This article provides an in-depth analysis of its project background, incentive plan, and the latest oAMM model.

The decentralized contract platform SynFutures recently announced the launch of the Blast mainnet for its latest version, implying an upcoming token airdrop. It also introduced a series of activities including O_O point incentives, Blast's Big Bang airdrop rewards, and a 500,000 bonus trading competition, making it the focus of the market. This article provides a detailed analysis of its project background, incentive plan, and the latest oAMM model.

1. Project Background

SynFutures is a decentralized derivatives trading platform that pioneered the permissionless contract market model, allowing anyone to list a coin with liquidity in 30 seconds, supporting both futures and perpetual contracts. Since the end of 2021, it has iterated through two versions, accumulating a total trading volume of 2.3 billion USD, 110,000 users, and supporting over 240 trading pairs, truly returning the decision-making power for DeFi contracts to the community.

The latest version, Oyster AMM (oAMM), has achieved the first-ever organic combination of on-chain matching, on-chain settlement order book, and AMM on this basis, compatible with the high capital efficiency of CeFi and the permissionless and decentralized characteristics of DeFi. The contract has been audited by QuantStamp.

The founding team of SynFutures has backgrounds in top international investment banks, internet companies, and crypto OGs, and has received favor from investors including Pantera, Polychain, Standard Crypto, Dragonfly, Framework, SIG, Hashkey, IOSG, Bybit, Wintermute, CMS, and Woo, with total funding exceeding 38 million USD to date.

(SynFutures V1/V2 Data Dashboard https://dune.com/synfutures/synfutures)

2. Latest oAMM Mainnet Incentive Plan (Triple Airdrop Opportunity + 500K USDC Trading Competition)

Upon the launch of the SynFutures mainnet, it announced its exploration of the decentralized path and introduced a point incentive called O_O. The project has announced that all Blast points, Blast yield, and additional developer token airdrops will be 100% distributed to users, and it is about to launch a trading competition with a bonus pool of up to 500,000 USD.

As a background, as a popular L2, Blast announced that 50% of future token airdrops will be directly given to the project party for distribution, and teams that won the Big Bang competition during the testnet period will receive additional airdrops. SynFutures stood out and won the championship prize in the Big Bang competition with over 3000 participating teams, and will receive additional airdrop token rewards.

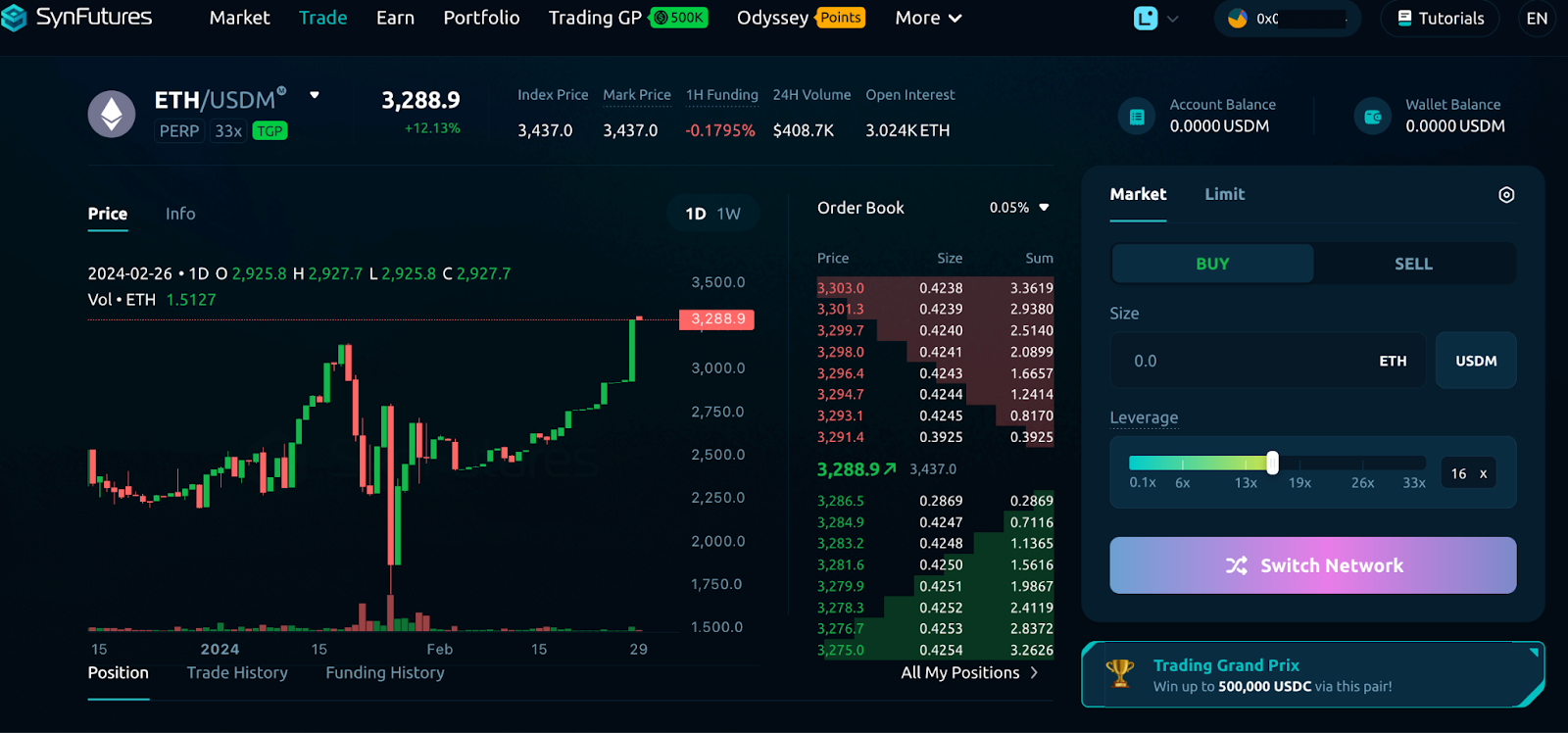

Specifically, SynFutures' current first-phase activities revolve around three perpetual contract trading pairs: BTC-USDB (with USDB as collateral), WETH-USDB reverse (with WETH as collateral), and USDT-USDB (with USDB as collateral).

2.1 First Day Airdrop of SynFutures O_O Points

Blast users, dYdX/GMX users, and Pudgy Penguin NFT users can directly receive SynFutures O_O point airdrops when registering for the O_O activity on the first day of SynFutures' launch.

Participation method: https://oyster.synfutures.com/#/odyssey

2.2 LP Airdrop Rewards

LPs can receive triple airdrop opportunities: Blast native token point rewards + 50% Blast Big Bang Winner airdrop rewards + SynFutures O_O point rewards.

Reward behaviors: Providing funds in the designated trading pair AMM pool and trading with limit orders are considered as providing liquidity. Additionally, inviting friends can also earn a certain percentage of point rewards. Providing larger amounts, for longer periods, and closer to the Fair Price will result in higher rewards.

Participation method: The LP activity points are named O_O.

Registration for participation rewards must be done here: https://oyster.synfutures.com/#/odyssey

Specific rule details can be found in their official blog: https://docsend.com/view/nr8xm4bezx6ziwu5

2.3 Trader Rewards

Traders can also receive triple rewards: Blast native token point airdrop rewards + 50% Blast Big Bang Winner airdrop rewards + 500,000 bonus pool trading competition rewards.

Reward behaviors: It is worth noting that for trader rewards, the Blast point reward is only related to trading volume, while the cash prize for the trading competition is purely based on the level of profitability. Regardless of the size of the trading volume, the top 50 profitable traders each week will receive rewards for 8 weeks, showing sincerity. This trading competition has also invited well-known DeFi industry KOLs (including keyboardmonkey, Awawat, CL, jez, jae C, CMS Trading, Kronos Research, and more than ten other degenerate traders and institutional leaders) to participate, enhancing the fun.

Participation method: Point rewards do not require registration, only interaction on their Dapp:

The Grand Prix trading competition is expected to take place in the first week of March.

Specific rules can be found here: https://docsend.com/view/uzzn5d6pqd2zsegn

2.3 Rewards for V1 and V2 Version Loyal Users

For SynFutures old version users and past activity participants, the local official has indicated that there will also be corresponding rewards in the future.

2.4 Wen Token?

The team has indicated that they are researching token issuance, and the point plan will last for 3-4 months, implying plans for token issuance and airdrops at that time.

3. SynFutures oAMM Model In-Depth Analysis

SynFutures' oAMM combines on-chain order book matching with AMM, bringing true decentralization innovation to the industry. Its features are as follows:

3.1 Single Token Concentrated Liquidity Model, Enhancing Capital Efficiency in Open Markets

SynFutures' previous version pioneered sAMM, allowing anyone to easily provide a token and create new trading pairs for any asset with a price, bringing revolutionary changes to the on-chain derivatives market. One of the features of the latest version of Oyster AMM is the introduction of a range-limited concentrated liquidity mechanism on a constant product price curve, allowing concentrated liquidity around the current price. It allows users to provide deeper liquidity while earning higher returns by allowing users to provide more liquidity with the same asset value.

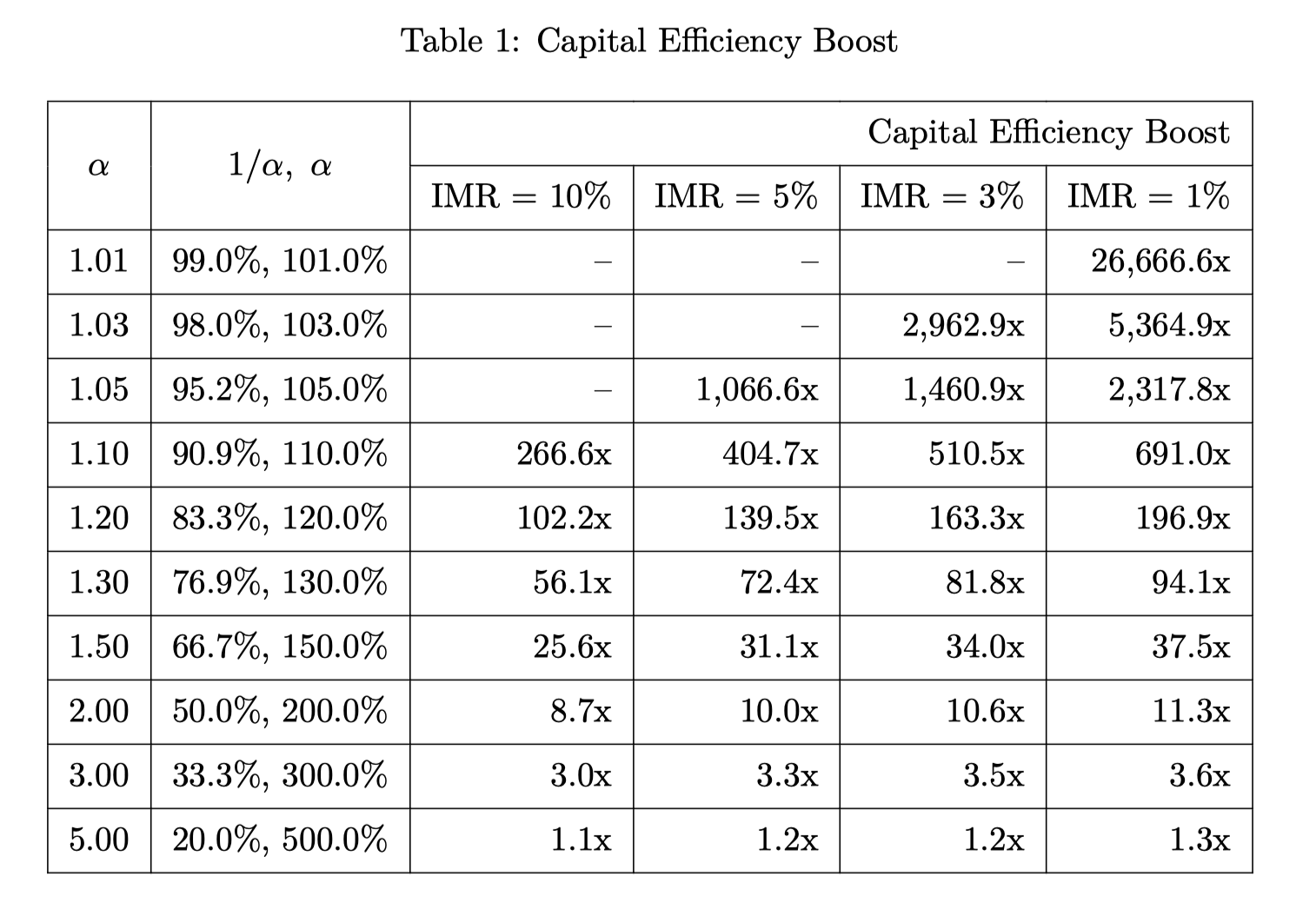

Unlike the typical spot market liquidity model, it introduces a margin management and liquidation framework tailored for derivatives, using only one token to simplify the trading ecosystem. Unlike other concentrated liquidity mechanisms, SynFutures liquidity providers only need to define the expected range width using parameters, and then the Oyster AMM will automatically set lower and upper price boundaries. For example, when a liquidity provider wishes to add liquidity to the ETH-USDC pool, they choose a 300% range with the base token price at $1000. In other words, they will provide liquidity between $333.33 (1000/300%) and $3000 (1000*300%), which is equivalent to providing more than 3 times (depending on the IMR) capital efficiency improvement.

In the current parameter settings, the highest capital efficiency improvement is 26,666.6 times, meaning that providing $1000 liquidity is equivalent to providing $26,666,666 liquidity within the specified range.

To ensure that single-token liquidity providers do not initially hold the risk of the other asset in the trading pair, the model creates long and short positions for users, resulting in a net zero position in the underlying asset, with leverage determined by the specified range. Liquidity providers can win more trading fees by narrowing the specified range while providing an equal amount, but if the price of the trading pair moves beyond the range, directional trading position risk may occur. Liquidity providers act as market makers willing to take on risk, with the main goal of compensating for impermanent loss and directional position risk through earning sufficient trading fee incentives.

3.2 On-Chain Matching, On-Chain Settlement, Pioneering Fully Decentralized Derivatives Order Book

While AMM has democratized market access, it still requires greater liquidity to achieve equivalent price slippage compared to the order book model. Therefore, SynFutures V3 also introduces the order book model.

SynFutures has achieved the first fully decentralized order book model with "on-chain matching, on-chain settlement" in the contract market. Prior to this, most contract order book functions in DeFi claimed to be decentralized, but the matching process was actually conducted in a centralized manner, at most settling on-chain. Even DyDX V4, with its independent chain, conducts off-chain order book matching.

By using a fully on-chain matching approach, SynFutures has unparalleled transparency, fairness, and security advantages. Placing matching off-chain may lead to similar backdoors as seen in FTX, where trade execution is controlled by a centralized team and can be prioritized in the background, similar to MEV attacks in black box trading. Additionally, cross-chain transactions between different systems can lead to more failures, especially during market volatility, and may also result in the industry-criticized phenomenon of unilateral shutdown or "pulling the plug" of centralized servers.

3.3 Order Book and AMM Atomic Trades, Achieving Organic Unity of Liquidity

Unlike the typical centralized limit order book's first-come, first-served principle, Oyster AMM introduces a matching process applicable to AMM. It can be summarized as follows:

- Since AMM prices are curves rather than points, any limit orders at a given price point will be executed before utilizing AMM concentrated liquidity

- Trading volume is proportionally allocated to multiple limit orders at the same price

- If there are no limit orders at that price point or the depth is insufficient, traders will start using the nearest AMM liquidity to the price

This collaborative approach significantly reduces the system performance and gas fees required for order matching, while also reducing overall slippage and ensuring traders can enjoy predictable atomic trades. Furthermore, if the trader's order size remains within the existing limit order range, their efficiency can reach the level of centralized exchanges, enjoying unlimited capital efficiency improvement, further bridging the gap between on-chain and centralized systems.

3.4 Stable Price Mechanism and Dynamic Fees, Enhancing User Risk Protection

Finally, the SynFutures team has introduced leading international investment bank and financial technology company risk management mechanisms to enhance user protection and price stability. These mechanisms include a dynamic penalty fee system to suppress price manipulation and balance the risk-return configuration of liquidity providers, as well as delayed abnormal fund withdrawals, among others. The contract has also been audited by Quantstamp.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。