Ether.fi has the highest asset liquidity, and Renzo has the highest fixed income.

Author: Nan Zhi, Odaily Planet Daily

Last week, the encrypted re-staking service provider EigenLayer announced the completion of a $100 million financing round, with a16z participating. Binance Labs also announced investments in two Restaking protocols, Puffer Finance and Renzo. On the other hand, in early February, according to on-chain analysts, Sun Yuchen's three addresses had staked 271,328 stETH, currently valued at $880 million.

The popularity of Restaking is increasing.

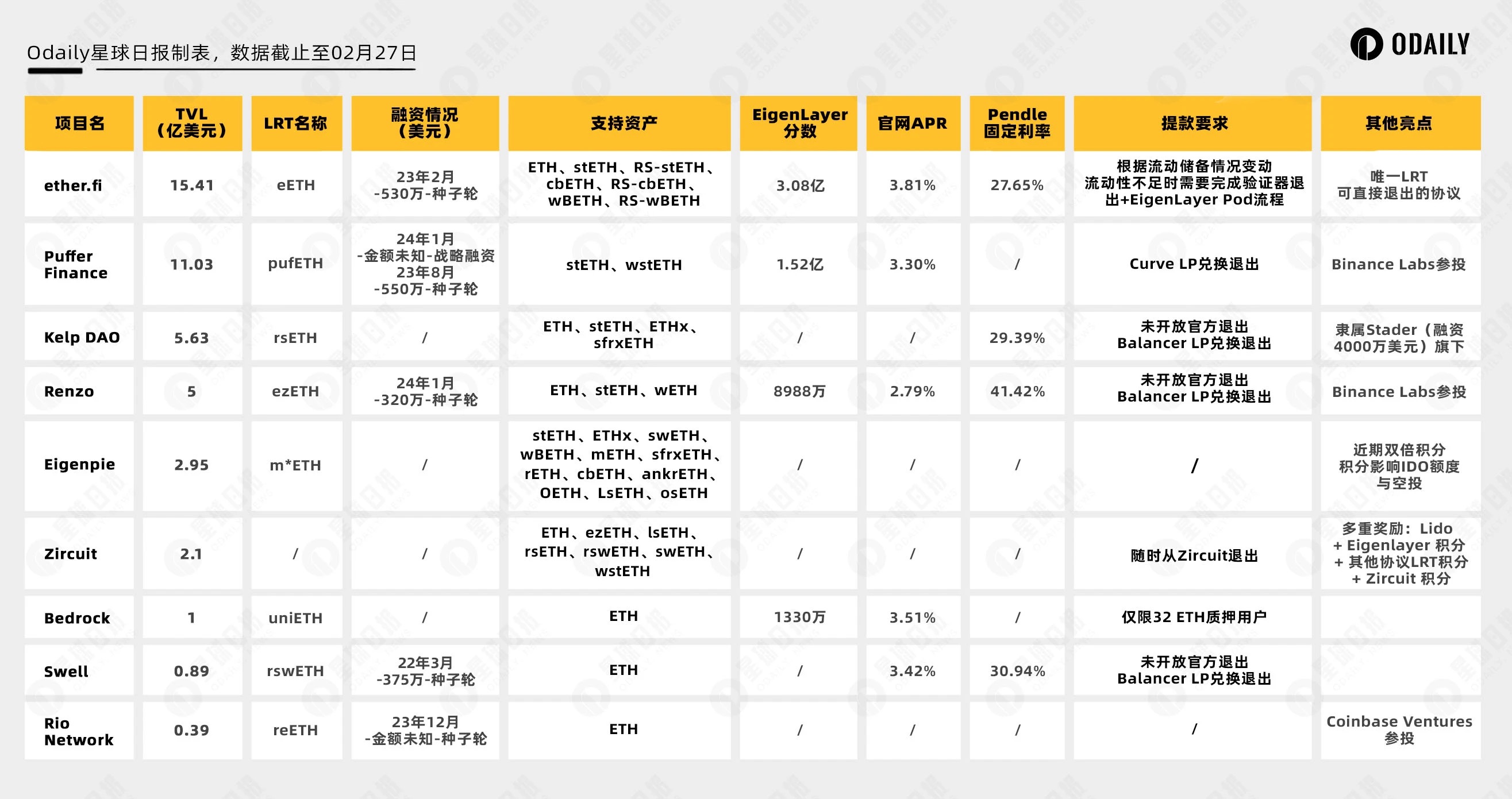

Odaily Planet Daily will summarize various mainstream Restaking protocols in this article, comparing their differences and highlights from multiple dimensions. The following image shows a list of protocols in descending order of TVL.

Protocol Comparison

Financing

In terms of financing, there are currently few publicly announced financing situations, with the time concentrated at the end of 2023 and the beginning of 2024 (Swell's financing mainly targeted the LSD business at that time), with amounts in the millions of dollars.

On the other hand, there is not much overlap in the participating institutions of each protocol. The leading institutions for ether.fi are North Island Ventures and Chapter One, while Puffer Finance's leading institutions are Lemniscap and Faction, among others. The most significant financing event is Binance Labs' announcement of investment in Puffer Finance and Renzo, with the market believing that this news indicates a high possibility of the tokens being listed on the Binance exchange. With the disclosure of investment news, TVL has rapidly increased.

Pendle Fixed Interest Rate

Pendle encapsulates interest-bearing tokens into SY (Standard Yield tokens), which are then split into principal and yield components, PT (Principal tokens) and YT (Yield tokens) respectively. Users holding PT tokens can exchange them for an equivalent principal at maturity, while all interest during the period belongs to YT. The price difference between the current PT and the maturity price represents the fixed income.

Pendle has introduced a proprietary navigation interface for LRT, with the fixed income at maturity for each protocol ranging from 30% to 40% and maturity periods of 120 days and 57 days. It is worth noting that holding only PT means obtaining fixed income only, foregoing points and staking income.

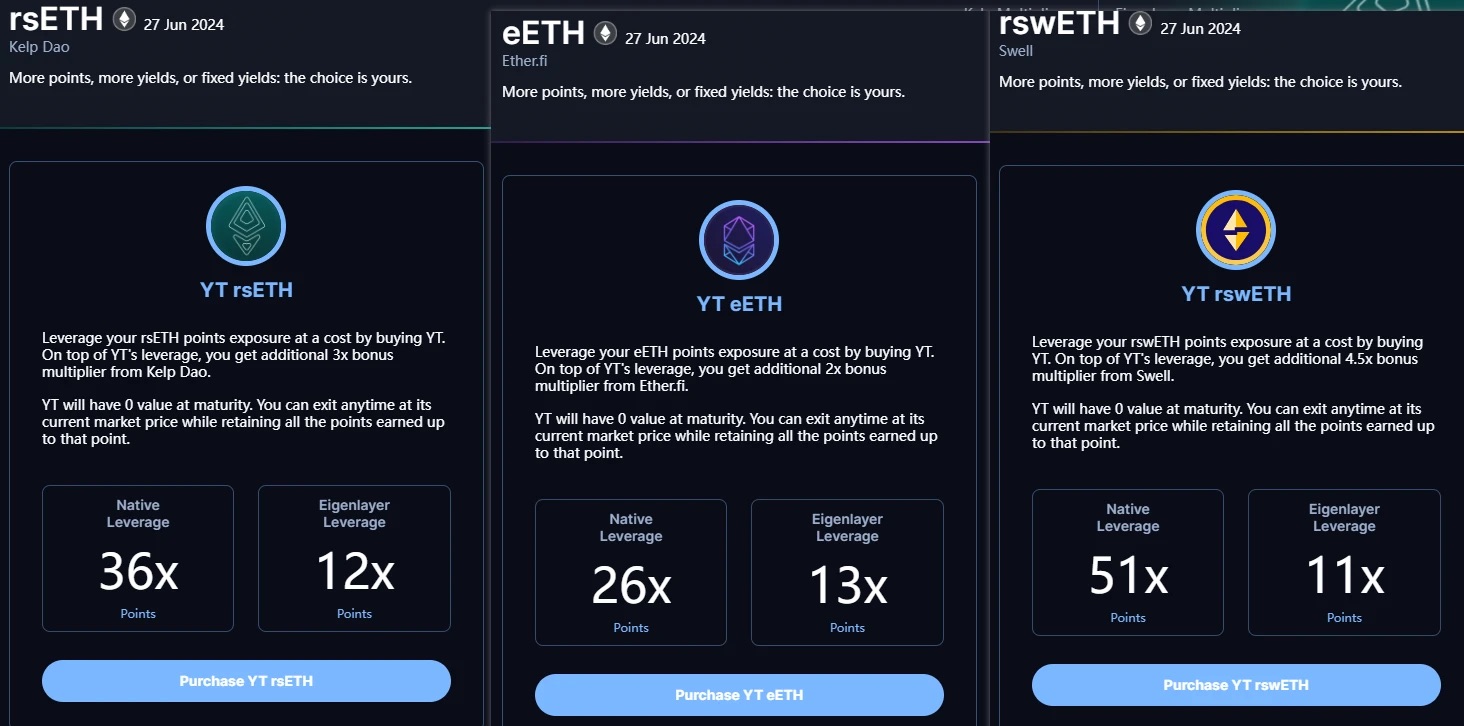

Purchasing YT is equivalent to using leverage to obtain EigenLayer points and project points. The following screenshot from Odaily Planet Daily shows some YT products from several protocols, which are equivalent to obtaining EigenLayer points with a leverage of ten times and come with different leverage points.

EigenLayer Points

Currently, only four protocols have disclosed EigenLayer points, with ether.fi having the most at 308 million and Bedrock the least at 13.3 million.

In addition, according to data from the Whales Market, the current floor price of EigenLayer points is approximately $0.15/point. For ether.fi's stakers, this is equivalent to holding a total of $46.2 million in point assets, accounting for approximately 3% of TVL. Readers can similarly calculate the value of EigenLayer points for other disclosed protocols based on TVL, or convert the point assets of other protocols based on TVL.

Furthermore, Whales Market has also launched project points for ether.fi, with a relatively poor market depth. Based on the floor price of $0.00074/point, the Loyalty Points for the current protocol are 22.1 billion, approximately equivalent to $16.42 million. There are no publicly available prices for points from other protocols for reference.

Asset Withdrawal

Most of the current Restaking protocols have not yet implemented withdrawal logic and can only be withdrawn in the form of asset exchange through various DEX, resulting in some erosion. Ether.fi is the only protocol that allows direct withdrawal and has prepared liquidity reserve funds to meet users' immediate withdrawal needs.

However, ether.fi has also faced accusations of "stealing points." Community users pointed out that based on the TVL and EigenLayer points of other protocols, ether.fi actually received significantly fewer points than the calculated points it should have received. Ether.fi responded that the relatively small number of points is due to the time difference of deposits and the reserve fund prepared for users' immediate withdrawal, in order to transfer all EigenLayer points to users.

Conclusion

Each Restaking protocol has different characteristics, and users can choose according to their own needs:

For users with high liquidity requirements, they can stake on ether.fi to have the opportunity to withdraw and participate in other protocols at any time.

For users seeking stable income, they can choose to purchase Renzo's PT.

For users with moderate risk preferences, Puffer is a suitable choice, as it has a high expectation of being listed on Binance and has many large stakers, such as Sun Yuchen, who is the top staker for Puffer.

In addition, there are also protocols with rich reward types, such as Zircuit and Eigenpie, suitable for users who want to improve the efficiency of fund utilization and balance income expectations.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。