The NFT ecosystem needs to be reshaped and innovated.

Author: BIB Exchange

Preface: To be honest, the author didn't want to write this article, because once it's written, everyone will discover this opportunity. The author could have quietly accumulated a lot of chips at a low price, quietly built a position, and quietly bought in. But once everyone understands the logic and background, they will understand the development of this track. That's why the author doesn't talk about hidden secrets. Because this is no longer "hidden," it should be clear, because the American project party needs to deify SOL, and the NFT depression also needs another breakthrough, which is the deification of the token.

I. Starting with peanuts

Recently, Musk posted a tweet about Deez Nuts. This project seems to be a bold satire of Disney and the US government, but in the coin circle, many people think it is calling for the integration of tokens. It also resonated with the majority of coin circle investors and NFT ecosystem enthusiasts! So why did it resonate? What exactly are Nuts?

1.1 Talking about token exchange

It is not difficult to see that the trading volume of traditional NFT platforms is continuously shrinking, so it is necessary to reshape or innovate the NFT ecosystem. In today's cryptocurrency field, "token exchange / token duality" has become a topic of great concern. However, this concept is far more than just a new way to solve the liquidity problem of NFTs, but involves a comprehensive, systematic, and all-element turbocharged innovation in various aspects such as asset categories, protocol standards, operation promotion, infrastructure, and application ecology in the entire encryption industry.

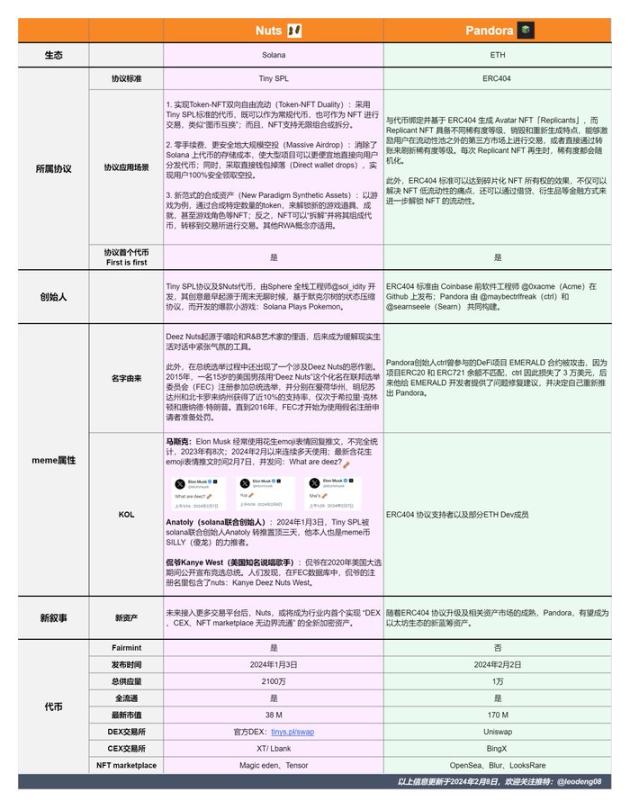

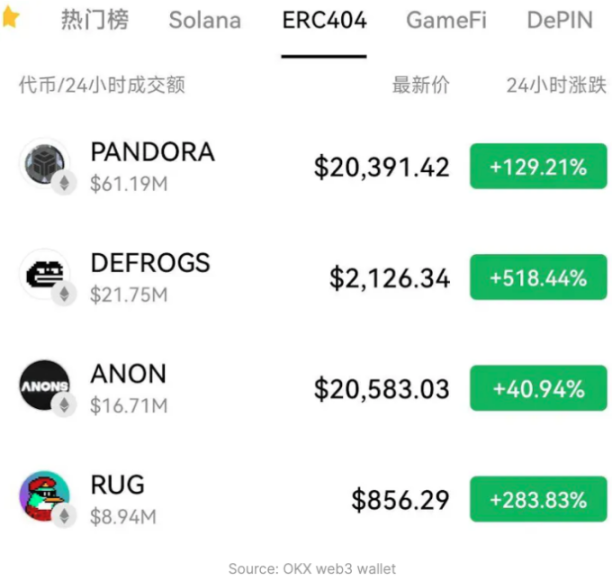

Therefore, the successful cases of representative projects $Nuts on Solana and @PandoraERC404 further promoted the discussion of the "token exchange" concept. From the peak value of 0.3u to 2.3u, it took $Nuts 9 days on Solana, while @PandoraERC404 took 6 days from 400U to 24000U on Ethereum. This pulling phenomenon has sparked continuous attention and increasing popularity for the "token exchange" concept.

1.2 Flash in the pan or sustained development

We can see from a set of data that in December 2023, the monthly trading volume of NFTs on Solana reached 360 million US dollars, exceeding Ethereum for the first time. Compared with Ethereum, Solana's number of trading users is nearly twice as many, and the number of transactions is ten times as many. The on-chain DEX of Solana: as of February 2, 2024, the trading volume of Solana's on-chain DEX is about 11.49 billion US dollars, surpassing Ethereum for two consecutive days. The trading volume of Solana's DeFi aggregation platform Jupiter even once exceeded the total trading volume of Uniswap V2 and V3 protocols.

The homepage of the Tiny SPL protocol is a Merkel tree, a smiley face, quite reminiscent of Windows98, which is the homepage of Nuts. It doesn't look particularly innovative, but it's actually a return to simplicity.

1.3 Choosing between ETH and SOL

First of all, Ethereum's gas fees are relatively expensive. Although this issue is often talked about, for projects like Pandora that need to frequently mint and burn NFTs, as the trading volume and frequency increase, Ethereum's gas fee issue may become more challenging. Recently, the blue-chip NFT project Degods, which just migrated from Ethereum to Solana, is considering migrating back to Solana.

However, some people think this way: comparing the token exchange projects of ERC and Nuts, a rational analysis. The background of ERC's token exchange project is strong, with a good origin, a large pool, and sufficient funds. Faced with long-unseen innovation, everyone is willing to rush into NUTS. The background is average, but it is not just about token exchange, or rather, the main selling point of Nuts is not token exchange, but reducing the rental of SOL addresses.

The biggest problem with minting NFTs is the high gas fees, but for projects like Pandora that need to frequently mint and burn NFTs, as the trading volume and frequency increase, the gas fee issue on Ethereum may become more challenging. Recently, the blue-chip NFT project Degods, which just migrated from Ethereum to Solana, is considering migrating back to Solana.

Image source: https://twitter.com/leodeng08/status/1755444384097775932

However, some people hold different views: comparing the token exchange projects of ERC and Nuts, conducting a rational analysis. The ERC token exchange project has a strong background, a good origin, and sufficient financial strength, so in the future, token exchange at the ERC level will be more in line with the public investors.

Of course, we may also consider some more macro factors. SOL's current shareholders are not poor, and they are constantly brewing and deifying. Faced with long-unseen innovation, once NUTS starts to flow in. Although Nuts has an average background, its value is far more than just token exchange. In other words, the main selling point of Nuts is not token exchange, but reducing Solana's rent.

II. Tiny SPL Protocol

ERC-404 is a new token standard developed by the Pandora team, and it adopts the "token duality" concept in the Tiny SPL protocol. Its "dual substitutability" design has attracted a lot of attention, leading to speculation in the $PANDORA token, with a market value increase of over 100 times in a short period of time, and prompting many projects to issue tokens under the ERC-404 standard.

2.1 Origin - Driven by liquidity

One of the biggest downsides of NFTs is the lack of liquidity, as when they are sold to each other, the lack of buyers leads to easy accumulation of large inventories that are difficult to circulate.

To solve the liquidity problem of NFTs, Emerald introduced an improved token standard, ERC-404, which can be traced back to the Uniswap Emerald project, which aims to solve the liquidity problem of NFTs. Inspired by Emerald, the Pandora team optimized its contract to the ERC-404 token standard, attempting to bridge the gap between the ERC-20 and ERC-721 standards through this innovative coding method.

2.2 Based on the Tiny SPL Protocol - Sharding Technology

The ERC-404 standard has attracted widespread attention due to its unique approach to sharding NFTs. Simply put, "token duality" is like water that can be both a solid (ice) and a liquid (water), giving NFTs both scarcity and liquidity.

Specifically, when NFTs have "token duality," it's like ice that can quickly turn into water when needed. Water can flow at any time, while ice is difficult to circulate in a narrow bottleneck. If we compare the bottle to a wallet, we can better understand this concept: the scarcity of NFTs is its advantage, but also the reason for poor circulation. So, how to solve this problem?

You can consider a method that gives NFTs both scarcity and liquidity. The ERC-404 project has achieved this goal. It borrows from the technology of the Tiny SPL protocol, giving NFTs a digital balance, as if it has transformed into a form with 100 dollars.

For example, when you own this NFT, if you want to sell or transfer it to someone else, let's say you want to transfer 50 dollars, you need to pay a fee of 100 dollars first, and then mint two NFTs worth 50 dollars each. This way, you and the recipient each hold a value of 50 dollars. However, it is important to note that this process will incur a large amount of fees, equivalent to an additional 30% slippage.

2.3 Design Concept

The ERC-404 standard is an experimental token standard designed to address the liquidity issues of NFT (non-fungible token) collections. It combines the features of ERC-20 fungible tokens and ERC-721 non-fungible tokens to enhance the utility of NFT collections in the DeFi ecosystem.

The core innovation of the ERC-404 standard lies in the "dual substitutability" design, using lossy encoding to store the quantity information of fungible tokens and the ID identifiers of non-fungible tokens in the same data structure, while ensuring their differentiation. In addition, ERC-404 also introduces a mapping mechanism, allowing natural conversion between fungible tokens and their corresponding non-fungible tokens, thereby enhancing the liquidity of NFTs.

The working principle of ERC-404 is to design a contract template to facilitate transactions involving ERC-721 and ERC-20 tokens. The contract does not change the parameters of existing standards but facilitates transactions between different asset types. However, it should be noted that whether ERC-404 will be recognized by the Ethereum Foundation or the wider community is currently uncertain.

2.4 Shortcomings and Development

Although the ERC-404 standard has received widespread attention, there are still some challenges in practical application, such as technical vulnerabilities and doubts about long-term success and acceptance in the crypto community.

While the ERC-404 project has successfully provided liquidity to NFTs, this rapid conversion is not without cost, as it requires paying a significant amount of gas fees. Additionally, although the project has increased the liquidity of token shares on decentralized exchanges, with the decline in prices of Pandora and other ERC-404 tokens, there are doubts about the long-term success and acceptance of this standard in the crypto community.

In any case, through "token duality," NFTs can achieve both scarcity and liquidity. The ERC-404 project has successfully achieved this goal by borrowing from the technology of the Tiny SPL protocol.

III. Key Market Projects

3.1 GH0ST

Some investors have expressed that GH0ST, like Nuts ($NUTS), is an interesting project worth considering for investment. It is described as the first project of SPL22, the latest iteration of the SPL20 inscription. Compared to Metaplex NFT, GH0ST uses Token2022 and eliminates the 0.023 SOL minting fee. This allows creators to add minting fees themselves, with these fees being used 100% to fund liquidity pools (LP).

Regarding the minting process of GH0ST, it uses the SPL20 protocol, essentially a fair public launch protocol for minting on Solana. These coins are minted as NFTs in batches of 1000. Subsequently, each NFT can be traded by splitting into individual tokens, and vice versa.

The reason it is called GH0ST is mainly because it is based on the new standard of Token22, to the extent that most wallets cannot display them correctly. Therefore, when minting, you cannot see these tokens in your wallet until they are converted into SPL tokens. Nevertheless, as an exchangeable token, some platforms such as dexscreener still display them as unknown.

3.2 MUBI

"MUBI's new return exceeds 10 times, a certain MUBI trader's total assets increased from 31.5 million dollars to 2.97 million dollars in just one month," I believe many readers have seen this event, regardless of MUBI's ecological application, the perspective of value appreciation alone is enticing.

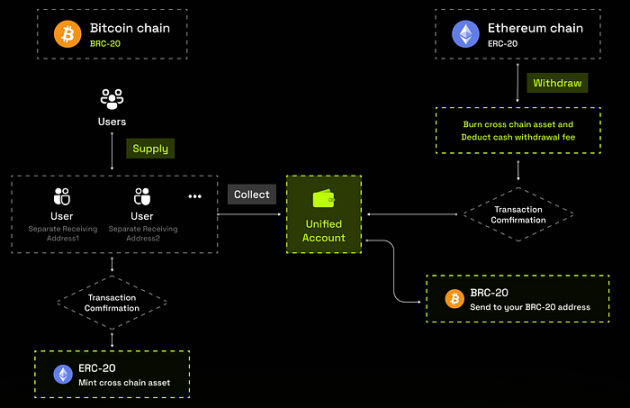

In a sense, MUBI is seen as the infrastructure of inscriptions. If we somewhat consider Bitcoin as the consensus layer and Ethereum as the execution layer, then MUBI is the cross-chain inscription between the two. How does the token bridging of MultiBit work? Users connect their crypto wallets to MultiBit, select the BRC-20 tokens they want to transfer, and point them to the specified BRC-20 address provided by the protocol. After receiving and verifying the deposited tokens, MultiBit generates an equal amount of tokens on the EVM network through the minting process.

MultiBit's bidirectional bridging feature allows users to restore tokens from the EVM network to Bitcoin. When withdrawing, the MultiBit protocol destroys the corresponding tokens on the EVM chain and returns an equivalent value of tokens to the user from a secure cold wallet. In addition to Ethereum and BNB Chain, MultiBit has also extended its token bridging functionality to the Polygon and Arbitrum networks.

3.3 SoBit

SoBit is a cross-chain platform, and the SoBit protocol is an innovative solution designed to seamlessly connect BRC-20 tokens to the Solana network, enhancing the liquidity and utility of BRC-20 tokens in the Solana ecosystem. The project's mission is to create a more unified connection in the Web3 ecosystem, unlocking more native crypto liquidity for the future.

SoBit's roadmap covers plans from the fourth quarter of 2023 to the third quarter of 2024. This includes testing and auditing features, launching a new user interface, introducing automatic routing and real-time support for BRC-20 assets, collaborating with more Solana DeFi partners, and establishing a BRC-20 application alliance.

Innovations in SoBit v2, such as improved security, accelerated cross-chain speed, expanded asset support, and enhanced user experience, have made the project increasingly prominent. It can provide one-stop cross-chain services for any new BRC20 assets and launch assets through contracts, enabling assets to better access funds and users in the Solana ecosystem.

According to the roadmap, SoBit is expected to become the platform with the broadest support for BRC20 assets and leverage the advantages of the Solana ecosystem to become the most promising value oasis in the inscription track. SoBit is expected to launch version 3, including a more feature-rich LaunchPad and support for staking of inscription assets, as well as a global index and Bridge as a Service (BaaS) function compatible with SRC-20 inscription assets.

IV. Development and Prospects

4.1 New Paradigm of Issuance

Some say, "NUTS is exciting, in the future, NFTs that cannot be exchanged for tokens will have no buyers!" As mentioned earlier, if future NFTs cannot be converted into tokens, it will be difficult to attract the favor of investors, especially during the crypto bull market when people are more concerned about the channels for realizing the value of their NFTs.

Therefore, the development of inscriptions is breaking through at the protocol level, which means it may be a new protocol or protocol layer that can change the asset paradigm of the crypto world. This indicates that inscriptions may have the potential to have a significant impact on the entire crypto world, as it can promote the transformation and evolution of asset paradigms.

4.2 NFT's DeFi

By achieving liquidity for NFTs, "token duality" will reboot NFTFi, focusing on solving liquidity control issues to ensure the stability of token values and avoid overheating and undercooling. This will involve the development of new algorithmic stablecoins, market-making mechanisms, lending, liquidity mining, and other financial services to promote the continued healthy development of the cryptocurrency ecosystem.

4.3 Proliferation of Low-Cost NFTs

With projects like Nuts, many people previously refrained from minting inscriptions on ETH/BTC due to high costs, especially during congested periods when significant minting fees were charged. The entry of the token duality method will greatly compress the space, leading to the emergence of a large number of high-quality projects.

4.4 Rich Expansion of Infrastructure Layer

As mentioned earlier, platforms like OpenSea are experiencing continuous declines. To support a large number of token exchange transactions, the demand for infrastructure services will become more urgent. This will involve the development of high-throughput and low-latency basic networks, reliable smart contracts, and interoperability solutions. For example, the development of token exchange mechanisms for cross-chain technology will facilitate seamless exchange of assets on different blockchains, driving the integration of the cryptocurrency ecosystem.

The boundaries between DEX, inscription markets, and NFT markets have become blurred. This indicates that inscriptions may have established close connections between different areas of crypto trading and assets, potentially facilitating the trading and liquidity of assets, further driving the development of the crypto world.

4.5 Emergence of a New Asset Category: Inscriptions + NFT + FT

"Token duality" will combine non-fungible tokens (NFTs) and fungible tokens (FTs) into a new asset category, officially becoming a new asset class. These assets will exhibit characteristics similar to ordinals of BRC20 tokens, demonstrating the duality of NFTs/FTs. This innovation will drive the development of asset types in the crypto industry, potentially leading to the emergence of more projects similar to $Nuts and Pandora. For example, the NFT market is expected to experience a surge in application scenarios and business models, further driving the development of the crypto industry and bringing more innovation to "token duality" applications. Areas such as AI, DeFi, GameFi, and RWA have enormous potential for development and will become important directions for "token duality" applications.

4.6 The Era of Transformation of Digital Assets in the Solana Blockchain Ecosystem

The introduction of SPL-20 inscriptions on the Solana blockchain and the significant evolution it brings. SPL-20 inscriptions are a unique and professional registration standard in the Solana network, linking to the program-derived addresses (PDA) of NFTs, storing binary data such as images or JSON metadata. For example, the mutable imprint of SPL-20 inscriptions serves as reserved space, and the immutable artifact serves as a permanent record. In addition, LibrePlex plays a crucial role in the development and deployment of SPL-20 inscriptions, proposing the concept of fair launch modules and bidirectional bridges to enhance accessibility and functionality in the digital asset field.

SPL-20 inscriptions not only embed data into the blockchain; they represent a more detailed and structured approach in the broader field of blockchain inscriptions. It involves creating program-derived addresses (PDA) linked to NFTs, which store binary data such as images or JSON metadata. SPL-20 tokens defined by JSON contain each operation as a minting of NFTs, with each operation having an associated order number. Examples of assets created according to this specification include $SOLS and $LADS tokens.

V. Conclusion

With the introduction of inscriptions, the analysis of $NUTS provides valuable insights: SPL-20 has become a unique and professional registration standard in the Solana network. The Solana blockchain is currently undergoing significant evolution, and the concept of inscriptions has received attention in the blockchain world, especially in the context of Ordinals and BRC-20 emphasized in the Bitcoin ecosystem.

While inscriptions originated in the Bitcoin network, they are also described as destined to eventually break out of the Bitcoin network. This implies that inscriptions may become an important bridge connecting different blockchain networks, further emphasizing their critical role in the crypto world. However, more importantly, we should look forward to the future development trends of "token duality" and conduct in-depth thinking and predictions about it.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。