Draft: Jaleel, BlockBeats

Editor: Jack, BlockBeats

The definition of Bitcoin Layer 2 has once again sparked heated discussions in the community.

From the beginning of last year to the present, the Bitcoin ecosystem has experienced several downturns. After being hot for nearly a year, it now seems to be at a critical moment. The undeniable consensus in the market is that the Bitcoin ecosystem will remain the biggest hotspot for a long time to come. Therefore, the market is now seeking new opportunities in the BTC ecosystem, and many users at home and abroad believe that the outbreak point in the later stage will be Bitcoin Layer 2.

Therefore, in the past month, the fervor around Bitcoin Layer 2 has intensified, with no fewer than fifty projects in the market. Competing for TVL, overlay concepts, and a fifty-fold increase in a day, Bitcoin Layer 2 has become one of the most exciting and chaotic tracks. A major reason for this situation is that Bitcoin Layer 2 has not yet been definitively defined.

Who Can Define Bitcoin Layer 2?

Unlike Ethereum Layer 2, the mysterious founder of Bitcoin did not define Bitcoin Layer 2 before "disappearing." In this mixed track, what exactly is Bitcoin Layer 2? Currently, the community has not reached a consensus, and different researchers have different answers.

"Authenticity" according to "Bitcoin Magazine"

The editorial committee of Bitcoin Magazine recently clarified their position on reporting Bitcoin Layer 2 in the document "BITCOIN MAGAZINE EDITORIAL POLICY ON BITCOIN LAYER 2S."

The three defining points for Bitcoin Layer 2 that have sparked community discussions are:

Using Bitcoin as the native asset: Layer 2 must fundamentally be designed in Bitcoin units, using Bitcoin as its primary token or account unit, or as a mechanism for system fees. If it has tokens, they must be backed by Bitcoin.

Using Bitcoin as a settlement mechanism to enforce transactions: Users at Layer 2 must be able to exit the system through a mechanism, whether trusted or untrusted, to return control of their funds to Layer 1.

Demonstrating dependency on Bitcoin's functionality: If a system continues to operate even if the Bitcoin network fails, it is not Bitcoin Layer 2.

Established in 2012, Bitcoin Magazine can be said to be one of the oldest and most mature sources of information focused on Bitcoin. Therefore, many community members believe that the definition provided by Bitcoin Magazine is "authentic."

Under Bitcoin Magazine's definition, most of the "mythical creatures" of Bitcoin Layer 2 in the market today do not meet their "standards." Community KOLs and researchers have also expressed their opinions.

Well-known Bitcoin ecosystem KOL 0xSea stated, "Strictly speaking, according to this definition, it is difficult to say that the majority of projects in the market are Layer 2; most are 'sidechains.' The Layer 1 protocol Atomicalsxyz's AVM (technology) meets the above three points, but it does not operate as an independent chain, so it can probably be called Layer 1.5."

Mindao, the founder of dforce, also believes that "Bitcoin Magazine, as an important promoter of Bitcoin, has released the latest editorial policy, emphasizing 'legitimacy' for Bitcoin Layer 2. Those that do not meet 'legitimacy' will not be reported. According to this definition, most can only be considered bandits."

Mindao also stated, "This standard may be difficult, but in practice, it requires many sacrifices in terms of economic models and architecture, which most projects have no intention of doing. Many people believe that there should be no talk of legitimacy for 'ownerless' Bitcoin, but in terms of ideology, legitimacy is everywhere, regardless of 'ownerless' or 'owned.' This emergence of 'legitimacy' is a very interesting phenomenon."

Some community members have also expressed their dissatisfaction with Bitcoin Magazine's strict definition, believing that, no matter how influential Bitcoin Magazine is, its definition of Layer 2 only represents the views and opinions of their magazine and editorial committee and cannot represent the definitive official definition.

For example, GP of AC Capital, Cryptographic Wei Tuo, sharply stated, "Seriously no one cares. Bitcoin Magazine has been around for a long time, but it does not have the same influence on Layer 2 as Layer 2Beat does on Ethereum."

How VCs Who Have Invested in Dozens of Bitcoin Layer 2 Projects Define It

Dashan, the founder of Waterdrop Capital, who has invested in dozens of Bitcoin Layer 2 projects, expressed his views on the definition of Layer 2 in a previous AMA.

He believes that in a broad sense, any platform that consumes BTC as gas or uses BTC as the underlying asset and can serve as a DApp platform, with performance far superior to BTC Layer 1, can be considered Bitcoin Layer 2. This includes but is not limited to application platforms based on Indexer, EVM rollup, EVM cross-chain, sidechains, Lightning Network, and RGB, among others.

In a narrow sense, for it to be considered Bitcoin Layer 2, it needs to meet at least the following two conditions:

- Whether it shares security with BTC.

- Whether it is resistant to censorship.

In detail, if BTC crashes, can Layer 2 survive on its own? The most it can be called is a sidechain. Are the nodes of Layer 2 or cross-chain multi-signatures decentralized enough, such as multichain, where the multi-signatures are all in the hands of a few relatives, and if users get into trouble, their assets will be lost as well.

In addition, Dashan also mentioned that a BTC Layer 2 that meets Ethereum community standards, in addition to the narrow definition of Layer 2, needs to meet two more criteria: whether Layer 1 can verify transactions on Layer 2, and whether Layer 1 assets can escape smoothly when Layer 2 collapses.

However, at the time, Dashan also stated that this was only his personal opinion. In fact, discussing "what the ideal BTC Layer 2 is" is meaningless. He pointed out that Satoshi Nakamoto would not personally come out to tell the community what his ideal BTC Layer 2 looks like, and no organization has the right to dictate this orthodoxy.

Early Bitcoin ecosystem KOL xiyu also stated, "It is currently a chaotic stage, and who is the real Bitcoin Layer 2 should not be defined by fixed standards but should be determined by the market. This is what I learned on brc20."

Chaos isn't a pit. Chaos is a ladder.

Currently, the solutions and forms of Bitcoin Layer 2 can be said to be diverse, with particular emphasis on ZK technology concepts, which also reflects the disorderly nature of the Bitcoin Layer 2 track from another perspective.

Projects in Chaos, a Chaotic Track

In January of this year, the Bitcoin ZK Rollup Layer 2 solution SatoshiVM caused a stir on Twitter, and its native token SAVM saw a nearly 50-fold increase on the first day of trading. Many people have made millions of dollars by selling SAVM.

However, in the midst of a frenzy of promotion by major KOLs, SatoshiVM was exposed by community members for potentially being the same team as Bool Network. Bool Network had previously developed a bridge contract called TokenBridge.sol, using the same function names and events, and it seems that SatoshiVM's version is a direct implementation of it.

Bool Network was established at the end of 2020 and has long been dedicated to Bitcoin Layer 2 solutions. In 2022, they published an academic paper on the topic, and their Github organization can be found here.

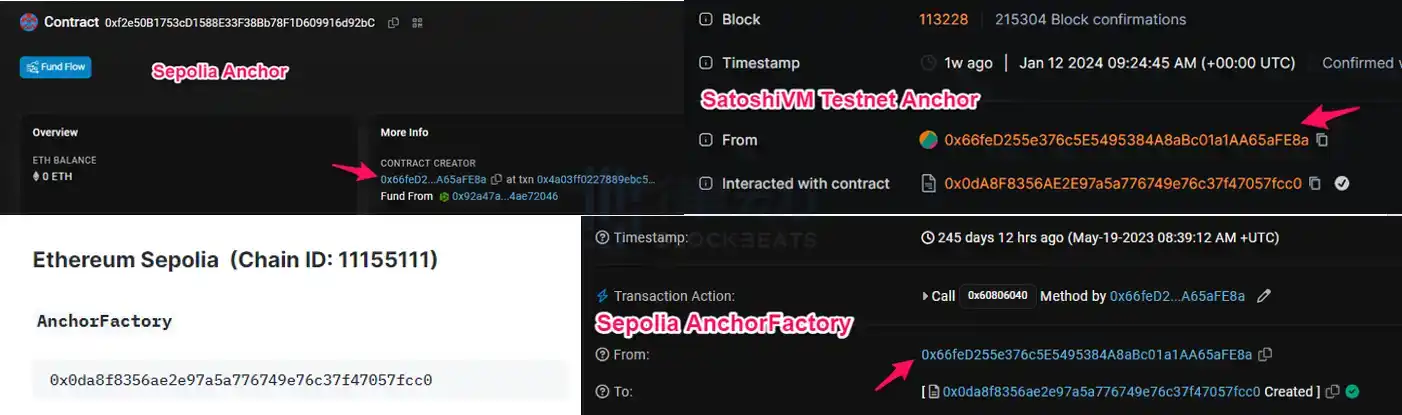

Upon reviewing Bool Network's documentation, they provided us with the address of the AnchorFactory on Sepolia, showing that the system was deployed in May 2023. Interestingly, the address that deployed AnchorFactory is the same as the one that deployed SatoshiVM Anchor: 0x66feD255e376c5E5495384A8aBc01a1AA65aFE8a.

If Bool Network only provided a technical solution for SatoshiVM, it could be plausible without more direct evidence, especially since Bool Network is currently focused on Bitcoin validation layers and can serve all Bitcoin Layer 2 solutions.

But the plot thickens.

On January 25th, Ape Terminal, the platform conducting the IDO for SatoshiVM, publicly quarreled with the SatoshiVM team, exposing each other for "conflicts of interest."

Leading the promotion of SatoshiVM, self-proclaimed advisor to SatoshiVM, and well-known KOL with 500,000 followers, MacnBTC, challenged Ape Terminal, accusing them of deceiving everyone and conducting an unfair sale. Despite 200,000 wallets applying to participate in the IDO, only 10 winners were chosen each time, and all the winners were members of the Ape Terminal team. Although the Ape Terminal team reimbursed part of the IDO fees to the Satoshivm team, they made millions of dollars by selling pre-sale wallets.

In response to the accusations, Ape Terminal released a statement countering the claims, stating that SAVM was a project founded by the well-known KOL MacnBTC. "SAVM was a bittersweet event for Ape Terminal. Mac and his KOL friends profited over $20 million by dumping in their own community." Ape Terminal provided detailed information about their interactions with Mac and records of token liquidation through a Google document.

In Ape Terminal's view, they became the scapegoat for Mac.

In response, MAC stated that he is an advisor to the SatoshiVM team and has worked closely with them. He introduced Ape Terminal to the SatoshiVM team, but after the SatoshiVM team achieved success, he was unfairly attacked and did not engage in liquidity grabbing; someone else did.

Chaos is Actually a Good Thing

Many people consider the horse-catching incident of SatoshiVM to be a symbol of chaos, but in reality, such chaos may be a prelude to the flourishing of the industry.

The Bitcoin Layer 2 track is in chaos, much like the chaotic period of numerous Bitcoin forks in 2013. It was in this chaotic community atmosphere and the long-standing block size war that Vitalik, a staunch supporter of large blocks, founded Ethereum, laying the foundation for the prosperity of the subsequent era of public chains.

As stated in "Game of Thrones": "Chaos isn't a pit. Chaos is a ladder." Chaos itself does not mean loss of control or disorder; on the contrary, it is a process of exploration and practice, a prelude to constructive development.

In any emerging technology or industry, the establishment of consensus usually requires a period of chaos. This is because at the beginning of something new, everyone has their own views and understandings, and it takes time to integrate and unify these viewpoints to form a more widespread consensus. The Bitcoin Layer 2 track is no exception. Although the current discussions about its definition may seem chaotic, it is a process in which the community gradually tends towards consensus through active discussion. This chaos is a necessary part of development, a process of refining a more comprehensive consensus from diverse viewpoints.

Currently, the cryptocurrency industry is deeply engaged in discussions about the Bitcoin Layer 2 track. This kind of chaos is not negative; it indicates that the community is striving to re-examine this track, reflecting on possible "hype" and inaccuracies. This self-reflection and in-depth discussion are the driving force for the industry to find projects with real potential and create a more favorable development environment for them. It is through such deep dialogue that the industry can stand out in a competitive environment and move towards a healthier and more sustainable development.

Different participants have expressed their unique viewpoints in this discussion, including investors, media, project teams, and the broader community. This diversity of voices enriches the discussion, allowing different perspectives to be considered, providing a more comprehensive view for the industry. Although there may be debates and differences in this process, it is precisely this diversity and conflict that sparks innovation and progress. This is a battle of ideas, where various parties gradually form a common understanding through communication, debate, and cooperation.

In this chaos, it also means that industry participants are reflecting on their own roles and responsibilities. Investors are considering how to make more rational investments, the media is examining its objectivity in reporting, and project teams are re-evaluating the true value and feasibility of their projects. This is a necessary condition and a key step for industry progress.

Just as chaos is not a pit but a ladder, the chaos in the Bitcoin ecosystem will also be a path to higher-level development.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。