" spread trades (blockfi, dcg/genesis, 3ac, Alameda, etc)

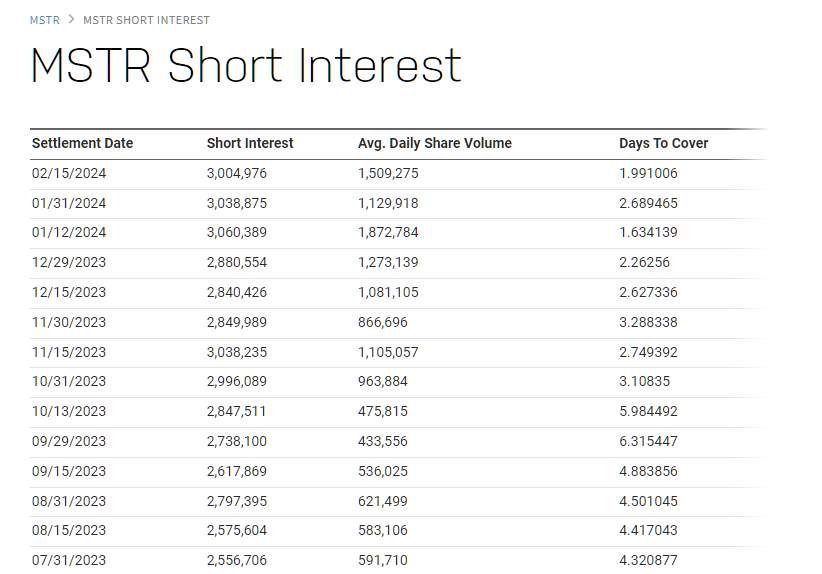

MSTR currently has $3b of short interest - roughly 20% of its float. I imagine a lot of that float is angry tradfi boomers trying to capture the premium to NAV

The funny thing is that the premium went from 50% pre ETF to 13% post ETF but now has reached highs of 70%

The bull market is not nearly over so you might get the opposite effect here where that spread blows out in a mega squeeze - $GME style. Keep in mind that it's just gotten big enough to be included in S&P 500

$MSTR as levered $BTC is back baby

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。