Author: Fu Ruhe, Odaily Planet Daily

Since last year, RWA (Real World Assets) has become a hot sector in Web3. Some projects are continuously exploring ways to bring more assets into the crypto world, such as real estate.

One of the projects recently noticed by Odaily Planet Daily is Parcl. Unlike other single real estate tokenization projects, Parcl has built a regional real estate price index trading product, which has expanded to 10 regions (mainly in US cities) and will soon launch real estate index products for cities such as Hong Kong, London, and Jakarta, Indonesia.

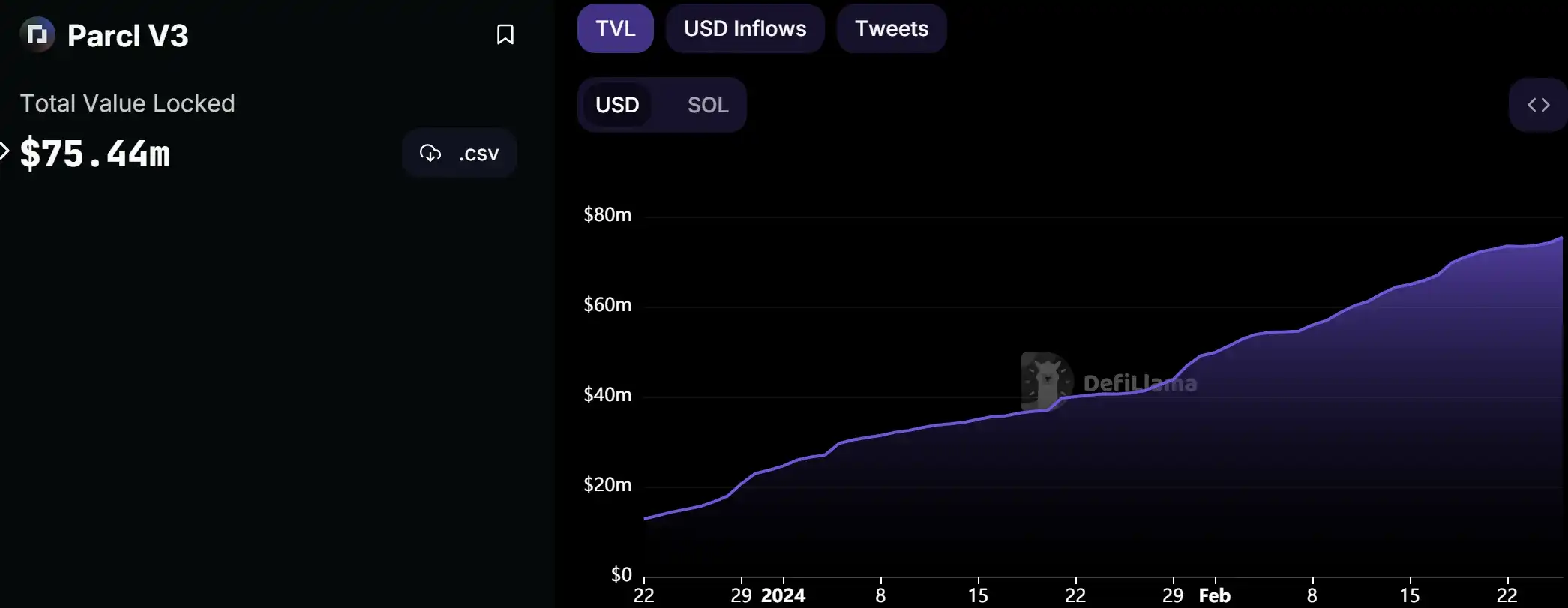

The official announcement recently stated that the token PRCL will be launched in April this year. With the expected potential airdrop, the Total Value Locked (TVL) continues to soar, currently exceeding 75 million USD, more than triple the growth since the beginning of the year. Odaily Planet Daily has summarized some methods on how to potentially obtain airdrop opportunities.

Project Overview

Parcl is a derivative platform for decentralized real estate indices based on the Solana public chain.

The real estate index of Parcl is similar to traditional financial REITs (Real Estate Investment Trusts), but Parcl does not directly tokenize mature REITs products. Instead, Parcl Labs calculates data points for a specific city region to create the current region's real estate market price index, which is then transmitted on-chain by the Parcl development team through the Pyth oracle. Note: Parcl Labs Price Feed (PLPF) estimates the price per square foot of residential real estate for multiple markets and property types on a daily basis.

Previously, Parcl operated on the V2 version, and Odaily Planet Daily has compiled related articles "A Comprehensive Guide to Using Solana's RWA Platform Parcl: How Does RWA Change Real Estate Investment?" which covers the product usage process. Therefore, this article will not elaborate further on the product usage process. Those interested can read the previous article for learning.

Parcl operates on the V3 protocol version, which expands liquidity issues, introduces decentralized governance, and risk control functions to protect LPs (Liquidity Providers) and traders from market imbalances. Essentially, there is no significant difference in user experience compared to the previous version.

According to the product page, Parcl offers a total of 10 tradable real estate market indices, mainly in US city regions. However, it will soon launch indices for cities such as Hong Kong, London, and Jakarta, Indonesia.

Currently, there are no other restrictions on Parcl's trading, with a minimum trading amount of 1 USDT. However, based on the observation of the index for each region, the fluctuation is relatively low. The data in the image shows a 10x leverage fluctuation rate over 3 months. Therefore, Parcl is more suitable for investors with large capital and diversified asset income needs. Ordinary investors may be more accustomed to the high volatility of the crypto market and may prefer traditional financial markets for long-term and relatively stable assets.

According to DeFiLlama data, Parcl's TVL is 75.44 million USD, more than triple the growth since the beginning of the year. With the upcoming Parcl airdrop, the increase in LPs and traders may be a core reason for the growth in Parcl's TVL.

Predicting Parcl Airdrop Criteria, NFT Holders May Have A Chance to Receive Airdrops

According to official information, Parcl will launch the PRCL token in April this year, with a total supply of 1 billion tokens and an initial community supply of 7%-8%. The use cases of the PRCL token can be summarized as follows:

- Data Function: The PRCL token is integrated into the Parcl Labs API as a gateway mechanism for obtaining high-quality residential real estate data.

- Further Protocol Incentive Programs: Eligible PRCL holders have the opportunity to participate in Perpetual Network Incentives (e.g., points), which will be launched shortly after the initial allocation event.

Specific details of other token economics will be officially disclosed in March this year, and Odaily will continue to follow up.

To potentially obtain airdrop opportunities, the author has discovered the following possible airdrop criteria by researching the development history of the Parcl project.

1. Parcl's Points Activity: Currently in its second season, this points activity adopts three criteria: 4 points per USD for LP providers; 2 points per USD for traders (calculated at the time of opening a position); and 10% points for inviting new users. According to data, nearly 150,000 people are currently participating in this activity.

2. NFT Holders: In May 2022, Parcl issued "Homeowners Association" at a price of 0.5 SOL, but in less than half a year, the price fell below the issuance price. Due to the expected airdrop, the price rose to 15 SOL by the end of 2023, and currently, there are no listings on Opensea.

Conclusion

Parcl is different from other RWA real estate projects, especially considering the technical details of the real estate market index developed by Parcl Labs. The team is relatively professional, with many members coming from Microsoft and well-known financial institutions. The project's design is also innovative, using a self-developed index-based derivative trading platform, which differs from directly tokenizing traditional financial assets. Parcl has no access restrictions, allowing most Web3 users to participate directly (except for the US), making it easier for expansion.

Although there are no access restrictions, limited returns may become one of the limiting factors for its expansion. Due to the natural properties of real estate, market fluctuations are relatively low compared to the crypto market, making it more suitable for investors seeking stability and familiar with real estate. The trading enthusiasm of Web3 users may be hindered.

In addition, according to the token economic model officially released by Parcl, the initial supply accounts for only 7%-8%, and some tokens may be rewarded to users participating in trading or adding LPs, attracting more users for continuous inflow.

In summary, the fundamentals of the Parcl project are good, and the subsequent development will depend on the token strategy after the airdrop.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。