832 days later, Bitcoin returned to above $60,000, approaching the market value of silver.

Author: Peng SUN, Foresight News

From the evening of February 28th to the early morning of February 29th, it was the Chinese New Year for the cryptocurrency market. After 832 days, Bitcoin once again rose above $60,000, igniting the FOMO sentiment across the entire market. In just two days, Bitcoin surged by $10,000, rising from $52,000 USDT to a peak of $64,000 USDT. At this moment, the market value of Bitcoin reached a high of $1.225 trillion, approaching the market value of silver ($1.277 trillion).

Exchanges did not miss out on the extreme market conditions. At 1:54 am, Coinbase paid tribute to the bull market by crashing. Coinbase stated on Twitter that some users might see their Coinbase account balance as zero and may encounter errors when buying or selling. Several hours later in the morning, Coinbase gradually completed the crash repair, and currently, all platform services have been restored.

Bitcoin, above $60,000, is making waves again

Bitcoin is making waves again. The last time my non-crypto friends asked me about the crypto world was during the Bali murder case. At that time, this incident had widely circulated on Weibo and Xiaohongshu, causing significant negative impact on the crypto market.

But this time, Bitcoin's rise is impressive. In fact, when Bitcoin surged over $50,000 two days ago, it was already trending on Weibo. However, tonight, due to Bitcoin's price reaching $60,000, "Bitcoin" occupied two spots on the trending list.

Similarly, friends from traditional financial media began to experience FOMO yesterday afternoon. Upon hearing that someone made $2 million from a $200,000 investment, they started asking about how to buy BTC, while realizing that they only made $2,000 after staying up all night to write articles.

1 am, both long and short positions liquidated

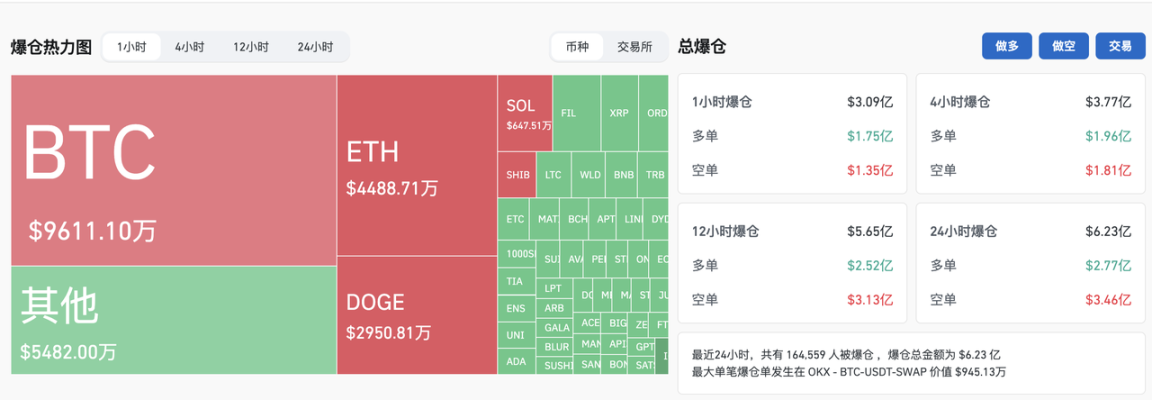

From 1 am to 1:30 am, in just half an hour, the entire network liquidated over $300 million.

Let's take a look at what exactly happened. First, around 00:54, Bitcoin surged to $62,000 USDT and in less than 20 minutes, it broke through $63,000 USDT, triggering market sentiment. Then, within 3 minutes, Bitcoin once again broke through $64,000 USDT, causing short positions to liquidate $135 million.

The bulls were unstoppable, but the bears were not willing to fall behind. After breaking through $64,000 USDT, Bitcoin did not continue to rise, but fell back to above $63,000 for a few minutes before dropping to around $61,000 USDT. Seizing the opportunity, the bulls caused a drop to $58,666 USDT on the 15-minute chart, leading to the liquidation of $177 million from the bulls.

After that, the market re-entered a phase of tug-of-war between long and short positions. Currently, Bitcoin is still fluctuating above $61,000.

Rise in concept stocks of digital currencies

As Bitcoin surged, concept stocks of digital currencies experienced a widespread rise. Represented by Coinbase, today Coinbase rose by over 1.5%, over 21% in a week, and over 51% in a month. At the same time, MicroStrategy rose by over 10% today, Marathon Digital rose by over 2.3%, Canaan Technology rose by over 5.7%, Ebang International rose by over 21.9%, and The9 City rose by over 1.87%.

Bitcoin ETF's daily trading volume hits a new high

Currently, the driving force behind this round of rise can still be attributed to a large influx of traditional funds into Bitcoin ETFs. Firstly, the trading volume of Bitcoin spot ETFs reached $7.69 billion on February 28th, setting a new record since its launch, surpassing the previous record of $4.66 billion.

As of February 27th, the net inflow of Bitcoin spot ETFs totaled $576 million, while Grayscale's GBTC ETF saw a net outflow of $125 million in a single day. It is worth noting that BlackRock's IBIT ETF saw the highest net inflow of Bitcoin spot ETFs yesterday, with a net inflow of approximately $520 million, setting a new high for IBIT's daily net inflow, with a total net inflow of $6.54 billion.

The second highest net inflow on the 27th was Fidelity's FBTC ETF, with a net inflow of $126 million, and a total net inflow of $4.48 billion for FBTC. As of the time of writing, the total net asset value of Bitcoin spot ETFs is $43.16 billion, with an ETF net asset ratio (market value as a percentage of total Bitcoin market value) of 3.86%, and a total cumulative net inflow of $6.72 billion.

Multiple sectors see gains: NFTs, meme tokens, storage, GameFi, AI

The recovery of Bitcoin's market has once again driven the rise of other sectors, directly related to NFTs. As NFTs are priced in sats, the rise in Bitcoin naturally led to a rise in the price of NFTs. In the Bitget NFT section, the leading project ORDI rose by over 11% today, reaching a peak of $81 USDT, almost returning to the high point of the market in early January, with other tokens also seeing significant gains.

The recent rise in meme tokens is eye-catching. When Bitcoin broke through $64,000 in the early morning, DOGE, as the largest meme token, surged by over 13%, boosting Bitcoin. BONK saw a 24-hour increase of 47.7%. After a single-day increase of over 50% in the past two days, PEPE once again rose by over 44% yesterday, reaching a new high since May 6, 2023. WIF aimed for $1 USDT, breaking through $0.93 USDT yesterday, with a single-day increase of over 44%. It is obvious that the strength of the market is directly reflected in the FOMO sentiment in the community.

The storage sector saw a widespread rise due to the launch of Arweave's supercomputer AO, with AR breaking through $20 USDT and $30 USDT in the past two days, reaching a new high since May 2, 2022, with a rise of over 43% yesterday and over 19% today. FIL also doubled in the past month, reaching a high of $8.6 USDT recently, setting a new high since August 2022. Filecoin launched FVM last year and is preparing for the L2, DeFi, and other areas, as well as the launch of the Interstellar Consensus on the mainnet in the second half of the year.

Following the recent rise in the GameFi sector, Binance will also launch the cross-chain game Portal in the near future, and GALA, which has been in a downtrend, finally began to rise recently. Yesterday, influenced by Gala Games' launch of GalaSwap, GALA surged by over 22% to $0.04 USDT in the morning. It is also worth noting that Gala Games will initiate a token burning mechanism.

The AI + Web3 concept has been recognized as the consensus for 2024 since October last year, and Binance has invested in or launched several AI concept projects through the Launchpool. Yesterday, FET rose to a new high of $1.38 USDT, with an increase of over 18%. WLD also reached a new high in the past week, reaching a peak of $9.49 USDT.

Conclusion

On February 29, 2024, Bitcoin reached a high of $64,000, only 10% away from the historical high of $69,040 in the last bull market. Currently, Bitcoin has stabilized above $61,000, and the tug-of-war between long and short positions continues.

Interestingly, from the low point of $16,000 in November last year to now, Bitcoin has not experienced any pullback. Many voices in the community have expressed panic, as no one knows the reason behind this round of rise. The entry of Wall Street capital has left many experienced traders predicting the market incorrectly and missing out on the opportunity. The approval of Bitcoin ETFs and the entry of traditional capital may have rendered the traditional methods ineffective, but regardless of the future trend, one should maintain awe of the market. After all, just half an hour in the early morning was enough to make many people lose their positions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。